Recently, several traditional giants have launched new Layer2 blockchain projects, sparking discussions about liquidity fragmentation and economic models within the Ethereum ecosystem.

Written by: Ice Frog

Not long ago, Paradigm announced a $20 million investment in Ithaca to build a Layer2 blockchain called Odyssey; the established DeFi project Uniswap launched Unichain; the exchange Kraken, which raised $120 million, is launching its own L2 public chain inkonchain; and traditional giant Sony announced the launch of a new L2 network.

As the elimination battle among hundreds of L2s has not yet concluded, a new wave of well-backed L2s has entered the already chaotic battlefield, posing even greater challenges to Ethereum's fragmented liquidity. The question of whether L2s are parasitic or symbiotic has also led to greater divergence. However, from a longer-term perspective, the intensification of these divergences often signals that some transformation and adjustment are occurring. This article will comprehensively elaborate on how these new L2 narratives will settle and what new changes they will bring. Before sorting through the newly entered L2s, it is necessary to first discuss the positive and negative evaluations of L2s and the fundamental issues behind them.

### 1. What is the Fundamental Issue?

Parasitism and symbiosis are not contradictory; they are essentially developmental dilemmas.

The South Korean film "Parasite" sparked a global discussion upon its release because it revealed one of humanity's deepest mysteries: the boundaries of human nature depend on the boundaries of wealth distribution. The issue of wealth or interest distribution has historically been the root of all social problems, which holds true in the real world and remains so in the blockchain world. From this perspective, the so-called liquidity fragmentation issue of L2s is essentially about insufficient traffic and uneven distribution. The so-called parasitic problem of L2s is fundamentally that they currently lack the ability to generate value and cannot feed back into the mainnet while selectively opting for a laid-back approach.

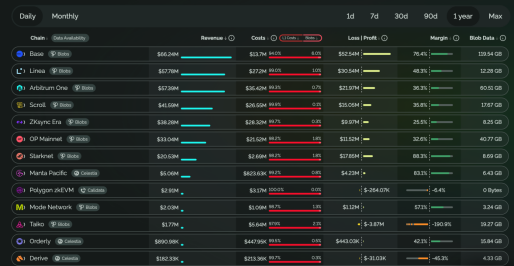

From an economic perspective, the cost side of L2s mainly consists of fees paid to the mainnet for settlement operations, and the other is the cost of renting Blob space; the revenue side mainly comes from users paying gas fees. In this economic model, the Ethereum mainnet effectively outsources transaction execution to L2s, allowing the mainnet to focus on security and data availability while continuously upgrading to reduce costs.

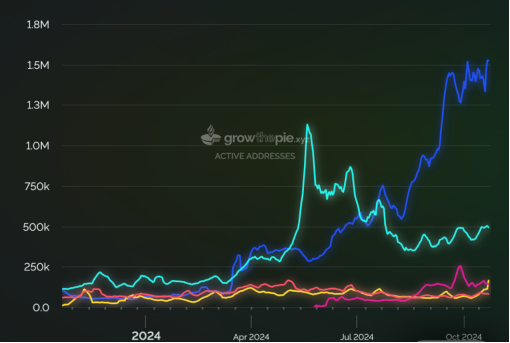

The positive cycle of this economic model relies on L2s being able to attract more users through their own ecosystem development, thereby forming significant economies of scale to feed back into the mainnet. The reality is that, apart from a few strong L2s, most active users have not only failed to increase but have gradually fallen into stagnation.

Further reflection from the perspective of economic models and interest distribution helps us understand why so many L2s are entering this space one after another.

Behind any commercial behavior, there are clear interests at stake, whether it is on-chain margin trading, the massive traffic built on Ethereum, or the wealth effect after token issuance, all of which make this business highly attractive. However, how these interests are perceived divides these L2s into different types, mainly as follows:

- Follow-the-trend and laid-back type: Since the entry threshold for L2s is low and I can share in the profits, why not participate? If the narrative fails, it's the mainnet's fault, not mine, but I won't miss out on any share of the profits. This type is often seen among relentless PUA users who, after exploiting the system, directly reveal their intentions, regardless of criticism, as long as the money is secured, such as Scroll.

- Self-reliant type: I am strong enough and want my share, but if the mainnet is underperforming, I can't take the lion's share of the profits, and if I can't compete with you, I will do it myself. Examples include Optimism and Unichain.

- Alternative path type: I bring my own traffic and may not necessarily value your traffic, but I need to leverage your path. For instance, Sony's Soneium.

As analyzed in our article "L2 in Data: Stalled Growth, Elimination Race Begins," L2s themselves have not been disproven. The current real dilemmas they face stem from a poor external environment, stagnation in the Ethereum mainnet's narrative, and the overdrawn trust from users by the aforementioned laid-back L2s. When these factors are combined, especially when the majority of L2s are purely "follow-the-trend and laid-back," merely draining the mainnet without any building mentality, criticism of parasitism is not unwarranted. More critically, such L2s occupy the vast majority, akin to the gut microbiome; when your immunity is strong enough, an imbalanced microbiome may not cause significant issues, but once you become weak, it can become the last straw that breaks the camel's back. We need not deny Ethereum's current weaknesses, but we cannot doubt its long-term future as a cornerstone of the blockchain world. The plight of L2s is merely a turning point in developmental history; from a longer-term perspective, these follow-the-trend and laid-back L2s are likely to become relics of the blockchain's ruins, while the Ethereum ecosystem must undergo a process of sifting through the sands to be reborn.

Therefore, from the above analysis, we can adopt a more objective perspective to view this divergence: parasitism is merely the status quo, while symbiosis is the true future. Viewing the issue from a developmental lens, the entry of new L2s may not necessarily be a bad thing; it is more likely to serve as a catalyst for accelerated elimination or transformative adjustment.

### 2. New Entrants in L2

Each has its own ambitions, but the central idea is user experience and application.

2.1 Unichain

Recently, the most talked-about L2 is undoubtedly Unichain, launched by the DeFi leader Uniswap, which has received both criticism and praise. However, as analyzed above, for a native DeFi leader that already brings its own traffic, creating its own L2 makes complete commercial sense.

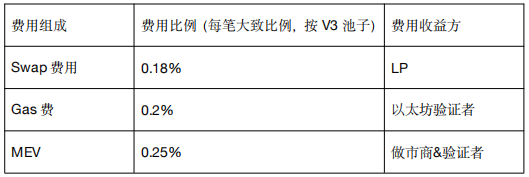

As the largest DeFi on-chain, Uniswap currently has over 1 million daily active users and accounts for over 40% of on-chain DEX trading volume, which is double that of the second-largest competitor, with an annual trading volume close to $700 billion on Ethereum. The development challenges Uniswap faces include expanding its market position and share, as well as increasing protocol revenue and token value. The solution to these two issues lies in how to enhance user trading experience, reduce transaction costs, and further strengthen competitiveness. From the composition of transaction costs, the main variables and corresponding beneficiaries are as follows.

Roughly speaking, traders pay an average cost of about 60 basis points. Based on an average trading volume of $700 billion, this alone amounts to approximately $4.2 billion in fees annually. If you are a UniSwap and Uni token holder, naturally, two thoughts arise: can the $4 billion be distributed to Uni token holders instead of Ethereum stakers? Additionally, can the fees be lowered further to expand the scale? Following this line of thought, Unichain was naturally born. Analyzing the problem from the perspective of interests makes the choices of many projects quite clear.

Unichain specifically achieves the above goals through the following methods:

- Instant Transactions: Overall, it is built on the Op Stack and collaborates with Flashbots to develop a feature called Verifiable Block Building. This mainly involves further dividing a block into four sub-blocks (Flashblocks), thereby accelerating state updates and shortening effective block time, reducing overall block time to 0.25 seconds. Additionally, Unichain uses TEE (Trusted Execution Environment) to separate sorting and block building, allowing for prioritized sorting while taxing MEV and internalizing MEV revenue. The combination of TEE and Flashblocks effectively balances transaction speed and security, but it also places higher demands on the network and technology.

- Lower Costs and Greater Decentralization: Unichain's validation network is composed of a decentralized network of node operators. To become a validator, one must stake UNI tokens and receive rewards based on the amount staked. Each block validation is selected based on UNI staking weight. In other words, Unichain mainly utilizes a combination of centralized validation and verifiable blocks to achieve sorting transparency, while the entire transaction execution process takes place on Unichain, significantly reducing transaction costs.

- Cross-Chain Liquidity: At this level, Uniswap is practicing "intent-centered" interaction building. In other words, through an intent model, user needs are directly converted into intents, and the system autonomously selects paths to execute, completing the entire cross-chain interaction. The intent-centered approach can truly achieve seamless cross-chain operations, effectively reducing liquidity fragmentation and risks associated with manual operations. Overall, as a leader, Uniswap's launch of Unichain not only demonstrates its understanding of technology but also highlights its ambition to become the liquidity center of the entire chain DeFi, further enhancing its value capture ability and the value of UNI tokens.

2.2 Ithaca

On October 11, Paradigm announced a $20 million investment in Ithaca, dedicated to building a Layer2 blockchain called Odyssey. They have also sent several executives to take positions, particularly with Paradigm's CEO serving as chairman and the CTO as CEO, indicating significant emphasis on the project.

Odyssey is built on Reth, OP Stack, and Conduit. Reth is an Ethereum execution node client launched by Paradigm, characterized by its use of the Rust programming language, which offers good memory safety and concurrency performance. Odyssey is built using the Reth SDK, meaning that the use of this library will provide Odyssey with high throughput and low write latency, along with greater scalability. Additionally, another notable feature is the direct incorporation of Ethereum's upcoming Pectra and Fusaka upgrades into Odyssey, primarily to achieve account abstraction, improved operational efficiency, and reduced gas costs.

On this basis, in terms of user experience, wallets can be created directly using existing Google or Apple key tools; users can log in to the testnet without needing a wallet, gas tokens, bridge interactions, or RPC prerequisites. As Ithaca claims, Odyssey indeed has a futuristic feel for L2s, incorporating many features from Ethereum's roadmap ahead of time, ultimately achieving early experiences of functionalities like account abstraction. From this perspective, it reflects Paradigm's ambition to accelerate the development of the entire Ethereum ecosystem, attracting participation from the ecosystem and users, especially early involvement from developers.

2.3 Sonic

In August of this year, Fantom officially announced its rebranding to Sonic Labs and introduced the S token. The token will be used for airdrops, staking, incentive programs, and more. As an established public chain, Fantom's main technical foundation is driven by an improved version of the DAG (Directed Acyclic Graph) consensus mechanism called Lachesis, which was initially designed to solve the blockchain trilemma. Due to this mechanism, Fantom's main characteristics are high speed and cost advantages. In 2019, it launched the EVM-compatible Opera mainnet, and during the subsequent DeFi frenzy, Fantom became a hotspot, especially with the involvement of DeFi leader Andre Cronje, which brought Fantom to its peak. However, with Andre Cronje's exit, not only did the token price plummet, but the emergence of newer competitors like Solana with more impressive technologies further suppressed Fantom's development.

This significant overall technical upgrade of Fantom has attracted market attention, partly due to the traffic effect brought by Andre Cronje's (AC) return, as he is an influential figure in the DeFi era; on the other hand, there is indeed considerable room for improvement in Ethereum's scalability and performance.

AC claims that Sonic will become an existence that surpasses parallel EVMs. Specifically, there are several upgrades:

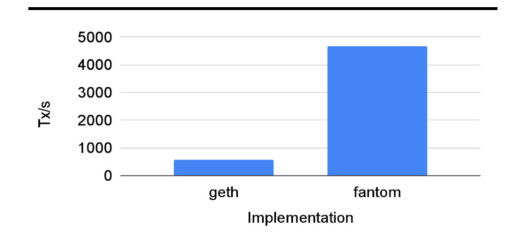

- Introduction of a New Fantom Virtual Machine (FVM): This mainly involves converting EVM bytecode into FVM format while compressing data through parallel processing, significantly reducing execution time.

- Carmen Data Storage Solution: Previously, the state data of smart contracts on Fantom was stored in StateDB, with the EVM executing these contracts and updating the database. This upgrade features a complete redesign of the database, incorporating an indexing system, and it no longer uses RPL encoding and MPT pruning, saving both time and space. The change in the storage solution is akin to the virtual memory of an operating system, resulting in an overall RPC storage cost reduction of nearly 90%.

- Consensus Mechanism Upgrade: Further optimizations have been made based on the original Lachesis, reducing redundant information and improving decision-making efficiency, while also shortening transaction confirmation times. According to test data provided by Michael Kong during his presentation, it can process an average of 4,500 transactions per second, an 8-fold increase, with block space usage reduced by 98%. Theoretically, it can handle 400 million transactions daily, approximately four times the current transaction volume of VISA.

If the Sonic upgrade truly reflects the experimental data, from the perspective of the Ethereum ecosystem, it will become an L2 with high concurrency and top-tier TPS, surpassing the vast majority of L2 projects. Additionally, the foundation will establish an incubator through Sonic Lab, investing heavily to support ecological projects, with over 300 projects currently in collaboration. If subsequent operations are handled well, the overall development momentum is worth looking forward to.

2.4 Soneium

Soneium is the Ethereum L2 launched by tech giant Sony, primarily built on the Op Stack and will also join Optimism's Superchain network. From the limited information available, the overall architecture is expected to be quite similar to Optimism, with DA mainly relying on the Ethereum mainnet, but indexing may primarily be controlled by the project team, and details regarding execution and settlement remain unclear.

After more than half a month of development, the ecological projects have already taken shape, with over 60 projects, and the cooperative applications will focus on entertainment, Web3 gaming, and NFT services. Additionally, due to Sony's prior collaboration with Astar Network, it is expected that Astar zkEVM will transition to Soneium, and the tokens will also be migrated accordingly.

From the project's long-term vision, it aims to leverage Sony's global distribution channels and capabilities in Web2 to bridge Web2 and Web3. It is also relatively clear that Soneium plans to develop functionalities similar to Story Protocol to protect creators' intellectual property. Considering Sony's strong presence in the gaming sector, such a strategic plan is not surprising, but the market's excitement stems from traditional tech giants like Sony entering the crypto industry, which fills the market with anticipation.

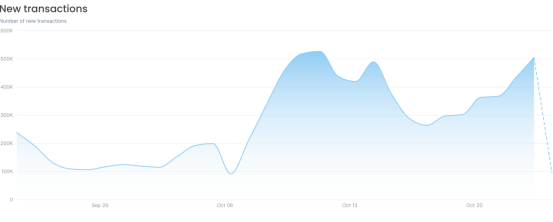

Currently, the testnet data is growing rapidly, with the cumulative number of wallet addresses exceeding 2.2 million and a total of 14 million transactions processed, indicating a relatively significant overall data growth.

Overall, this is an attempt by a traditional giant, and the testnet data reflects market expectations, but it remains unclear whether there are plans for token issuance and a specific roadmap in the future.

### 3. Summary and Outlook

Only through the sifting of sand can true gold be seen; application breakthroughs are the future!

As mentioned at the beginning of this article, the current Ethereum coin price is weak, the ecological narrative is lacking, and issues like liquidity fragmentation are real, especially with the continuous decline in coin prices exacerbating negative market feedback. However, even so, it is evident that the newly entered L2s still need to rely on the Ethereum tree.

From the product layout and intentions of these newly entered L2s, we can roughly see an important trend:

While there may be divergence in the re-evaluation of Ethereum's value, a transformation around value distribution is indeed occurring. The new L2s either possess disruptive technological strength, have their own traffic advantages, or have significant potential in linking Web2 scenarios. They do not intend to replace Ethereum but rather consider how to carve out a larger piece of the pie through their own strengths amid the existing dilemmas.

This may also represent a breakthrough approach for the Ethereum L2 ecosystem. Projects need to have particularly outstanding advantages in technology, traffic, or ecology; otherwise, they will struggle to make any waves in the market.

Additionally, from the focus of these projects, a clear trend is that new projects are placing greater emphasis on developing user experience-oriented application products rather than simply stressing the foundational role of infrastructure. This is significant given the current overabundance of infrastructure in Ethereum. For the many laid-back L2s, whether these new entrants are catfish or sharks, or merely a piece of fish meat, remains unclear in the current environment.

Looking at the broader context of human history, no great endeavor escapes the cyclical laws. The process of rising from a long trough to the peak must undergo the test of refining through fire, but no one knows whether today's market stars will still have a voice in the next cycle. What we can be certain of is that elimination will not stop, and development will not stagnate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。