Background

Bitcoin broke through the $67,000 mark on October 15, rising approximately 10% over three days. This price breakthrough lasted 76 days, finally moving out of the $49,000 - $66,500 range, and is seen as a signal of the return of a bull market.

In terms of market sentiment, the Fear and Greed Index has also risen to 71, indicating a greedy zone. However, the recovery in market sentiment is limited to Bitcoin, as altcoins have not followed suit in terms of price increase, which can be observed from the BTC.D (Bitcoin market capitalization dominance).

Currently, BTC.D stands at 58.77%, as shown in the chart below, indicating that Bitcoin's market share is at a new high for this cycle, reaching its highest point in three and a half years since April 2021.

Are altcoins weak, and is a true bull market about to begin?

WOO X Research believes that we are currently witnessing signs of a bull market explosion: major players are buying large amounts of Bitcoin, pushing up prices and draining altcoins. Once Bitcoin's price rises to a certain level, funds will flow out of Bitcoin to pump other altcoins, officially starting the altcoin season.

However, the prerequisite for starting the altcoin season is the rise in Bitcoin's price. So, what positive factors in Q4 2024 could help Bitcoin continue to rise?

Interest Rate Cuts

As the leader of the crypto market, Bitcoin's price growth relies on the influx of off-market funds, making interest rate cuts one of the key factors driving Bitcoin's price increase.

Interest rate cuts mean that the U.S. is releasing more liquidity into the risk market, which theoretically will boost the stock market and other fiat currency assets. As the asset with the highest risk and relatively smaller market capitalization, Bitcoin can also benefit from this.

Currently, a 50 basis point cut has been made in September, marking the beginning of the Federal Reserve's rate-cutting cycle. According to Fed Watch, the probability of the November rate being between 450-475 basis points is 92%, confirming that we are in the early stages of rate cuts.

The transmission of liquidity often takes time, and Q4 2024 presents an opportunity for the crypto market to absorb the overflow of liquidity.

ETF Incremental Funds

The BTC ETF was approved this January and is seen as Bitcoin being recognized as an asset class by traditional finance. The continuous buying from traditional institutions is regarded as one of the main narratives for the price increase.

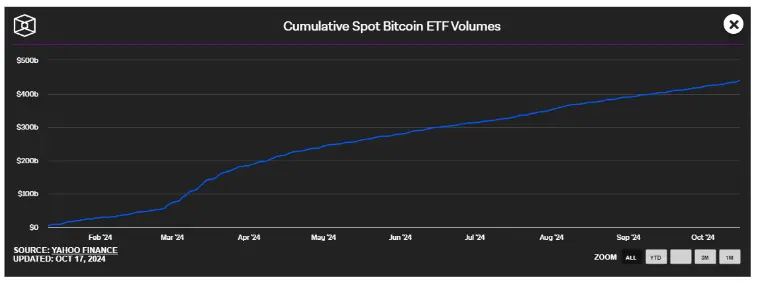

Looking at the data, the total assets of BTC ETFs have reached a historical high of $64.4 billion, with a cumulative net inflow of $20 billion.

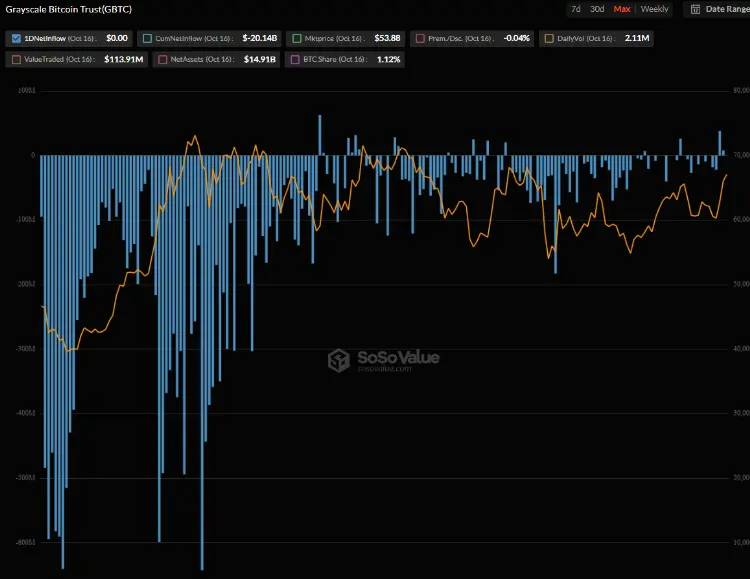

Among the concerns, the selling pressure from Grayscale's GBTC has significantly decreased recently, and there are even signs of net inflows.

In terms of trading volume, it has also steadily grown, reaching a total of $440 billion.

In summary, the BTC ETF data shows a very healthy trend. Investors have not lost interest in Bitcoin over time, and BTC ETFs continue to attract external funds, while the current Bitcoin price has not yet peaked, indicating there is still ample room for growth.

Continuous Growth of Stablecoins

The issuance of stablecoins does not dilute value like other tokens; due to the collateral backing them, they can be pegged to one dollar, representing an increased demand for stablecoins in the crypto market. Theoretically, this is seen as hot money flowing into the market, which is a positive signal.

The market capitalization of stablecoins has steadily grown this year, increasing from $130 billion to $172.8 billion, with a year-to-date increase of 32%, and it is expected to continue to grow.

Among them, USDT holds nearly 70% of the market share, with a market capitalization growth of $28 billion since 2024, indicating a significant level of money printing.

Reviewing past experiences, we can find the correlation between stablecoin market capitalization and Bitcoin prices as follows:

- In 2021, as Bitcoin prices rose, the market capitalization of stablecoins also increased, indicating that funds were flowing into the cryptocurrency market, with investors possibly temporarily holding funds in stablecoins while waiting for opportunities to buy Bitcoin or other crypto assets.

- In 2022, as the market declined, both Bitcoin prices and stablecoin market capitalization fell, indicating that funds were leaving the market, with investors converting stablecoins back to fiat or directly withdrawing funds.

- From 2023 to 2024, both Bitcoin prices and stablecoin market capitalization have shown a gradually rising trend, suggesting that market interest is returning and funds are flowing back into the cryptocurrency market.

There is a strong positive correlation between Bitcoin prices and stablecoin market capitalization. When Bitcoin prices rise, stablecoin market capitalization typically increases, indicating an influx of market funds; conversely, when Bitcoin prices fall, stablecoin market capitalization decreases, indicating an outflow of market funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。