This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,887.55 -1.61%

Bitcoin (BTC): $61,068.94 -1.66%

Ether (ETH): $2,398.48 -1.49%

S&P 500: 5,792.04 +0.71%

Gold: $2,617.57 +0.35%

Nikkei 225: 39,380.89 +0.26%

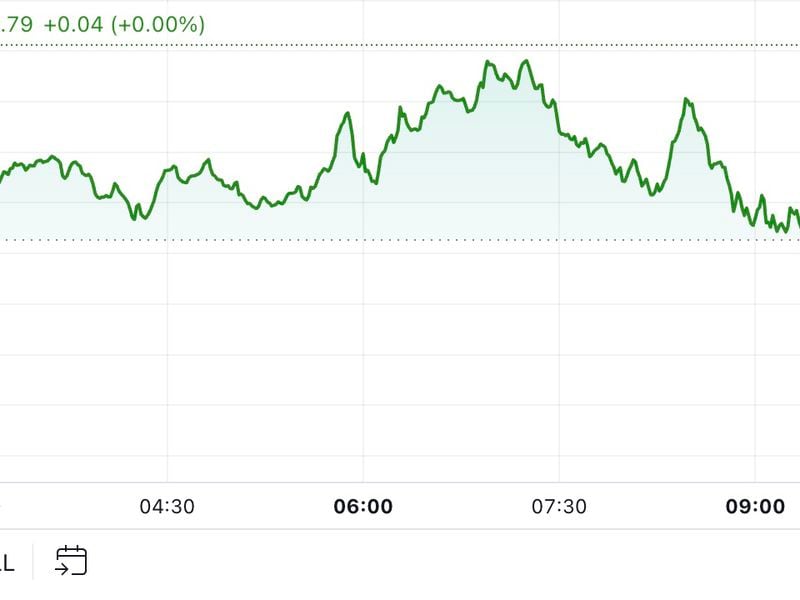

Bitcoin nursed losses during the European morning, trading about 1.6% lower over 24 hours even after returning to $61,000 following a dip to as low as $60,300 late on Wednesday. The broader crypto market has fallen 2%, as measured by the CoinDesk 20 Index. Attention will turn to September's CPI report out of the U.S. later Thursday, which is expected to show increases of 0.1% month-on-month and 2.3% year-on-year. Hotter-than-expected prints could strengthen calls to stop interest-rate cuts, which would likely weigh on risk assets such as cryptocurrencies.

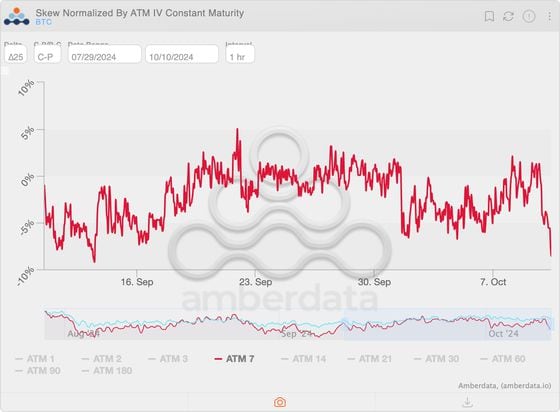

The minutes from the September Fed meeting, released Wednesday, showed policymakers were divided on how aggressive the central bank should be. "A substantial majority of participants" favored cutting the interest rate by half a percentage point, though some expressed misgivings about going that large, the minutes said. "Crypto sentiment has moved back into the fear zone (39), reinforcing the contrast with 72 (greed) in equities," said Alex Kuptsikevich, a senior analyst at FxPro. "This dynamic is easily explained by the appreciation of the dollar and the increased attractiveness of bonds, which reduces institutional traction in bitcoin." The dollar index (DXY), rose to 102.97, the highest since Aug. 16, taking the cumulative gain since the Sept. 30 low of 100.18 to 2.7%, according to data source TradingView.

Ether ETFs in the U.S. registered zero flows in either direction on Wednesday, according to data compiled by SoSoValue. This is the second time this week the funds have seen no activity and the third time since they listed in July. That leaves net outflows since their debut at $562 million, in contrast to their bitcoin equivalents, which have drawn net inflows of nearly $19 billion since January. Bitcoin ETFs saw outflows of over $30.5 million on Wednesday. It was a fairly muted day for them too, with nine of the 11 funds registering zero flows in either direction.

- Omkar Godbole

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。