AI-related calculations of DePIN seem to be in a favorable position and are expected to become the next major vertical field.

Author: Niklas Polk

Translation: Airis, Deep Tide TechFlow

“Like an ouroboros: the value of crypto tokens lies in your ability to use them to earn yields, which are paid by others trading the crypto tokens. […] I would love to see a story that is sufficient to explain the source or possible sources of these yields, rooted in something external. And I have heard some reasonable possibilities! For instance, there are some fundamental structural reasons suggesting that cryptocurrencies are durable and more efficient for international currency transactions. But I would like to hear more of such stories.”

— Vitalik

Introduction

The cryptocurrency market is moving beyond its initial focus on ERC20 tokens and DeFi. While these areas dominate current user activity (the most mainstream contracts on-chain are usually stablecoin ERC20s and decentralized exchanges) and portfolio allocations (currently, seven of the top ten token holdings of Nansen's "Smart Money" are DeFi project tokens or tokens primarily used for DeFi), and have developed to the extent of offering a variety of reliable operational products, the growth may tend to flatten as its monetary market attributes reduce yields and profit opportunities. Meanwhile, interest in non-monetary capital markets is increasing.

There are three possible implications—first, the next significant use case for cryptocurrencies may exist in vertical fields and assets beyond ERC20 tokens. Second, for sustainability, these new assets or products must provide sufficient yields by bringing new value on-chain or creating off-chain value. Third, these new use cases should be suitable for cryptocurrencies and interoperate with new types of DeFi serving non-ERC20 tokens to leverage this vast liquidity market (over $8.2 billion in total DeFi locked value), utilizing existing mature products while avoiding vulnerabilities like price oracles. We refer to this other side of DeFi as Object-Oriented Finance (OOF). As Vitalik wrote, this new era of DeFi needs underlying objects that stem from more fundamental values, possibly from off-chain, which can be assessed through cash flows rather than data. This report explores several such vertical fields and identifies those with the potential to go beyond simple tokenization and primitive DeFi, believing that among many possibilities, the following use cases will attract a broader audience.

Emerging Vertical Fields

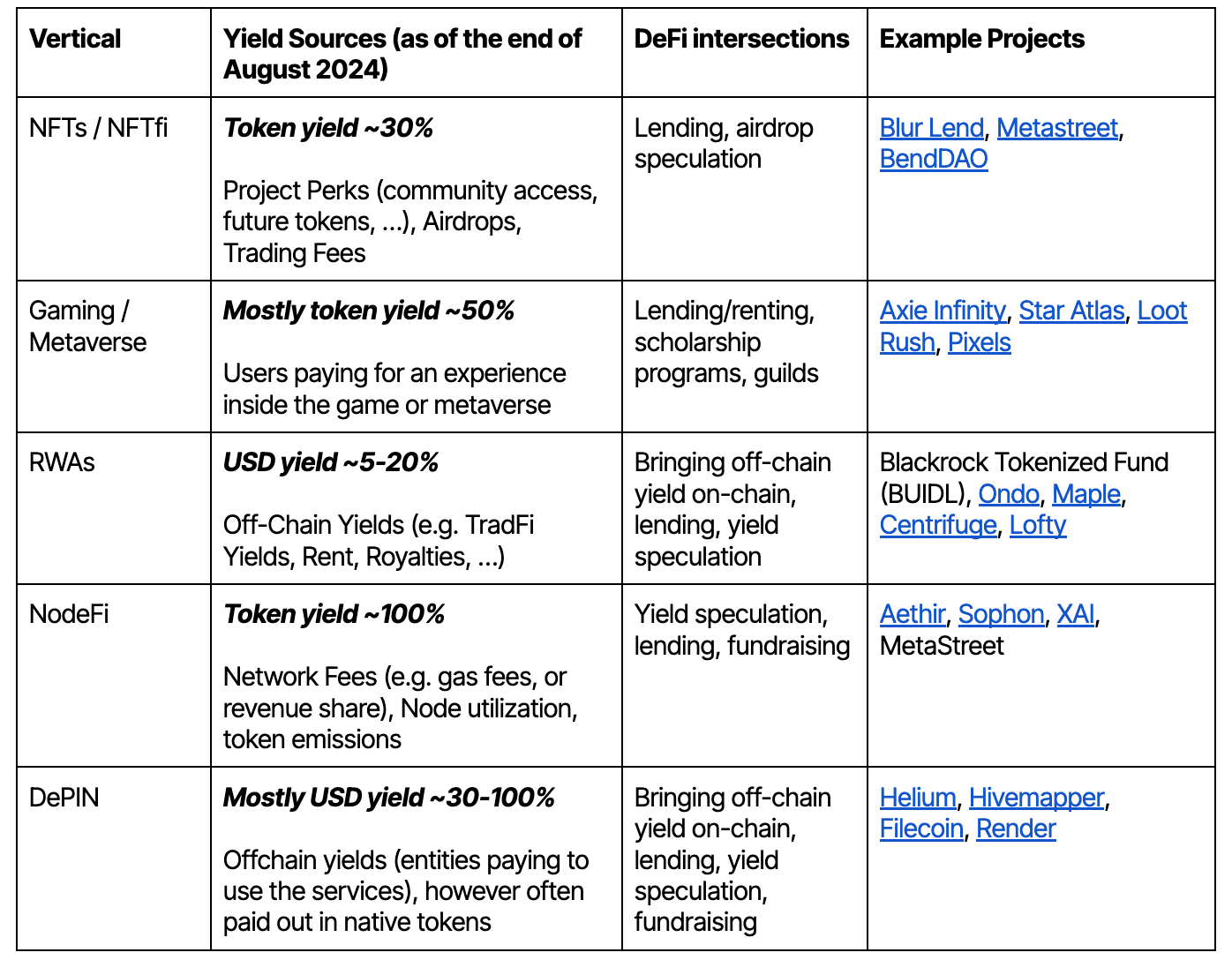

The following section analyzes five of the most promising emerging cryptocurrency vertical fields. Each field is briefly introduced, followed by its key market indicators and a critical assessment of future growth prospects. The table below provides a concise overview of each vertical field, highlighting its yield potential, possible DeFi intersections, and notable project examples, which will serve as a guide for further exploration.

NFTs

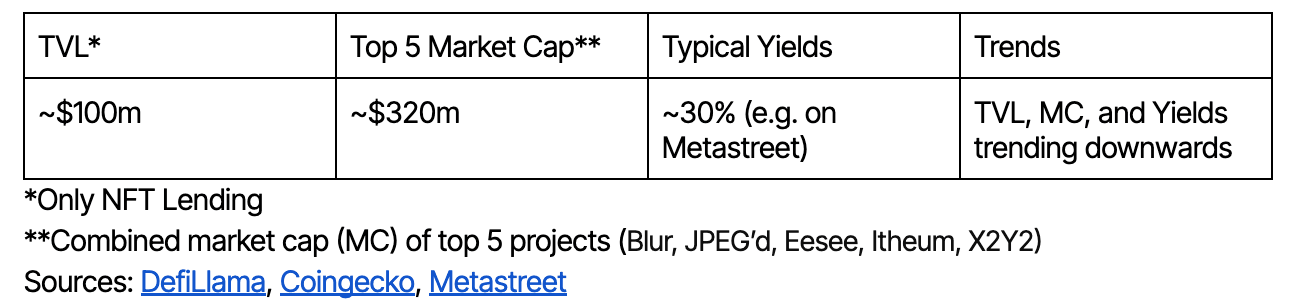

NFTfi has most notably driven the integration of non-ERC20 tokens (especially non-fungible tokens) into the DeFi ecosystem in the lending space. During the peak of the NFT market, various NFTfi products emerged, most of which were focused on lending. However, due to the lack of intrinsic ways for many NFT collectibles to generate yields, they often struggle to prove their value beyond social "hype." When project sentiment or narratives change, these assets can experience significant devaluation, making them unsuitable as collateral. This issue is further amplified by the extreme illiquidity of many NFTs, leading to most NFTfi and lending protocols failing to achieve and maintain widespread adoption.

Although the overall NFT market, as well as the NFTfi extension market, has not returned to its former glory in 2024, NFTfi still attracts some attention due to the revival of airdrop enthusiasm this year.

Frequent Airdrop NFTs

As airdrop strategies become more specialized, protocols begin to seek "real" market participants. A common practice is to allocate a portion of their airdrop tokens to holders of designated blue-chip NFT collections. For some similar NFTs (e.g., Pudgy Penguins and Miladys), this addresses the issue of "inherent" yields (i.e., the non-zero probability of future cash flows associated with holding the asset), making them more attractive lending assets and adding some resilience to their floor prices.

Even so, the number of such NFT collectibles is ultimately limited, and thus the growth potential of this market is also very limited. Additionally, the frequency, value, and sustainability of airdrops are difficult to predict, placing the entire vertical field in a high-risk market state.

Infrequent Airdrop NFTs

Since the end of the last NFT cycle, the value of most NFT collectibles has been declining. Lacking actual factors to support their value, these collectibles are largely non-productive assets and are highly sensitive to changes in narratives and "fear, uncertainty, and doubt" (FUD), making them unsuitable as collateral. Notably, art NFTs seem to be more resilient, as collectors primarily purchase them for their aesthetic value, but from a financial perspective, they remain non-productive assets.

While a new NFT hype cycle may drive demand for lending markets associated with these collectibles, such demand may be short-lived, as it will eventually fade again without additional cash flows.

Gaming/**Metaverse

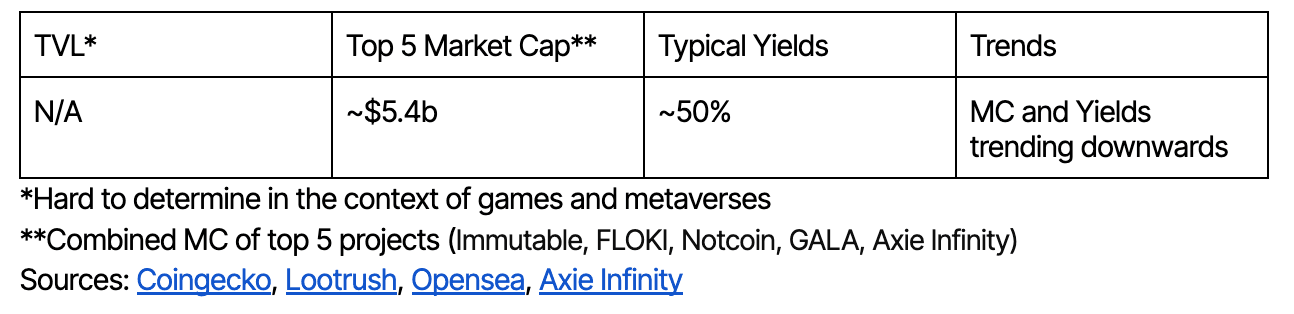

Similar to the NFT market, the gaming and metaverse markets have also experienced peak periods. This is not to say that there are no exciting developments in the field currently, but the overall valuation and asset prices in this area are on a downward trend.

However, unlike NFTs, these assets typically have built-in revenue mechanisms. Users participating in games or metaverse experiences are often willing to pay for that participation. For projects in early stages, their models can even be inverted, allowing project teams to incentivize user participation by directly distributing tokens. In either case, gaming and metaverse assets are generally productive assets, leading to strong competitive lending yields and use cases, such as Axie's scholarship program, where Axie owners "rent" their Axies to other players and share the generated loot (tokens).

Nevertheless, such collateral also faces many of the same drawbacks as NFTs, including volatility and market dependency, with most yields still appearing in the form of (similarly volatile) tokens.

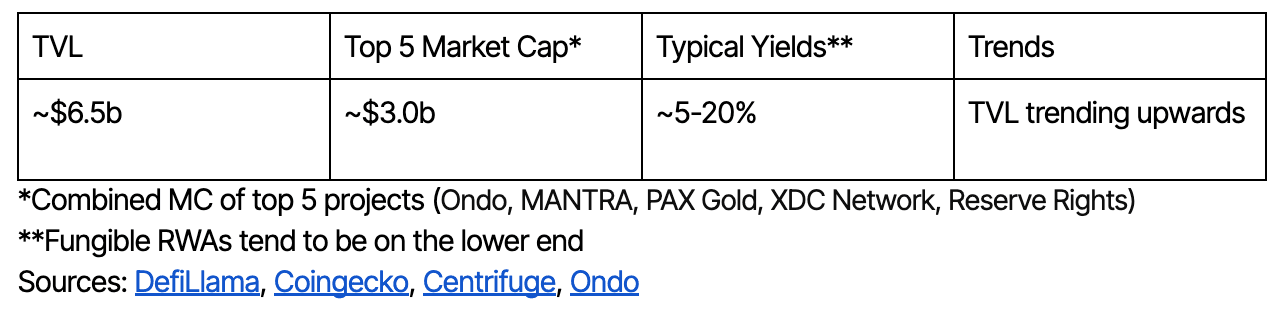

Real World Assets (RWAs)

Real world assets are typically productive assets, differing from the previously discussed asset types, as these assets and their primary yields come from outside the crypto space and are denominated in fiat currency. This reduces many of the sustainability issues faced by NFT, gaming, and metaverse yields, resulting in lower volatility for these real world assets, making them more suitable as collateral. However, bringing off-chain assets on-chain can undermine the trustworthiness of the blockchain. People must trust the entities bringing real world assets on-chain to ensure accurate valuations and maintain user rights in case of issues (often involving multiple jurisdictions).

While this situation applies generally to all RWAs, distinguishing between fungible/crypto-related RWAs (such as government bonds, funding rates) and non-fungible/less crypto-related RWAs (such as real estate, intellectual property) helps assess the opportunities and challenges within this vast and diverse asset field.

Fungible RWAs

Fungible and crypto-related RWAs, such as tokenized government bonds (e.g., Ondo, BUIDL, Maple) or other traditional financial products (e.g., Ethena tokenizing funding rates), are conceptually closer to DeFi, making them relatively easy to implement, although they may still face regulatory hurdles.

These products typically appear in the form of pools, where users can deposit yield-accumulating tokens and process them through DeFi like other tokens. They can also be easily integrated into most DeFi applications.

The underlying assets are usually pegged to the dollar or stablecoins, making them ideal collateral. However, despite their sustainability and reliability, the on-chain growth potential of such assets is questionable, as off-chain alternatives are already easily accessible, making it difficult to attract retail users. Additionally, since yields are typically in the single-digit range, these pools often are not the first choice for crypto natives seeking high returns unless combined with yields from other DeFi applications or leveraged.

Non-fungible RWAs

Non-fungible RWAs are conceptually more complex, harder to implement on-chain, and often face greater regulatory challenges. The underlying assets are often illiquid (e.g., real estate), and their value is difficult to verify or estimate (e.g., intellectual property).

On the other hand, non-fungible RWAs often provide higher yields, depending on the specific asset, as their yields typically come from outside the crypto market. This helps diversify income sources, and if successfully combined with other DeFi applications, on-chain investors also have the opportunity to achieve substantial yields.

Moreover, for retail investors, such yields are often difficult to access due to high barriers (e.g., entry restrictions for intellectual property) or excessive initial investment requirements (e.g., real estate). This is also an incentive for these assets to go on-chain.

However, to date, the existing non-fungible RWA market has not achieved large-scale adoption or attracted significant liquidity due to its immaturity, cumbersome operations, and ongoing regulatory issues.

NodeFi

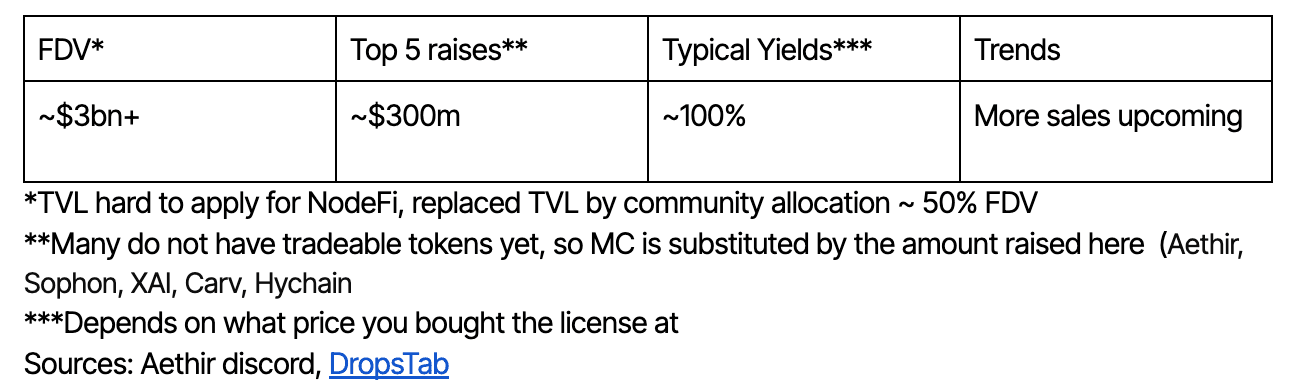

NodeFi is an emerging narrative and project fundraising method. Specifically, the operation licenses of blockchain nodes are tokenized (usually as NFTs) and sold, with node operators' rewards typically being quite substantial. Moreover, at least for project teams, this model seems to be quite effective; the sales of just three major nodes (XAI in November 2023, Aethir in March 2024, and Sophon in May 2024) collectively raised nearly $250 million.

This license is a productive asset and allows buyers to earn yields by running nodes or delegating operations.

Currently, the yields can be very competitive based on node licensing prices (which often adopt a tiered system where the later you purchase, the higher the price). The crypto market tends to quickly seize successful models, and with the success of past node sales, there may be more sales formats in the future to further expand this emerging field.

However, node sales also have their drawbacks. First, their yields are closely tied to the crypto market and are typically denominated in project tokens, relying on valuations and network usage. This, in turn, affects the value of node licenses, making them highly volatile. Second, the full utilization and integration of node licenses may pose centralization risks to the network itself. For this reason, many project networks are designed to make node licenses non-transferable and limit the number of nodes a single user can purchase. Nevertheless, a thriving ecosystem around node licenses is conceivable, and new NodeFi products like XAI and MetaStreet have begun to unlock these restrictions.

Overall, despite being highly dependent on the crypto market conditions, the NodeFi vertical is growing and may persist. While it is currently difficult to identify clear winners built on this foundation, as these productive assets continue to gain popularity, a winner is likely to emerge.

DePIN

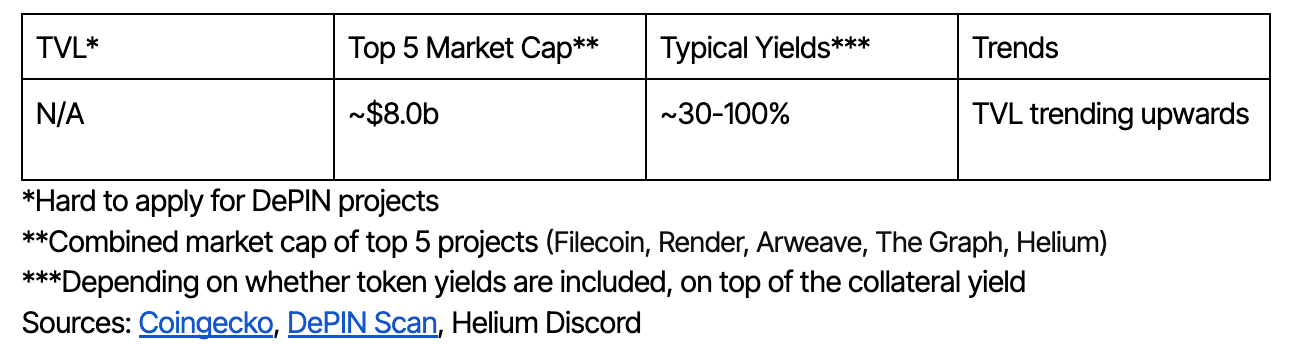

Decentralized Physical Infrastructure Networks (DePIN) is a recently highlighted category. The current main sub-industries include computing/AI-related networks (such as Render), wireless networks (such as Helium), sensor networks (such as Hivemapper), and energy networks (such as Arkreen). Although the concept of DePIN has existed for some time (the Helium blockchain launched in 2019), the rise of AI since the release of ChatGPT-3 in November 2022 has significantly driven a lot of hype around computing-related projects. Following this trend, distinguishing computing/AI-related DePIN from other types of DePIN helps facilitate a more precise discussion of this field.

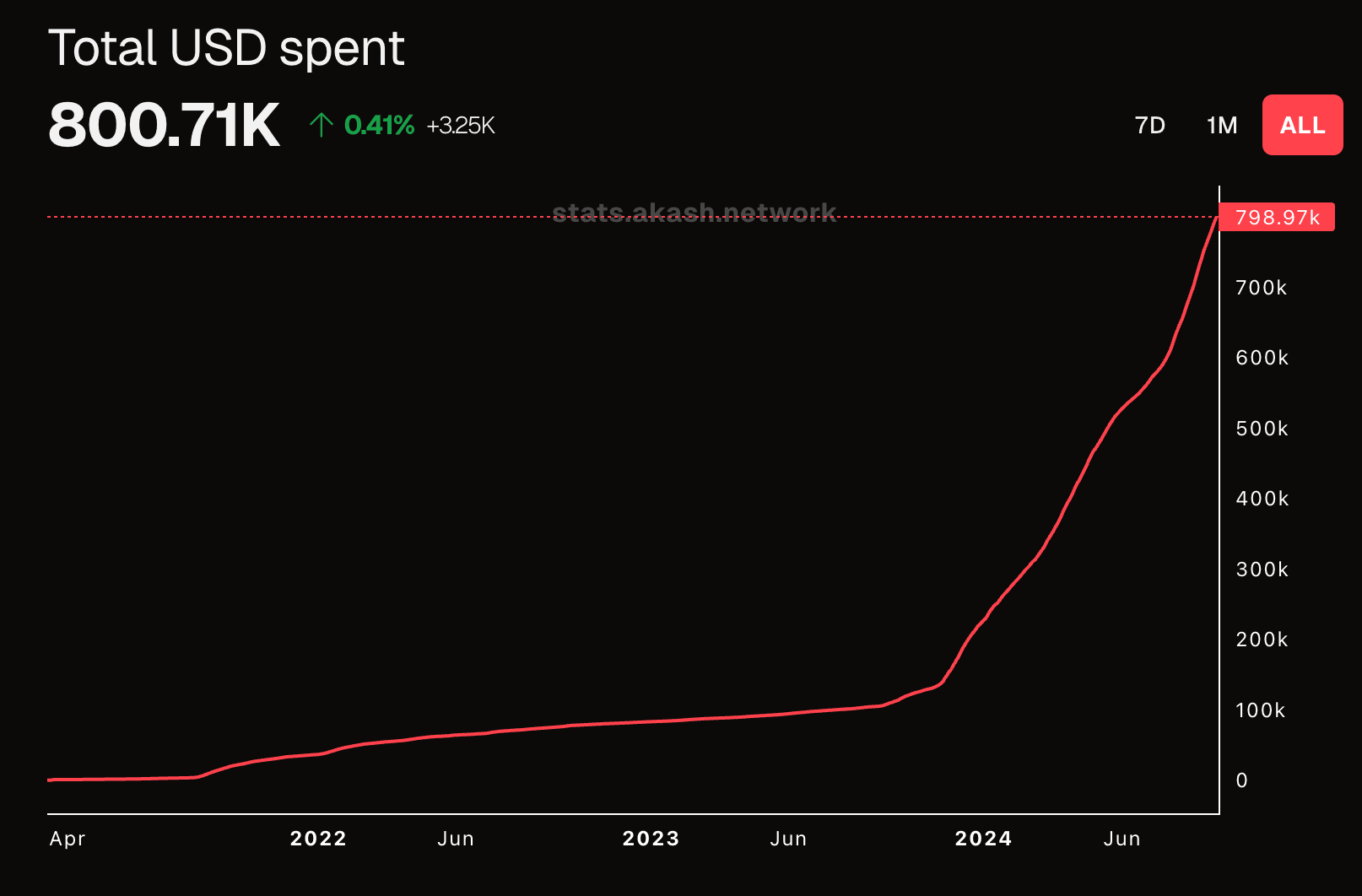

Computing/AI-related DePIN

Although these projects have not yet captured a significant share of the GPU leasing market (the GPU-as-a-service market was approximately $3.2 billion in 2023, while Aethir's annual revenue is about $36 million, and Akash Network's total leasing revenue since 2021 is less than $800,000), the field is rapidly attracting the attention of investors and users.

As AI gradually becomes the core of technological innovation, training proprietary models has also become a key differentiator for many companies. GPU leasing, as a sub-industry of DePIN, may experience significant growth. The real demand for GPUs and willingness to pay continue to rise (this topic will be explored in detail in future reports), making these yields highly competitive compared to other on-chain opportunities. Additionally, since these yields come from outside the crypto ecosystem, they are typically denominated in dollars, opening the door to interesting opportunities like yield speculation similar to Pendle, becoming a bet on the GPU market.

Moreover, compared to other verticals (such as NFTs, real estate, and project-related licenses), the price of GPUs as underlying assets is relatively easy to assess and predict, making it very attractive as a lending use case.

However, it is worth noting that this field also faces some trust and regulatory issues similar to those discussed in the RWA section, albeit to a lesser extent. Additionally, DePIN is often susceptible to challenges from off-chain competitors, as these markets and use cases benefit from economies of scale and centralized efficiencies. However, the unique opportunities brought by integration with the crypto market—such as token incentives and additional yields through DeFi integration—mean that the AI-related computing field has a significant opportunity to capture a considerable market share in the future.

Non-computing DePIN

Non-computing DePIN networks include wireless networks (such as Helium), sensor networks (such as Hivemapper), and energy networks (such as Arkreen). The yields of these networks often heavily depend on the utilization of "nodes," with significant yield variations (for example, frequently used Helium hotspots can generate higher yields, while Hivemapper can earn more for mapping "important" streets).

This sub-industry faces many of the same challenges as AI-related computing DePIN, and in some respects, its advantages are less pronounced. Many products' demand sides can often be well-served by off-chain solutions, and industries like wireless and sensor networks do not face the same increasing demand as the AI computing field. Furthermore, ensuring standardization and maintenance of these services is more challenging than running GPUs in data centers. GPU applications are typically more diverse, while many non-computing DePIN industries overly rely on project-specific equipment, limiting their scope of use.

Nevertheless, the potential of DePIN is enormous, and an innovative non-computing application with strong product-market fit could capture global attention at any moment.

Conclusion

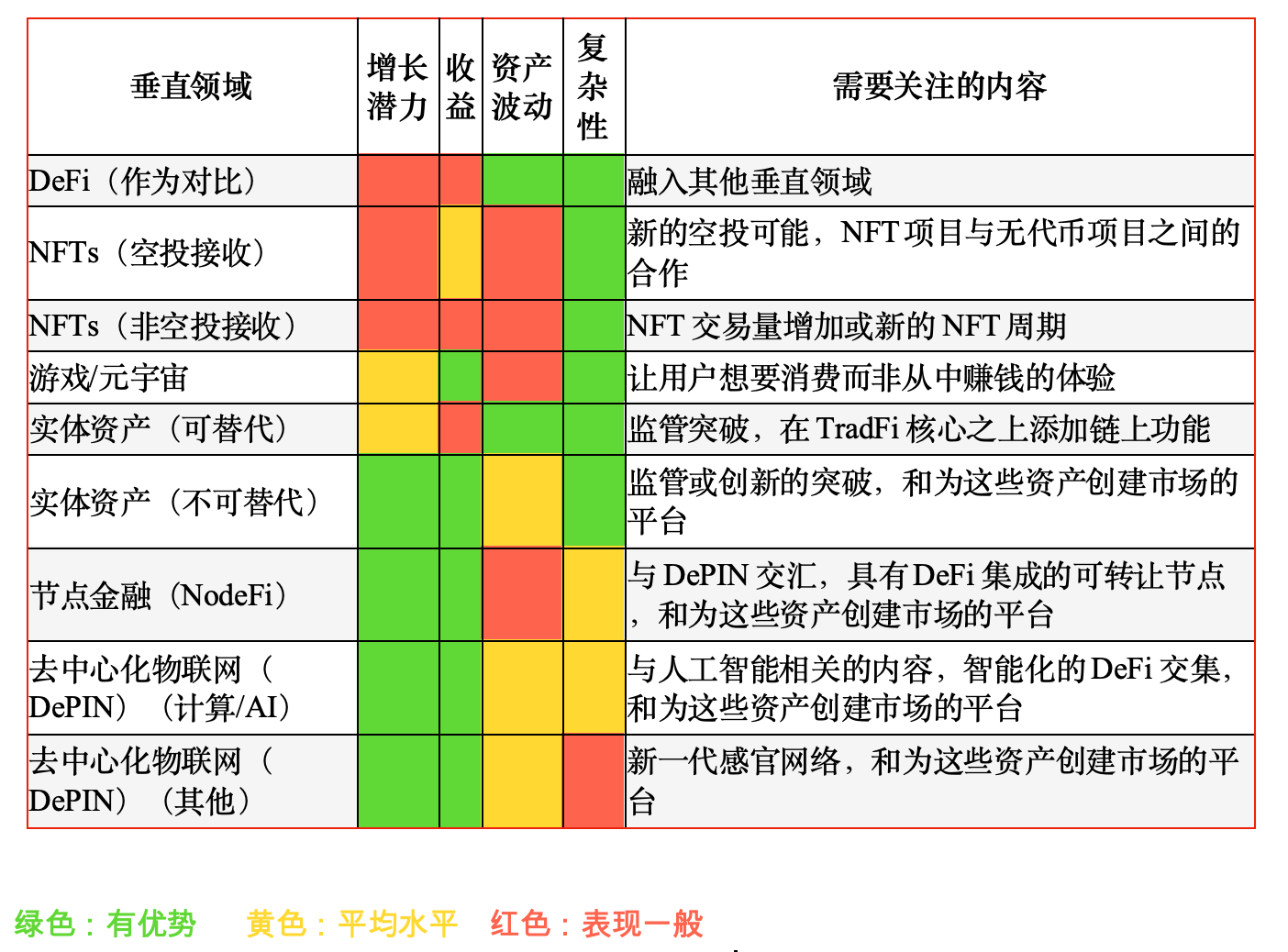

The table below shows the performance of the discussed emerging vertical fields across the following dimensions:

• Growth Potential: Assessing the growth potential of existing markets and the ability to capture shares in corresponding off-chain markets.

• Yield Potential: Evaluating the yield potential of the vertical field, excluding additional token incentives.

• Asset Volatility: Measuring the volatility of productive assets and their correlation with the success of individual projects, which also indicates their suitability as collateral.

• Complexity: Considering the complexity of implementation, including off-chain components and regulatory issues.

Overall, AI-related computing DePIN seems to be in a favorable position and is expected to become the next major vertical field, with a considerable and rapidly growing market, high yield potential, predictable asset prices, and relatively low implementation complexity. Currently, it appears that, given the appropriate time, the synergies and potential interoperability between these projects and existing crypto-native use cases (such as innovative fundraising, lending, yield speculation/fixed income products, or self-repaying loans) will trigger breakthroughs and develop successful products.

It is worth mentioning that NodeFi and non-fungible RWAs are also strong competitors. NodeFi has enormous growth and yield potential and a straightforward implementation approach, looking quite promising. However, it largely depends on the success of the underlying projects and tokens, and node licenses are typically non-transferable, which imposes restrictions. It has yet to prove its long-term sustainability and has not created a market for these node licenses that is easy to interoperate with DeFi.

Non-fungible RWAs offer relatively high yields and have the potential to bring real advantages that are currently unavailable in the off-chain market onto the chain. However, the implementation and regulatory barriers are complex, and no products have achieved deep retail penetration yet.

Notably, the three vertical fields mentioned above face similar challenges in creating markets for their assets and successfully (and sustainably) integrating them into DeFi. This may mean that a breakthrough in one vertical field could trigger innovation in others. As Vitalik mentioned, the current major DeFi lending protocols have yet to provide markets for low liquidity, high-value assets, which are precisely the assets that "ordinary people" own and are familiar with.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。