This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

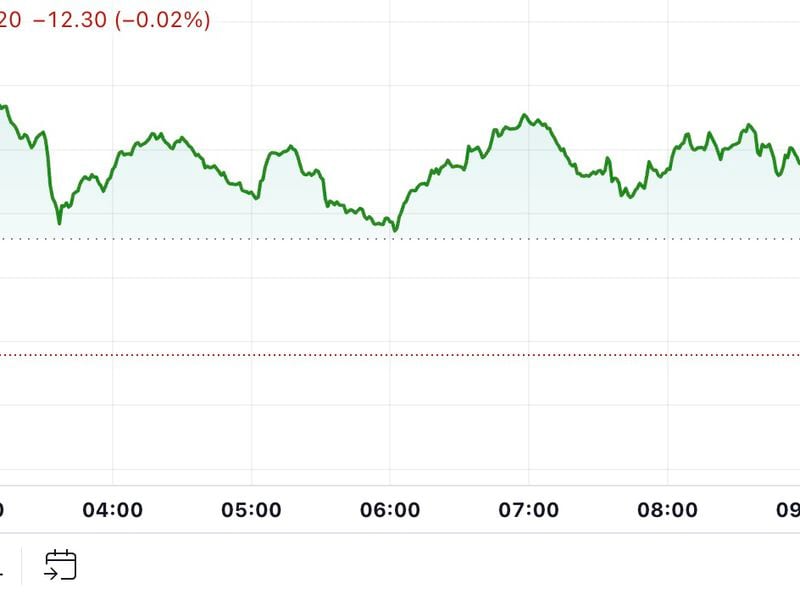

CoinDesk 20 Index: 1,950.34 +1.51%

Bitcoin (BTC): $62,977.62 +1.55%

Ether (ETH): $2,451.18 +1.29%

S&P 500: 5,751.07 +0.9%

Gold: $2,656.7 +0.22%

Nikkei 225: 39,332.74 +1.8%

Bitcoin rose to near $64,000 ahead of a busy week for economic data out of the U.S. It subsequently dropped back to $63,000, around 1.6% higher over 24 hours. The broader digital asset market rose about 1.5%, as measured by the CoinDesk 20 Index. The Federal Open Market Committee (FOMC) minutes and key economic figures are due on Wednesday. The Bureau of Labor Statistics (BLS) will release inflation data for September and the number of initial jobless claims for the week ended Oct. 5.

Memecoins rose over the weekend as social sentiment and riskier behavior among crypto traders grew. Talks and posts of the so-called “memecoin supercycle,” a prediction that the tokens will lead the next crypto bull market, trended on social app X. Solana-based popcat (POPCAT) and Ethereum-based mog (MOG) jumped over 12% in 24 hours, while BNB Chain-based simon’s cat (CAT) rose 10%. Cat-themed memecoins continue to lead their dog-themed counterparts and remain the preferred choice for riskier memecoin bets. Interest in memecoins comes amid low market volatility in more serious crypto sectors, such as layer-2 blockchains, and rising negative sentiment around tokens backed by venture capital funds – which are increasingly perceived as overpriced and a bad bet for retail traders.

Metaplanet said it bought another $6.7 million worth of bitcoin to take its stash to 639.5 BTC, worth approximately $40.6 million at current prices. The Tokyo-listed company purchased around 108.8 BTC at an average price of just under 9.2 million yen ($61,900) per coin. It has now spent just shy of 6 billion yen on the largest cryptocurrency by market value, paying an average price of 9.3 million yen apiece. The company has the second-largest bitcoin holdings among Asia-listed companies, behind Hong Kong-based technology firm Meitu. Metaplanet shares rose 7.9% to 988 yen and are over 500% higher year-to-date.

- Omkar Godbole

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。