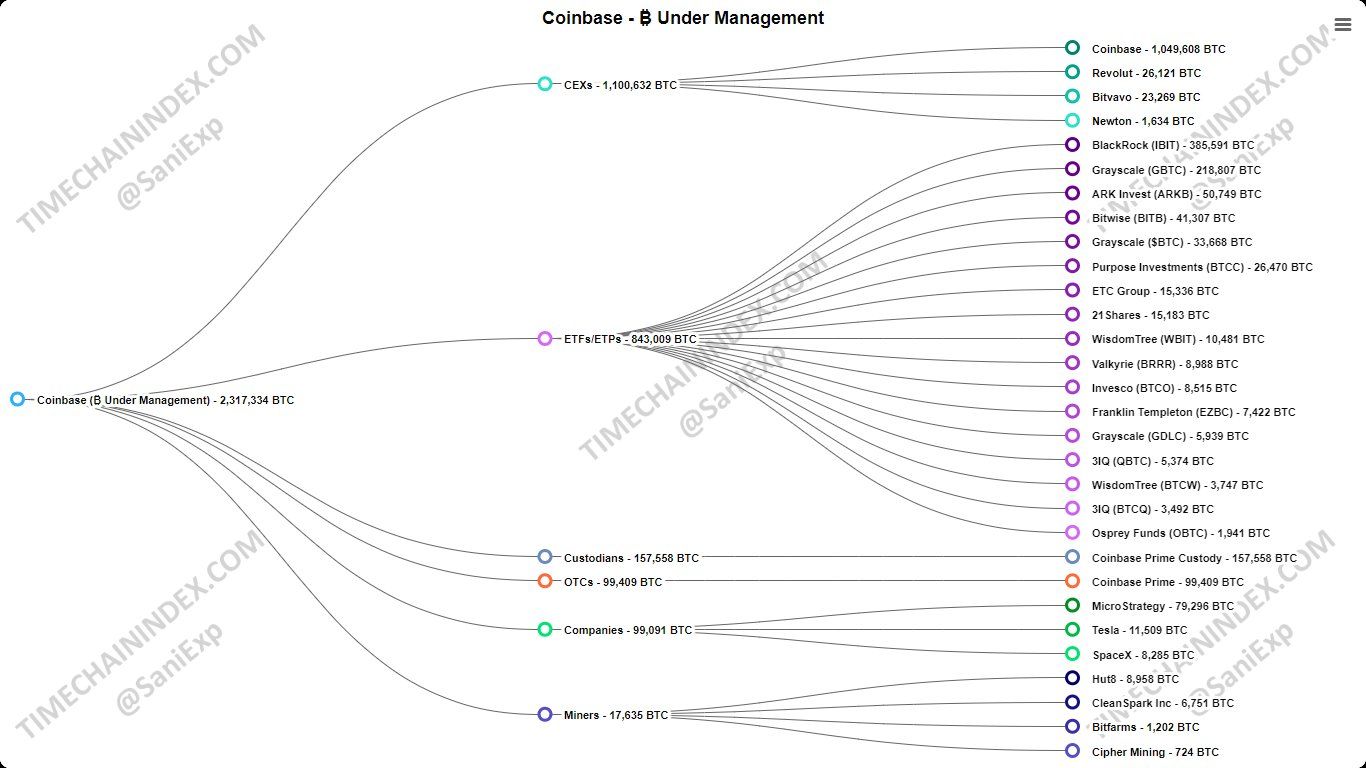

On Oct. 21, Sani, a bitcoiner who operates the Bitcoin-focused site timechainindex.com, posted an intriguing snapshot of Coinbase’s bitcoin holdings. According to his data, the company holds 2,317,334 BTC, valued at a whopping $156.38 billion based on current exchange rates. Sani dubbed the visualization “The new and improved Coinbase Bitcoin Honey Pot.”

This updated reference links back to a chart he shared on Sept. 2, where he warned, “No one is ready for the biggest hack in history.” Although Coinbase has built a solid reputation for security and hasn’t suffered any major breaches, critics can easily argue that holding such a large share of bitcoin is a risky game.

Just because there haven’t been hacks in the past doesn’t mean future security is guaranteed—especially with cyber threats becoming more sophisticated by the day. As one of the largest custodians of bitcoin, Coinbase remains a prime target for hackers. To stay ahead, the company must constantly bolster its defenses and stay vigilant against new attack methods.

The reality is, that a breach of this size could send shockwaves through both its user base and the broader crypto market. Sani’s data further provides additional insight into why Coinbase holds so much bitcoin, breaking it all down in greater detail. The chart highlights that centralized exchanges (cexs), like Coinbase’s exchange service, are responsible for holding a significant portion of bitcoin.

Another major player in this space is exchange-traded products (ETPs), such as U.S. spot bitcoin exchange-traded funds (ETFs). Additionally, Coinbase safeguards funds for over-the-counter (OTC) providers, as well as big names like Tesla, Microstrategy, and even bitcoin miners. With so much value at stake, a breach of Coinbase’s security could potentially bring about highly sophisticated, coordinated cyberattacks aimed at exploiting any weak points in the system.

Moreover, the risks don’t stop at cyber threats. The regulatory and operational challenges of managing such a large cryptocurrency hoard are equally significant. Any shifts in regulatory policies, operational missteps, or management blunders could lead to financial losses for both Coinbase and its users.

For example, Microstrategy’s founder, Michael Saylor, recently referenced the U.S. government’s 1933 confiscation of gold in an interview. His comments are particularly timely, as a working paper from the Federal Reserve Bank of Minneapolis explores the possibility of prohibiting bitcoin. What if the government decided to not only ban bitcoin but also seize the BTC held on Coinbase?

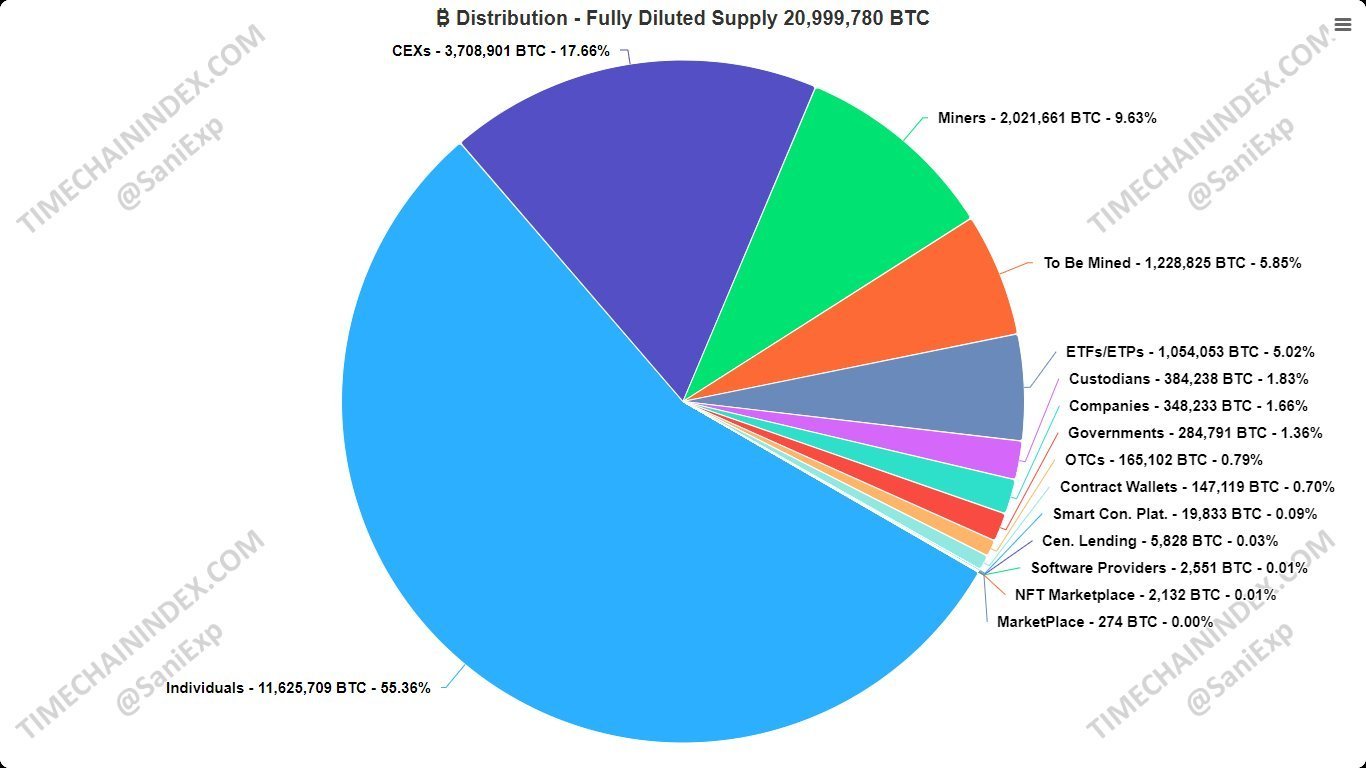

In another chart, Sani illustrates that “one-third of all bitcoin that will ever exist is currently held by entities vulnerable to government control (6102-style seizures).” That’s a staggering amount of BTC. Echoing the sentiments of many self-custody advocates, the timechainindex.com founder emphasized, “Take control of your financial freedom, self-custody your coins and protect your sovereignty.”

As the concentration of bitcoin in centralized custodians like Coinbase intensifies, the inherent risks also magnify, spotlighting the paramount importance of self-custody. Embracing self-custody not only aligns with the foundational ethos of cryptocurrency—promoting financial sovereignty and reducing reliance on third-party entities—but also provides a crucial safeguard against the vulnerabilities exposed by centralized storage solutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。