Bitcoin’s price is trading near its previous peak, hovering around $71,800 to $72,000 as of late October, largely driven by a sharp increase in ETF demand, according to data from Cryptoquant, a leading crypto analytics firm. In October, net ETF purchases surged from -1,300 BTC to 5,800 BTC, with a single-day purchase peak of 7,700 BTC recorded on Oct. 13.

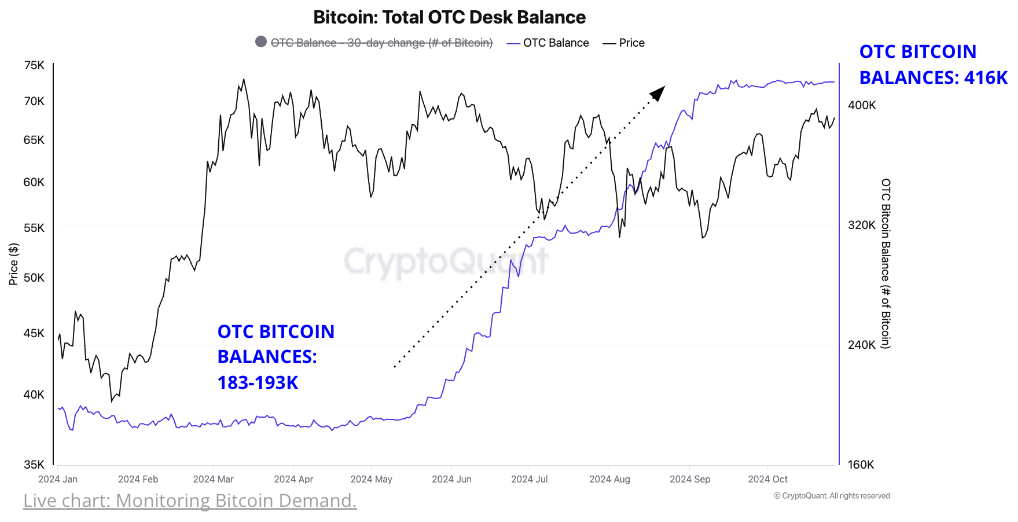

“The price of bitcoin has rallied even as there is more supply available for ETFs to purchase on [over-the-counter (OTC)] desks than at the start of the year,” the report states. “Cryptoquant estimates that the total amount of bitcoin on OTC desks is around 416K BTC, compared to a daily balance of 183-193K bitcoin in Q1 2024.”

Cryptoquant’s analysis adds:

Higher OTC desk balances allow ETFs to source bitcoin without the need to purchase on exchanges, thus avoiding any direct effect on the price.

Cryptoquant’s analysts point out that ETFs’ daily purchases now represent a lower share of OTC inventory compared to early 2024, signaling that a further demand increase would be necessary to significantly reduce OTC bitcoin supplies. Moreover, Cryptoquant notes a shift in the 30-day growth rate of bitcoin holdings on OTC desks, which has slowed dramatically since mid-2024.

Currently, OTC desks have increased their holdings by just 3,000 BTC over the past 30 days, down from a rise of 77,000 BTC in August and 92,000 BTC in June. This reduction in growth, coupled with declining daily inflows to OTC desks, which now average 90,000 BTC, represents the lowest inflow levels seen this year—a 52% drop from the average recorded in the first nine months of 2024. According to Cryptoquant, these factors may exert upward pressure on bitcoin’s price as supply dwindles amid heightened demand.

Overall, Cryptoquant’s research highlights that bitcoin’s potential to break through its all-time high hinges on ETF demand sustaining its current pace or increasing. While current dynamics in OTC supply have tempered the direct impact of these purchases on the open market, sustained or rising demand may gradually erode OTC reserves. Cryptoquant’s findings exemplify a market poised for further growth, contingent on the balance between ETF acquisition rates and available OTC inventory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。