Original | Odaily Planet Daily (@OdailyChina_)

_

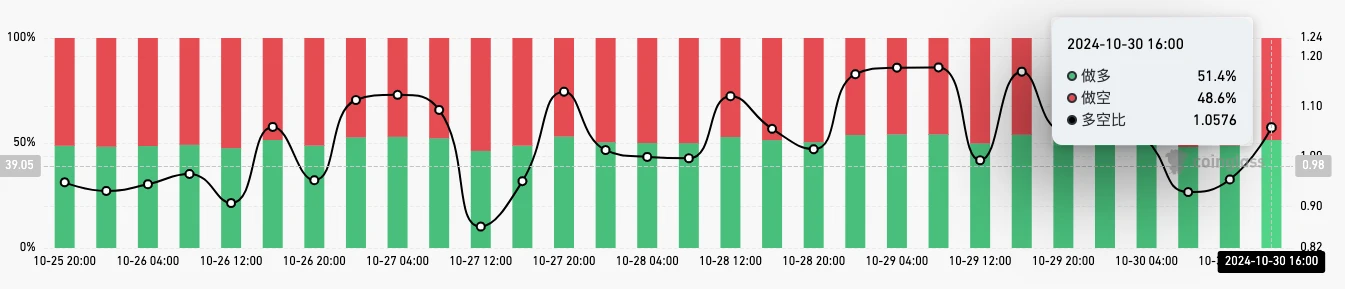

In the early hours of today, BTC briefly rose to 73,650 USDT, just 130 USDT shy of this year's historical high of 73,787.1 USDT from March, and BTC's market share also broke 60% (currently retreated to around 58.7%). According to Coinglass data, as of 4 PM today, the BTC long-short ratio is 1.0576, indicating that from the market sentiment perspective, bulls believe that BTC breaking new highs in the short term is a foregone conclusion. Major blockchain media outlets have also prepared articles in advance, proclaiming that BTC will be great again.

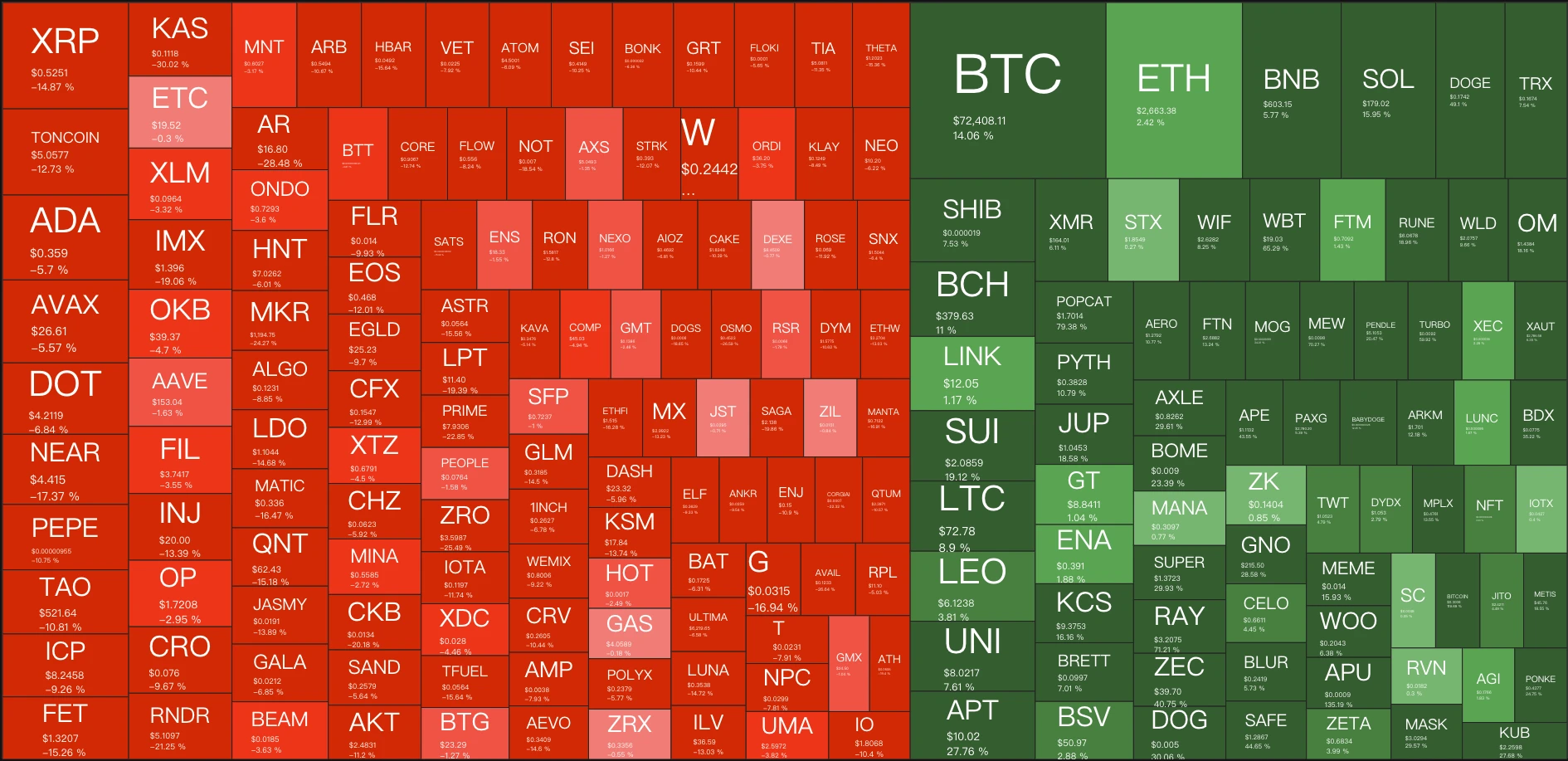

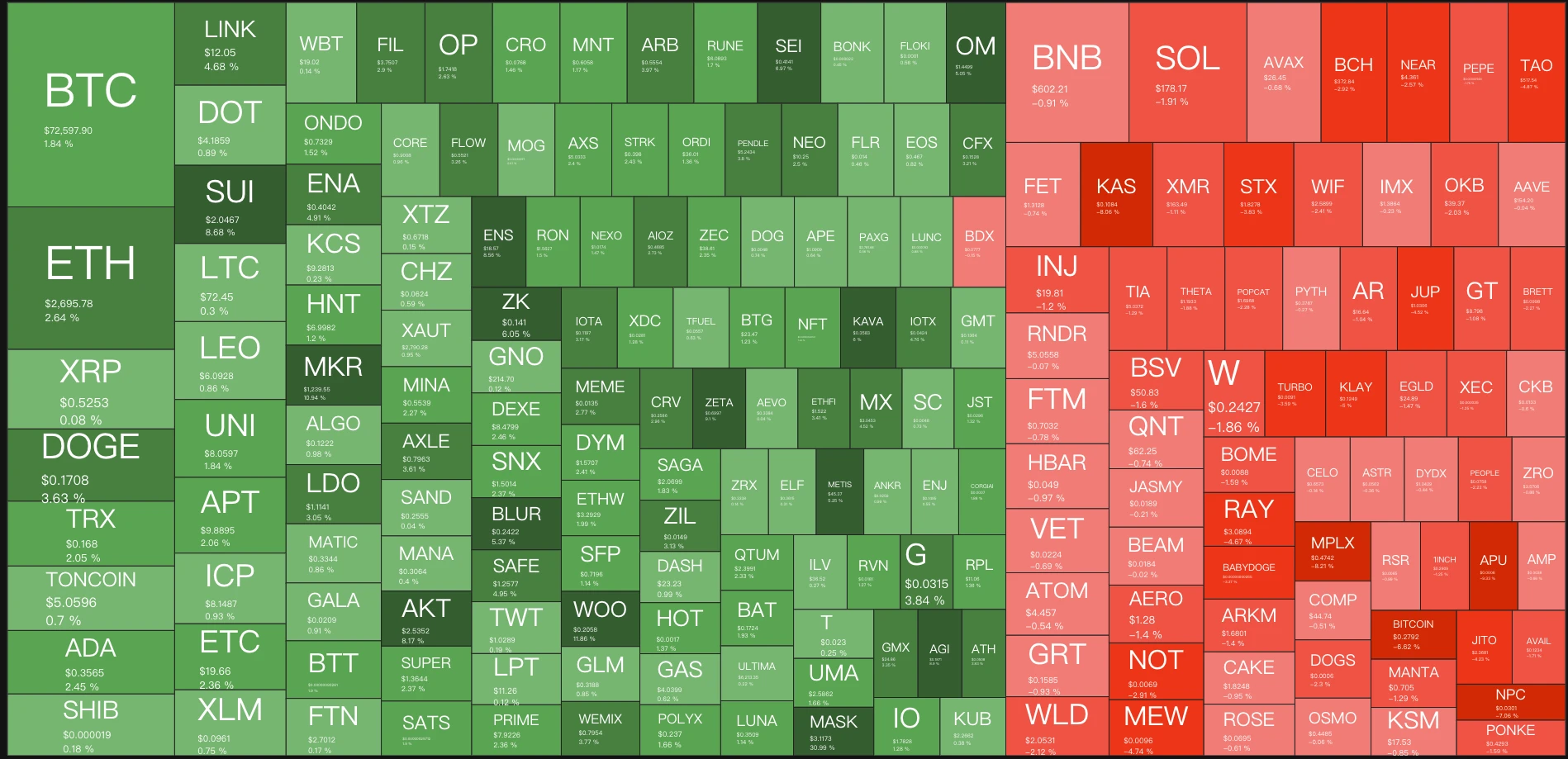

However, despite BTC's price continuously breaking through and nearing new highs since yesterday, the altcoin market has shown lackluster performance.

According to Quantify Crypto data, in October, BTC's price rose from 63,327 USDT to above 72,000 USDT, an increase of about 14%. Among the top 200 cryptocurrencies by market capitalization, only 73 tokens, aside from BTC, saw an increase in October, while the remaining 126 tokens are still in a downtrend, including TON, PEPE, LDO, OP, ARB, and others.

So, can altcoins follow BTC in this round of market? Odaily Planet Daily will attempt to analyze the reasons why altcoins are not performing prominently compared to BTC in this article.

BTC's upward momentum mainly comes from ETF and institutional purchases

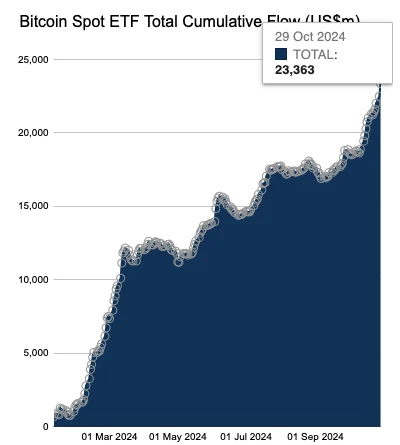

The biggest difference in this round of the crypto cycle compared to previous ones is the approval of the Bitcoin spot ETF in the U.S. and the entry of more institutions, which generally have a bullish outlook on Bitcoin. According to Farside Investors data, as of October 29, the net inflow into U.S. spot Bitcoin ETFs was $23.363 billion, equivalent to a net inflow of 323,600 BTC. If we compare the U.S. spot Bitcoin ETF to a massive exchange, its BTC wallet balance has already surpassed OKX, ranking behind Coinbase and Binance.

At the same time, the approval of the U.S. spot Bitcoin ETF has led to a large number of institutional purchases of BTC. Many globally renowned listed companies have included Bitcoin in their balance sheets. Recently, global internet giant Microsoft also stated that it will discuss whether to invest in Bitcoin to hedge against inflation and other macroeconomic impacts at its next shareholder meeting. Moreover, compared to retail investors, institutional investors are less likely to engage in short-term operations influenced by market sentiment, which is more favorable for Bitcoin's price impact.

However, the BTC price increase driven mainly by ETF and institutional purchases has difficulty radiating funds to the altcoin market. The reason is that the altcoin market generally has high volatility and unclear regulations, making institutional investors prefer the stability and regulatory friendliness of Bitcoin. Although the approval of the Bitcoin spot ETF has brought many new retail funds into the crypto market, these new funds are unlikely to flow into the altcoin market. For new entrants, investing in crypto ETFs is more familiar and convenient than directly investing in cryptocurrencies, so the existence of crypto ETFs is more likely to siphon off new funds that should have flowed into the altcoin market during a bull market.

VC tokens face a trust crisis, Meme market siphons off funds

Another prominent feature of this cycle is the trust crisis surrounding VC tokens, leading people to embrace the Meme market. Players in the altcoin market primarily focus on making money. In the past, having well-known VC investments backing a project was beneficial for both token distribution and secondary markets. However, people are gradually realizing that VC tokens generally suffer from "high valuations and low liquidity."

Due to various narratives and exit requirements, VCs inflate token valuations before they are listed, and once the tokens are traded on exchanges, they sell their early low-priced holdings to the market. Given the low circulation of altcoins, prices inevitably decline, and retail investors not only fail to profit from the inflated valuations but also become the final "bag holders," leading to a gradual loss of confidence in VC tokens.

At the same time, the massive unlocking of VC tokens has further depressed altcoin prices in a context of slow growth in incremental funds and a loss of confidence in existing funds. For example, Celestia will unlock 175.59 million TIA tokens at 10 PM Beijing time tonight, worth approximately $900 million, accounting for 79.91% of the current circulating supply. Even excluding tokens already traded in the OTC market, there are still 92.3 million TIA that will enter the market, worth about $460 million, and currently, very few people are willing to actively buy in.

In this situation, investors have embraced the relatively fair Meme market. Although the Meme market currently also faces severe PVP phenomena, rampant "conspiracy groups," and short token lifecycles, for investors, this is simply a case of "picking the best among the worst."

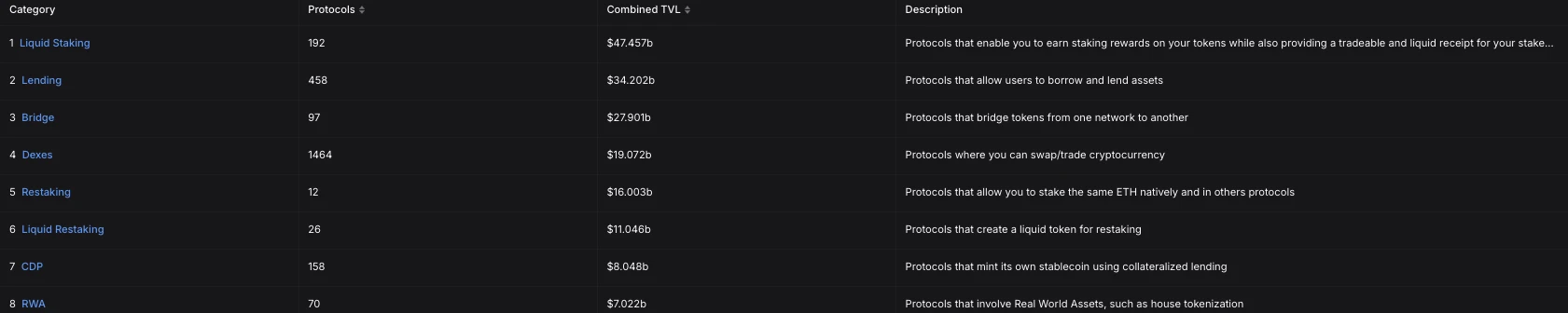

From the data perspective, yesterday the total market capitalization of Meme coins on Solana was raised to over 12 billion USD, setting a historical high. According to DefiLlama data, the TVL of the CDP and RWA sectors is $8.048 billion and $7.022 billion, respectively, indicating that market interest in Meme coins is surpassing that of altcoins under VC-led narratives.

Under regulatory pressure, altcoins struggle to breathe

Another widely accepted reason for the poor performance of the altcoin market is the regulatory pressure facing the crypto industry in 2024. The SEC's fines in the crypto sector for 2024 are expected to reach 4.68 billion USD, a staggering increase of 3018% compared to $150.26 million in 2023. Additionally, many leading crypto companies have been accused by the SEC this year, including Binance, Coinbase, ConsenSys, Uniswap, and OpenSea.

Compliance and regulatory pressures have hindered the altcoin market in terms of trading and promotion. In many countries and regions, BTC has received regulatory recognition, allowing people to trade BTC legally, but most altcoins do not have such a regulatory environment and continue to struggle to "prove they are not securities and their legality." Even Tether, a stablecoin giant, experienced a temporary decoupling when the Wall Street Journal reported that "the U.S. Treasury is considering sanctions against Tether," even though the government did not confirm it, illustrating the current regulatory pressure on the crypto market.

The regulatory pressure is also a major reason why the crypto industry is paying close attention to the U.S. elections. ConsenSys even sent a letter to the future U.S. president in advance, calling for friendly regulation of the crypto industry. If the new president adopts a friendly policy towards crypto, it may boost the confidence of retail and even institutional investors in altcoins.

Slow innovation progress in altcoin projects

Although the primary market financing remains relatively prosperous, the innovation progress of altcoin projects is still slow, with narratives stagnating. Projects have not kept pace with the industry's and market sentiment's development in terms of technological and narrative innovation. Ethereum founder Vitalik is still sorting out the future development roadmap for Ethereum, while projects within the ecosystem are stacking narratives around L2, LST, Restaking, etc. Other ecological protocols are also primarily building around these narratives.

In the current environment, investors have become desensitized to projects packaged under these narratives, and these projects have accumulated a sufficiently high bubble, leaving little room for growth. Without sufficient new technological or narrative innovations to support them, the competitiveness of altcoins, especially older ones, will continue to decline.

Past crypto cycles may have become ineffective

Looking back at previous bull markets, such as those in 2017 and 2021, the crypto market exhibited a cyclical pattern of "Bitcoin rises, then altcoins rotate." When Bitcoin continues to break through highs with strong growth, it triggers heightened market sentiment and increased risk appetite among users, leading to an altcoin bull market.

However, in this round, we may no longer be able to apply such a rigid approach. The past crypto cycles may have become ineffective. As mentioned earlier, the approval of the Bitcoin spot ETF, the entry of more rational institutional investors, tightening regulatory policies, retail investors losing confidence in altcoins, and the emergence of low-cost, no-threshold tokens like Meme coins and inscriptions all contribute to the uniqueness of this cycle.

As a result, even if BTC breaks previous highs and continues to rise, the situation in the altcoin market may not improve. Instead, some new areas such as Meme coins, inscriptions, and the Bitcoin ecosystem may gain opportunities.

Conclusion: Hope the above analysis is wrong

Of course, biases can influence perspectives. Despite the current poor performance of the altcoin market, as BTC approaches new highs (and there may even be a reversal), we still hope for a bright performance from altcoins. From today's data, BTC's rise has already led to some altcoins rebounding. According to Quantify Crypto data, today among the top 200 cryptocurrencies by market capitalization, 130 tokens have rebounded, while 70 tokens are still in a downtrend, with DOGE rising 3.68% today and SUI rising 8.63%.

However, stepping back, in the current market situation, Bitcoin dances alone, and the market's FOMO sentiment towards altcoins is poor, causing altcoin prices to gradually return to their value. This process of de-bubbling may also be part of the bull market plan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。