On-chain dark pools provide traders with privacy protection while eliminating the need for centralized intermediaries.

Author: Tiger Research Reports

Translated by: Deep Tide TechFlow

Key Points Summary

In traditional financial markets, large-scale trades by institutional investors can significantly impact market prices, potentially leading to losses for other market participants. To mitigate these effects, dark pools were introduced as an alternative trading system where trade details remain confidential before execution.

Although dark pools have continued to grow since their inception, trust has been undermined due to information leaks and misuse by operators. In response, regulators in several countries have taken action to strengthen oversight of these platforms. Given this, blockchain-based dark pools have emerged as a potential solution.

On-chain dark pools provide traders with privacy protection while eliminating the need for centralized intermediaries. This addresses several issues faced by traditional financial systems. Additionally, the growing demand for private trading is expected to drive the development of the on-chain dark pool market in the near future.

Deep Tide Note: In traditional financial markets, dark pools are private trading platforms that allow institutional investors to execute large securities trades without publicly disclosing trade information. Trades conducted in dark pools are not displayed in real-time on public markets, and trade information is typically published with a delay or only partially disclosed.

1. Introduction

The volatility of traditional financial markets continues to rise, primarily driven by technological advancements and various market factors. Large-scale trades by institutional investors, particularly block trades and the evolution of high-frequency trading (HFT) technology, are major contributors to this volatility.

This heightened market volatility poses significant risks to ordinary investors. As a result, institutional investors seek alternatives that can minimize market disruption while executing large block trades. An increasingly recognized solution is the dark pool, an alternative trading system designed for private trading.

Dark pools differ from traditional exchanges in several key ways. First, trade details such as order prices and volumes are not made public before execution. Second, dark pools primarily support block orders, with some platforms setting minimum order sizes to filter out smaller trades. Finally, they employ unique execution methods, including centralized matching of large orders and executing trades at the midpoint of market spreads. These features enable institutional investors to execute large trades at favorable prices without disclosing strategic information to competitors, thereby reducing market impact.

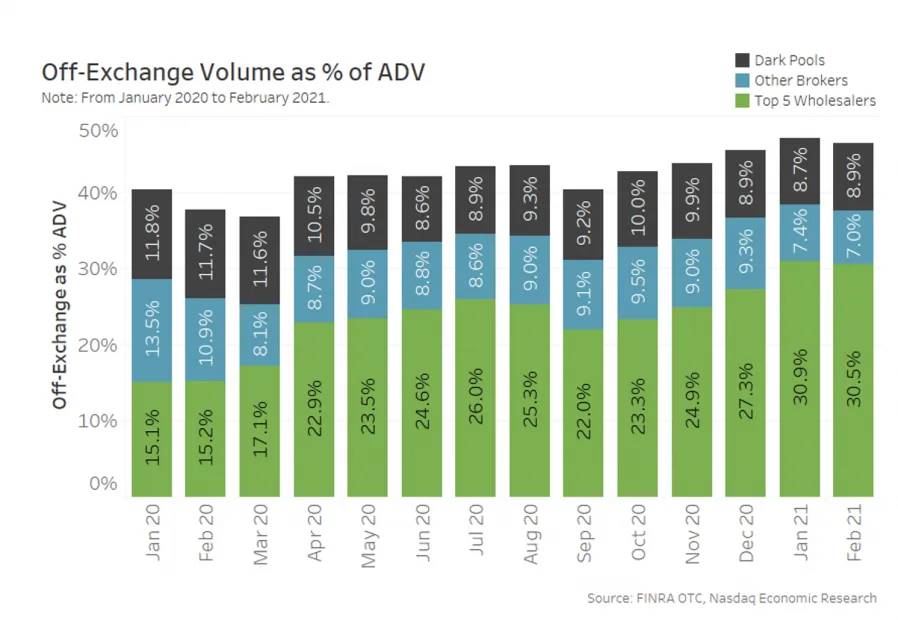

Source: Nasdaq

Dark pools have primarily developed in the United States and Europe. In the U.S., dark pools once accounted for about 15% of total trading volume, peaking at 40% of daily trading volume. Currently, over 50 dark pools are registered with the Securities and Exchange Commission (SEC), and the number continues to grow. In Europe, the introduction of the Markets in Financial Instruments Directive (MiFID) in 2007 has spurred the development of dark pools.

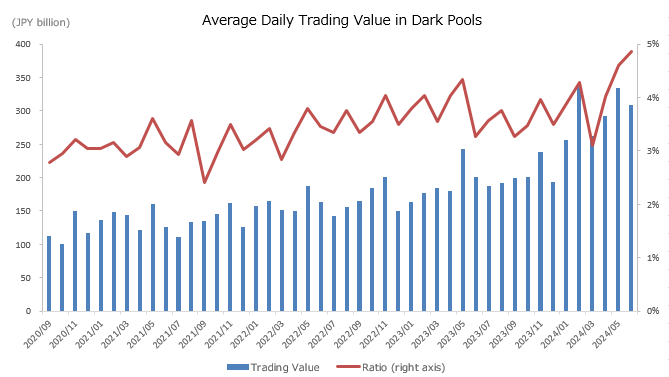

This trend is also expanding in Asia. Since 2010, Hong Kong and Singapore have adopted dark pool systems, while Japan and South Korea have introduced these platforms within their respective regulatory frameworks.

Japanese dark pool trading trends, Source: JPX

Although dark pools were initially designed for institutional investors handling block trades, recent data shows a shift towards smaller trades. According to FINRA (Financial Industry Regulatory Authority) data, the average trade size in the top five dark pools in the U.S. is only 187 shares. This shift can be attributed to two factors: first, the emergence of platforms targeting retail investors has diversified the types of trades within dark pools. Second, institutions are increasingly inclined to split large orders into smaller trades to reduce market impact, thereby altering the trading patterns within these platforms.

2. Challenges Faced by Dark Pools in Traditional Financial Markets

Dark pools offer significant advantages by reducing market impact and lowering the costs of block trades through the non-disclosure of trade details before execution. However, criticisms surrounding dark pools persist, leading some countries to either avoid adopting them or restrict their use. This is primarily due to several major concerns.

First, while dark pools enable cost-efficient large-scale trading, this comes at the expense of transparency. In public markets, trade information occurring within dark pools is hidden until the trade is completed. This lack of transparency makes monitoring and regulation more difficult, raising concerns about potential negative impacts on financial markets. Second, the concentration of liquidity in dark pools reduces liquidity in public exchanges. This increases trading costs for ordinary investors and may decrease market efficiency.

Third, although dark pool trades remain confidential, there have been known instances of platform operators deliberately leaking information. Documented cases show that the harmful effects of these leaks have deepened skepticism towards dark pools.

3. The Inevitable Rise of On-chain Dark Pools

**Some believe that *decentralized finance (DeFi)* systems provide solutions to the problems faced by traditional dark pools.** As mentioned earlier, the operation of dark pools primarily relies on the assumption that operators will not exploit client information. This is a key factor in ensuring the confidentiality of trades. However, in the realm of traditional dark pools, instances of operators leaking information for compensation are not uncommon.

Imagine a scenario involving a dark pool named "BlackTiger" and a stock called "Tiger." Suppose Institution A intends to purchase 5 million shares of Tiger from Institution B. The operator of BlackTiger leaks this information to Investor C for compensation. As dark pool trade execution may take time, Investor C waits for the price of Tiger to drop before purchasing a large quantity of shares. After the dark pool trade is publicly disclosed, the stock price rises, allowing Investor C to sell the shares at a profit, thus exploiting the information asymmetry.

This practice undermines trust in centralized dark pools in traditional finance. One reason this issue persists is that operators can earn substantial profits by exploiting this information asymmetry, often exceeding the potential penalties they might face. Although some countries have attempted to address these issues through stricter regulations, skepticism towards dark pool operators remains strong.

4. Implementation of On-chain Dark Pools

Source: Delphi Digital

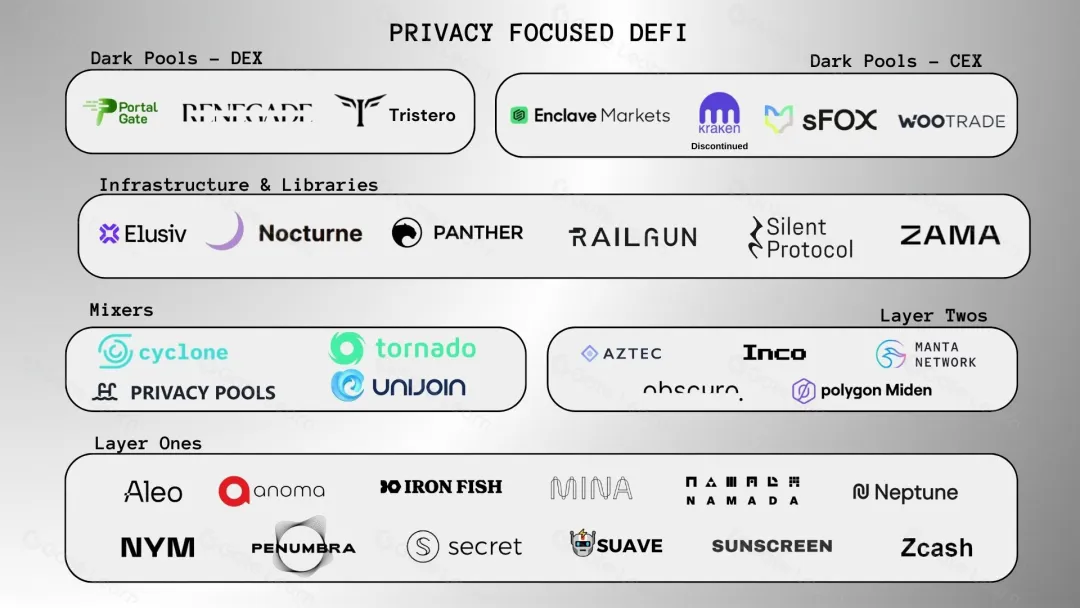

In the decentralized finance (DeFi) space, some platforms have partially implemented dark pool functionalities. Decentralized exchanges (DEX), such as Uniswap, provide a degree of anonymity for traders by utilizing automated market makers (AMM) to match token trades without revealing participant identities. DEX operates on blockchain networks and smart contracts, eliminating the need for intermediaries or centralized control. This effectively removes the trust issues often present in traditional dark pools, where operators may misuse client information.

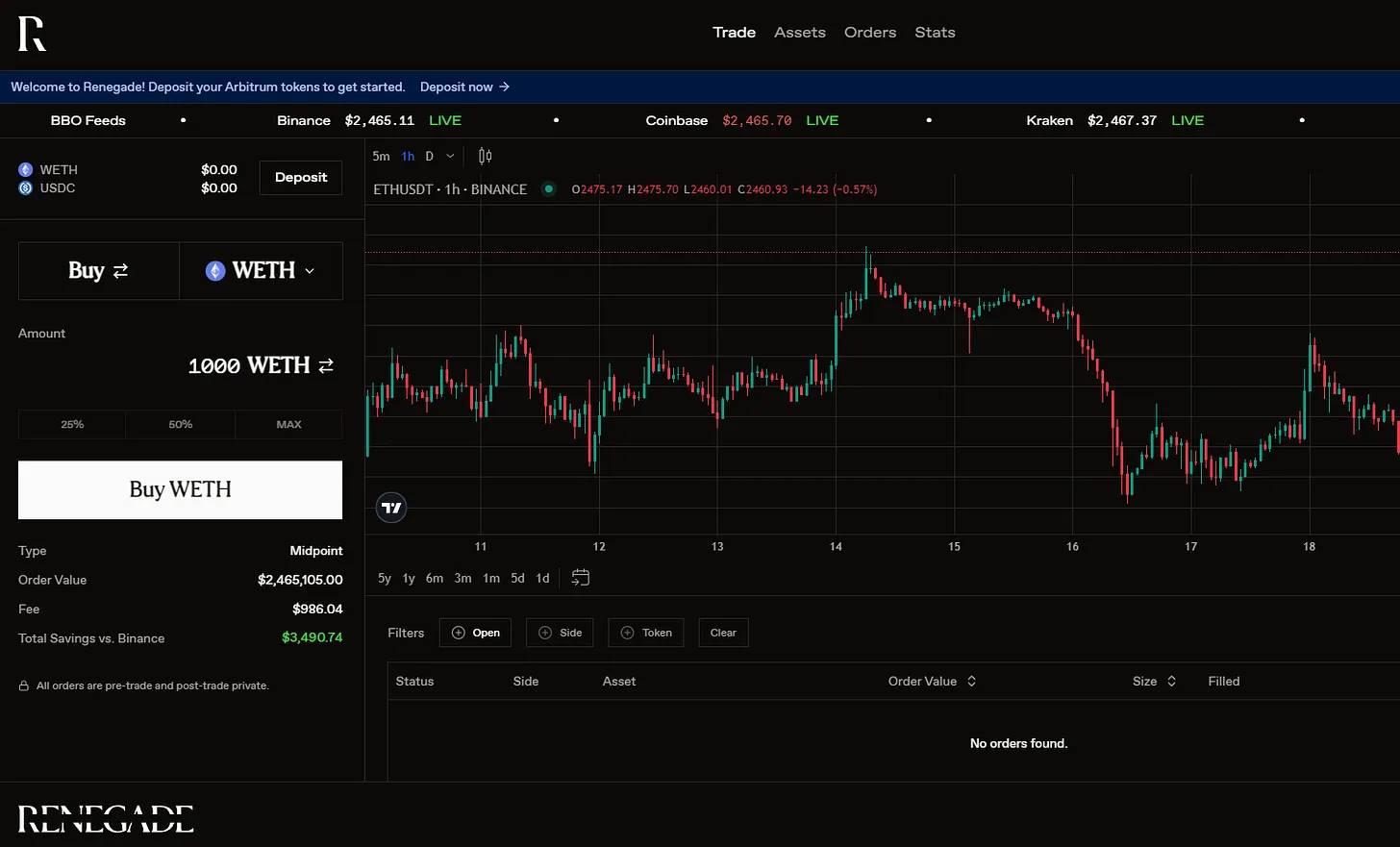

Source: Renegade

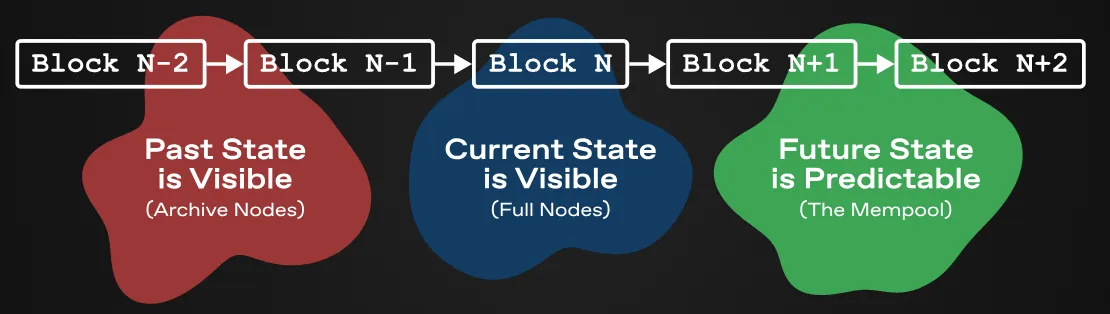

**However, due to the inherent transparency of **blockchain technology, decentralized exchanges (DEX) find it challenging to fully replicate the confidentiality of traditional dark pools. Wallet addresses associated with certain institutions or large traders are often tagged and traceable, making transaction details visible to everyone on the blockchain. Services like block explorers and trackers make completed and pending transactions easily accessible. Traders and platforms often leverage this transparency, which can lead to increased market instability and issues such as transaction copying and maximum extractable value (MEV) attacks, creating a less favorable environment.

To address these challenges, on-chain dark pools introduce technologies such as Zero-Knowledge Proofs (ZKP), Multi-Party Computation (MPC), and Fully Homomorphic Encryption (FHE) to achieve private trading mechanisms. ZKP ensures that participants can prove the validity of a transaction without revealing the actual inputs, thus maintaining the confidentiality of the trade. For example, traders can prove they have sufficient token balances to complete a trade without exposing their entire balance.

Source: Renegade

A notable on-chain dark pool is Renegade, which uses Multi-Party Computation (MPC) for order matching and Zero-Knowledge Proofs (ZKP) to execute matched trades. This ensures that no information about orders or balances is disclosed before the trade is completed. Even after the trade is completed, only the tokens involved in the trade are visible. Smart contracts verify ZKP, thereby reducing the risk of malicious behavior by block producers or orderers. Other protocols, such as Panther, also utilize ZKP and cryptographic techniques to facilitate private on-chain trading.

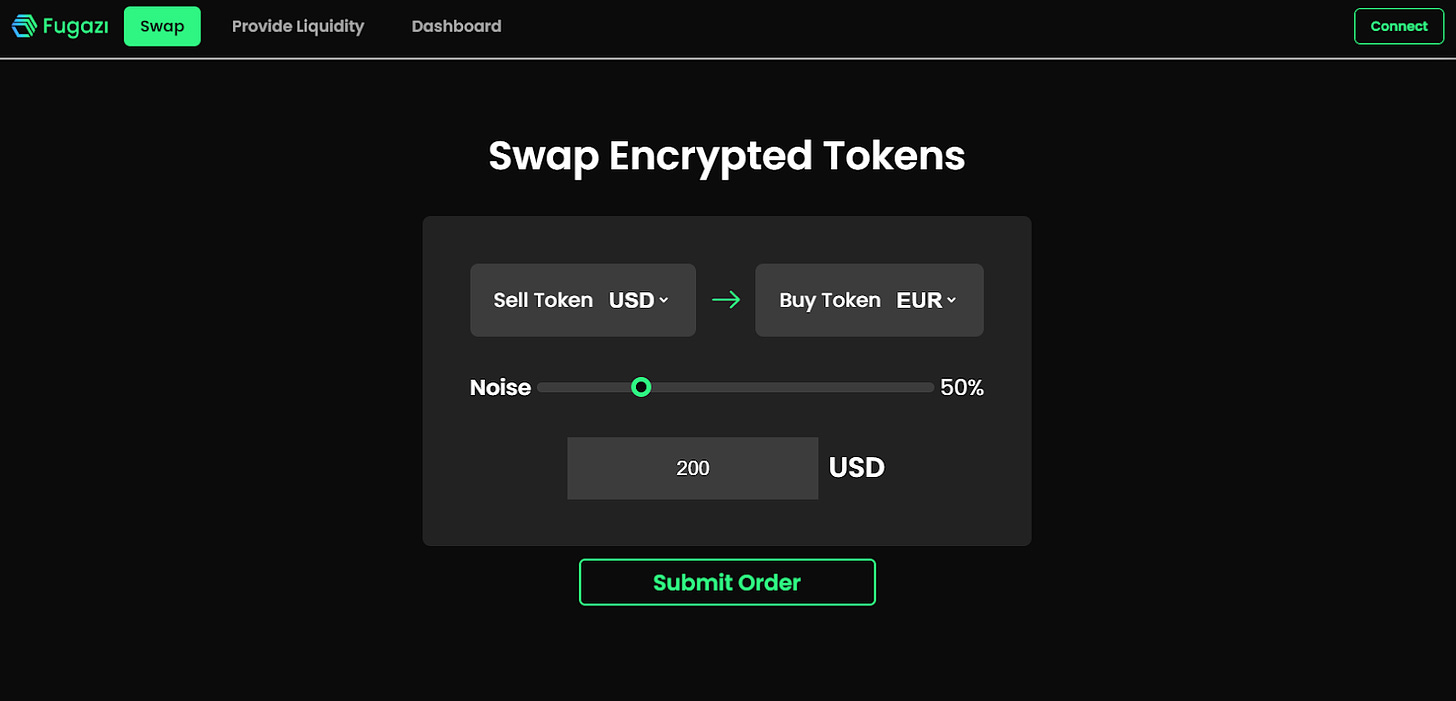

Source: ETH Online 2024

Meanwhile, decentralized exchanges (DEX) based on Automated Market Makers (AMM), such as Uniswap and Curve, are vulnerable to front-running and back-running attacks. This refers to trades being monitored by third parties in the transaction memory pool, allowing them to replicate or manipulate trades, resulting in unfavorable price outcomes for the original traders.

To address this, projects like Fugazi have gained recognition at ETH Online by introducing mechanisms such as batch trade processing and noise orders to prevent MEV attacks. Fugazi bundles user trades with random noise orders and then applies Fully Homomorphic Encryption (FHE). This prevents third parties from identifying specific trade details and executing front-running attacks. While many on-chain dark pools use peer-to-peer (P2P) systems to reduce slippage, Fugazi's approach of combining AMM with measures to mitigate MEV attacks represents a promising advancement in protecting participants.

5. The Dilemma of On-chain Dark Pools: Transparency

One of the main concerns surrounding on-chain dark pools is whether they will affect the transparency of blockchain networks. Since the inception of blockchain technology, it has faced a series of challenges, including the "blockchain trilemma" (balancing scalability, decentralization, and security). Similarly, the transparency issues brought about by on-chain dark pools present another challenge that requires extensive research and experimentation to address.

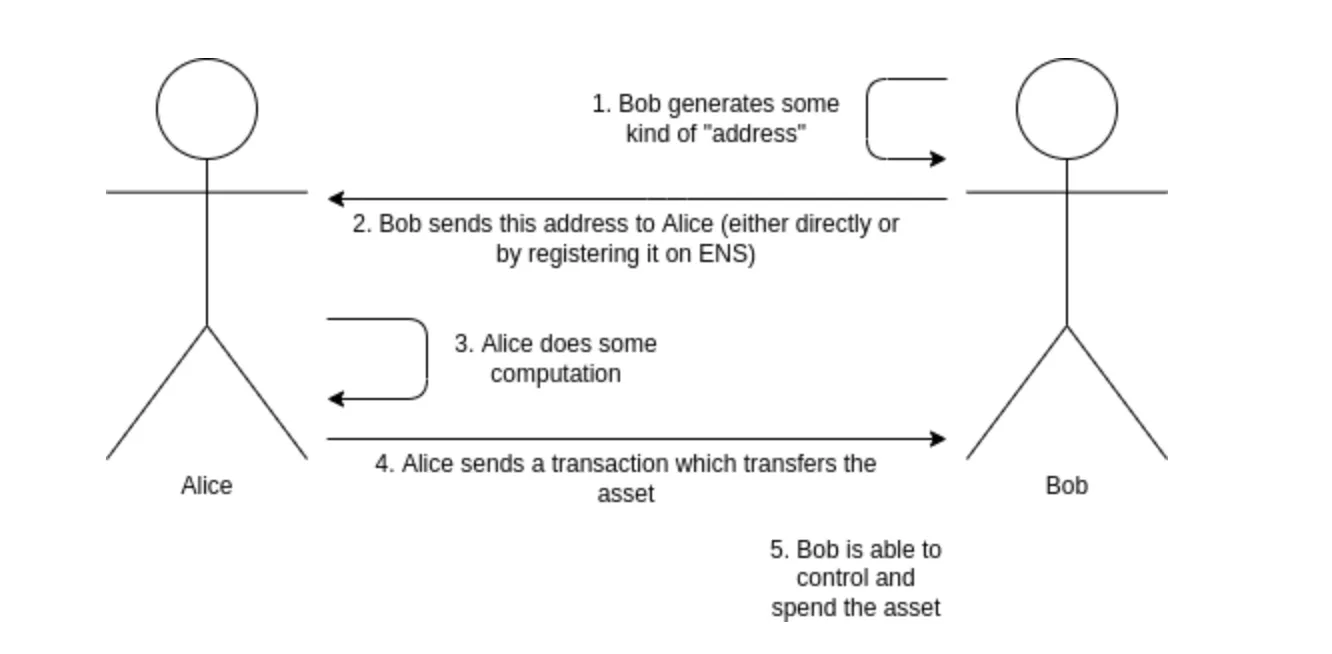

Source: Vitalik Buterin’s blog

Essentially, there may be a trade-off between transparency and security in blockchain systems. The development of on-chain dark pools aims to minimize security risks and market impact, responding to the inherent transparency of blockchain. Even Ethereum founder Vitalik Buterin has proposed the concept of stealth addresses to alleviate privacy concerns arising from publicly available information, such as wallet addresses and Ethereum Name Service (ENS) records. This indicates that while transparency is a significant advantage of blockchain, achieving widespread adoption may require a balance between transparency and user privacy without compromising user experience.

6. The Prospects of On-chain Dark Pools

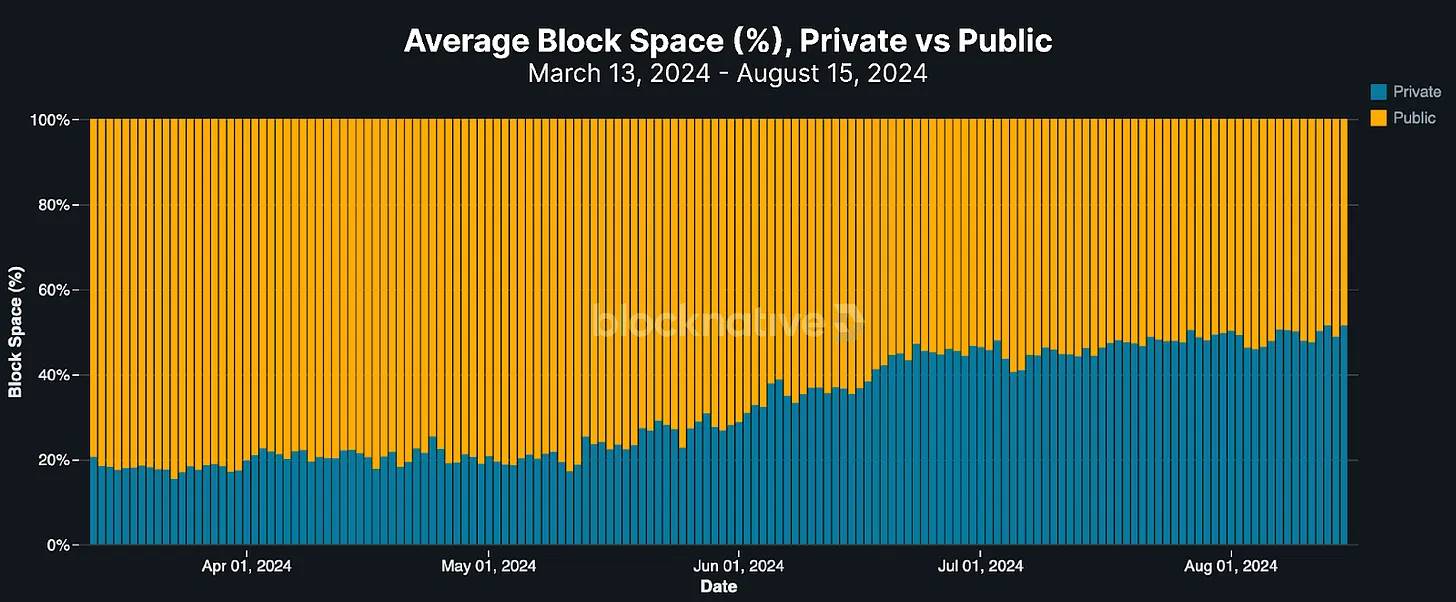

Source: Blocknative

The growth potential of on-chain dark pools is expected to increase significantly. This is evidenced by the rapid growth of private trading within the Ethereum network. While private trading accounted for only 4.5% of total Ethereum transactions in 2022, it has recently surged to over 50% of total gas fees. This indicates that people are striving to avoid the impact of bots on trading outcomes.

Users can utilize private memory pools for private trading, but this still relies on trust in a small number of operators controlling these memory pools. Although private memory pools offer stronger censorship resistance compared to public memory pools, the fundamental issue remains: block producers can still monitor and potentially exploit trading information. Given these challenges, the market for on-chain dark pools—where trades can be securely hidden while maintaining transparent accessibility—looks set to continue growing.

7. Can On-chain Dark Pools Revolutionize Financial Markets?

Dark pools in traditional financial markets face a severe trust crisis due to incidents such as money laundering, hacking, and information leaks. As a result, regions that were once leaders in dark pool adoption, such as the U.S. and Europe, have implemented regulations to enhance transparency and set clear conditions for non-public trading. In contrast, markets like Hong Kong have restrictions on the use of dark pools, limiting participation and prohibiting retail investors from engaging in dark pool trading.

Despite these challenges, on-chain dark pools with strong censorship resistance and security could bring transformative changes to the financial industry. However, for widespread adoption of on-chain dark pools to occur, two key issues must be addressed. First, the platforms and entities operating these pools must undergo thorough scrutiny to ensure their stability and reliability, as they rely on blockchain networks and smart contracts. Second, there is currently a lack of a clear regulatory framework for on-chain dark pools. Institutional investors must exercise caution in their participation and ensure they review all relevant regulatory requirements before engaging in such markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。