Will the "Trump Trade," which Wall Street is fully betting on, usher in a new situation?

Written by: RockFlow

Key Points

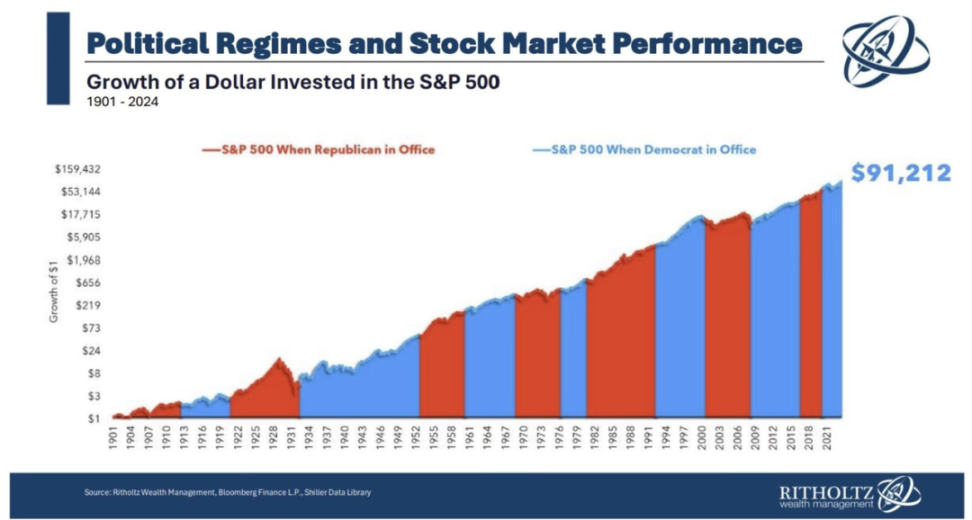

① Historical data of the S&P 500 index since 1901 shows that regardless of which party controls the White House, the index tends to rise in the long term.

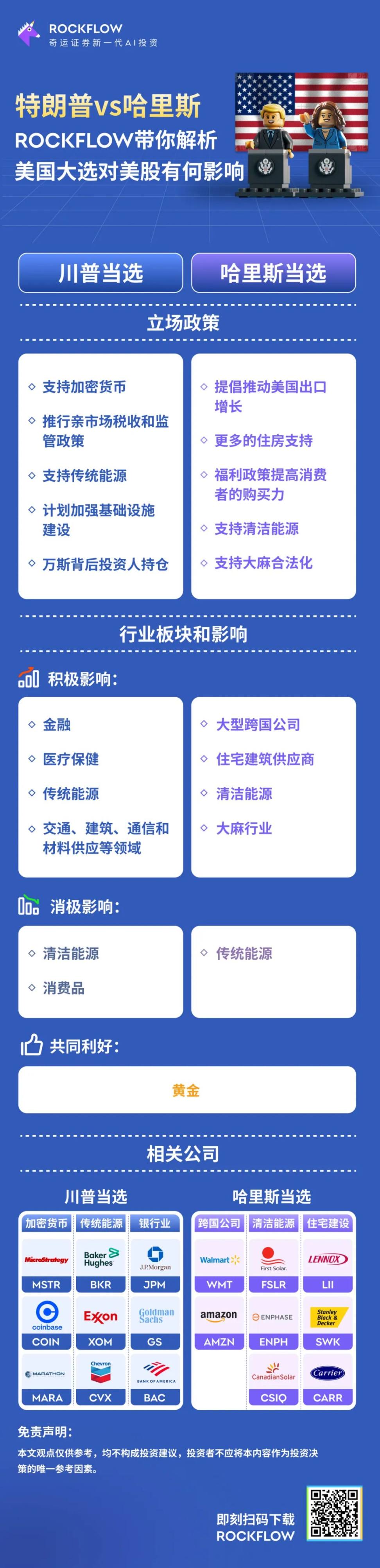

② The market generally believes that given Trump's current stance, his support for cryptocurrencies, traditional energy, infrastructure development, and tax cuts; whereas if Harris takes office, she is inclined towards welfare policies, healthcare, green energy, and support for U.S. exports and housing.

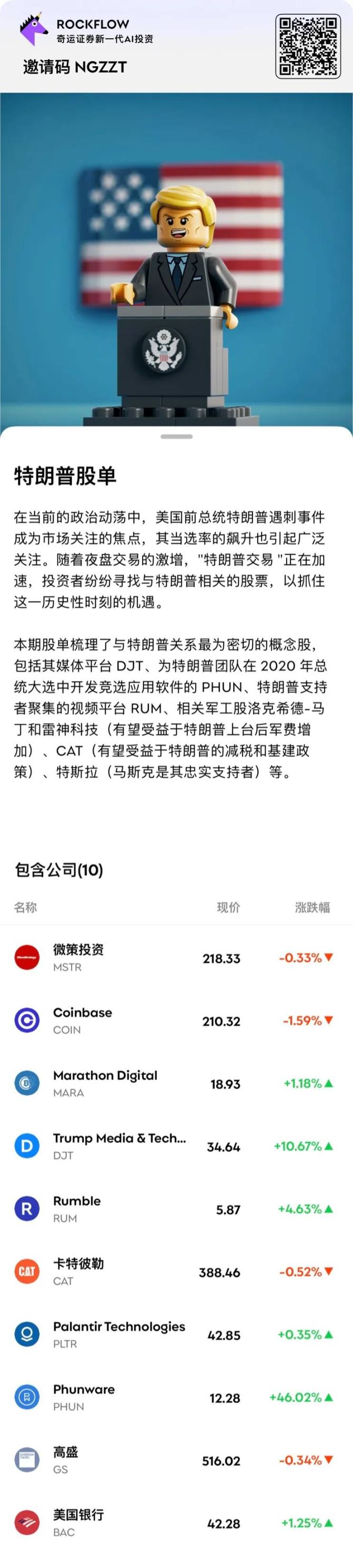

③ The U.S. stock market is currently reviving the "Trump Trade." For example, Trump's social media company DJT has doubled since October; Phunware has risen over 200% this month; additionally, cryptocurrency concept stocks publicly supported by Trump have collectively rebounded, with Bitcoin rising over 10% from its low this month.

With the Federal Reserve's recent announcement of its first interest rate cut since 2020, the market's focus is shifting to the next major event—the U.S. election on November 5.

The chart below shows the historical trend of the S&P 500 index since 1901, with red representing periods of Republican control and blue representing Democratic control. Historical data indicates that regardless of which party controls the White House, the index tends to rise in the long term.

However, due to the differing policy inclinations of candidates from different parties, the emergence of a new president will have significant impacts on various sectors of the U.S. stock market.

Recent polls show that Harris and Trump are neck and neck in the presidential election. In an ABC/Ipsos poll, Harris leads by 4 percentage points, while Trump has a slight edge in other polls. This indicates that Harris's support has declined since the last New York Times poll in early October.

This is also the reason why Goldman Sachs, JPMorgan, and Deutsche Bank have collectively voiced their support for the "Trump Trade" in recent weeks. A report from JPMorgan on the 17th stated that hedge fund capital flows show a strong preference for Republican themes, while the clear representative of a Democratic victory—renewable energy—has been heavily sold off in recent weeks.

The current market generally believes that given Trump's current stance, his support for cryptocurrencies, traditional energy, infrastructure development, and tax cuts; whereas if Harris takes office, she is inclined towards welfare policies, healthcare, green energy, and support for U.S. exports and housing.

RockFlow has detailed the differing positions of the two and their impacts on related sectors, listing relevant concept companies and targets to help everyone discover more investment opportunities from this important event.

1. Trump Trade

Recently, as Harris's polling lead over Trump has narrowed, the latest betting odds in the gambling market also show that Trump has overtaken Harris. The market is reviving the "Trump Trade."

For example, Trump's social media company DJT has doubled since October. Phunware has risen over 200% this month, and additionally, cryptocurrency concept stocks publicly supported by Trump have collectively rebounded, with Bitcoin rising over 10% from its low this month.

The RockFlow research team previously launched a list of Trump stocks, which includes important targets related to the "Trump Trade," such as the media platform DJT founded by Trump, PHUN, which developed campaign apps for the Trump team during the 2020 presidential election, the video platform RUM where Trump supporters gather, and related defense stocks Lockheed Martin and Raytheon Technologies (expected to benefit from increased military spending after Trump takes office), CAT (expected to benefit from Trump's desired tax cuts and infrastructure policies), and Tesla (Musk is a loyal supporter).

Additionally, given Trump's political stance and policy inclinations, more pharmaceutical stocks (like Eli Lilly), and bank stocks (like Goldman Sachs and JPMorgan) are expected to benefit from his potential return to office.

Specifically, investors can focus on the following four sectors:

1) Trump supports cryptocurrencies, which may benefit MSTR, COIN, MARA

Trump attended the Bitcoin 2024 conference and expressed his views on cryptocurrencies. He claimed that if he returns to the White House, he will strive to make the U.S. the world's "cryptocurrency center" and a "Bitcoin powerhouse." He promised to promote the mining and popularization of Bitcoin under his governance to ensure the U.S. maintains a leading position in the global cryptocurrency industry. Trump also announced that the federal government would retain all of its Bitcoin holdings, approximately 210,000 coins, accounting for 1% of the total Bitcoin supply, making the U.S. the first country to include Bitcoin in its national strategic reserves, giving Bitcoin a strategic value similar to gold.

2) Trump supports traditional energy, which may benefit BKR, XOM, CVX

This year, the Republican Party released a new policy agenda: in terms of energy policy, its stance has shifted from "supporting the development of all tradable energy without subsidies" to "comprehensively increasing energy production, simplifying approval processes, removing inappropriate restrictions on oil, gas, and coal markets, achieving U.S. energy independence; opposing green policies and abolishing electric vehicle subsidies." The Republican Party, led by Trump, has higher demands for energy independence, with more apparent support for traditional energy and suppression of new energy.

3) Trump supports loosening financial regulations, which may benefit JPM, GS, BAC

Trump's attitude towards the regulation of financial institutions, especially banks, leans towards relaxing restrictions and reducing requirements for capital and capital adequacy ratios. He believes that loosening financial regulations can release the capital stock in the banking system, thereby promoting banks to increase loan issuance. Additionally, the tax reform policies proposed by Trump would also help enhance the profitability of financial enterprises.

4) Trump plans to strengthen infrastructure construction, which may benefit CAT

The infrastructure construction plan advocated by the Trump administration is also a focus of market attention. The goal of this plan is to comprehensively upgrade and transform U.S. infrastructure through large-scale public and private funding. His advocacy for increased investment in infrastructure is expected to benefit industries closely related to infrastructure construction, including transportation, construction, communications, and materials supply.

2. Harris Trade

In contrast to Trump, Kamala Harris emphasizes inclusive economic growth, sustainability, and addressing wealth inequality. If Harris takes office, investors should focus on the following benefiting sectors:

1) Harris advocates for promoting U.S. export growth, which may benefit WMT, AMZN

Harris's stance on tariffs is more moderate and friendly than Trump's; she believes that Trump's tariff policies will lead to increased consumer spending on gasoline and everyday groceries, thereby putting pressure on the economic situation of middle-class families. She advocates for promoting U.S. export growth. This attitude may have a positive impact on global trade, especially for large U.S. multinational companies with extensive business and overseas income in the global market.

2) Harris calls for more housing support, which may benefit SWK

According to previous reports, Harris has called for the construction of 3 million new homes over the next four years to address the high housing prices caused by supply shortages, while planning to eliminate tax incentives for Wall Street financial institutions purchasing homes to counteract the rapid rise in housing prices. On the demand side, Harris plans to provide higher down payment assistance and tax credits for first-time homebuyers to stimulate the market. These measures will have a positive impact on residential construction suppliers.

3) Harris supports clean energy, which may benefit FSLR, ENPH, CSIQ

With Harris's support, the Biden administration successfully signed the landmark Inflation Reduction Act. Additionally, she proposed injecting $20 billion into the EPA's greenhouse gas reduction fund to promote the growth of clean energy. She emphasized strict regulation of oil companies and other polluting enterprises, having previously sued several fossil fuel companies, including a lawsuit against a pipeline company over oil spills, and investigating ExxonMobil for potentially misleading public behavior regarding climate change. Harris's attitude towards promoting clean energy may be more proactive than Biden's.

4) Harris supports the legalization of marijuana, which may benefit TLRY, CGC

The Democratic Party is working to legalize marijuana at the federal level, and Harris supports this stance. In a previous vice presidential debate, she stated that the Biden-Harris administration is committed to "legalizing marijuana and clearing the criminal records of those convicted of marijuana-related offenses." Harris has also openly criticized existing marijuana restrictions as "unreasonable" and called for the DEA to reclassify marijuana. Therefore, if Harris wins, the marijuana industry may become one of the major benefiting industries.

3. Conclusion

The RockFlow research team believes that the upcoming U.S. presidential election will bring new investment opportunities to the U.S. stock market. If you are optimistic about Trump's election, you can pay attention to opportunities in industries such as cryptocurrencies, traditional energy, and infrastructure construction; whereas if you believe Harris will ultimately win, you can invest in healthcare, green energy, and housing support-related concept companies.

The targets involved in the "Trump Trade" and "Harris Trade" will continue to spark heated discussions in the next two weeks. By deeply understanding the policy strategies and differing preferences of the two candidates, investors can effectively avoid investment risks and seize market opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。