Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

Previously in the articles “A Perspective on a Thousand Solana 'Smart Wallets': Who is Making a Fortune? What Can We Learn?” and “Data Summary of Two Thousand Smart Addresses Characterizing Ethereum Meme Big Winners: Diamond Hands or PvP | Produced by Nan Zhi”, the author conducted statistics and reviews of high-profit addresses for popular tokens based on multi-dimensional data such as win rates, profit-loss ratios, and drawdown situations.

Recently, based on the above statistical methods, the author further iterated the "score evaluation method" for these smart addresses, aiming to identify the "diamond hand players" among these smart addresses and follow their trades, exploring whether following diamond hands can serve as a stable profit-making method. Additionally, the author has designed a simple "cut-following coefficient" (to harvest following wallets) to enhance the profit and drawdown protection of the account. Odaily will share and discuss the "diamond hand score evaluation method" and "following settings" in this article.

Risk Warning: This system was launched on October 8 and has only been running for 6 days. Although it has achieved certain results, from an objective perspective, the data volume and comparative experiments are insufficient, the rigor is limited, and it is for readers' reference only. Furthermore, to ensure the objectivity of subsequent tests, this article will not disclose any addresses.

Basic Situation Description

Principal: 7 SOL and 8 SOL were deposited on October 8 and October 12, respectively. The reason for the additional funds is that the holding period of the tokens in the following address (smart address) was too long, and all SOL was converted into tokens, making it impossible to continue following, hence the addition.

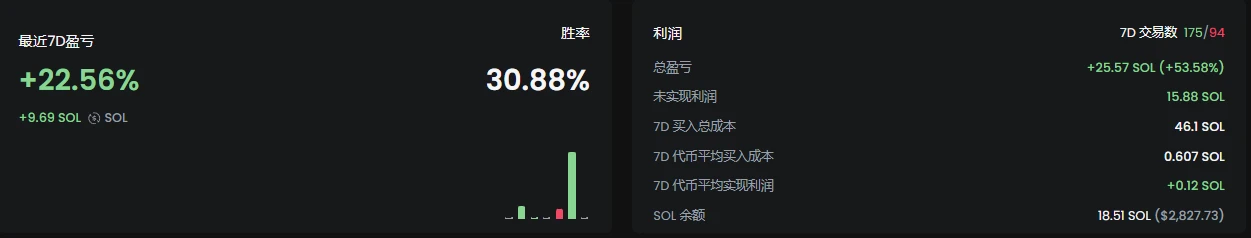

Profit: As of October 14, 13:30 (UTC+8), the total account funds were $3,570, approximately 23.64 SOL, with a profit rate of 57.6%.

Following Settings: In most cases, a fixed following of 0.3 SOL for each trade; if the smart address purchases less than 0.1 SOL, it will not follow (the reason will be explained later); both buying and selling will be followed; tokens with a market value greater than $30 million will not be followed; the priority fee for buying and selling is 0.0005 SOL.

Account Data Details, where the total profit is incorrect, see below

Diamond Hand Evaluation System

The first version designed 13 evaluation dimensions, and the current exposed core issues include: ① The evaluation system is overly influenced by the amount of funds; addresses with the same profit-loss ratio and win rate significantly favor higher fund amounts, ② cannot filter out addresses that engage in malicious schemes, ③ lack of statistics on holding periods. The detailed calculation methods are as follows:

30-day win rate, full score 1 point: Score equals the 30-day win rate;

7-day profit, full score 1 point: 7-day profit greater than $50,000 gets full score, profit from $0 to $50,000 scores linearly, negative profit gets 0 points;

30-day profit, full score 1 point: 30-day profit greater than $100,000 gets full score, profit from $0 to $100,000 scores linearly, negative profit gets 0 points;

Average profit per purchase, full score 1 point: 30-day profit ÷ 30-day purchase count, less than 300 gets 0 points, greater than 2000 gets 1 point, scores linearly in between;

Average profit per sale, full score 1 point: 30-day profit ÷ 30-day sale count, less than 300 gets 0 points, greater than 2000 gets 1 point, scores linearly in between;

(Note: The above four indicators have the first problem mentioned in this section: overly favorable to large fund addresses.)

Trading style, full score 1 point: Average profit per purchase ÷ Average profit per sale, if greater than 1.5, score is calculated, otherwise 0 points. Score equals “average profit per sale score” × 50%. (Note: Looking to find addresses that buy in small amounts and sell in batches at high points.)

Total profit, full score 1 point: Less than $10,000 gets 0 points, greater than $100,000 gets 1 point, scores linearly in between; (Note: Total profit = profit from the top 30 tokens + losses from the bottom 30 tokens.)

Profit TOP1 ratio, full score 0.166 points: Calculation method is profit from the most profitable token ÷ total profit, greater than 0%, less than 75% scores, otherwise 0 points. Score equals “total profit score ÷ 6”;

Profit TOP5 ratio, full score 0.166 points: Calculation method is profit from the top 5 tokens ÷ total profit, greater than 0%, less than 100% scores, otherwise 0 points. Score equals “total profit score ÷ 6”;

Profit TOP10 ratio, full score 0.166 points: Calculation method is profit from the top 10 tokens ÷ total profit, greater than 0%, less than 150% scores, otherwise 0 points. Score equals “total profit score ÷ 6”;

Additionally, there are three indicators for loss TOP1, TOP5, TOP10, with methods similar to the above three indicators, which will not be elaborated further.

Cut-Following Coefficient

Some smart money addresses, due to the presence of numerous following wallets, will purchase low market cap tokens to drive up prices, then sell for profit after the following buys in. To avoid this situation, the "cut-following coefficient" is designed, addresses with a cut-following coefficient greater than 0 will not be considered for following.

The author obtained the last 50 tokens traded by each smart address, among which:

The token comes from a pump

Current market cap is less than 100k

Bought and sold within 60 seconds with consistent amounts (±5%)

For each traded token that meets all three conditions, it is counted as a cut-following score +1, and the final cut-following coefficient is obtained by dividing by the total count of statistics. Addresses with a coefficient greater than 0 will not be considered in the automatic following system, while manual operations will annotate the size of the cut-following coefficient after the address.

First Version System Reflection

Based on 6 days of testing, the author reviewed the profits and losses and gained some insights as follows:

Be sure to set a minimum following amount: The author set “if the smart address purchases less than 0.1 SOL, do not follow,” because there are cases of “malicious poisoning.” Some malicious addresses can transfer tokens of negligible value to smart addresses through unknown means, which are then recognized by the following bot as purchases made by the smart address, triggering the following, after which the malicious address sells for profit. The author only discovered this issue yesterday and has been poisoned with over a dozen tokens.

Trust the smart money's high buying: Recently, the upper limit for tokens on SOL has often been around $30 million market cap, such as MANYU, Pochita, Miharu, etc., which all plummeted after reaching this limit. The smart addresses tracked in this test did not purchase these tokens, with the only high-buying token being GOAT, which was bought at over $10 million market cap and sold at $80 million (currently at $110 million). Therefore, it is recommended to trust the judgment of these top addresses.

Do not actively take profits: In selecting following addresses, the system itself has a “style preference,” leaning towards addresses with high losses and high profits. If manual intervention is made to actively take profits, it will only disrupt the complete operation of this strategy, leading to missed large profits. (The account could have doubled the next day, but a lesson was learned from manually selling a token after it rose two to three times.)

Profit and loss data disclosure: After 6 days of testing, the following system purchased a total of 81 tokens, with only 29 tokens yielding positive profits, a win rate of 35.8%. Profit TOP1 yielded a total profit of $1,247, accounting for 55% of the total invested funds; TOP5 yielded a total profit of $2,408, accounting for 106% of total funds. Loss TOP1 incurred a loss of $214, accounting for 9.4%, while TOP5 incurred a loss of $789, accounting for 34.3%. This demonstrated a state similar to that of the following addresses.

Next Steps

In summary, during the 6-day test, the system's profits were relatively stable, with profits coming from multiple tokens rather than a stroke of luck, and the holding periods were long, ranging from a few hours to several days, without the need for PvP battles.

The next version iteration plans to identify small fund addresses that can achieve stable profits and enhance the ability to recognize malicious operations and addresses. Additionally, the currently identified smart addresses often operate in the early hours of Beijing time, with domestic daytime "golden dogs" basically not participating, necessitating an expansion of the smart address inventory.

If this following system does not incur losses within a month, a second update of this article will be conducted, so stay tuned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。