Leading the charge, Blackrock, the world’s largest asset manager, snagged $309 million in a single day. So far, Blackrock has seen a total of $22.77 billion in positive inflows, and its IBIT fund holds 380,971 BTC at the time of writing. Trailing behind, Ark Invest’s and 21shares’ ARKB attracted $100.2 million, followed by Grayscale’s GBTC with $45.7 million, and Fidelity’s FBTC collecting $11.69 million.

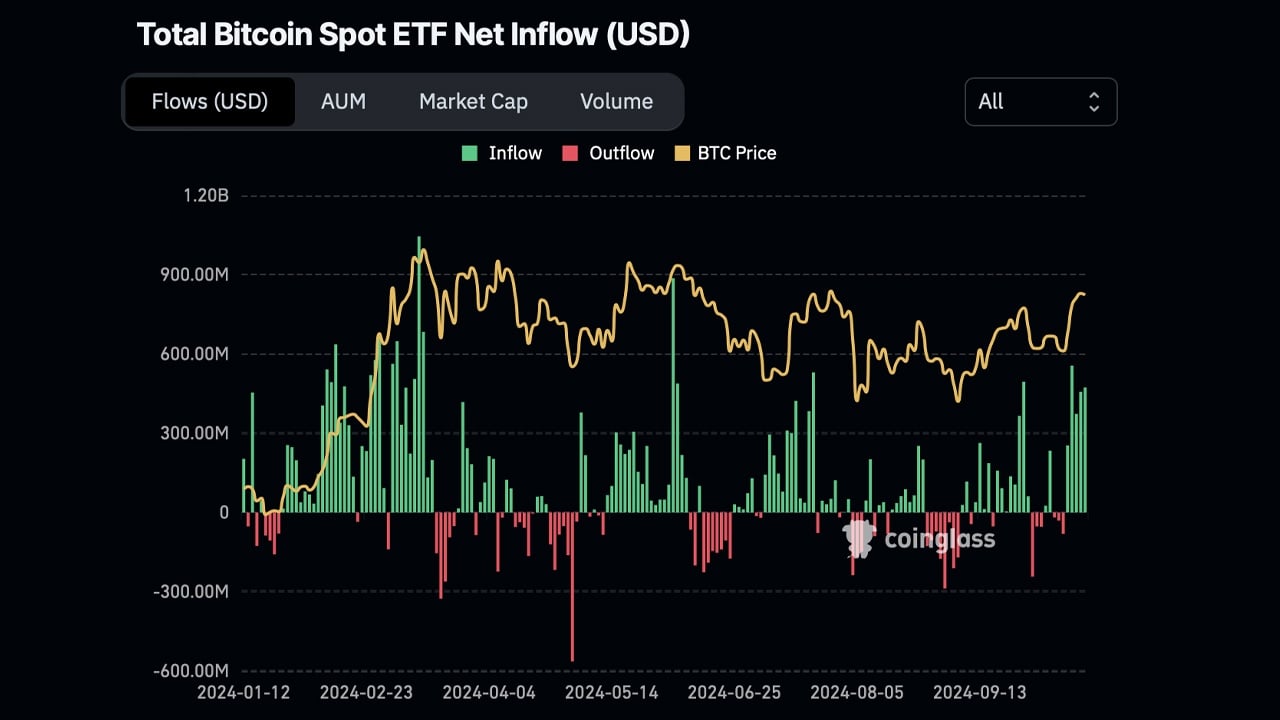

Bitcoin ETF daily flows according to coinglass.com on Oct. 18, 2024.

Meanwhile, Franklin Templeton’s EZBC brought in $3.88 million. Of the 12 funds, around seven saw no movement either way. The additional $470 million boosts the total net inflows to $20.66 billion since Jan. 11. Approximately $1.47 billion in trading occurred, and the bitcoin ETFs hold reserves worth $64.06 billion. Altogether, the funds control about 4.84% of bitcoin’s market cap.

As for the ethereum ETFs, they amassed $48.41 million in inflows. Fidelity’s FETH led the pack with $31.12 million, followed by Blackrock’s ETHA which gathered $23.56 million. Grayscale’s ETH Mini Trust took in $5.13 million, 21shares’ CETH captured $2.33 million, and Bitwise’s ETHW added $1.49 million. Invesco’s QETH picked up $518,640.

However, despite these gains, Grayscale’s ETHE saw a $15.74 million drop, dampening the overall increase. Both ETHV and EZET had neutral results with no changes. The $48.41 million gain brings the net outflows, since July 23, down to $481.90 million. On Thursday, roughly $126.7 million was traded among the ethereum ETFs. At press time, the nine ether funds collectively hold $7.18 billion in ETH reserves, or 2.3% of the cryptocurrency’s market cap, according to sosovalue.xyz metrics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。