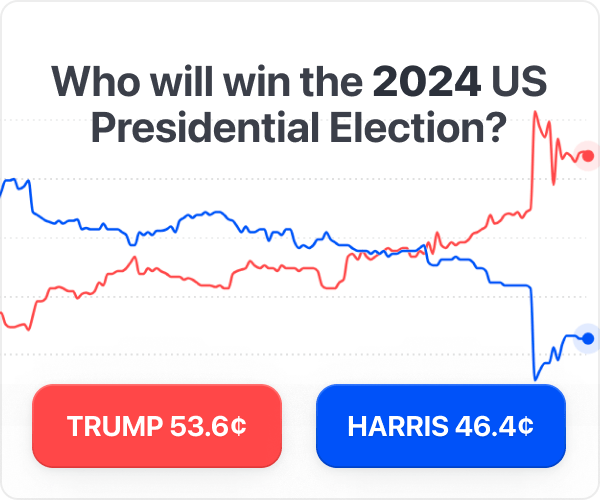

QCP Capital‘s analysts observe that the U.S. elections are now driving market dynamics, with just two weeks to go. Betting markets are showing a significant lead for Donald Trump over Kamala Harris, which has fueled discussions around new economic policies. The market update notes that a possible Trump presidency could lead to increased tariffs and tax reductions, contributing to a rally in the U.S. dollar and pushing U.S. bond yields higher.

QCP’s market analysis states:

Given Trump’s more crypto-friendly stance, it’s no surprise that [bitcoin] is trading higher as well.

In the crypto space, bitcoin (BTC) is benefiting from this economic environment, rising in tandem with other assets. QCP reports that BTC is now approaching $69,000, supported by record levels of open interest across exchanges, which now totals $40.5 billion. The market update also highlights that market participants are positioning themselves in response to the anticipated 2024 interest rate cuts, with markets already pricing in 1.5 cuts for next year.

The QCP update further emphasizes the importance of upcoming U.S. economic data, particularly the Non-Farm Payrolls (NFP) report, which will be released next Friday. As the last labor market report before the Federal Reserve’s next meeting, QCP’s analysts believe it could shape expectations on future interest rate decisions, adding to market uncertainty and potential shifts in asset prices.

“All eyes are on the NFP release next Friday as uncertainty around the labor market persists,” QCP said. “As the last NFP report before the next Fed meeting, it will play a critical role in shaping expectations for the Fed’s next move on interest rates.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。