Original Author: @Flip_Research, Twitter

Original Title: "SOL- The Emperor's New Clothes"

Translation: zhouzhou, BlockBeats

Editor's Note: This article profoundly explains the potential issues with Solana. Although its user base and transaction volume seem to surpass Ethereum, a deeper analysis reveals that much of the transaction volume may stem from wash trading and exit scams, leading to a false sense of prosperity. The author points out, through detailed data analysis of user activity, DEX transaction volume, and MEV phenomena, that SOL's metrics are exaggerated and that the on-chain ecosystem faces serious fundamental problems.

Recently, my social media timeline has been filled with bullish rhetoric about $SOL and promotions for various altcoins. I began to believe that a super cycle for altcoins truly exists and that Solana would surpass Ethereum to become the leading Layer 1 (L1) blockchain. However, as I delved into the data, the results were unsettling… In this article, I will share my findings and why Solana may be a house of cards.

First, let’s look at the bullish arguments clearly articulated by @alphawifhat:

User Base Comparison

- Four key data comparisons with ETH and L2:

- High user ratio

- Relatively higher transaction fees

- Higher decentralized exchange (DEX) transaction volume

- Significantly higher stablecoin transaction ratio

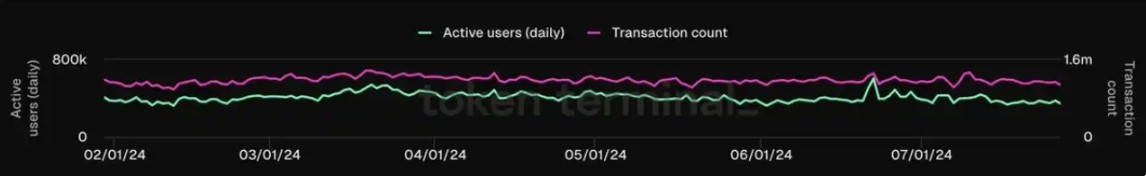

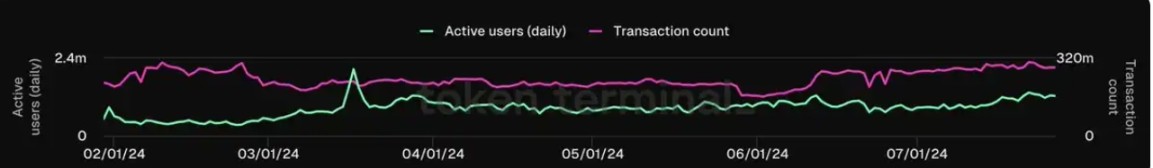

Here is a comparison of the user base between the ETH mainnet and SOL (only comparing mainnet data, as most of ETH's transaction fees come from the mainnet after the Dencun upgrade, data source: @tokenterminal):

ETH User Base and Transaction Volume

SOL User Base and Transaction Volume

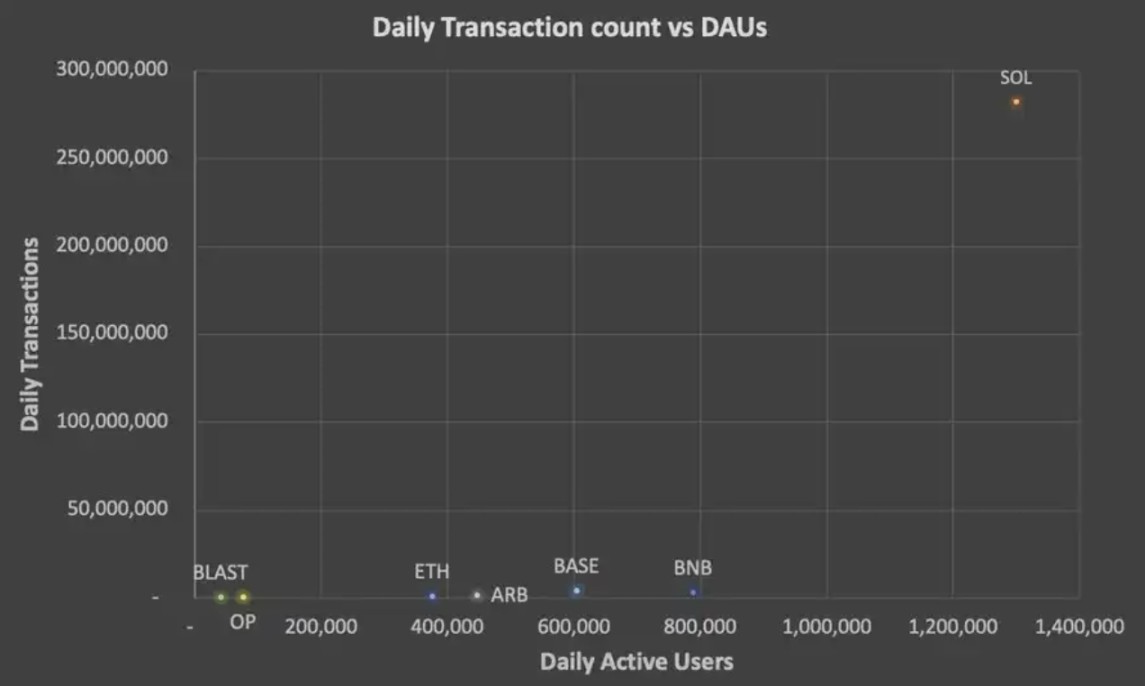

On the surface, SOL's data looks impressive, with daily active users (DAUs) exceeding 1.3 million, while ETH has only 376,300. However, when I considered the transaction volume, I found some strange phenomena.

For example, on Friday, July 26, ETH had 1.1 million transactions corresponding to 376,300 DAUs, meaning each user conducted about 2.92 transactions on average per day. In contrast, SOL had 282.2 million transactions corresponding to 1.3 million DAUs, implying that each user conducted an average of 217 transactions daily.

I thought this might be due to SOL's low transaction fees, allowing users to conduct more trades, adjust positions more frequently, and increase arbitrage bot activity. However, when I compared it to another popular chain, Arbitrum, I found that on the same day, Arbitrum's per-user transaction volume was only 4.46 transactions. Similar results were found when looking at data from other chains:

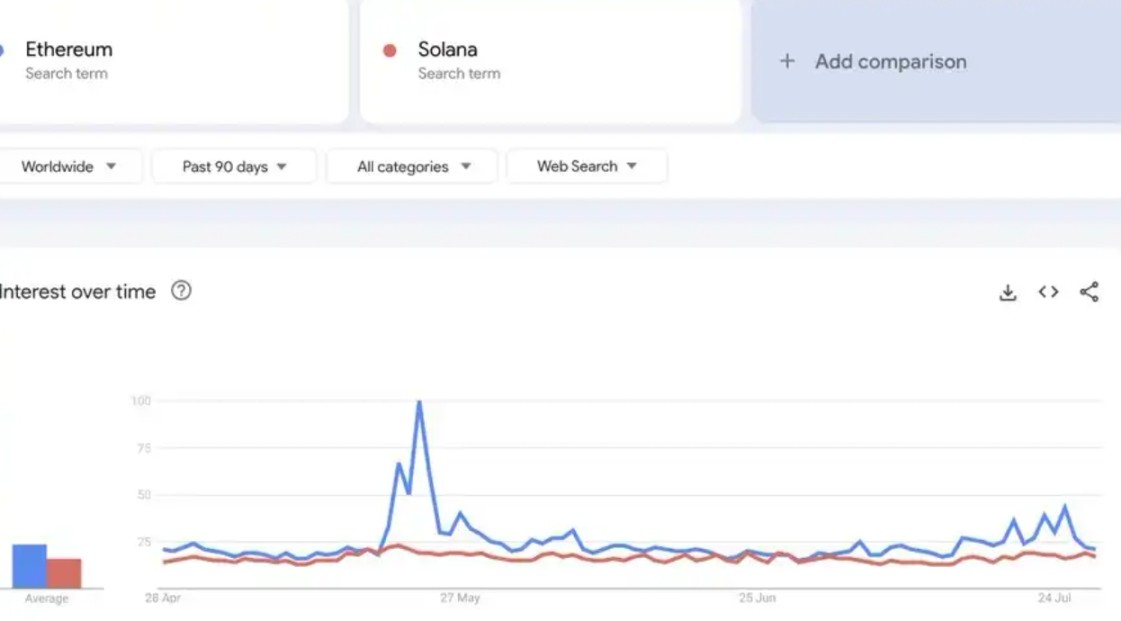

Given that SOL's user count is higher than ETH's, I checked Google Trends, which should be relatively neutral regarding each user's value.

The results showed that ETH either matched or led SOL in trends. This was contrary to my expectations, especially considering the significant gap in SOL's daily active users and the recent hype surrounding SOL altcoins. So what exactly is happening?

Decentralized Exchange Transaction Volume Analysis

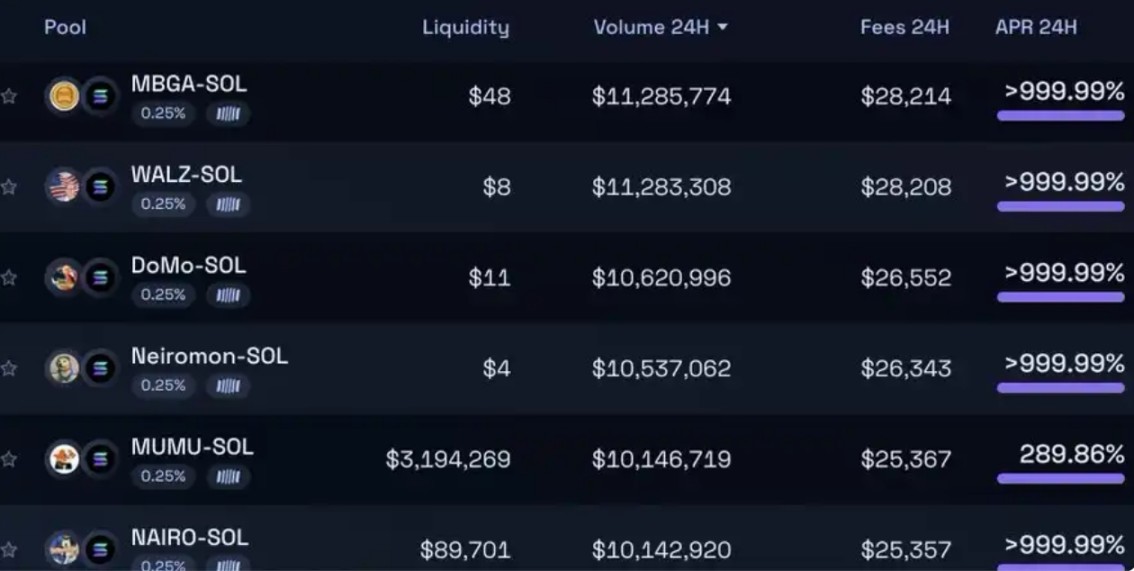

To understand the differences in transaction volume, analyzing the liquidity pools (LPs) of Raydium is quite enlightening. Even a preliminary observation reveals something is amiss:

Initially, I thought this was merely wash trading through low liquidity "honey pot" liquidity pools to attract occasional altcoin speculators, but a closer look at the charts revealed that the situation was far worse than I imagined.

Every low liquidity pool project experienced an exit scam in the past 24 hours. For example, MBGA had 46,000 transactions in the past 24 hours, with a trading volume of $10.8 million, involving 2,845 unique wallets, generating over $28,000 in fees on Raydium. (In comparison, a similarly sized legitimate liquidity pool, $MEW, generated only 11,200 transactions.)

Upon reviewing the participating wallets, I found that the vast majority seemed to belong to the same network of bots, conducting tens of thousands of transactions. They independently generated false trading volume through random amounts of SOL and random transaction counts until the project exited, then moved on to the next target.

In Raydium's standard liquidity pools, over 50 projects exited in just the past 24 hours, with transaction volumes exceeding $2.5 million, generating over $200 million in trading volume and more than $500,000 in fees. The number of exit scams on Orca and Meteora was noticeably lower, while there were almost no exit scams with substantial trading volume on Uniswap (ETH).

It is clear that exit scams on Solana are extremely severe, leading to multiple impacts:

Given the abnormally high ratio of trading users and the number of on-chain wash trading and exit scam projects, the vast majority of transactions are not organic. On major ETH L2s, the daily trading user ratio is highest on Blast (which also has low fees, and users are farming Blast S2), with a trading user ratio of 15.0x. Roughly comparing, if we assume the real SOL trading user ratio is similar to Blast, this means over 93% of transactions (and corresponding fees) on Solana are non-organic.

The only reason these scams exist is that they are profitable. Therefore, users lose at least an amount equal to the fees and trading costs daily, accumulating to millions of dollars.

Once these scams can no longer be profitable (for example, when actual users tire of losing money), most of the transaction volume and fee income is expected to decrease significantly.

It appears that users, real fee income, and DEX transaction volume have all been significantly exaggerated.

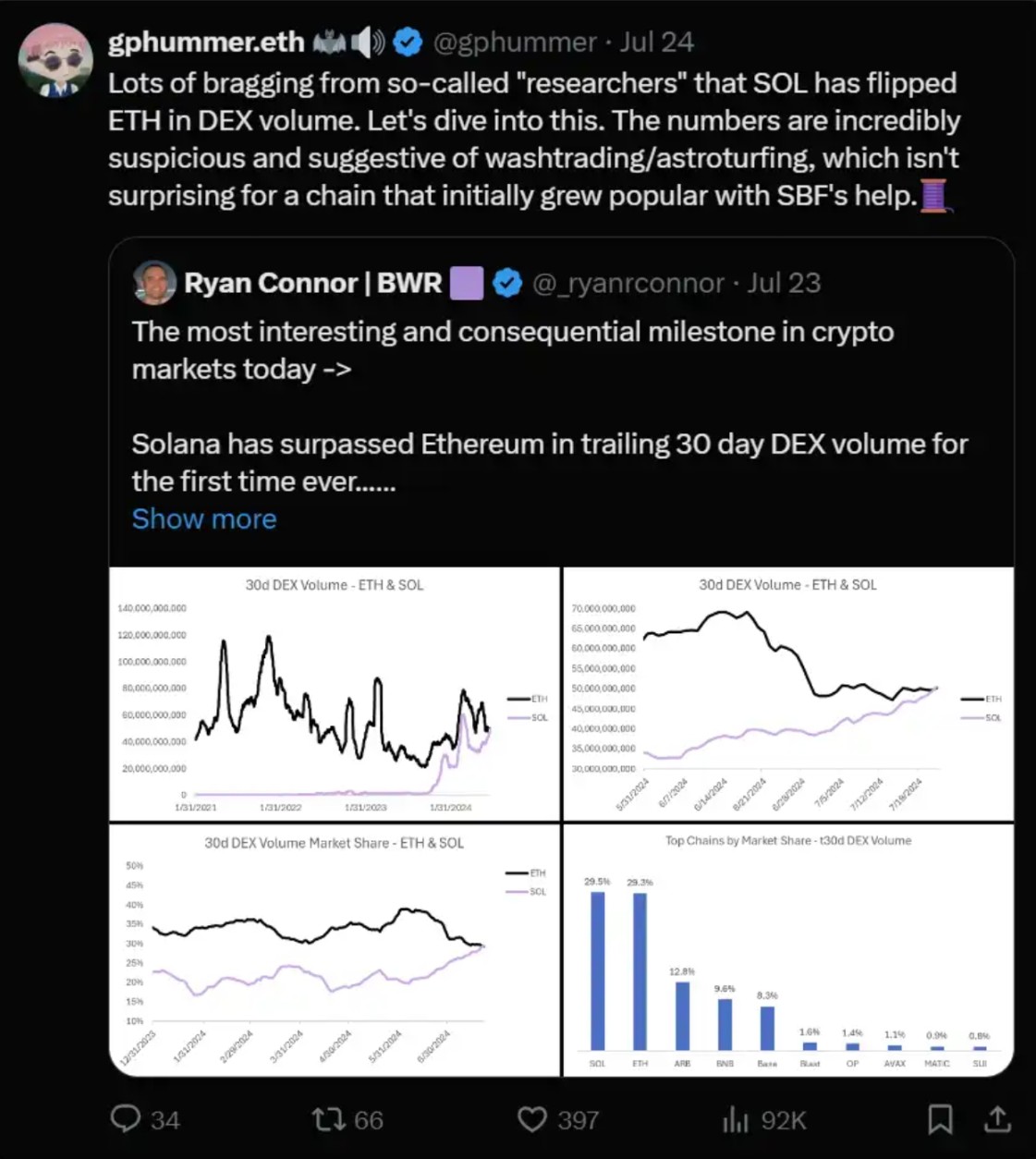

I am not the only one reaching this conclusion; @gphummer recently expressed similar views:

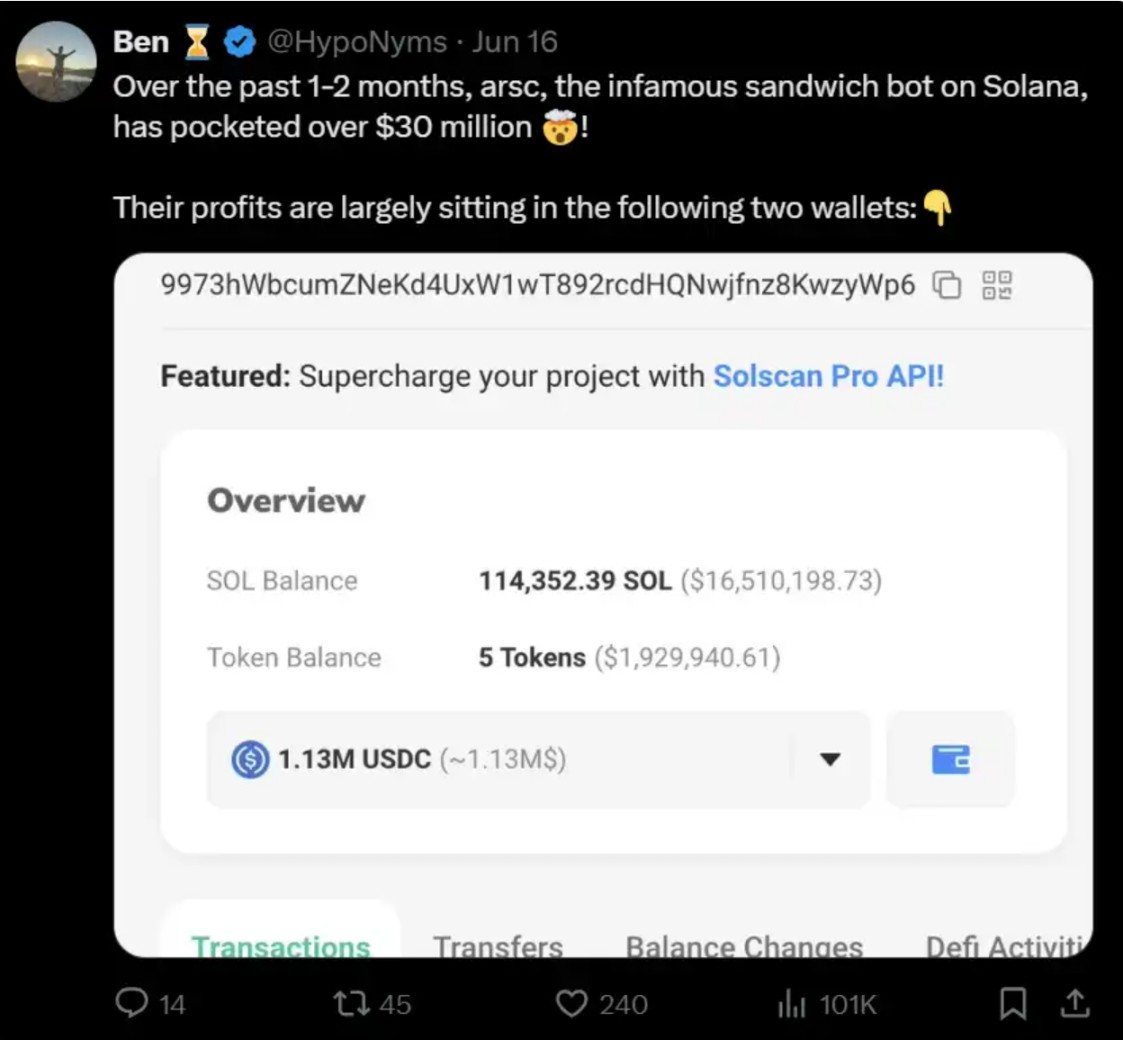

MEV on Solana

Solana's MEV is in a unique position. Unlike Ethereum, Solana does not have a built-in transaction pool (mempool); instead, projects like @jito_sol once created off-chain infrastructure (now deprecated) to simulate transaction pool functionality, providing opportunities for MEV, such as front-running and sandwich attacks. Helius Labs wrote an insightful article detailing Solana's MEV.

The problem Solana faces is that most of the tokens traded are highly volatile, low liquidity altcoins, and traders often set slippage above 10% to ensure smooth execution. This provides an attractive attack surface for MEV to extract value:

If we look at the profitability of block space, it is clear that most of the current value comes from MEV tips:

Although this is strictly considered "real" value, MEV is only executed when profitable, meaning it only occurs as long as retail investors continue to participate (and net lose) in altcoin trading. Once the altcoin frenzy begins to cool down, MEV fee income will also collapse.

I see many arguments about SOL mentioning that it will eventually shift towards infrastructure projects like $JUP, $JTO, etc. While this shift may indeed occur, it is worth noting that these tokens have lower volatility and higher liquidity, which clearly will not provide the same MEV opportunities.

Mature participants are incentivized to build the best infrastructure to take advantage of this situation. In my in-depth research, several sources mentioned rumors that these participants invest in controlling transaction pool space and subsequently sell access to third parties. However, I cannot verify this information. Nonetheless, there are clearly some distorted incentive mechanisms—by directing as much altcoin activity to SOL as possible, certain mature individuals can continue to profit from MEV, engage in insider trading on these altcoins, and benefit from the price increase of SOL.

Stablecoins

When discussing the trading volume and total value locked (TVL) of stablecoins, another strange phenomenon arises. The trading volume of stablecoins is significantly higher than ETH, but when we look at the stable TVL data from @DefiLlama, ETH's stable TVL reaches $80 billion, while SOL is only $3.2 billion. I believe that compared to the trading volume and fees on low-fee platforms, stablecoin (and broader) TVL is a metric that is less easily manipulated, showing the risk exposure of participants within it.

The dynamics of stablecoin trading volume further emphasize this point—@WazzCrypto pointed out that when the CFTC announced it was investigating Jump, the trading volume suddenly dropped.

Retail Value Extraction

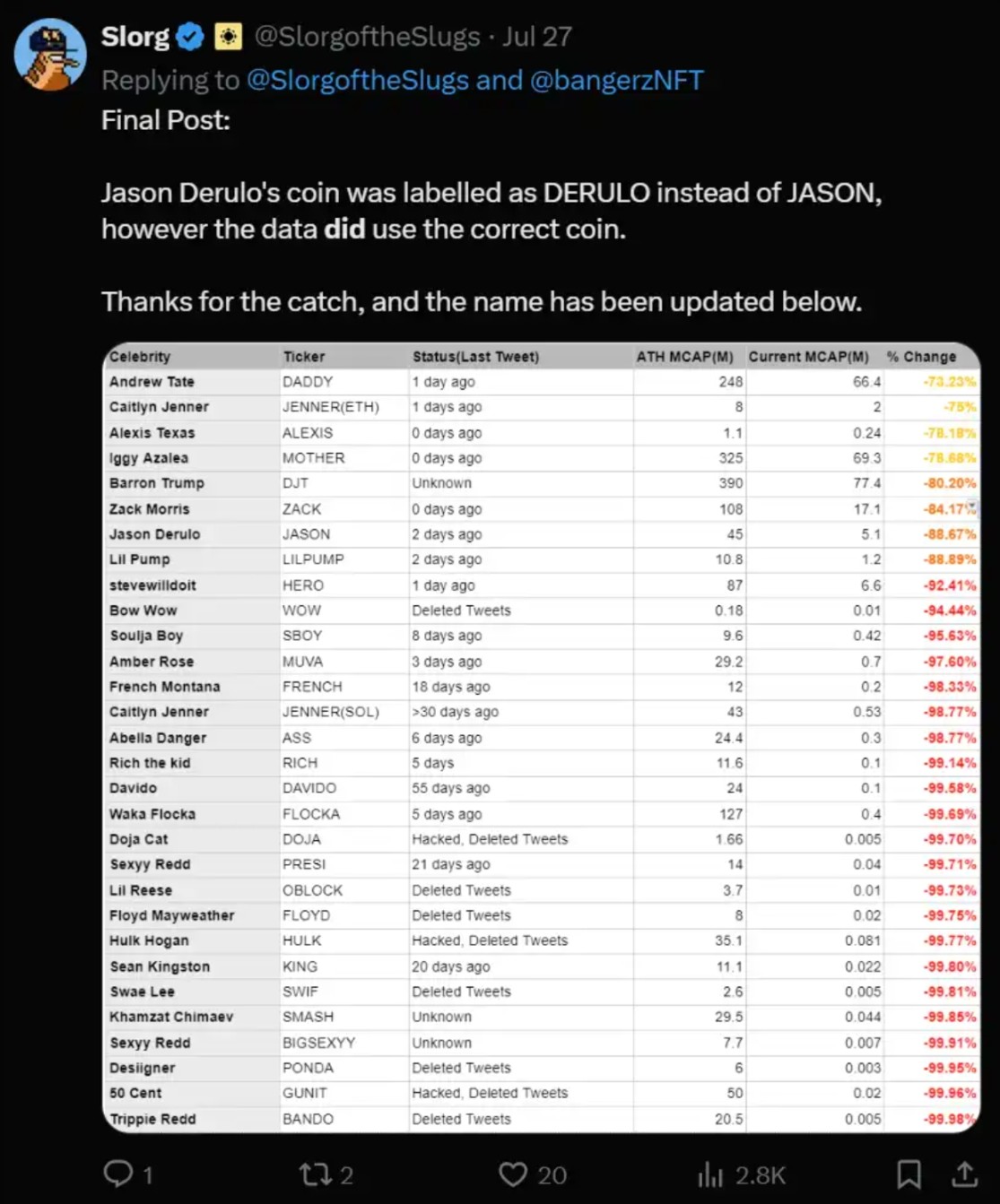

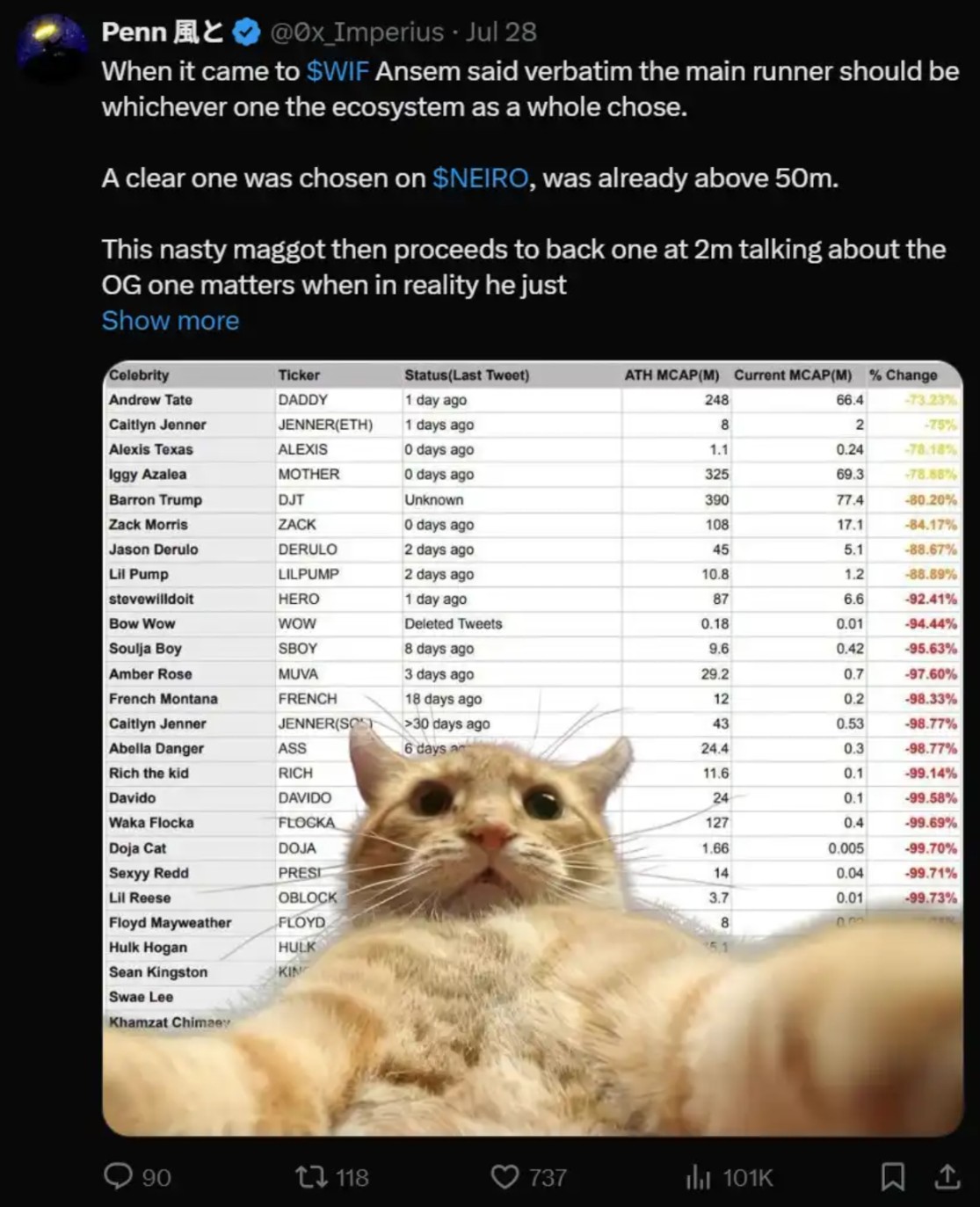

In addition to exit scams and MEV, the outlook for the retail market remains bleak. Celebrities have chosen Solana as their preferred chain, but the results have not been ideal:

Andrew Tate's DADDY is the best-performing celebrity token, but the return rate is still as high as -73%. On the other end of the boxing skill level, the situation is equally dire:

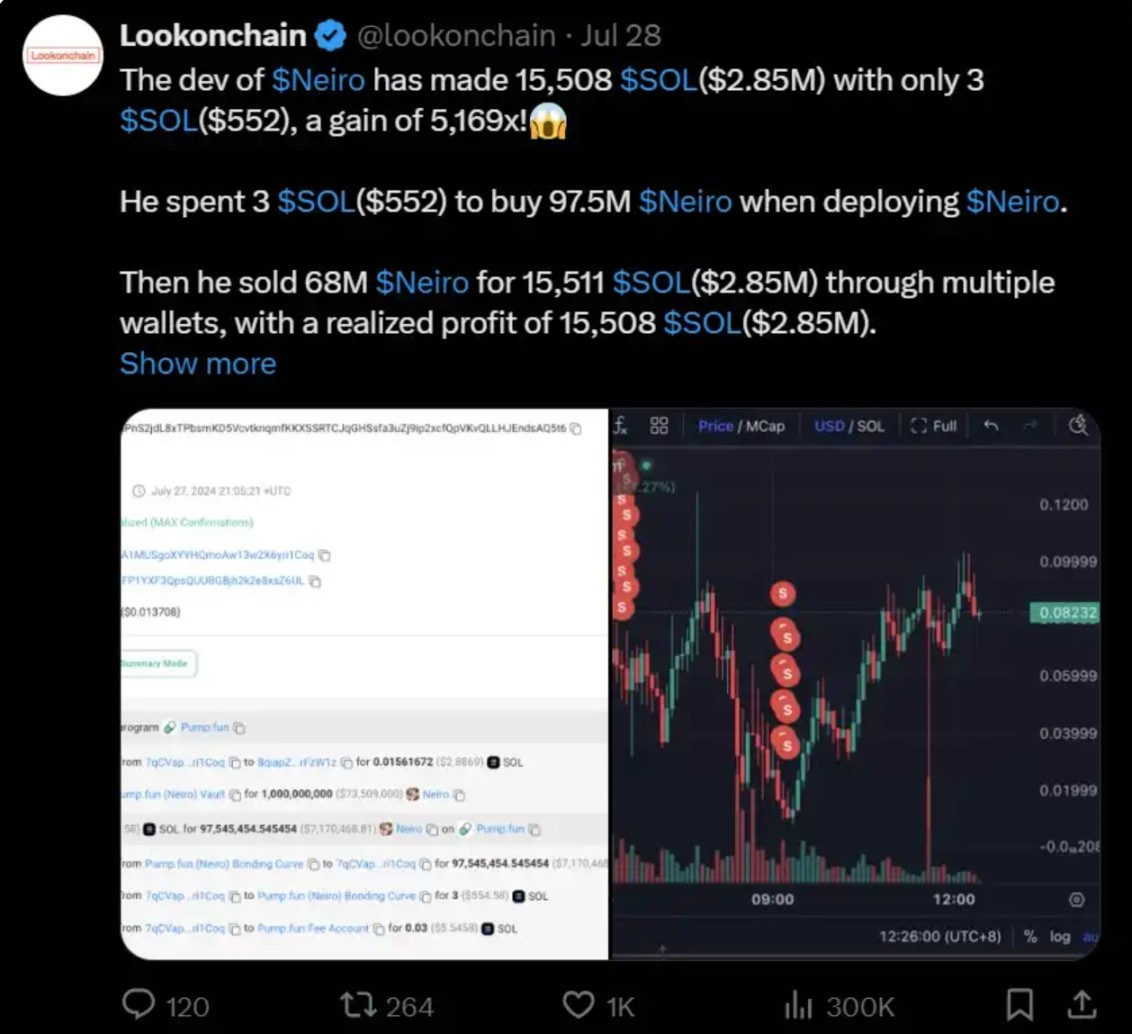

A quick search on X also reveals rampant insider trading and evidence of developers dumping tokens on buyers:

My timeline is filled with people who have made millions by trading altcoins on Solana.

I do not believe that KOL posts on X represent a broader user base; in the current frenzy, they can easily enter a position, promote their tokens, profit from their followers, and repeat the process. There is definitely a survival bias here—the voices of the winners far outweigh those of the losers, creating a distorted perception of reality.

Objectively speaking, retail investors are suffering millions in losses daily, with victims including scammers, developers, insider traders, MEV, KOLs, etc. This does not even account for the fact that most of the tokens they trade on Solana are merely unsupported altcoins. It is hard to deny that most altcoins will ultimately follow the old path of $boden.

Other Considerations

The market is volatile, and when sentiment shifts, factors that buyers once ignored will become apparent:

- Poor chain stability with frequent failures.

- High transaction failure rates.

- Difficulty in reading block explorers.

- High barriers to development, with Rust being far less user-friendly than Solidity.

- Poor interoperability with EVM. I believe that multiple interoperable chains competing with each other would be healthier than being confined to a single (relatively centralized) chain.

- Low likelihood of ETFs, both from a regulatory and demand perspective. @malekanoms also pointed out some views that I think are relevant from a traditional finance perspective (along with a rebuttal from @0xmert):

- High emission rates of up to 67,000 SOL daily (approximately $12.4 million).

- There are still 41 million SOL (approximately $7.6 billion) locked in the FTX estate sale. By March 2025, 7.5 million (approximately $1.4 billion) will be unlocked, and until 2028, an additional 609,000 (approximately $11.3 million) will be unlocked monthly. The purchase price of most tokens was around $64 each.

Conclusion

As usual, those selling shovels and hammers are profiting from the Solana altcoin frenzy, while speculators often unknowingly incur losses, and the commonly cited SOL metrics are significantly exaggerated. Furthermore, the vast majority of organic users are rapidly losing money on-chain due to the influence of bad actors. We are currently in a frenzy phase, with retail inflows still exceeding the outflows of these mature players, creating a positive halo. Once users become fatigued from ongoing losses, these metrics will collapse rapidly.

As mentioned above, SOL also faces various fundamental resistances, and once sentiment shifts, these issues will become prominent. Any price increase will exacerbate inflationary pressures and unlocks. Ultimately, from a fundamental perspective, SOL is overvalued; although existing sentiment and momentum may drive prices up in the short term, the long-term outlook is much more uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。