Under the rules of the "points game" in Restaking, should we still only focus on "TVL"?

Written by: Bedrock

Hook:

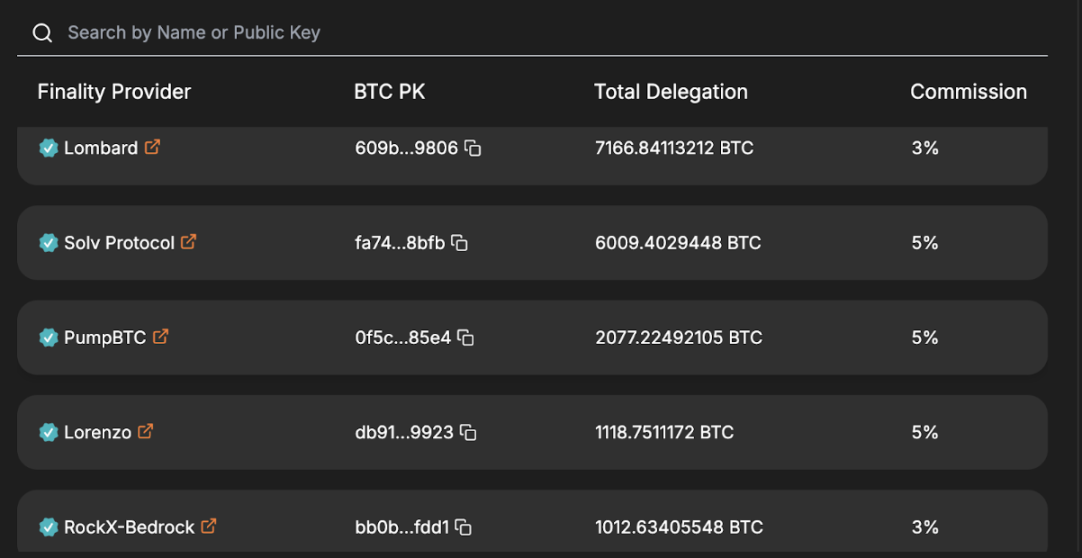

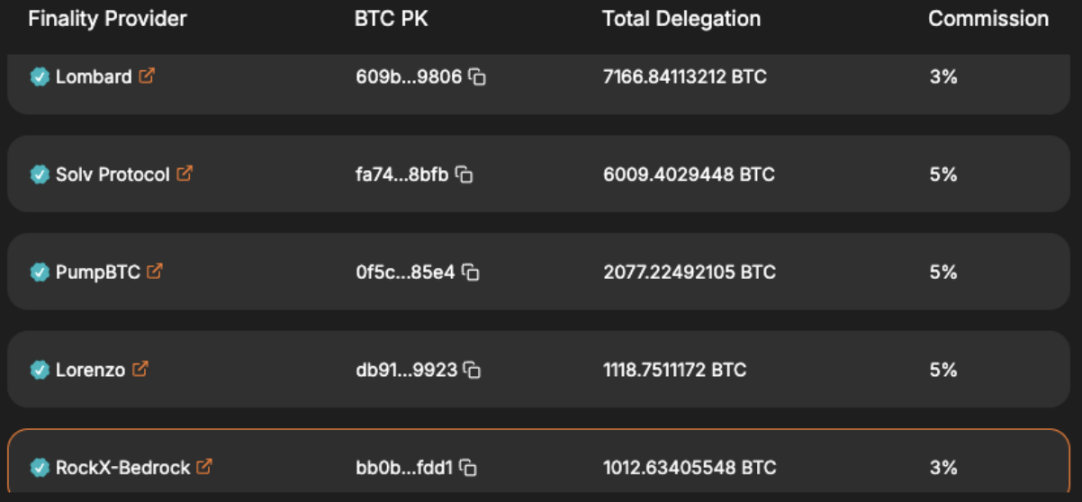

Babylon Phase-1 Cap-2 ended at 3:08 AM on October 9th (UTC+8) (block height 864799). A total of 22,891 BTC was deposited into Babylon, with over 12,000 Stakers participating. Gas prices surged from 60 satoshis to a peak of 5281 satoshis, consuming a total of 1.56 BTC. The results of the participants in various BTC Restaking tracks are as follows:

(source: https://btcstaking.babylonlabs.io/ ,https://x.com/babylonlabsio/status/1843795315721416722 ,_

https://mempool.space/zh/block/000000000000000000001e14e2e02b7ecd370f30e9e6d32042b569dc8cf0f597 )

At this moment that should be a time of "celebration," I urge everyone to calm down and consider whether we should still only focus on "TVL" under the rules of the "points game" in Restaking.

1. Beware of the "too big to fail" TVL

Just less than 10 days ago, the creators of Restaking promoted the points game to the "household name" EigenLayer, whose token $EIGEN opened for transfers after a 5-month lock-up period. The peak price was $4.5, and the current price is $3.78, with a circulating market cap of about $700 million and an FDM of about $6.35 billion. Compared to EigenLayer's peak TVL of over $20 billion, the current TVL is $11,726,166,528.30 (about $11 billion). The huge gap between EigenLayer's massive TVL and the current market cap of $EIGEN has left ambitious Restakers sighing, "As one drinks water, one knows whether it is cold or warm."

(source: https://coinmarketcap.com/currencies/eigenlayer/ , https://defillama.com/protocol/eigenlayer#information )

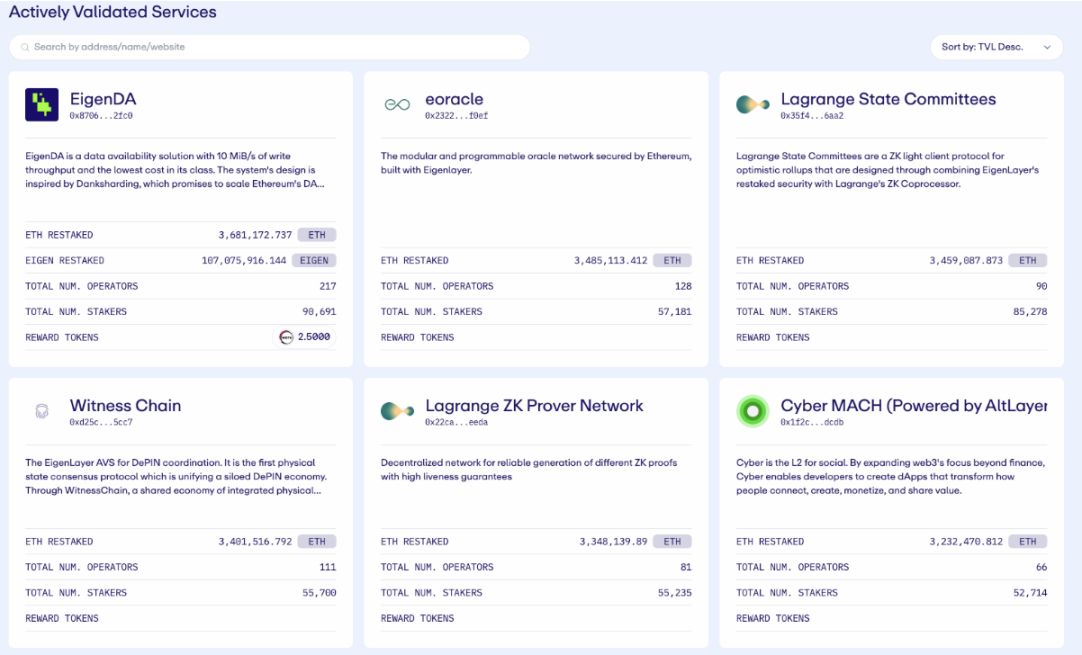

2. Excessive TVL only dilutes returns

EigenLayer has done a lot to protect small and medium Restakers: low-protection accounts, a 5-month lock-up period after token issuance, and additional airdrops before circulation. However, it now seems that these measures can only prevent large-scale panic events. Particularly, the 5-month lock-up period, which was intended to use time to create development space for AVS, has had little effect. However, even when AVS shows significant improvement, the current excessive TVL of EigenLayer has surpassed what AVS requires. Among the 17 launched AVS, 15 have a Delegated ETH TVL exceeding $1.5 billion. The question is, how many AVS can support the security of $1.5 billion? Or is this the fundamental constraint on AVS development: the excessive TVL of EigenLayer makes AVS returns negligible! EigenDA's Weekly Rewards are only 2.5 ETH, while the market cap of Delegated ETH and EIGEN exceeds $9 billion!

(source: https://app.eigenlayer.xyz/avs/0x870679e138bcdf293b7ff14dd44b70fc97e12fc0)

3. In the current prevalence of points games, the Restaking track needs new metrics

I won't discuss how to improve EigenLayer's returns, after all, "what belongs to Caesar should be given to Caesar," and the "Caesars" have their own issues. For us Restakers, what we care more about is real returns—after all, no one wants to wake up early and work hard to grab the first mining, only to end up working for the miners. Let's return to the Good Old Days: during the DeFi Summer, we had not only TVL but also APR! APR, as the most intuitive indicator of returns, once drove people crazy: if there is a 100% profit, capital dares to risk the gallows; if there is a 300% profit, capital dares to trample all laws of the world— from Capital. But in the points era, EigenLayer's points cannot be directly compared to Babylon's points because points are called points precisely because they are not yet circulating and have no price. However, within the same ecosystem, we can calculate how many points assets of the same value can earn! Therefore, we seek the "APR" metric of the points era, PPC—Points per Coin!

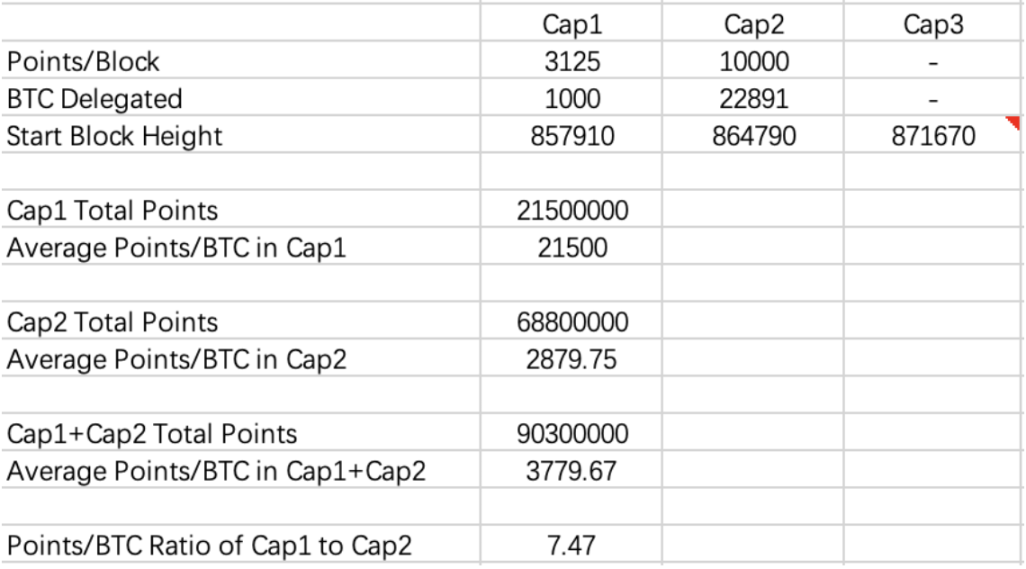

4. Calculation method of PPC—Points per Coin

Taking Babylon as an example, it opened two Caps, with Cap1 being 1000 BTC and Cap2 being 22,891 BTC. The rules for generating Babylon Points for the two Caps are also different; in the Cap1 phase, each block generates 3125 points, while in the Cap2 phase, each block generates 10,000 points. Assuming the block length from Cap2 to Cap3 is the same as from Cap1 to Cap2, we can calculate that the average points earned per BTC in Cap1 is 21,500 Babylon Points, while in Cap2 it is 2879.75 Babylon Points. The difference exceeds 7 times! It can be seen that the cost-effectiveness of Cap1 is exceptionally high!

5. Comparing the participants in the Restaking track under the Babylon ecosystem

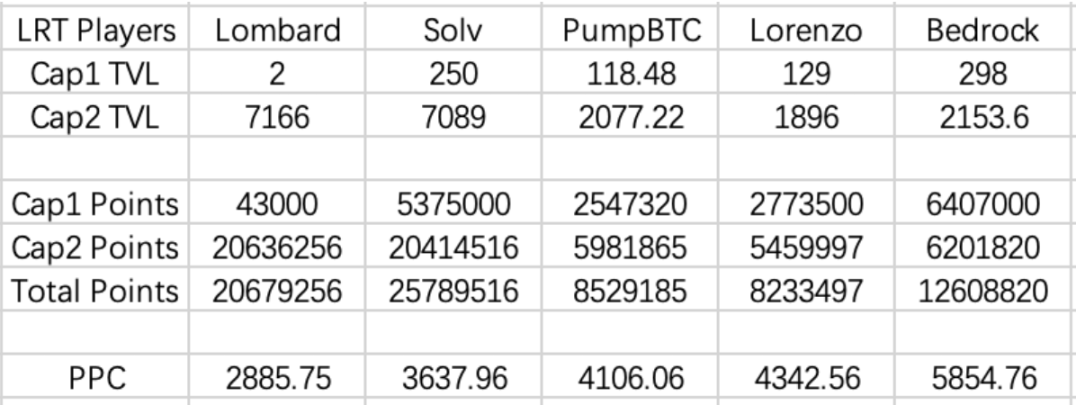

Now let's calculate the PPC of the main participants (TOP5 Finality Providers after Cap2 on the Babylon official website):

PS: The data for Staked BTC is selected from the highest values among the Babylon official website, project social media, and project official website.

It can be seen that,

- Ranked by TVL: Lombard, Solv, Bedrock, PumpBTC, Lorenzo;

- Ranked by PPC: Bedrock, Lorenzo, PumpBTC, Solv, Lombard.

It can be seen that if we consider both TVL and yield, Bedrock scores the highest.

6. For both Babylon and the BTC ecosystem, everything is just beginning

In fact, the more than 22,000 BTC from last night may seem like a lot, but converted to USD, it is about $1.5 billion, roughly 14% of EigenLayer's TVL. Comparing Babylon to EigenLayer may seem a bit unfair, but the Crypto market needs Babylon far more urgently than EigenLayer:

From the perspective of holders, BTC holders need a decentralized platform to generate staking profits more than ETH holders do;

From the perspective of Layer2, BTC L2 needs Validators As A Service more than ETH L2 does. Unlike AVS, there are already multiple BTC L2s with TVL higher than Babylon, although on the other hand, it can also be said that Babylon is relatively controlled in its TVL growth;

From the perspective of infrastructure, the demand for BTC from Babylon is much stronger than the demand for ETH from EigenLayer. In the Ethereum ecosystem, there are already too many infrastructures providing tools for developers. In contrast, the BTC ecosystem can create such a significant market response with just one Ordinals. Imagine when Babylon develops and matures, the BTC ecosystem will undergo tremendous changes.

Don't forget that BTC's market cap is not just a simple half of the entire Crypto market. Everything is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。