Original Title: "Raydium: King Of Solana De-Fi"

Original Author: @0xkyle__

Original Compilation: zhouzhou, BlockBeats

Editor's Note: This article mainly discusses Raydium's position and advantages on the Solana blockchain, especially its dominance in meme coin trading. It also analyzes Raydium's growth strategies, liquidity management, buyback mechanisms, and explains how these mechanisms help Raydium maintain its leading position in the Solana ecosystem.

The following is the original content (reorganized for better readability):

Introduction

The 2024 cycle has so far witnessed Solana's dominance, with the main narrative of this cycle—meme coins—originating from Solana. In terms of price appreciation, Solana is also the best-performing Layer 1 blockchain, having risen approximately 680% year-to-date.

Although meme coins are deeply intertwined with Solana, since the resurgence in 2023, Solana has regained attention as an ecosystem, thriving with protocols like Drift (Perp-DEX), Jito (liquid staking), and Jupiter (DEX aggregator), all reaching billion-dollar valuations. Solana's active addresses and daily trading volume have surpassed all other chains.

At the core of this thriving ecosystem is Raydium, Solana's leading decentralized exchange. The old saying "selling shovels in a gold rush" perfectly describes Raydium's position. While meme coins attract significant attention, Raydium quietly drives liquidity and trading behind the scenes, supporting this activity. Thanks to the continuous influx of meme coin trading and broader DeFi activities, Raydium has solidified its status as a key infrastructure within the Solana ecosystem.

At Artemis, we believe in an increasingly fundamentals-driven world—therefore, the purpose of this article is to construct a fundamentals report emphasizing Raydium's position in the Solana ecosystem. We adopt a data-driven approach aimed at analyzing Raydium's position in the Solana ecosystem through first principles.

Raydium Overview

Launched in 2021, Raydium is an automated market maker (AMM) built on Solana, supporting permissionless pool creation, ultra-fast trading, and yield earning. Raydium's key differentiator lies in its structure—Raydium is the first AMM on Solana and introduced the first hybrid AMM in DeFi that supports order books.

When Raydium launched, they adopted a hybrid AMM model that allowed idle pool liquidity to share with a centralized limit order book, whereas typical DEXs at the time could only access liquidity within their own pools. This meant that the liquidity on Raydium also created markets that could be traded on any OpenBook DEX GUI.

While this was a major differentiator in the early days, this feature is currently closed due to the influx primarily from long-tail markets.

Raydium currently offers three different types of pools:

Standard AMM Pool (AMM v4), previously known as Hybrid AMM

Constant Product Market Maker (CPMM), supporting Token 2022

Concentrated Liquidity Market Maker (CLMM)

For each swap on Raydium, a small fee is charged based on the specific pool type and fee tier. This fee is allocated to liquidity providers, Raydium token buybacks, and the treasury.

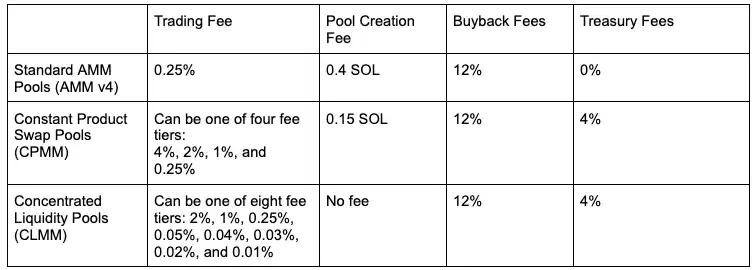

Below are the trading fees, pool creation fees, and protocol fees for different Raydium pools that we have recorded. Here’s a quick breakdown of each term and its corresponding fee level:

Trading Fee: The fee paid by traders when swapping

Buyback Fee: A certain percentage of trading fees used for buying back Raydium tokens

Treasury Fee: A certain percentage of trading fees allocated to the treasury

Pool Creation Fee: The fee charged for creating a pool, aimed at preventing pool abuse. The pool creation fee is controlled by the protocol's multi-signature and is used for protocol infrastructure costs.

Figure 1. Raydium Fee Structure

DEX Ecosystem on Solana

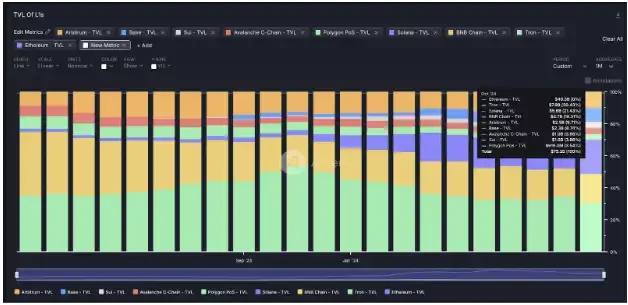

Figure 2. TVL on Solana

Now that we have analyzed how Raydium operates, we will assess Raydium's position in the Solana DEX ecosystem. It goes without saying that Solana has climbed to the forefront among L1 chains in the 2024 cycle—looking at Ethereum, Solana is the third highest chain in TVL, only behind Tron (second) and Ethereum (first).

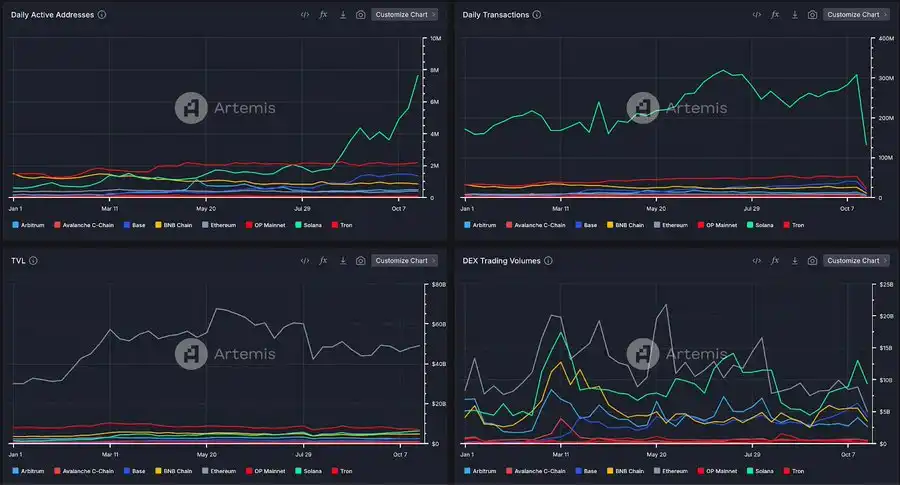

Figure 3. Daily Active Addresses, Daily Trading Volume, TVL, and DEX Trading Volume Across Chains

Solana continues to dominate in user activity-related metrics such as daily active addresses, daily trading volume, and DEX trading volume. The increase in activity and liquidity on Solana can be attributed to several different factors, one of the more notable being the "meme coin craze" on Solana.

The high speed and low cost of settlement on Solana, combined with the smooth user experience it provides for Dapps, have contributed to the growth and prosperity of on-chain trading. Tokens like BONK and WIF have reached multi-billion dollar market capitalizations, and with the emergence of the Pump.fun meme coin launch platform, Solana has become the de facto place for meme coin trading.

In this cycle, Solana is undoubtedly the most widely used Layer 1 and continues to lead in trading activity compared to other L1s. As a direct beneficiary of increased activity, this means that DEXs on Solana are performing exceptionally well—more traders mean more fees, leading to more revenue for the protocols. However, even among DEXs, Raydium has successfully captured a significant market share, as evidenced by the following data:

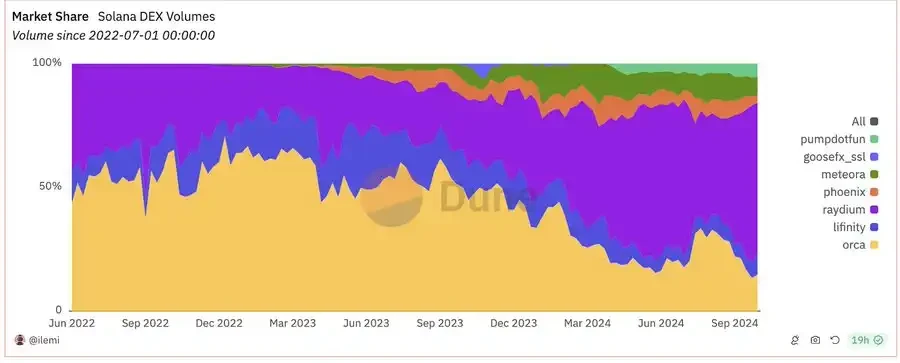

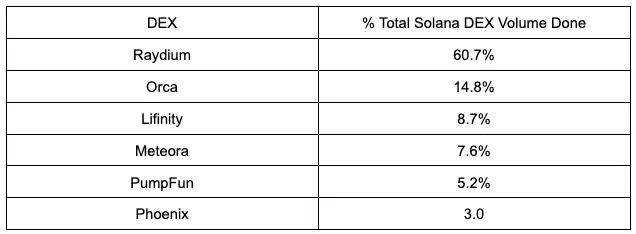

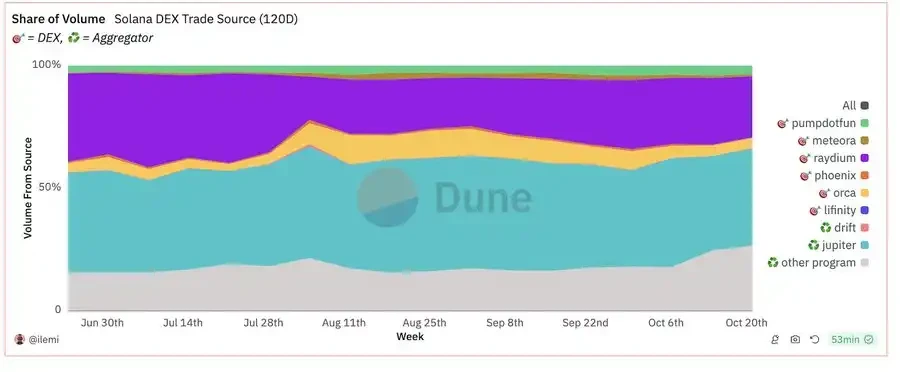

Figure 4. Market Share of Solana DEX Trading Volume

Currently, Raydium ranks first among other Solana DEXs, with trading volume leading all DEXs. Raydium accounts for 60.7% of the total trading volume on Solana DEXs, thanks to Raydium's support for various activities—from meme coins to stablecoins.

One way Raydium achieves this is by providing pool creators and liquidity providers with multiple options when creating new markets, allowing users to choose constant product pools for price discovery during initial offerings or opt for tighter range liquidity provision in concentrated liquidity pools—this enables initial price discovery for long-tail assets to occur on Raydium while remaining competitive in markets like SOL-USDC, stablecoins, LSTs, etc.

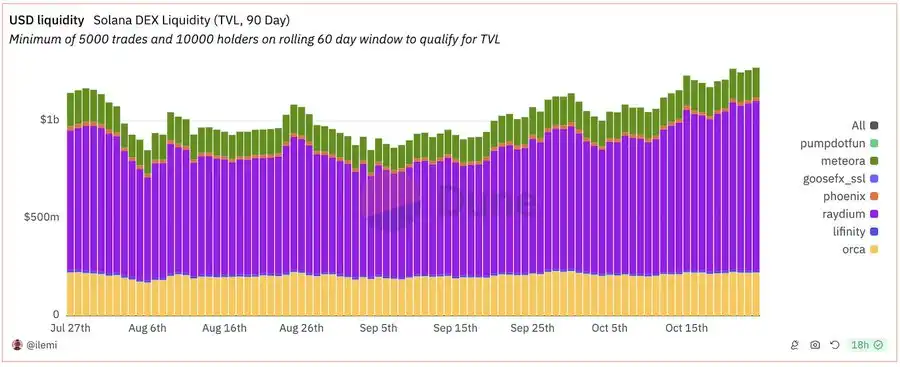

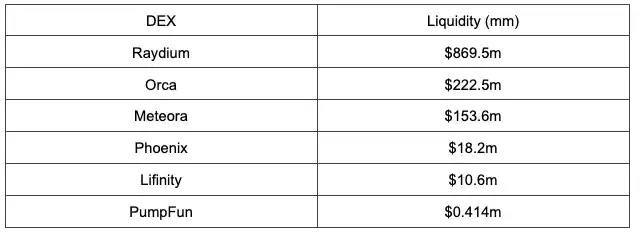

Figure 5. Liquidity Between Solana DEXs

Additionally, Raydium remains the DEX with the most abundant liquidity during trading. It is important to note that DEXs often face the issue of economies of scale, as traders tend to concentrate on the exchanges with the strongest liquidity to avoid trading slippage. Liquidity breeds liquidity—this creates a positive feedback loop where the largest DEX attracts the most traders, thereby attracting liquidity providers to profit from fees, which in turn attracts more traders looking to avoid slippage—this cycle continues indefinitely.

When comparing DEXs, liquidity is often overlooked, but it is crucial in assessing the best performers—especially considering that traders on Solana are trading meme coins, which not only have extremely poor liquidity but also require a common gathering point. If liquidity is dispersed among DEXs, it will lead to a poor user experience and dissatisfaction when purchasing different meme coins.

Examining the Relationship Between Meme Coins and Raydium

Raydium's popularity is also attributed to the resurgence of meme coins on Solana, particularly the meme coin launch platform launched by Pump.Fun, which has generated over $100 million in fees since its establishment earlier this year.

There is a direct connection between the meme coins from Pump.Fun and Raydium—when tokens launched on Pump.Fun reach a market cap of $69,000, Pump.Fun automatically deposits $12,000 worth of liquidity into Raydium. Continuing to emphasize liquidity, this means that Raydium is actually the most liquid platform for trading meme coins.

Like a virtuous cycle, Pump.Fun establishes a connection with Raydium > meme coins are launched here > people trade here > it gains liquidity > more meme coins are launched here > it gains more liquidity, and this cycle repeats continuously.

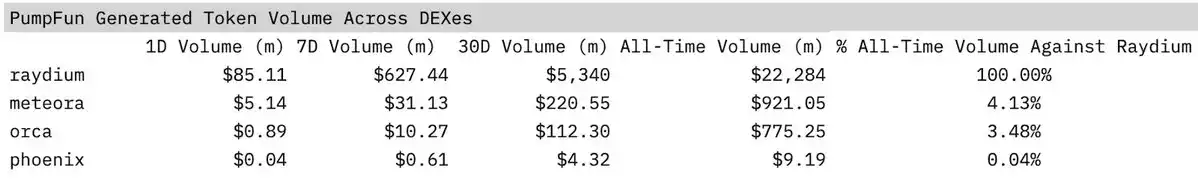

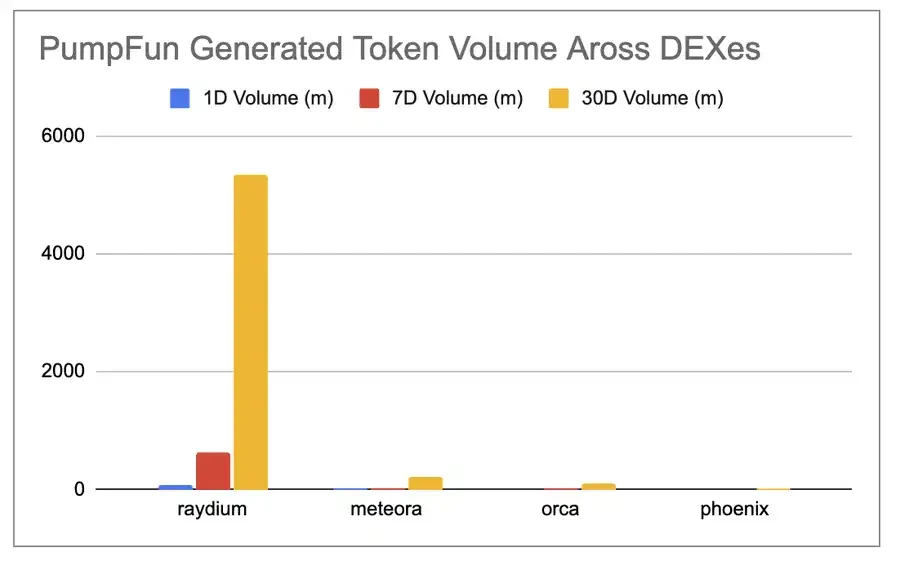

Figure 6. Trading Volume of Tokens Generated by Pump.Fun on DEXs

Therefore, Raydium is considered to follow the power law, with nearly 90% of the meme coins generated by Pump.Fun being traded on Raydium. Like a large shopping mall in a city, Raydium is the largest "shopping center" on Solana, meaning that most people choose to "shop" at Raydium, and most "merchants" (tokens) also want to set up shop there.

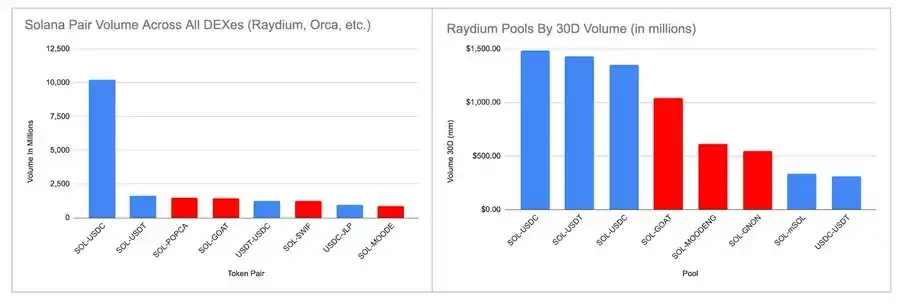

Figure 7. Trading Volume of Trading Pairs on Various Solana DEXs (30 Days) Compared to Trading Volume of Trading Pairs on Raydium (30 Days) (Red = meme coins, Blue = non-meme coins)

Figure 8. Trading Volume on Raydium by Token Type

It is important to note that while Pump.Fun relies on Raydium, the reverse is not true—Raydium does not solely depend on meme coins for trading volume. In fact, according to Figure 8, the three trading pairs with the highest trading volume in the past 30 days are SOL-USDT/USDC, accounting for over 50% of the total trading volume. (Note: The two SOL-USDC trading pairs are two different pools with different fee structures.)

Figures 7 and 9 also support this point, with Figure 7 showing that SOL-USDC far exceeds all other DEX trading pairs in terms of trading volume. While Figure 7 displays the trading volume across all DEXs, it still indicates that the trading volume in the ecosystem is not entirely driven by meme coins.

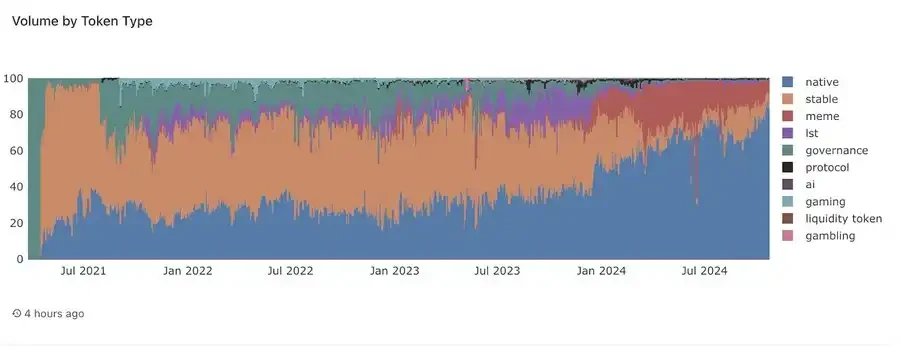

Figure 9 further illustrates Raydium's trading volume by token type, showing that "native tokens" occupy the largest market share, exceeding 70%. Therefore, while meme coins hold an important position on Raydium, they do not constitute the entirety of the overall trading volume.

Figure 9. Pump.Fun Revenue

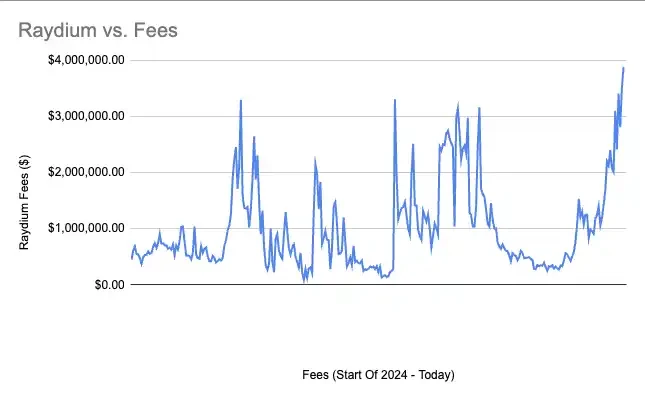

Figure 10. Raydium Revenue

That said, meme coins are highly volatile, and pools with higher volatility typically generate higher fees. Therefore, although meme coins may not contribute significantly to Solana's liquidity pools in terms of trading volume, they are important contributors to Raydium's revenue and fees.

This is particularly evident when observing the data from September—since meme coins are cyclical assets, they tend to perform poorly during "market downturns" as risk appetite declines. Consequently, Pump.Fun's revenue dropped by 67% from an average of $800,000 per day in July and August to about $350,000 in September; during this period, Raydium's fees also experienced a similar decline.

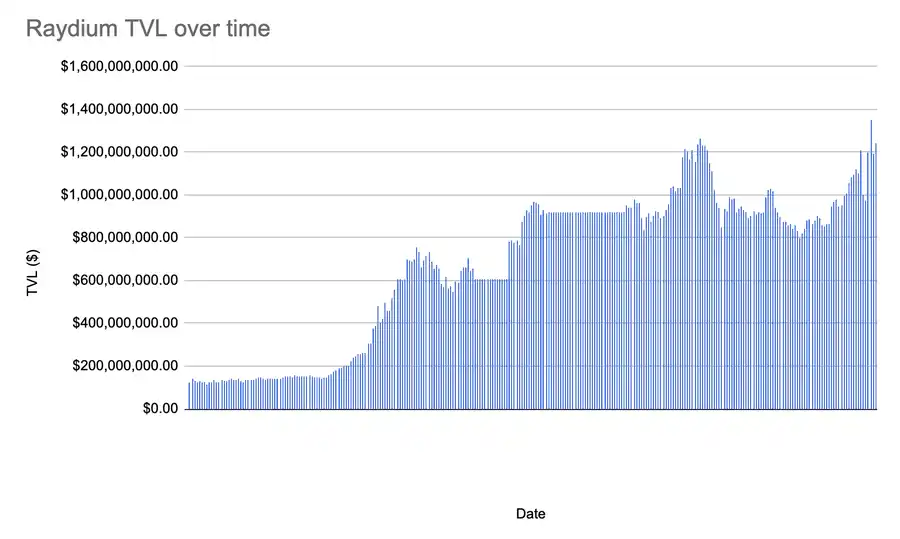

Figure 11. Raydium's TVL Over Time

But like everything else in the crypto industry, the sector is highly cyclical, and it is normal for metrics to decline during bear markets as risk gradually recedes. Conversely, we can focus on TVL as a measure of the protocol's true antifragility—while revenue is highly cyclical and fluctuates with the entry and exit of speculators, TVL is a metric that can signify the sustainability of decentralized exchanges (DEXs), reflecting their ability to withstand the test of time.

TVL is akin to the "occupancy rate" of a shopping mall—although fashion trends may fluctuate, the usage of the mall may vary by season, as long as the mall's occupancy rate is above average, we can measure its success.

Similar to a well-utilized shopping mall, Raydium's TVL remains stable over time, indicating that although its revenue may fluctuate with market prices and sentiment, it has demonstrated the ability to serve as a mainstay product in the Solana ecosystem and become the best and most liquid DEX on Solana. Therefore, while meme coins do contribute to its revenue, trading volume does not always rely on meme coins, and liquidity continues to flow to Raydium regardless of the season.

Raydium VS Aggregators

Figure 12. Sources of SolanaDEX Trading

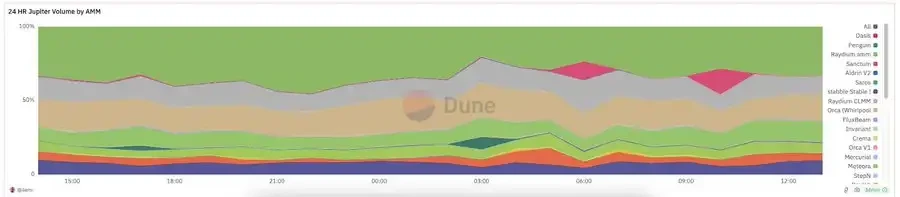

While Jupiter and Raydium do not directly compete, Jupiter acts as a key aggregator in the Solana ecosystem, routing trades through multiple decentralized exchanges (DEXs), including Raydium, ensuring trades are executed along the most efficient paths. Essentially, Jupiter serves as a meta-level platform, ensuring users obtain the best prices by sourcing liquidity from various DEXs (such as Orca, Phoenix, Raydium, etc.). Meanwhile, Raydium acts as a liquidity provider, supporting many trades routed by Jupiter by providing deep liquidity pools for Solana-based tokens.

Figure 13. 24-Hour Jupiter Trading Volume by AMM Category

While these two protocols work closely together, it is worth noting that the organic trading volume share directly contributed by Raydium is slowly increasing, while Jupiter's share is gradually decreasing. At the same time, Raydium accounts for nearly 50% of all trading volume from Jupiter's market makers.

This indicates that Raydium has succeeded in building a stronger, self-sustaining platform capable of directly attracting users rather than relying on third-party aggregators like Jupiter.

The increase in direct trading volume suggests that traders are finding value in using Raydium's native interface and liquidity pools, seeking the most efficient and comprehensive DeFi experience without going through an aggregator. Ultimately, this trend highlights Raydium's independent capability as a major liquidity provider in the Solana ecosystem.

Raydium VS Other Solana DEXs

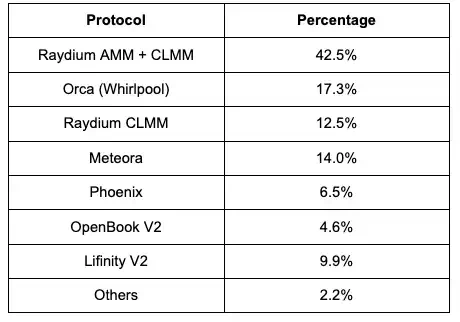

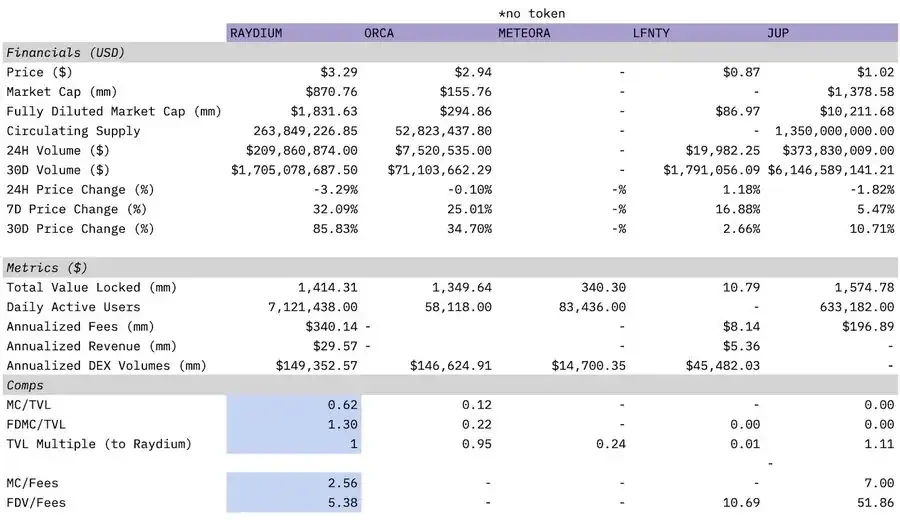

Finally, below is a comparison table of Raydium against other SolanaDEXs (including aggregators) built using the Artemis plugin.

Figure 14. Comparison of Raydium and SolanaDEXs

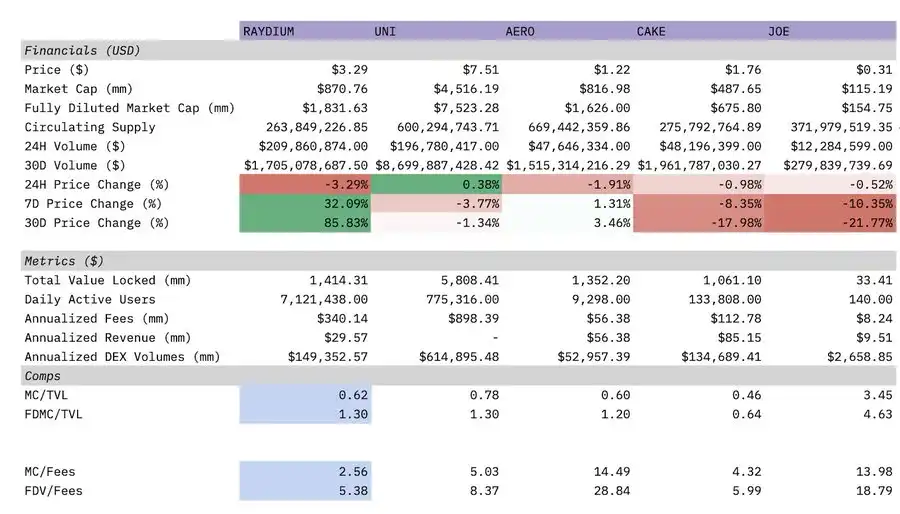

Figure 15. Comparison of Raydium and Popular DEXs

In Figure 13, we compare Raydium with the most popular DEXs on SOL, primarily including Orca, Meteora, and Lifinity—these four DEXs collectively account for 90% of the total DEX trading volume on Solana, and we also include Jupiter as an aggregator in the comparison. Although Meteora does not have a token, we still include it for comparison purposes.

We can see that Raydium has the lowest market cap/fee ratio and fully diluted market cap/fee ratio among all DEXs. Raydium also has the most daily active users, with the TVL of other DEXs being over 80% lower than Raydium—except for Jupiter, which we consider an aggregator rather than a DEX.

In Figure 14, we compare Raydium with other more traditional on-chain DEXs—it is evident that Raydium's annualized DEX trading volume is more than double that of Aerodrome, yet its market cap/earnings ratio is lower.

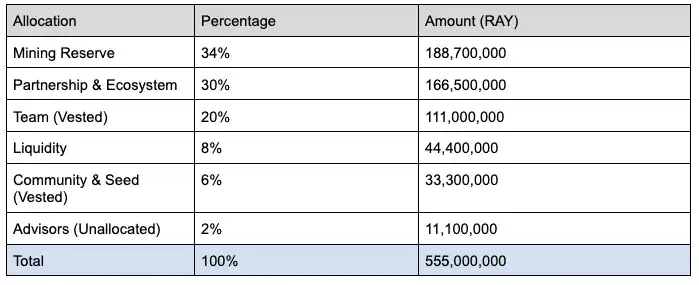

Raydium Token Economics

Here is a breakdown of Raydium's token economics:

Note: The team and seed round (accounting for 25.9% of the total) are fully locked for the first 12 months after the token generation event (TGE) and will be unlocked daily from the 13th to the 36th month, with unlocking ending on February 21, 2024.

Raydium tokens have multiple use cases: holders of RAY can stake their Raydium tokens to earn additional RAY. Additionally, it serves as a mining reward to attract liquidity providers, allowing for the formation of thicker liquidity pools. Although Raydium tokens are not governance tokens, a governance mechanism is currently being developed.

Despite the decline in the popularity of issuing tokens after the DeFi summer, it is worth noting that Raydium's annual inflation rate is very low, and its annualized buyback performs excellently in DeFi. Currently, the annual issuance is about 1.9 million RAY, with 1.65 million of that being staked RAY, which is very low compared to the issuance of other popular DEXs at peak times. At the current price, the annual issuance of RAY is worth about $5.1 million. This is significantly less compared to Uniswap, which has a daily issuance of $1.45 million before full unlocking, with an annual issuance of $529.25 million.

As we recall, every time a trade is made in Raydium's pools, a small trading fee is charged. According to the documentation: "These fees are allocated based on the specific pool's fees, used to incentivize liquidity providers, RAY buybacks, and the treasury. In summary, regardless of the specific pool's fee tier, 12% of all trading fees will be used for RAY buybacks." This fact, combined with Raydium's trading volume, produces some quite impressive results.

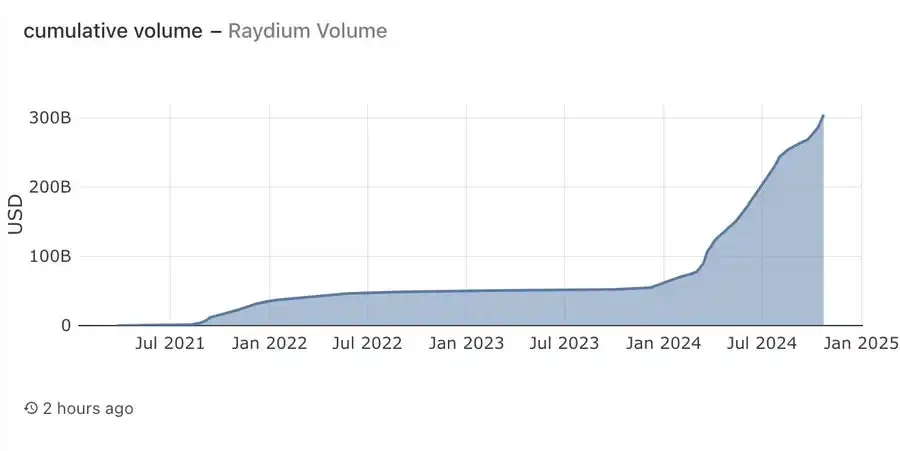

Figure 16. Cumulative Trading Volume of Raydium

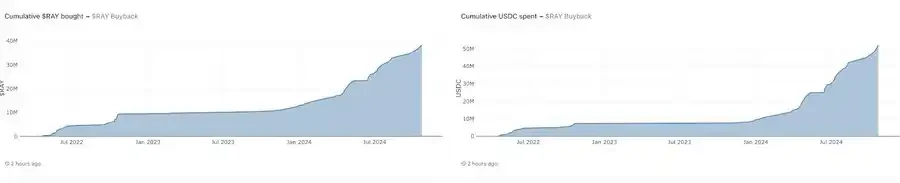

Figure 17. Raydium Buyback Data

With a cumulative trading volume exceeding $300 billion, Raydium has successfully repurchased approximately 38 million RAY tokens, worth about $52 million. This amounts to 14% of its current circulating supply. Raydium's buyback program is leading in the entire DeFi space, helping Raydium stand out among all DEXs on Solana.

Raydium's Advantages

Overall, Raydium has a clear advantage among all DEXs on Solana and is well-positioned in the context of Solana's continued growth. Raydium's growth story over the past year is remarkable, and with the increasing dominance of meme coins in the crypto market, especially the recent meme coin craze surrounding AI (such as GOAT), its growth momentum shows no signs of stopping.

As Solana's primary liquidity provider and automated market maker (AMM), Raydium has a strategic advantage in capturing market share from emerging trends. Furthermore, Raydium's commitment to innovation and ecosystem development is reflected in its frequent upgrades, strong incentives for liquidity providers, and active engagement with the community. These factors indicate that Raydium is not only prepared to adapt to the ever-changing DeFi landscape but also to lead this trend.

Ultimately, as a critical infrastructure in the rapidly evolving blockchain ecosystem, Raydium seems poised for good growth in the future if it continues on its current trajectory.

Disclaimer: This article does not constitute trading advice.

Original link: Artemis Research

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。