On Monday, Robinhood said began deploying election event contracts to select U.S. customers on Oct. 28, just ahead of the Nov. 5 U.S. presidential election. Available through Robinhood Derivatives, the platform allows users to speculate on the election outcome by trading contracts tied to either Kamala Harris or Donald Trump.

Robinhood noted that customers must meet specific eligibility criteria, including U.S. citizenship, to participate in these contracts, which the company describes as tools for engaging in real-time decision-making. The new election trading feature comes on the heels of Robinhood’s HOOD Summit in Miami, where the company first teased its plans to offer futures and index options.

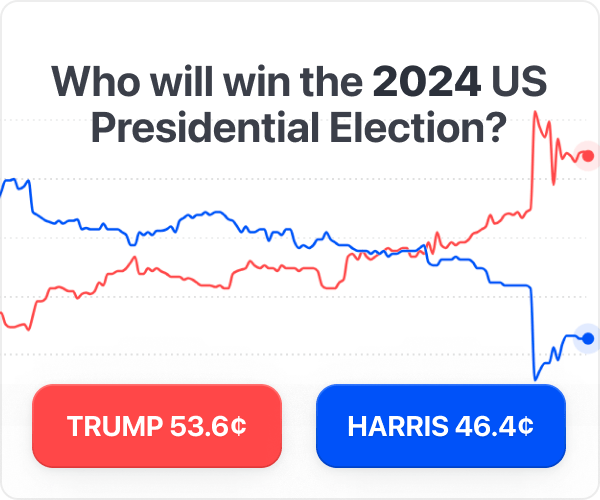

Robinhood claims that its event contracts open up “democratized, accessible” trading linked to key events. The company asserts that this introduction broadens its portfolio of continuous trading options, which currently includes 24/5 stock trading. Meanwhile, Polymarket and Kalshi, two competitors in the event-driven trading arena, are seeing rapid growth. Both platforms have attracted millions through election contracts, a niche Robinhood now enters.

As Robinhood’s election market goes live, the trading industry is watching whether its entry will bolster participation or spark increased regulatory scrutiny surrounding election-related trading. Yet, once the election outcome is finalized, this immense flow of capital tied to the U.S. presidential race could swiftly disappear. This is a trend that market observers are watching carefully as prediction markets evolve over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。