The proposal outlines a cautious approach to integrating Ethena’s liquidity and hedging flows onto Hyperliquid. If approved, the Ethena Risk Committee will conduct thorough due diligence to ensure Hyperliquid’s technical and legal compatibility with Ethena’s operations. Ethena plans to implement the integration incrementally, guided by its risk management committee, to ensure a controlled expansion of hedging activities on Hyperliquid.

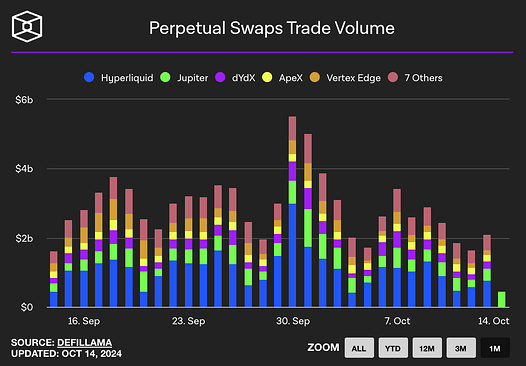

Ethena reports that Hyperliquid has consistently handled about 40% of the onchain perpetual trading volume throughout October, based on onchain data. Source: The Block.

Ethena says Hyperliquid has seen significant growth, boasting over 200,000 users and daily trading volumes ranging between $1 billion to $4 billion. Ethena’s proposal highlights Hyperliquid’s capacity to support large-scale onchain hedging, emphasizing that the decentralized exchange regularly accounts for 40% of the onchain perpetual trading market. Ethena’s risk team will assess Hyperliquid’s open interest (OI) across several assets, including bitcoin (BTC), ether (ETH), and solana (SOL), limiting exposure to 10% of Hyperliquid’s OI per asset.

The integration also proposes listing USDE on Hyperliquid’s platform, following a model used successfully with other exchanges. Ethena’s USDE stablecoin has grown in popularity as a USD-denominated asset across multiple blockchains. By moving some of its hedging activities and incorporating USDE into Hyperliquid’s L1, Ethena seeks to enhance transparency and reduce counterparty risk in its decentralized finance operations.

Let us know what you think about this subject in the comments section below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。