Crypto traders and industry executives have expressed favor toward Republican U.S. presidential candidate Donald Trump's policies on Bitcoin and digital assets. That predisposition has not translated to a fondness for the decentralized-finance project he is actively promoting, World Liberty Financial, or its WLFI tokens – as he found out this week. (Spoiler alert: The tokens are not exactly flying off the shelf.)

ALSO:

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday.

Screenshot from title page of World Liberty Financial's "Gold Paper," published this week (World Liberty Financial)

SMALL HANDS? A crypto project endorsed by U.S. Republican presidential nominee Donald Trump pushed forward with a plan to raise hundreds of millions of dollars by selling tokens. But demand for World Liberty Financial's WLFI tokens proved underwhelming, with an Ethereum wallet connected to the effort holding crypto proceeds of just $11 million as of press time, or roughly 3.6% of the amount allocated to the public sale – not even enough to cover a reserve for basic expenses.

Loyal readers of The Protocol will recall that CoinDesk was first to report, in early September, on the secret planning for World Liberty Financial – mostly confirmed a couple weeks later. We also chronicled the dismay over the project from hardcore Bitcoiners, who typically hate the idea of selling easily minted tokens, prompting some of them to reconsider their political support for Trump.

Finally, last week, official details of what the project actually is, or aims to be, began to emerge: Still to be developed and launched, it's a "best-in-class consumer application," distinguished by "simple onboarding and familiar UI/UX via one-click social login and wallet creation," according to a blog post. (UI/UX is shorthand for user interface and user experience.) Under the hood, the project plans to operate an instance of the decentralized-finance (DeFi) project Aave atop the Ethereum blockchain, with plans to eventually deploy on the layer-2 network Scroll, according to the blog. World Liberty Financial even posted a "temperature check" proposal to the Aave governance discussion forum to gather community feedback. One commenter inquired aloud whether the deal made sense for Aave, given that the Trump-affiliated project would promise 20% of revenue to Aave, "compared to 100% from the main Aave instance," and added that "it’s worth evaluating whether this might lead to internal competition between Aave’s current market and WLF’s, or if the growth from new users and increased liquidity will far exceed any potential downside." One snarky poster wrote that "the irony of a man notorious for not paying back creditors launching a decentralized lending protocol is almost too good to be true."

Several notable crypto figures joined a Spaces session on X on Monday to promote the token launch, including Stani Kulechov, founder of Aave; Sandy Peng, co-founder layer-2 network Scroll; and Luke Pearson, senior research cryptographer, Polychain Capital. "My DM's have been blowing up since this project happened," Scroll's Peng volunteered. Project officials said on the Spaces that some 100,000 users had already been whitelisted to claim the tokens.

Additional details came on Tuesday when the project released a "Gold Paper" with lots of fine print, including the revelation that the initial $30 million of "net protocol revenues" – including token sale proceeds – would be set aside to cover "expenses, indemnities and obligations" – and that most of the rest of the money would go to a company called "DT Marks DEFI LLC," whose owners and principals include Donald Trump. (That company also was allocated 22.5 billion $WLFI tokens, worth about $337 million at the fixed price of $0.015 each.)

The public token sale opened early in U.S. business hours on Tuesday, though the website for claiming the tokens quickly crashed and was down for most of the morning; there was virtually no communication from the team about what was happening. Commenters on the social-media site X widely noted that the token was "non-transferrable," seen as a serious drawback for fast-moving crypto trading types. At about 7 p.m. ET, Trump took to X to tout the token sale, writing "Today’s the day! @WorldLibteryFi token sale is live." After apparently discovering that World Liberty Financial's X handle had been misspelled, the post was deleted, and then reposted with the properly spelled handle, @WorldLibertyFi.

The extra promotion didn't appear to have much of an impact, with sales continuing at a trickle. As of Wednesday, some 761.8 million tokens have been sold, out of 20 billion offered, according to a dashboard on the crypto-tracking website Dune Analytics.

Dave Rodman, founder and managing partner of Rodman Law Group, who counts digital-assets and venture capital among his practice areas, told CoinDesk in an emailed comment that World Liberty Financial appears fraught with both securities-regulation and campaign-finance risks – "a joke project designed to extract value from purchasers in a very cynical manner whose principals will likely not face any real consequences and in the worst scenario, only serve to hurt this industry’s reputation in the long run." Here was the Bankless newsletter's take: "Whether the project can overcome skepticism and regain momentum remains to be seen, but the rocky start is a reminder that high-profile backers aren’t a guarantee for success in DeFi."

It's important to note here that the team behind World Liberty Financial has not responded to CoinDesk's repeated requests for comment over the past two days.

ELSEWHERE:

Uniswap Labs CEO Hayden Adams (Uniswap Labs)

The developer behind Uniswap, the biggest decentralized exchange, announced plans for Unichain, its own layer-2 network atop Ethereum, built with technology borrowed from the Optimism ecosystem. We rounded up some of the commentary.

Fundraisings

Deals and grants

Kadena's Alana Ackerson (Kadena)

Data and Tokens

Regulatory and Policy

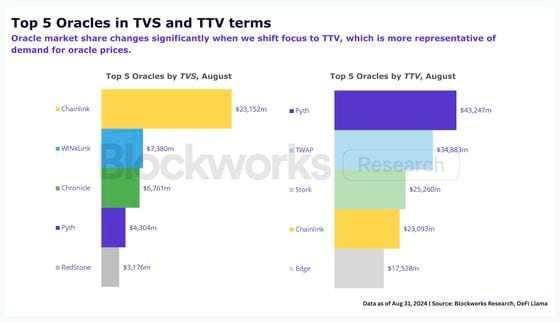

Comparison of market-share rankings for oracle projects based on total value secured (left) and total transaction value (Blockworks Research)

A recent Blockworks Research report on blockchain oracle projects was brought to our attention, showing different ways of ranking them – and how starkly different the results can be.

Oracles are crucial for DeFi systems because they deliver off-chain information – such as cryptocurrency prices – onto blockchains, where it can be read and processed by decentralized applications and smart contracts.

One thing to note here is the huge disclaimer that the Blockworks research was funded by Pyth Data Association, an organization supporting the blockchain oracle project Pyth, which clearly benefits from the report's conclusions.

The report notes that "total value secured," or TVS, has historically been the most popular way of ranking these projects. The metric is described as "how much value is secured by each oracle, which is the equivalent to the total pool of value that would be lost if an oracle malfunctioned or reported incorrect prices in a worst case scenario."

"TVS, at best, measures a pool of financial assets associated with an oracle’s services, but completely eschews the application’s activity associated with an oracle," according to the author, Ryan Connor.

An alternative metric is total transaction value, or TTV, which is "more strongly correlated to frequency of oracle price updates and therefore oracle revenue," according to Connor.

"We think the flaws in TVS, combined with the increasing demand for speed in DeFi ecosystems, and the necessity of DeFi to compete with centralized exchanges, makes TTV the most useful, publicly available key performance indicator for assessing oracle fundamentals today," the report concludes.

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

Karate Combat's Tech Hustler and Tactical Investing fight at CoinDesk Consensus in May 2024 in Austin, Texas. (Shutterstock for Consensus)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。