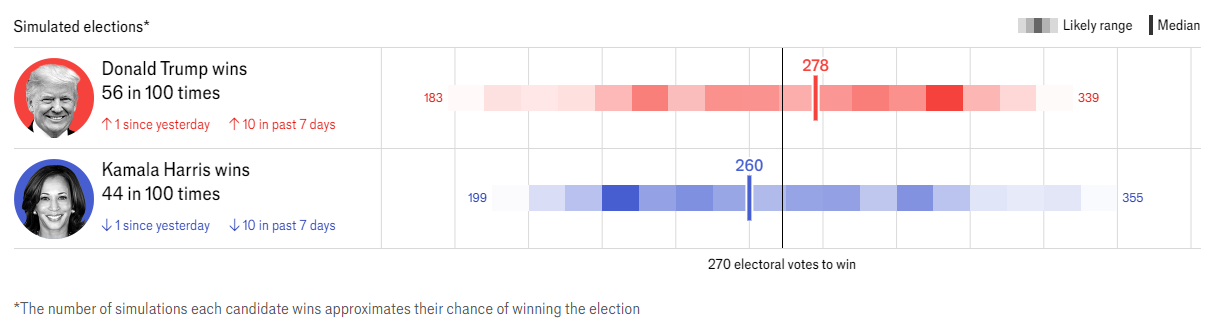

With less than two weeks until the U.S. presidential election, the call for Republican candidate Trump to be elected is growing stronger. Previously, Trump has publicly expressed support for cryptocurrencies and promised to make the U.S. a Bitcoin powerhouse. If he is elected and implements cryptocurrency-related policies, it will undoubtedly be beneficial for the crypto market in the long run.

Additionally, regarding the recent rise in Bitcoin, Forbes attributes the "possible reason" to market expectations that Trump will win the presidential election.

Currently, there is a strong consensus in the market regarding the outcome of the U.S. election, with a very strong sense of greed. Below, AICoin (aicoin.com) will share recent views on BTC opportunities based on major player behavior, chip distribution, and technical analysis.

BTC Opportunities

(1) Major Player Layout

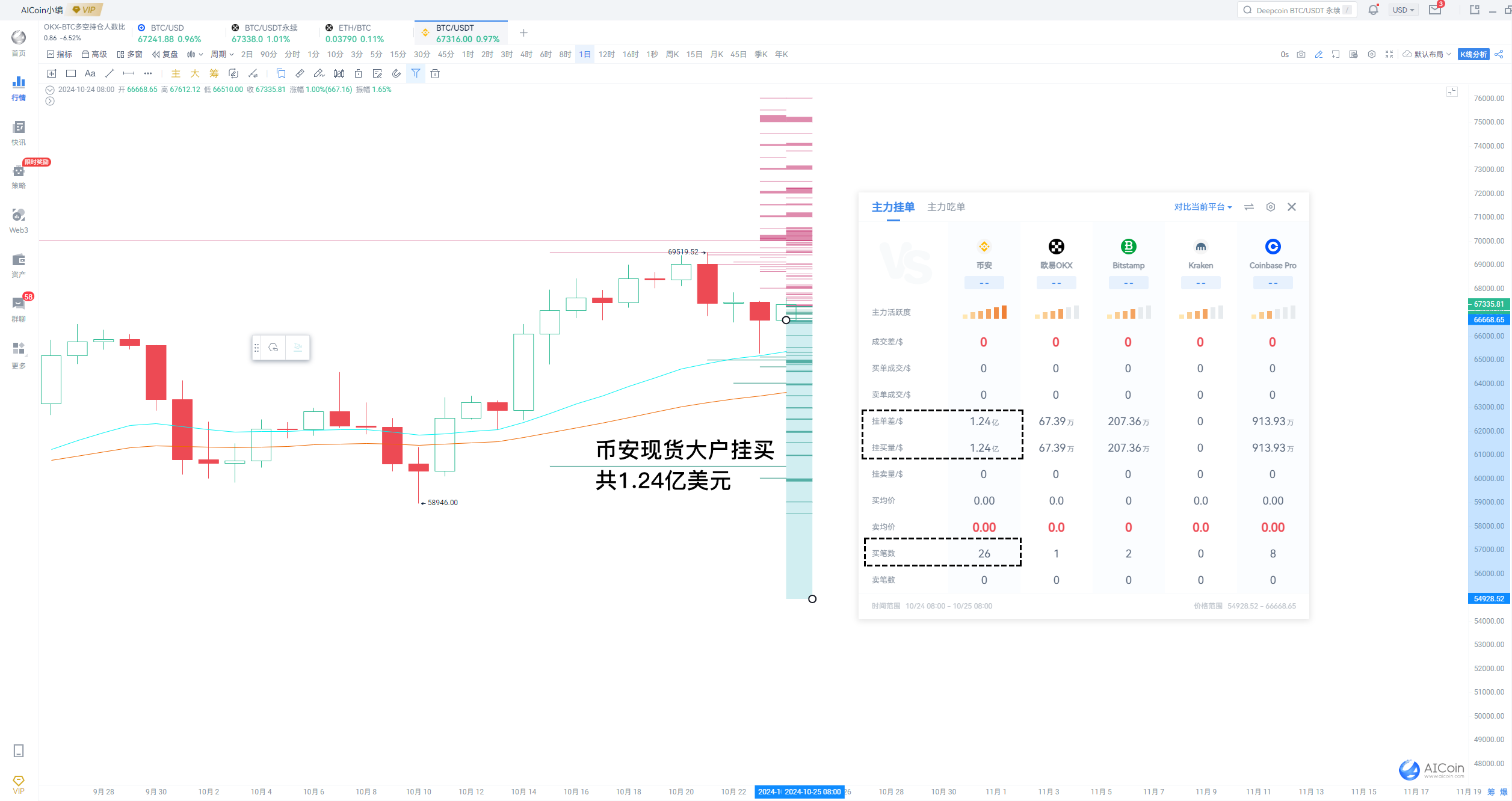

The market generally expects that if Trump wins the U.S. presidential election, Bitcoin could rise to $80,000. According to AICoin's major order data, large holders on Coinbase have already begun to position themselves around the $80,000 mark, with nearly $10.1 million in sell orders.

However, this year has seen frequent occurrences of "anticipated front-running," and it is possible that major players may suppress prices. Below $66,666, Binance spot large holders have placed a total of 26 large buy orders, amounting to as much as $124 million, with the lowest bet at $55,000.

Major orders are a feature of the PRO version K-line, allowing real-time monitoring of large holder order behavior. Unlock immediately: https://www.aicoin.com/zh-Hans/vip/chartpro

Regardless of whether expectations lead to a rise or fall, $70,000 will be the most important dividing line. Currently, large holders on Binance, Coinbase, and Bitstamp are heavily betting on $70,000, with sell orders of $36.716 million, $18.973 million, and $1.426 million respectively (with orders lasting over 33 days).

(2) OKX Long/Short Position Ratio

The current long/short position ratio for BTC on OKX is 0.84 and is trending downwards, indicating that major players remain bullish.

Interpretation of the long/short position ratio data: A ratio greater than 1 means that the number of long positions is dominant, but market funds are mainly controlled by large holders, who are a minority, indicating that major players are holding short positions and are bearish; conversely, a ratio less than 1 means that the number of short positions is dominant, representing the minority.

Major players are holding long positions and are bullish.

(3) Chip Peak

Currently, the BTC price is near the most concentrated price level of the year at $61,722. If it stabilizes, it is expected to surge towards the upcoming three-month high of $70,000, with chip support below at $62,850.

Typically, the price at which the chip peak is located can be seen as support and resistance levels:

• Support level: Located below the price; if the support level holds, the price rebounds; if it breaks, the market will accelerate downward.

• Resistance level: Located above the price; if the resistance level holds, the price retraces; if it breaks, the price will accelerate upward.

Experience immediately: https://www.aicoin.com/vip/chartpro

(4) Continuous Negative Premium on Coinbase

As of the time of writing, the price difference between Coinbase BTC/USD and Binance BTC/USDT is $75, with Coinbase BTC still maintaining a negative premium.

AICoin PRO supports adding index data to the sub-chart display, making data comparison more intuitive: https://www.aicoin.com/vip/chartpro

Regarding the recent Coinbase premium, there are two interpretations:

- U.S. traders are dumping spot.

- With the election approaching, trading using USDT to speculate on the election results is increasing.

Looking at past performance, a positive Coinbase premium often leads to a more stable upward trend, so this data change should be closely monitored in the next two weeks.

(5) Technical Situation

BTC is repeatedly testing the $67,000 support, which is near the most concentrated price level of the year and close to the 23.6% Fibonacci retracement level, indicating strong support.

However, on the 6-hour timeframe, the MACD has shown an invisible pattern at the zero axis, which often leads to the MACD fast and slow lines crossing the zero axis.

Invisible pattern: Price rises or falls, but the MACD volume bars do not release corresponding volume.

Additionally, on the daily level, the MACD shows potential top divergence and death cross signs. Typically, divergence leads to the MACD fast and slow lines approaching the zero axis, while on the weekly level, BTC has completed the adjustment at this level. If the daily bearish signal holds, it will lead to insufficient upward momentum on the weekly chart, and BTC is likely to lose key support.

Therefore, the closing in the next two days is crucial.

- Support zones: $67,122~$67,000, $65,300~$65,500, $63,305~$62,850

- Resistance zones: $69,950~$70,000

ETH Opportunities

Currently, ETH is following BTC down but not up, and ETH/BTC continues to decline. If it cannot break through the $2555~$2750 range, it will be difficult to see significant market movements.

SOL Opportunities

After touching the EMA52 on the 90-minute timeframe and forming effective support with the MACD fast and slow lines at the zero axis, it has risen above $170. However, on the 6-hour timeframe, the MACD volume bars have not shown significant expansion. If it can break through $178~$180, there is hope to surge to $195, and even see the "2" in the tens place again, with support levels to watch at $167 and $155.

Overall, whether Trump is elected or Harris takes office, it does not affect the currently high market sentiment. However, the crypto market is ever-changing, and it is essential to firmly grasp the trend by combining major player movements and technical indicators.

Data is for reference only and does not constitute any investment advice!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。