Crypto markets have shown signs of stability and growth as we enter the final quarter of 2024, according to data from the Q4 2024 Guide to Crypto Markets by Glassnode and Coinbase Institutional. The report emphasizes that, despite limited directional price movement, several indicators highlight a more mature market. Analysts from both organizations pointed to a surge in stablecoin adoption, rising layer two activity, and an increase in derivatives trading volume, indicating a maturing ecosystem.

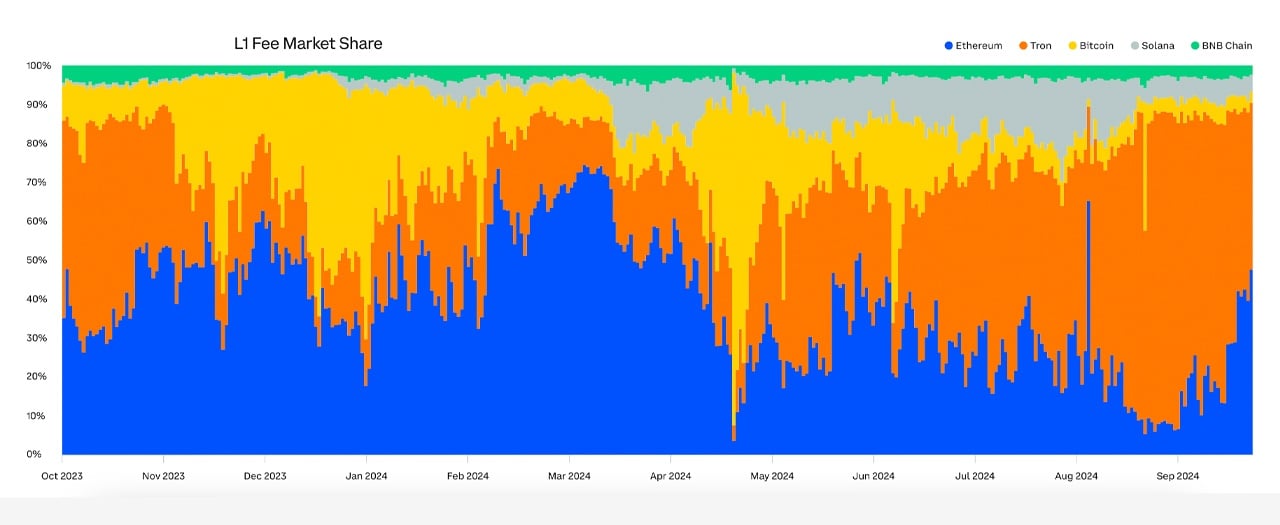

L1 Fee Market Share from the Coinbase Institutional and Glassnode report.

The success of spot exchange-traded funds (ETFs) and a rise in trading volumes underscore the growing institutional participation in the market. Glassnode and Coinbase researchers attribute the increased liquidity and accessibility to these instruments. Notably, the report highlights that US spot bitcoin ETFs saw significant inflows during the third quarter, boosting their assets under management to nearly $60 billion in just nine months. Meanwhile, spot ethereum ETFs, which launched mid-year, accumulated $7.1 billion by the end of Q3.

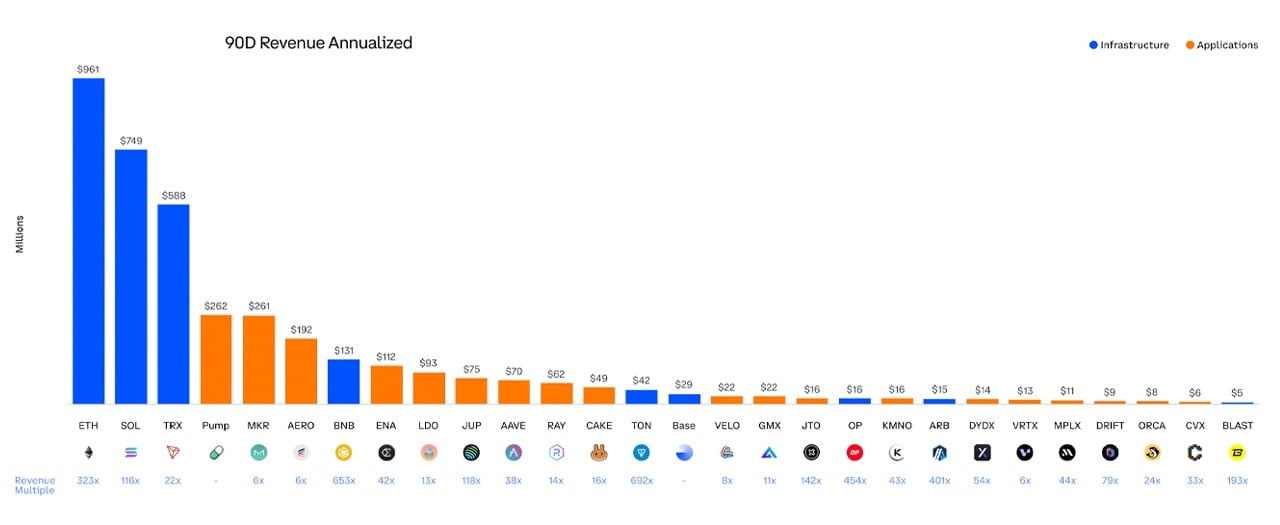

Infrastructure and application revenue over the last 90 days, according to the Coinbase Institutional and Glassnode report.

Layer two (L2) solutions on the Ethereum network, such as Arbitrum and Base, have seen a notable rise in activity. The report from Coinbase Institutional indicates that daily active addresses and transaction volumes on these L2s are steadily increasing, aided by reduced fees following Ethereum’s Dencun upgrade. Researchers noted that these developments are making the Ethereum ecosystem more attractive for users and developers alike, fostering a broader onchain economy.

Another area of growth identified in the report is the rise of stablecoins, with the total supply reaching an all-time high of nearly $170 billion by the end of September. Analysts from Glassnode noted that stablecoins are increasingly being integrated into payment systems, highlighting their utility in cross-border transactions and remittances. This trend is seen as a reflection of stablecoins’ growing mainstream acceptance and regulatory clarity, especially following the new Markets in Crypto-Assets (MiCA) rules in the European Union.

The report closes with a discussion on market sentiment, which has shifted towards fear amid a period of price consolidation. Analysts from Coinbase Institutional suggest that this shift could pave the way for the next rally, as historically, fear in crypto markets has often signaled a buying opportunity for investors.

What are your thoughts on this subject? Let us know what you think in the comments section below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。