抄底失败,市场并没有等来好消息。今日凌晨,白宫新闻秘书表示对中国的 104% 的额外关税已于东部时间中午生效,全球金融市场再次跳水。

4 月 3 日,特朗普关税政策出台时,美国财长贝森特曾发文建议所有国家都不要采取报复行动,等待在 4 月 9 日之前是否有任何谈判。甚至再次上演了「假新闻」戏码,寄望特朗普可能愿意就其对多个国家和特定产品实施的贸易壁垒展开谈判而出现反弹,让全球资本市场跟着短时「起死回生」。

但经过几日的博弈,市场并未等来好消息,从年初的 10% 到 3 月的 20%,再到 4 月初的 34%,如今叠加 50% 的「报复性加码」,中美贸易摩擦升级为一场「经济核战」。

中美再打贸易战,股市还能撑住么?

自特朗普政府上周宣布新一轮关税政策以来,国际资本市场遭遇剧烈震荡,美国股市首当其冲。截至本周二收盘,标普 500 指数跌破 5000 点,为近一年来首次,较 2 月 19 日的高点累计下跌 18.9%,距离 20% 跌幅的「技术性熊市」门槛仅一步之遥。据测算,标普 500 指数成分股在四个交易日内市值蒸发 5.8 万亿美元,创下自 1950 年代该指数设立以来最严重的四日连跌纪录。

与此同时,美国的关税政策引发全球资本市场连锁反应。彭博社统计显示,自 4 月 3 日特朗普提出所谓「对等关税」后,全球股市总市值已缩水 10 万亿美元,略高于欧盟 GDP 的一半。美国科技巨头成为重灾区,苹果、微软等七大科技公司市值合计蒸发 1.65 万亿美元,其中苹果公司因高度依赖海外供应链,股价四日暴跌近 23%,创 2020 年疫情暴发以来最大单周跌幅。

此前,加密圈内不少意见领袖坚信,加密资产类别不会受到传统关税影响,因为它们的交易无需经过国界与海关。他们认为,面对全球进入新一轮重商主义与贸易壁垒的时代,加密货币的价值主张反而更加凸显 Strategy 创始人 Michael Saylor 在 4 月 3 日发文表示「比特币没有关税。」

然而加密货币总市值已从 2024 年 12 月的峰值下跌了 35%,由 3.9 万亿美元降至 2.5 万亿美元。加密恐惧与贪婪指数」显示为 17,处于极度恐慌区间,表明市场情绪悲观。

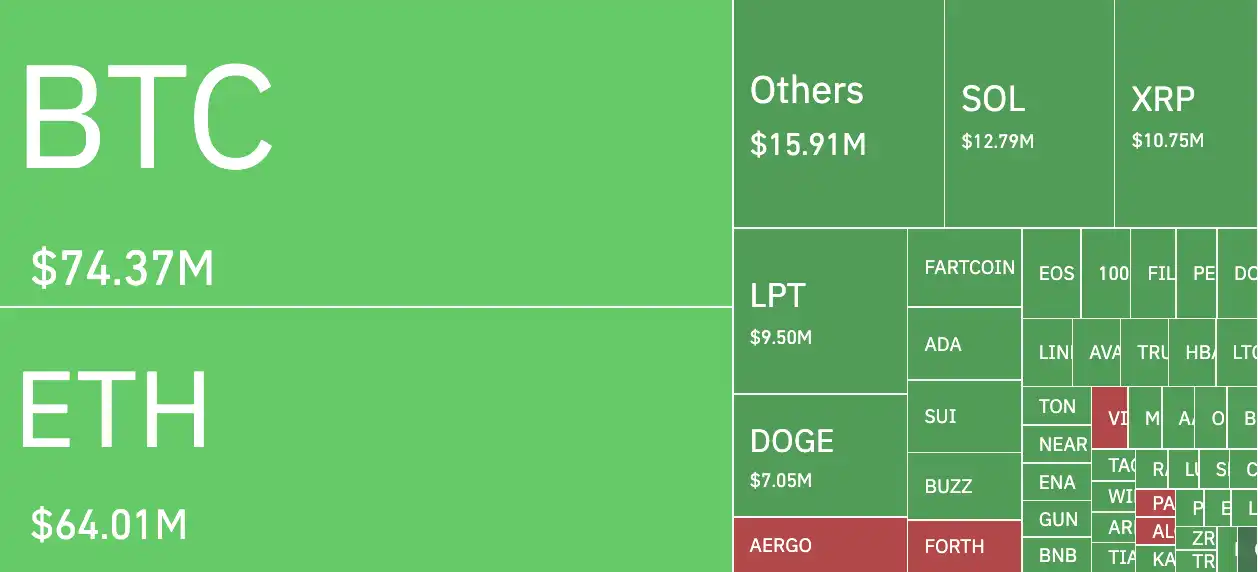

昨夜,比特币再次跌破 75,000 美元,与此同时,BTC 市占率节节攀升,山寨币市场惨不忍睹,以太坊再次跌破 1400 美元。

过去 12 小时,加密市场累计爆仓 2.43 亿美元,其中多头爆仓 1.92 亿美元,空头爆仓 5103 万美元。

比特币价格持续下跌甚至将导致一直买买买的 Strategy 被迫出售比特币。根据 Strategy 在 4 月 7 日向 SEC 提交的 8-K 表格,若比特币价格继续下跌,Strategy 或将被迫出售其比特币持仓以进行偿债,打破 Michael Saylor「永远不会卖出比特币」的承诺。

自特朗普在 2024 年 11 月赢得大选以来,Strategy 已以均价 93,228 美元买入 275,965 枚 BTC(257.3 亿美元),而这一部分已浮亏达 46 亿美元。

悲观预期加剧,分析师们怎么看当前市场

过去一周,包括高盛和摩根大通在内的多家华尔街银行警告称,贸易战若继续升级,美国乃至全球经济今年可能陷入衰退,将进一步削弱金融市场吸引力。

但美国白宫团队却在欢呼胜利,「现在正在筑底,真的在筑底,」特朗普首席贸易顾问彼得·纳瓦罗周一晚在福克斯新闻上说,「接下来会反转,标普 500 中那些率先将生产转回美国的企业将带动复苏,这很快就会发生。道指五万点,我敢打包票,而且不会出现衰退。」

不过,纳瓦罗的乐观言论并未获得摩根大通 CEO 杰米·戴蒙的认同,他在周一致股东的年度信中警告称,特朗普的关税将推高物价、拖累全球经济,并通过破坏美国的盟友体系削弱其全球地位。就连特朗普的一些盟友,包括埃隆·马斯克和比尔·阿克曼,最近也纷纷警告称,这种关税政策逻辑严重缺陷,是错误的路线。

加密分析师 Phyrex 认为从美联储的行为逻辑看,除非通胀明显回落,否则即便是「防御性降息」也很难快速落地。真正的分水岭,可能是 4 月底美国 GDP 数据出炉时。

从加密市场看,BTC 的换手率今日下降,URPD 数据显示,即便价格跌破 77,000 美元,但 93,000~98,000 区间的投资者几乎没有减仓,这说明当前的卖压并不来自高位持有者,顶部并未出现恐慌性抛售,链上结构相对健康,只要后续政策不再频繁反复,BTC 和风险市场仍可能获得阶段性修复的空间。

随着美国国债不再扮演避风港的角色,10 年期国债收益率回升至接近 4.3% 左右,高于 3 月底的水平,推高了抵押贷款和其他类型贷款的成本。30 年期美债收益率收盘报 4.76%,较周一最低点上涨近半个百分点。美国两年期与十年期国债收益率曲线利差扩大至 48 个基点,为 2022 年 5 月以来最陡峭水平。

BitMEX 联创 Arthur Hayes 发文表示,「留给美联储的时间不多了,情况正在失控。此前股市下跌会导致美国 10 年期国债收益率下跌,有利于风险资产。而现在的股市下跌,伴随美国 10 年期国债收益率上涨,这是坏事。市场终于意识到,如果美元出口收入减少,就不可能再有国债或股票的买盘,游戏结束。」

悲观预期还在加强,交易员 Eugene 发文称,「全球贸易关税的引入标志着世界秩序发生了 50 多年来未曾见过的变化。自由贸易一直是推动生产率和经济增长的关键因素,促成了世界上有史以来最大的长期牛市。从开放转向保护主义的立场将产生深远的影响,这种影响需要数年时间逐步显现,除非特朗普完全放弃他的关税计划。我认为这种可能性非常低。这将对全球风险资产构成相当大的长期阻力。

在加密货币方面,近期活跃开发者的结构性下降可能是最令人担忧的事情。在上一个周期中,我们可以观察开发者活动,并感到安慰,因为我们知道我们的行业仍然受益于长期的顺风。快进 2-3 年后,我们不仅没有产出任何特别有趣或重要的东西,而且未来的前景甚至比当时还要糟糕。

在上一个周期中,我们期待着 ETF 的推出,以及在支持加密货币的政府领导下更好的监管环境,作为隧道尽头的曙光。现在这些都实现了,但(再一次)未能达到预期,我看不到未来有什么能够让加密货币摆脱其天然的「Ouroboros」(自我循环、自我吞噬的困境)。

而从更宏观的层面来看,世界局势正处于百年未有之大变局中。亿万富翁对冲基金经理、桥水基金创始人达利欧发文表示,目前市场和经济对关税的关注虽重要,但不应忽视更深层次的全球性问题。他指出,我们正处于货币、政治和地缘政治秩序的「经典崩溃」阶段,这种情况一生中可能只发生一次,但历史上曾多次出现。

达利欧建议,不要被关税等短期事件分散注意力,应关注五大力量(经济、政治、地缘政治、自然、技术)的相互作用。研究历史上的类似周期(如货币危机等)有助于预测未来。

「当前的变化是历史性大周期的一部分,关税只是表象,真正的驱动因素是货币、政治和地缘政治秩序的结构性崩溃。理解这些力量的相互作用并学习历史经验,才能更好地应对未来。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。