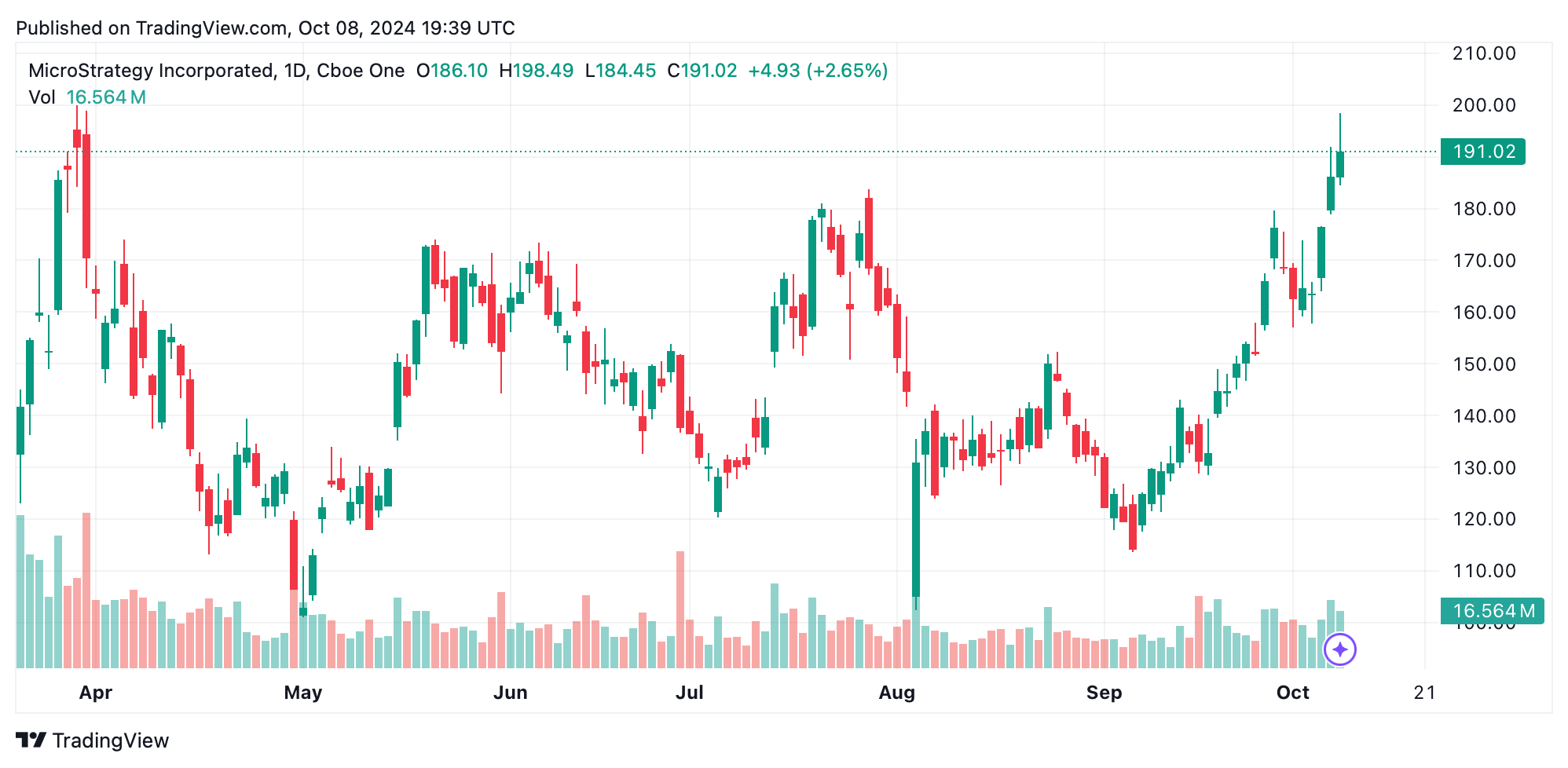

Back on June 30, 1998, Microstrategy’s stock (Nasdaq: MSTR) was priced at $18. Today, MSTR shares have skyrocketed over 988%, reaching $191 per share. Microstrategy is a business intelligence software company, founded by Michael Saylor in 1989, which helps organizations optimize their data-driven decision-making. Although its stock surged to $139 in January 2000, from October 2000 to September 2020, MSTR stayed below $20 per share.

Microstrategy’s bitcoin (BTC) reserve strategy started making waves during bitcoin’s bull run in 2021. By January of that year, MSTR shares surged past the $75 mark. Fast forward to the end of Oct. 2021, and the company’s stock hovered around $72, only to dip back below $20 by May 2022. In the last 12 months, MSTR has climbed 495%, with 28% of those gains stacking up in just the past six months. Meanwhile, Coinbase (Nasdaq: COIN) has experienced a different trajectory.

COIN is down 4.4% for the year and has dropped 34% over the last six months. Despite today’s 2.1% decline, it’s gained 1.33% over the past 30 days. MSTR has also outpaced its bitcoin holdings, which have appreciated 57% against the U.S. dollar. Microstrategy’s BTC stash now totals $15.61 billion. The company’s shares trade at a premium to its BTC holdings due to several factors, including offering leveraged exposure to bitcoin, option strategies, and accessibility to traditional finance (tradefi) investors.

Similarly, several mining stocks have experienced boosts like MSTR. MARA’s shares have jumped 860% over the last five years, and MARA Holdings (Nasdaq: MARA) has climbed 107% in the past 12 months. However, year-to-date, the crypto mining firm’s stock has slid just over 40%. Recently, MARA adopted Microstrategy’s playbook, choosing to accumulate bitcoin for reserves while holding onto the BTC it mines instead of selling it.

Across the globe, Japan’s Metaplanet Inc., listed on the Tokyo Stock Exchange, has also embraced Microstrategy’s bitcoin-buying strategy, with similar stock success. Over the past 12 months, Metaplanet shares have surged 397%, with a year-to-date increase of more than 452%. Over the last six months, the Tokyo-listed stock has jumped 168% against the U.S. dollar. Metaplanet recently added 108.786 bitcoin to its reserves for $6.7 million, bringing its total stash to 639.503 bitcoin, now valued at $40.36 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。