QCP Capital noted that bitcoin’s rally was powered by strong spot demand, pushing the digital currency up by 2.2%. This brief climb allowed bitcoin to reclaim the $68,000 level before finding stability at $67,000. The firm also observed a notable increase in long-dated options, particularly during U.S. trading hours, with 600 contracts trading at a $120,000 strike price.

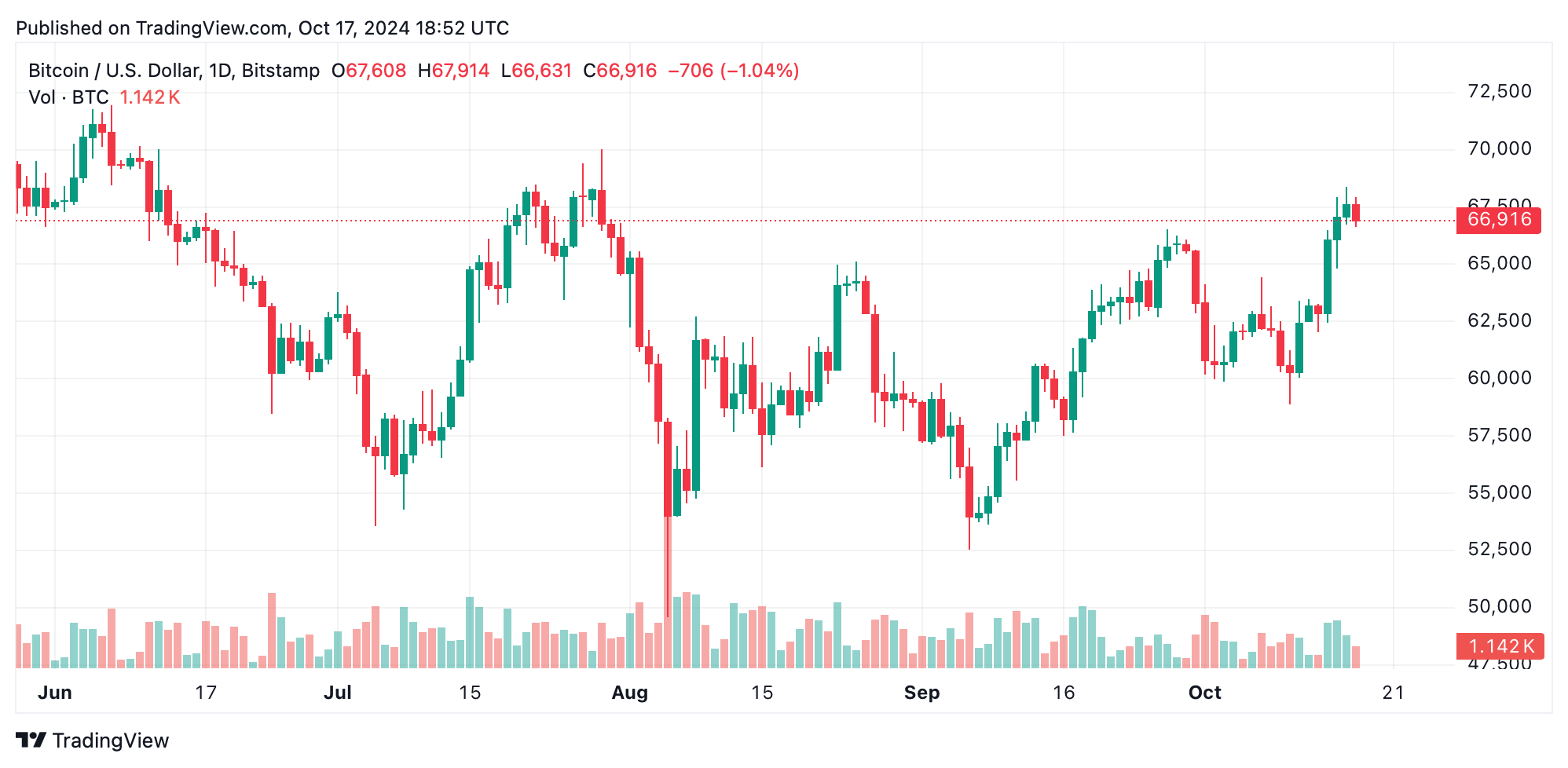

At 2:52 p.m. Eastern Time on Oct. 17, 2024, BTC is trading just under the $67K range.

Analysts at the firm see this as a positive sign from bullish buyers, eager for future gains. QCP also reported a substantial $458.54 million inflow into bitcoin spot ETFs yesterday, marking a significant vote of confidence.

This was the fourth straight day of ETF inflows, and QCP’s analysts believe this trend could pave the way for further rallies as bitcoin nears its all-time high of approximately $74K. The firm pointed out that these continuous inflows signal sustained bullish sentiment in the market.

Looking ahead, QCP identifies the upcoming U.S. election as a potential catalyst for bitcoin and the broader cryptocurrency market. The firm noted that options expiring around the election are trading at a 10% premium compared to other expiries, suggesting that investors expect more volatility. QCP believes any shifts in the polls or campaign narratives could have a significant impact on bitcoin’s price.

What are your thoughts on this subject? Let us know what you think in the comments section below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。