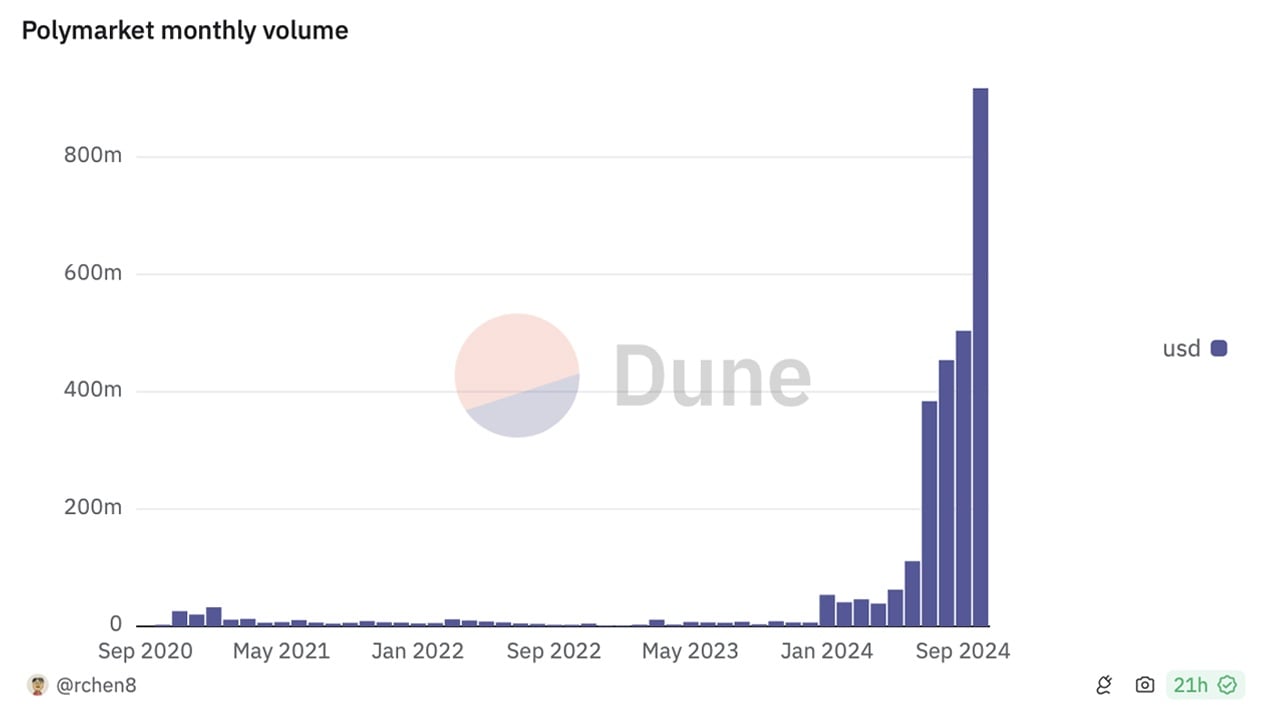

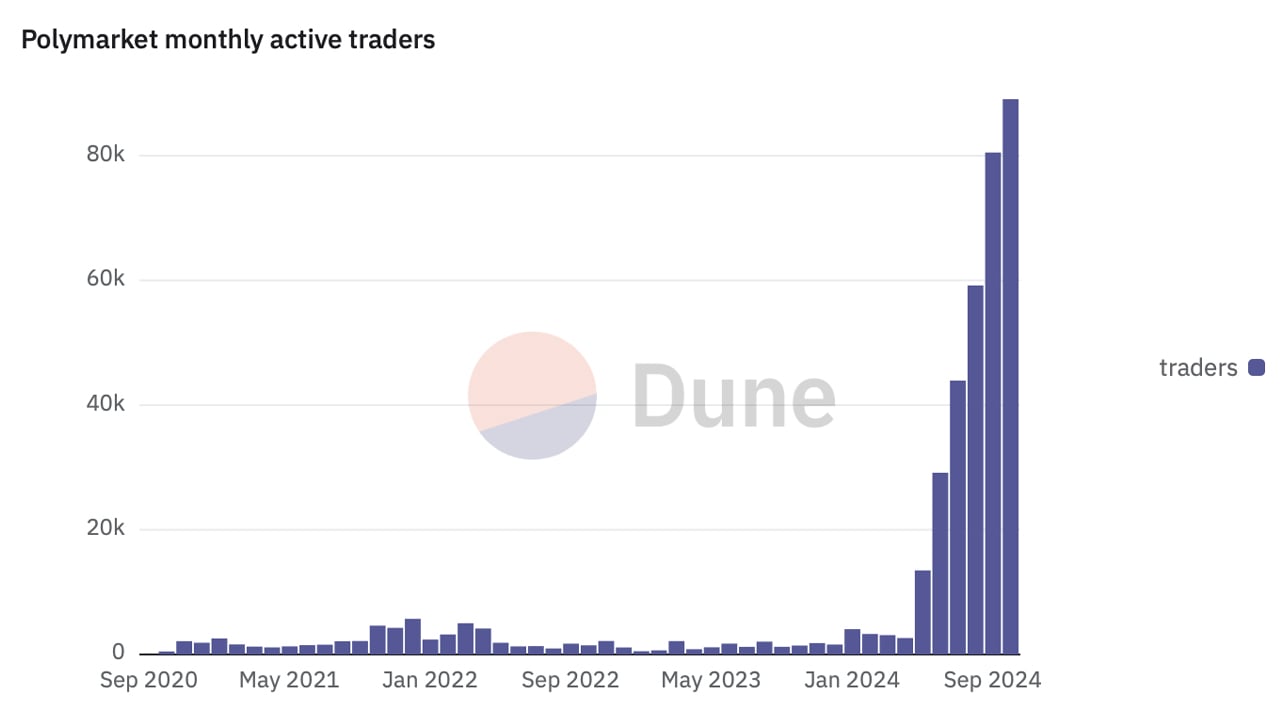

At the time of this writing, Dune Analytics figures reveal that Polymarket’s October volume has reached unprecedented heights. Back in September, Bitcoin.com News reported the platform’s volume reached just over $533 million. As of Oct. 17, however, October’s numbers show an astounding $917 million in volume, with the number of active traders surpassing September’s as well.

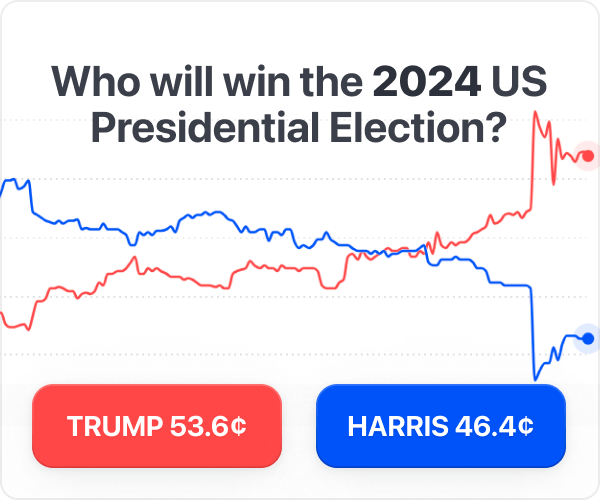

In short, Polymarket is a decentralized platform where users can wager on real-world events using cryptocurrencies. Built on blockchain technology, it operates via the Ethereum network and Polygon’s layer two (L2) solution, offering a transparent and seamless trading experience. While Polymarket hosts a wide range of predictions, the upcoming 2024 U.S. election, featuring Donald Trump and Kamala Harris, has significantly contributed to the platform’s bustling activity.

Last month, Polymarket hosted 80,514 active traders, and so far in October, that number has climbed to 89,075. On Oct. 7, the platform experienced its biggest single-day trading volume, hitting $98.36 million. Additionally, a new record for daily active traders was set on Oct. 15, when 17,944 users placed bets on the marketplace.

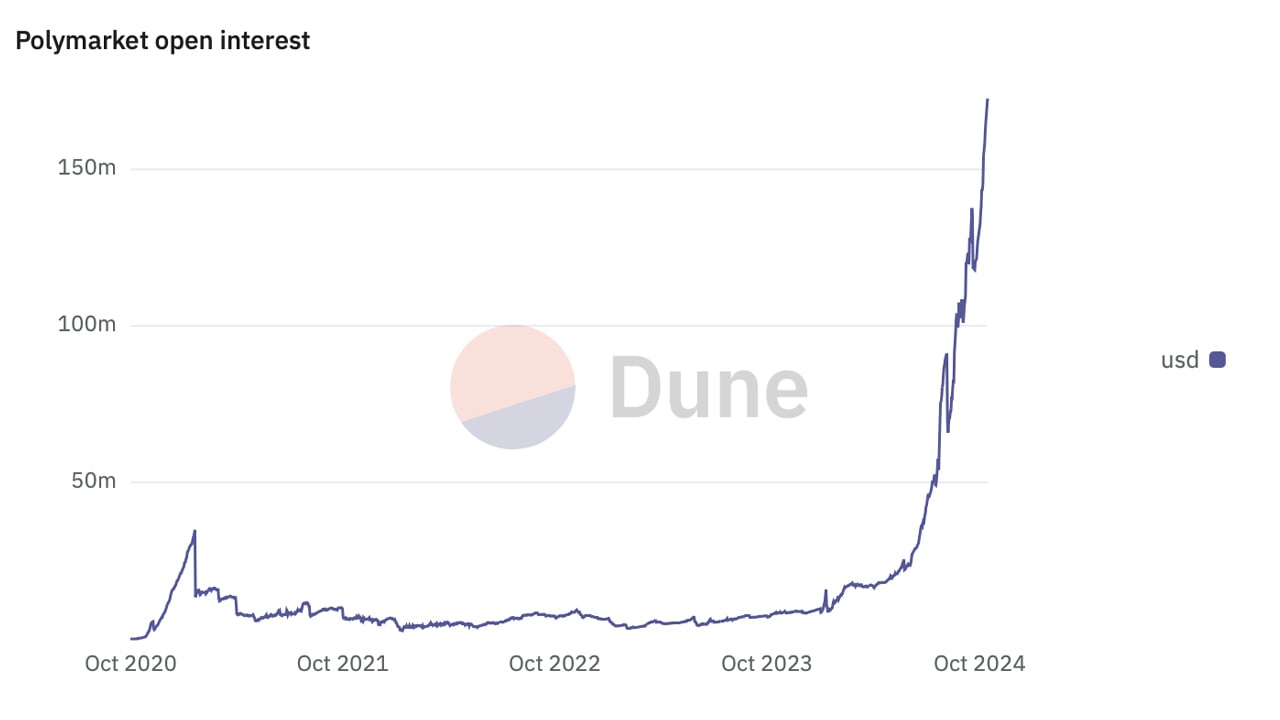

The platform’s open interest is currently sitting at an all-time high, surpassing $156 million. And with two weeks still left in October, these numbers are poised to go even higher as the U.S. election looms large. Polymarket has also seen a peak surge in new accounts, with 91,804 signups this month alone.

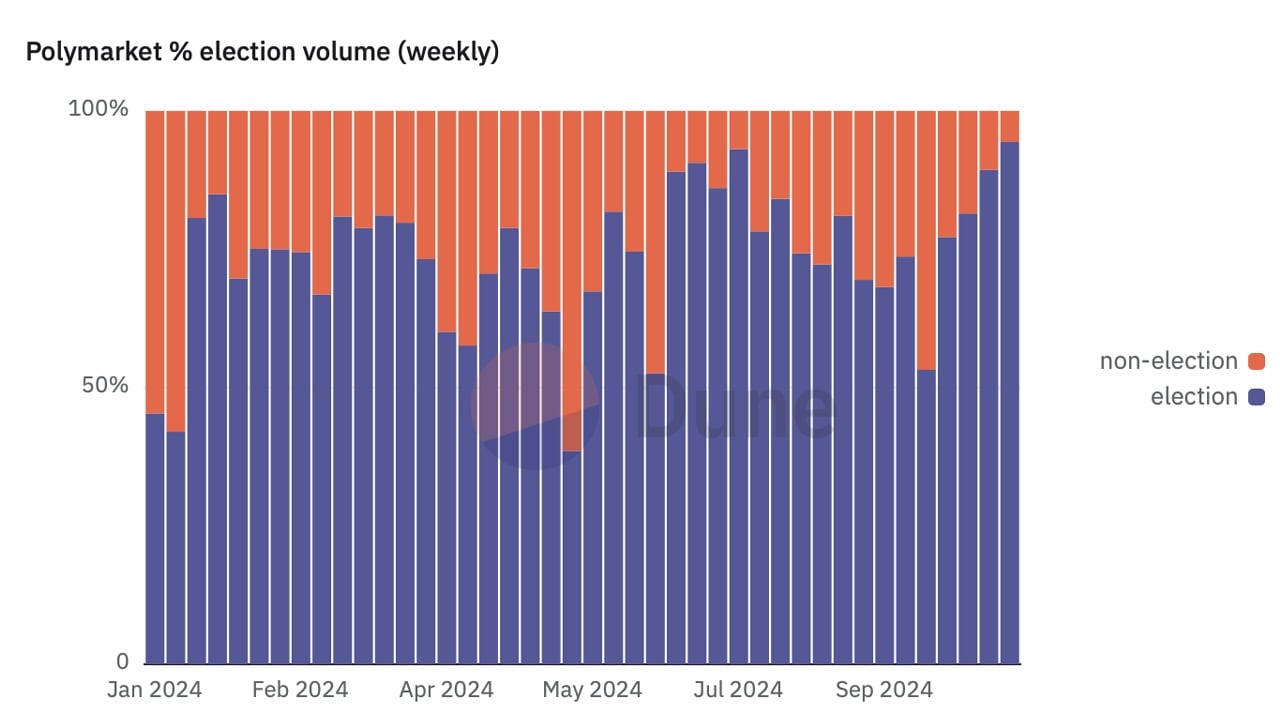

With the election now less than 20 days away, it’ll be fascinating to see if Polymarket can keep up this momentum. However, from a statistical perspective, there’s a chance activity could taper off a great deal after the 2024 election. That’s because the majority of Polymarket’s recent volume has been driven by election-related bets.

Data shows that between Sept. 29 and Oct. 14, 77% to 94% of the platform’s volume was tied to election wagers. On Oct. 14, 74% of users were betting on election outcomes, according to Dune Analytics. Despite this, on Oct. 7, Polymarket’s non-election betting also hit its highest daily volume of the year. As Polymarket continues to surge ahead of the U.S. election, its trajectory remains uncertain.

While election-related activity has been a major driver, it is unclear if the platform’s momentum will persist beyond November. However, its diversification into non-election markets offers a potential path for sustained growth, providing the platform adapts to evolving user interests and market conditions. The recent Satoshi betting tied to HBO’s documentary was a prime example of how quickly things can change in the prediction markets.

In the days leading up to the film’s release, the odds were all over the place. But when the leak about Peter Todd’s name surfaced and went viral, the betting lines swung dramatically in that direction. Whether this growth continues will depend on how well Polymarket can balance its election-driven momentum with broader market opportunities in the months ahead.

What are your thoughts on this subject? Let us know what you think in the comments section below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。