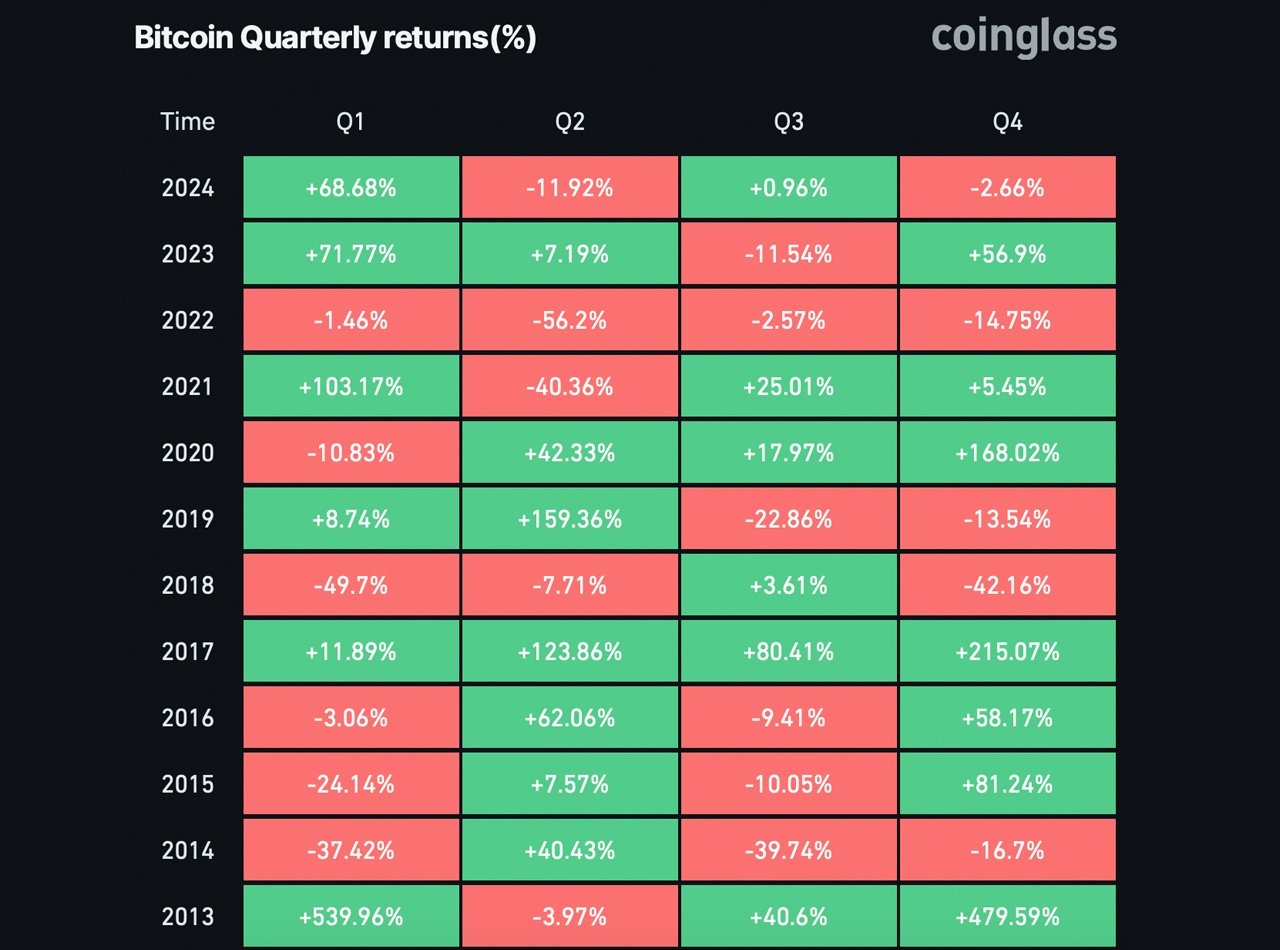

At the moment, crypto enthusiasts are left guessing whether BTC’s bull run will hold strong or fizzle out for the remainder of 2024. Traditionally, bitcoin performs well in the final quarter of the year. However, September defied expectations, and October kicked off as “Downtober” instead of the much-anticipated “Uptober,” reminding everyone that past patterns don’t guarantee future results. Some in the crypto community are feeling gloomy, believing the bull run might have reached its end.

Bitcoin quarterly returns according to coinglass.com on Oct. 4, 2024.

On the flip side, others liken BTC to a beach ball pushed just below the water’s surface, teetering under its all-time high of $73K, and ready to spring upward, potentially hitting new price highs. Presently, several developments could affect bitcoin’s price going forward in 2024 and many crypto market participants will be monitoring these events to see whether or not they will cause fluctuations in BTC’s value.

The U.S. Election

Many crypto market watchers are buzzing about the potential impact of the 2024 U.S. election between Kamala Harris and Donald Trump. However, plenty of cryptocurrency investors and analysts are convinced that bitcoin prices will rise in 2024, regardless of who takes the White House, although short-term price swings are expected around the election. Financial heavyweight Standard Chartered predicts BTC could reach $125,000 under a Trump administration, while a Harris presidency might see it hit $75,000. Meanwhile, brokerage and research firm Bernstein suggests Trump could drive BTC to $90,000, but under Harris, bitcoin might dip to $35,000.

The Fed’s Federal Open Market Committee Meetings

Many investors and analysts anticipate that potential interest rate cuts by the U.S. Federal Reserve could give bitcoin a boost, and for good reasons. Lower rates typically make borrowing more affordable, increasing liquidity in financial markets and prompting investors to chase higher returns in riskier assets like cryptocurrencies. Bitcoin, often viewed as a risk-on asset, tends to thrive in periods of loose monetary policy. The Federal Reserve has two remaining Federal Open Market Committee (FOMC) meetings for 2024: one on Nov. 8 and the final one on Dec. 18.

War and Tensions in the Middle East

The Middle East is currently facing escalating tensions following a string of hostile events. On Tuesday, Iran launched a direct military assault on Israel, using both missiles and drones. G7 leaders swiftly condemned the attack, calling it a grave threat to the region’s stability. This incident has intensified the ongoing conflict between Israel and Hezbollah in Lebanon, stirring fears of a broader war in the area.

Israel has vowed to retaliate, increasing investor caution and pushing markets from a risk-on to a risk-off stance. Historically, during times of geopolitical turmoil, investors shy away from riskier assets. This cautious shift often results in a sell-off in assets like cryptocurrencies as traders move their funds into traditionally safer havens. The latest missile strikes by Iran caused bitcoin to drop below $60,500.

Bitcoin ETF Options

Bitcoin ETF options could present several benefits for BTC prices, including improved price discovery, greater institutional participation, and expanded hedging opportunities. The launch of options tied to bitcoin ETFs can notably boost market liquidity. By allowing traders to take more strategic positions, options attract a broader spectrum of investors. This influx of activity can increase trading volumes, driving demand for the underlying bitcoin ETFs and, by extension, BTC itself. Options also provide leverage, enabling investors to gain exposure to larger amounts of bitcoin with less capital upfront. This leverage can amplify market movements, potentially leading to stronger price gains when sentiment is favorable.

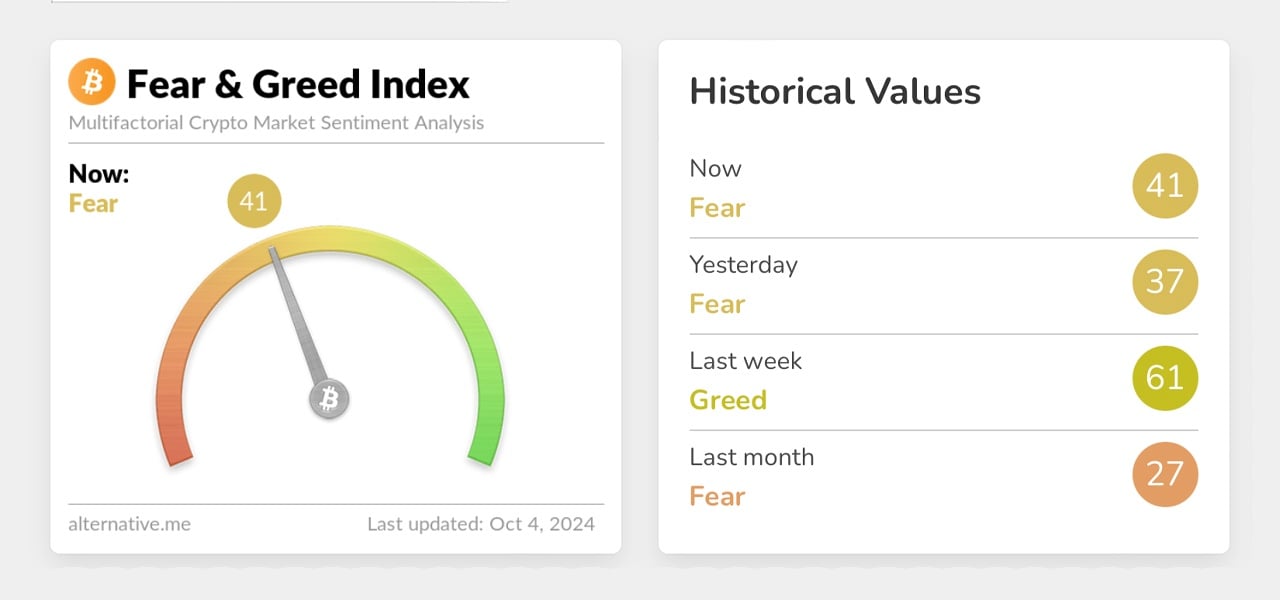

Crypto fear and greed index on Oct. 4, 2024.

As the year progresses, bitcoin’s trajectory remains uncertain, swayed by external forces such as geopolitical instability and shifts in financial policy. Market participants are closely monitoring these variables, recognizing that bitcoin’s future performance hinges not just on historical trends but also on the evolving global landscape. The culmination of these events will likely dictate the market’s direction.

With both optimism and skepticism surrounding bitcoin’s potential, the crypto community faces a pivotal period. Investors are left weighing short-term volatility against long-term growth prospects, aware that decisions made now could shape the asset’s future in an unpredictable 2024 market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。