Michael Saylor’s remarks about Executive Order 6102 have ignited discussion about the nature of gold confiscation and its relevance to bitcoin (BTC). He brushed off fears of BTC seizures as myths spread by “crypto-anarchists,” claiming Americans voluntarily gave up their gold in 1933 without arrests. Yet, history shows this account is oversimplified, with numerous cases of individuals who, despite their efforts, had their gold seized by the government.

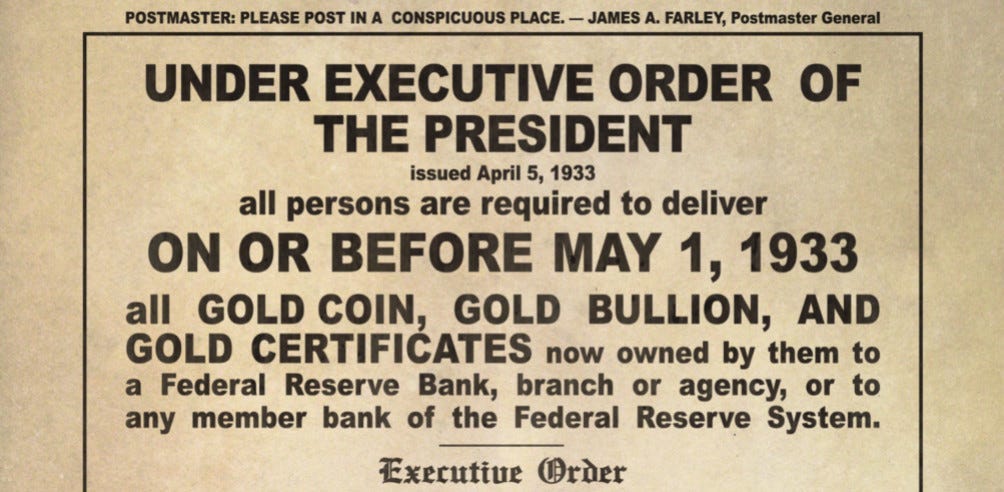

Executive Order 6102, signed by President Franklin D. Roosevelt on Apr. 5, 1933, required Americans to turn over their gold. Contrary to Saylor’s view, this wasn’t a mere suggestion—it came with hefty fines and prosecution for non-compliance. Those who resisted faced fines of up to $10,000 (about $240,000 today) and up to ten years in prison. Although widespread arrests didn’t happen, the order had serious consequences for those who tried to hold onto their gold through third parties.

Bitcoin advocate Jameson Lopp recently captured the significance of self-custody, stating, “Most 6102 gold seizures occurred at financial institutions that held gold on behalf of clients. For example: Frederick Barber Campbell tried to withdraw 5,000 ounces from Chase Bank. They reported him, and the gold was confiscated. Those who kept gold in self-custody were safe.” This directly refutes Saylor’s position and emphasizes that self-custody offers far better protection from government action than relying on financial institutions.

The story of Frederick Barber Campbell illustrates how banks, not individuals, bore the brunt of the government mandate. Campbell, a lawyer from New York, tried to pull out 5,000 ounces of gold from Chase Bank. The bank, however, informed the government, leading to the seizure of his gold. His case shows that trusting institutions to safeguard wealth often backfires, whereas those who privately held their gold were generally safer from confiscation.

When Roosevelt enacted Executive Order 6102, the government mainly targeted gold held by institutions. Banks and financial institutions, bound by regulations and eager to stay in the government’s good graces, quickly complied. They prioritized their legal obligations over their clients’ assets. Meanwhile, everyday Americans who kept their gold private or stashed it away were harder to track.

President Franklin D. Roosevelt signing the Emergency Banking Act of 1933.

It’s believed that only about 25% of gold coins in circulation were actually surrendered. Many, distrustful of the government or reluctant to part with their savings, chose to hide their gold instead. This selective enforcement shows how much more vulnerable institutional holdings were compared to individual ones. The parallels between 1933 and today’s financial world are striking.

Just as banks rushed to meet the government’s demands during the gold confiscation, centralized cryptocurrency exchanges might find themselves under similar pressure if governments move to control digital assets. Centralized exchanges like Coinbase or Binance, which hold significant amounts of bitcoin for their users, could easily be forced to comply to avoid legal trouble.

In contrast, bitcoin’s peer-to-peer design was made to sidestep the need for trusted third parties. Satoshi Nakamoto’s creation of bitcoin, as laid out in the Bitcoin white paper, was meant to eliminate the risks of the traditional trust-based model. Bitcoin transactions rely on cryptographic proof rather than intermediaries, ensuring that individuals can hold and move wealth without needing financial institutions or centralized authorities.

For today’s bitcoin users, the lesson from Executive Order 6102 is clear: self-custody provides the best protection against potential government overreach. As we saw in 1933, institutions are more likely to comply with government orders than individuals. Those who privately held their gold were far less likely to have it taken, just as bitcoin users who self-custody their holdings are more secure than those who store their bitcoin with exchanges or custodial services.

More than just safeguarding wealth from seizure, self-custody of BTC fulfills Bitcoin’s core purpose. Bitcoin was designed as a decentralized currency to empower individuals by removing the need for trusted third parties. Holding bitcoin in self-custody ensures that users maintain control over their assets, shielded from the vulnerabilities posed by centralized entities. Before this post was published, however, Saylor took to X to retract his earlier statements.

“I support self-custody for those willing & able, the right to self-custody for all, and freedom to choose the form of custody & custodian for individuals & institutions globally,” Saylor said. “Bitcoin benefits from all forms of investment by all types of entities, and should welcome everyone,” he added.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。