Bitcoin’s recent price action has been impressive, with the cryptocurrency approaching its all-time high. As of writing this, bitcoin is trading around $72k, showing strong momentum in the market. While the current short-term price action is exciting, it’s important to remember that no matter what happens over the next weeks and months, over the long term bitcoin is going much, much higher. How high? Let’s walk through it.

Over the past decade, bitcoin has been the best-performing asset. With an astounding average annual growth rate of 59%, it has far outpaced traditional investments:

• Stocks: 15% average annual growth

• Commodities: 12%

• Gold: 9.4%

• Real Estate: 5.6%

• Emerging Markets: 2.6%

• Bonds: 0.78%

Several key factors contribute to bitcoin’s sustained strength: increasing adoption and integration, inherent scarcity, and macroeconomic conditions shaped by government policies.

Institutional demand for bitcoin continues to grow. The bitcoin exchange-traded funds (ETFs) have attracted substantial interest from major financial institutions. The U.S. Bitcoin ETF is the most successful launch of an ETF in history, with inflows over $20 billion so far this year. This demand will increase by orders of magnitude as all institutions incorporate BTC, and bitcoin is integrated into new products such as the monstrously large options complex.

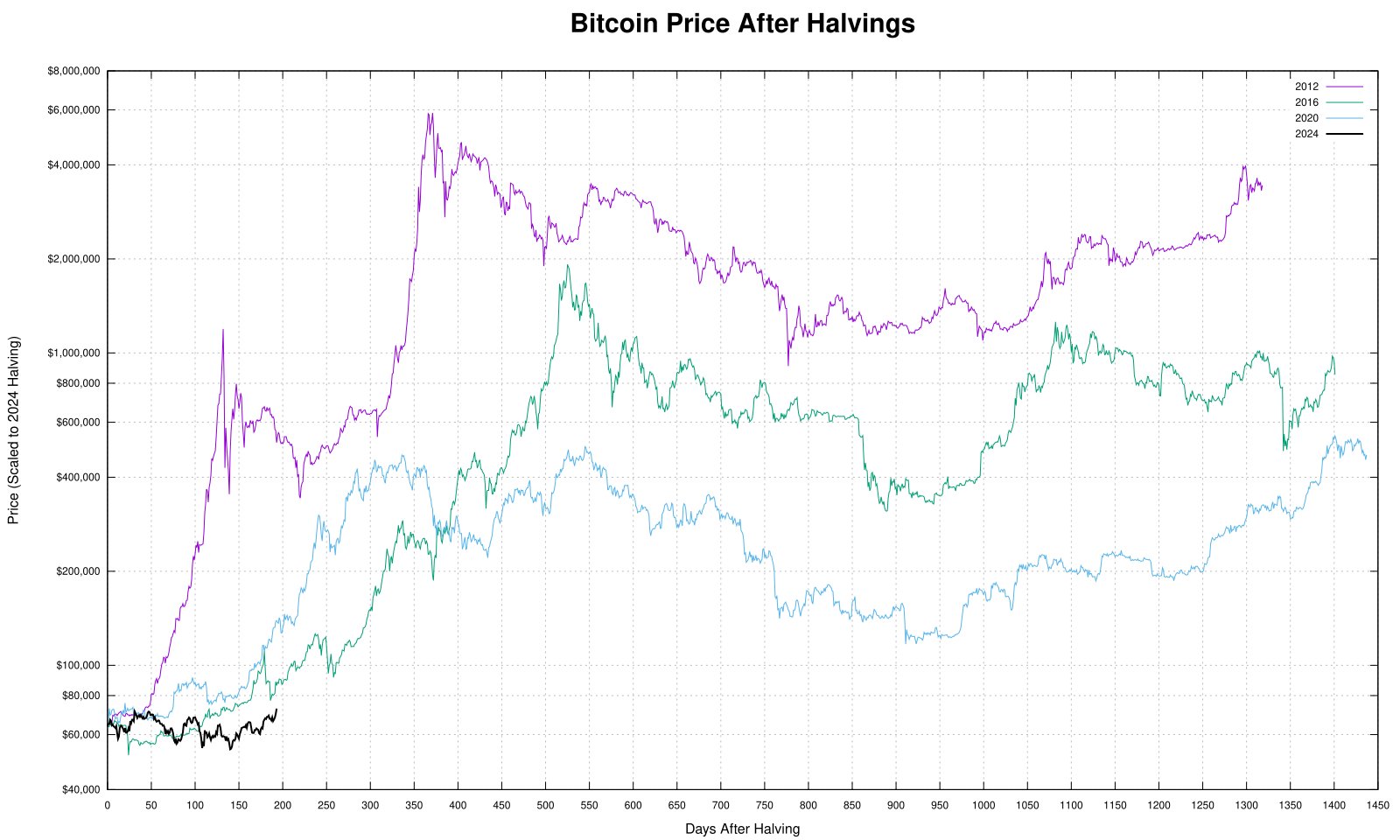

The scarcity of bitcoin is another critical factor. With a fixed supply of 21 million coins and a decreasing rate of new coin issuance through halving events. The halving event that took place earlier in the year is no doubt partially responsible for the current upward pressure on bitcoin’s price. Historically, halvings have been followed by significant price increases with a 100+ day time lag.

Halving Tracker

Halving Tracker

Macroeconomic factors also play a significant role. Central banks around the world have engaged in unprecedented money printing, leading to inflation. Governments, businesses, and people are all seeking assets that can serve as a hedge against currency debasement, and bitcoin fits this role better than the traditional hedge, gold. The Fed, the U.S. central bank, had been in a tightening cycle, but recently started cutting interest rates signaling the beginning of an easing cycle. Now that the U.S. has signaled easing, governments around the world will trip over themselves to ease even more.

Don’t’ believe me? One week after the U.S. announced its cut, China unleashed its largest injection of money into its dying economy in 4 years. They promised more to come. China won’t be the only one doing this.

Another macroeconomic factor is the trend of de-dollarization. The U.S. dollar, while still the dominant global reserve currency, has seen its share slowly decline—a long-term trend averaging a 0.52 percentage point drop per year since 1999. Factors driving this shift include the idiotic weaponization of the dollar (e.g., as a tool for sanctions), which motivates countries to seek alternative reserves, and the rise of other currencies like China’s renminbi in international trade. The net result is the U.S. dollar weakens, and assets such as gold and bitcoin strengthen. This will only accelerate in the future.

These factors combine to ensure bitcoin’s value will rise significantly in the future. Currently, bitcoin’s market capitalization is around $1.2 trillion and growing, making it comparable to major corporations and some commodities. To put this into perspective, if bitcoin’s market cap were to match that of silver (approximately $1.8 trillion), one bitcoin could be worth around $108,020.

- Silver: $108,020

- Gold: $873,534

- USD M2: $1,085,641

- Global M2: $4,359,238

- Global equities $5,641,026

- Global bonds: $6,666,667

- Global real estate: $32,307,692

While these figures may seem extraordinary, they show the potential for growth that bitcoin possesses, realistic potential at that. As adoption increases and the factors driving its value continue to strengthen, bitcoin is not just resilient—it’s laying the groundwork for unprecedented growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。