This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 2,119.85 +1.91%

Bitcoin (BTC): $68,334.71 -0.07%

Ether (ETH): $2,708.13 +2.27%

S&P 500: 5,864.67 +0.4%

Gold: $2,735.45 +0.51%

Nikkei 225: 38,954.60 -0.07%

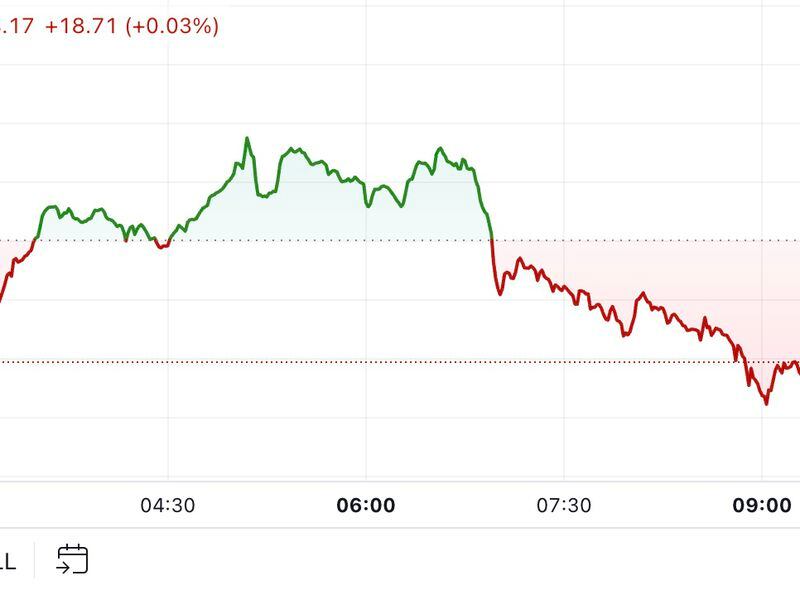

Bitcoin rose above $69,000 at the start of the Asian morning before retreating slightly to trade around $68,350. BTC's jump led to higher prices throughout the rest of the crypto market, with SOL rising nearly 5% to $166.50. The broader digital asset market, as measured by the CoinDesk 20, is 1.9% higher in the last 24 hours. Traders' attention is increasingly turning to the U.S. election, now barely two weeks away, with the pro-crypto candidate Donald Trump heavily favored on predictions site Polymarket. Risk assets such as bitcoin are - expected to be aided by macroeconomic factors in Japan and China, according to Singapore-based QCP Capital.

ApeCoin (APE), the Bored Ape Yacht Club-affiliated ERC-20 cryptocurrency used for governance and transactions in the ApeCoin ecosystem, has doubled in value over the weekend, topping $1.5 for the first time since April, according to CoinDesk data. The rally comes as the ApeCoin team debuted the highly anticipated blockchain network ApeChain Sunday. The ApeChain bridges also went live on Sunday, allowing users to transfer their tokens to ApeChain and automatically earn a staking yield on APE, ETH and stablecoins. The decision to bring native staking yield to APE likely galvanized investor interest in the token, according to Markus Thielen, head of 10x Research.

London-based pensions giant Legal & General is plotting a route into tokenization, which has become popular among traditional finance firms. The tokenization narrative accelerated after the arrival of BlackRock, the largest asset manager in the world, on the scene with its BUIDL fund on the Ethereum blockchain. Others are available from Franklin Templeton, State Street and Abrdn. “We are evaluating ways to make the Legal & General Investment Management Liquidity funds available in tokenized format,” said Ed Wicks, global head of trading at Legal & General Investment Management. “Digitization of the funds industry is key to improving efficiency, reducing cost and making a broad range of investment solutions available to a wider range of investors. We look forward to continued progress in this space."

- Omkar Godbole

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。