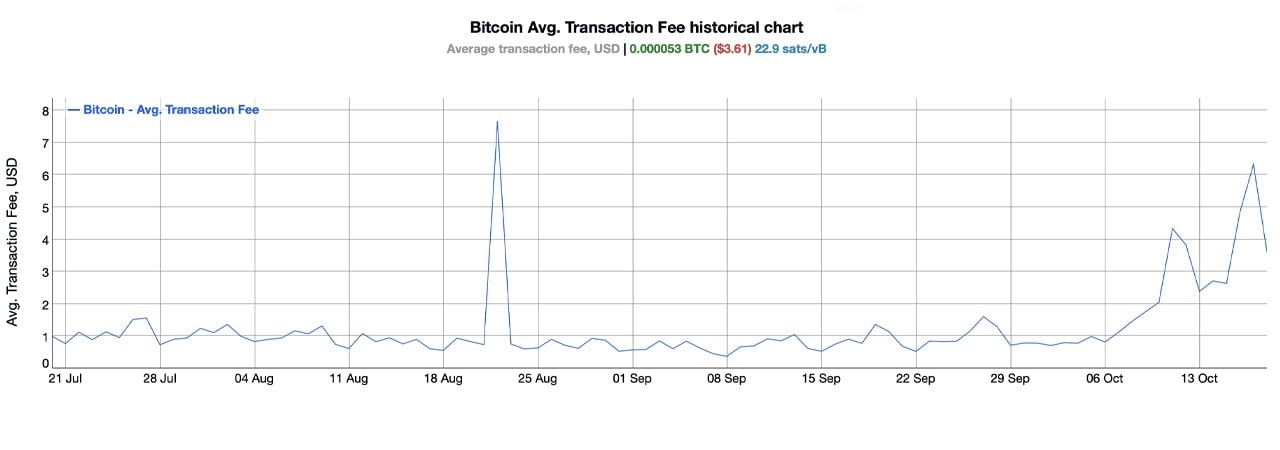

The latest spike in onchain fees correlates with bitcoin’s rise past $68K. For instance, on Oct. 6, the average transfer fee, according to bitinfocharts.com data, was just $0.81. Fast forward to now, and that fee has jumped over 354%, landing at $3.61. On Oct. 17, it spiked even more dramatically, reaching 680% higher than the Oct. 6 rate.

Average BTC fee on Oct. 19, 2024, according to bitinfocharts.com data.

However, averages don’t tell the full story for everyone. A more typical median fee is around 0.000017 BTC or 7.4 sat/vB, translating to $1.16 at current rates. High-priority transactions, according to mempool.space, show even lower costs, around 4 sat/vB or $0.38 per transaction at 3 p.m. Eastern Time on Saturday. Yet, Bitcoin’s mempool still holds a queue of 213,015 unconfirmed transfers.

Moreover, October’s fee totals have already outdone last month’s figures. Bitcoin miners pulled in $13.86 million from onchain fees in September. So far in October, with nearly two weeks left, miners have amassed $27.54 million in fees alone. Last month’s combined revenue from fees and the subsidy hit $815.7 million, while October’s revenue has reached $568.95 million so far—equivalent to about 69.74% of September’s total haul.

As bitcoin’s price momentum continues to ripple through transaction costs and mining revenue, the network’s evolving fee dynamics point out the complexities of market behavior. While the recent increases impact user decisions, they also reinforce bitcoin’s role in balancing supply, demand, and miner incentives. Looking forward, sustained price shifts could further reshape the interplay between fees and network capacity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。