Bitcoin (BTC) has surged over 40% this year, outshining major equity indices, fixed-income securities, gold and even oil, which recently rose on the back of geopolitical tensions.

However, according to data tracked by Goldman Sachs, its stellar performance in absolute terms is not sufficient to compensate for its volatility.

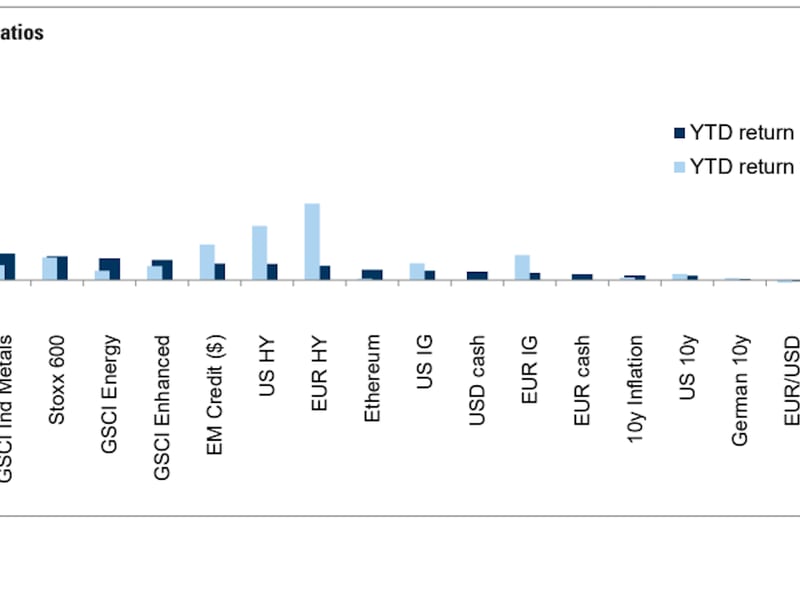

Bitcoin's year-to-date return to volatility ratio is under 10%, significantly lower than gold's industry-leading risk-adjusted return of nearly 20%. The ratio gauges the return an investment generates per unit of risk/volatility. The yellow metal has gained 28% in absolute terms.

In fact, Ethereum's native token ether, Japan's TOPIX index, and the S&P GSCI Energy Index are the only non-fixed income growth-sensitive investments with return to volatility ratios lower than bitcoin, said Goldman.

That relatively low risk-adjusted performance validates crypto skeptics' long-held view that bitcoin is too volatile to become a safe haven like gold.

It also helps explain why gold rose and bitcoin tumbled alongside equity markets last week after Iran launched missiles at Israel, ratcheting up tensions in the Middle East.

The low risk-adjusted returns make directional bets unattractive and likely explain the popularity of the bitcoin cash and carry arbitrage among traditional institutions. The arbitrage strategy allows traders to bypass price volatility risks while profiting from price discrepancies between spot and futures markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。