Cryptoquant‘s latest report highlights bitcoin’s strong historical performance during the fourth quarter, particularly in years following a halving. In 2012, 2016, and 2020, bitcoin saw gains of 9%, 59%, and 171%, respectively, in Q4. At the end of September 2024, bitcoin’s price trends closely mirrored those of previous halving years, leading to optimism for continued growth.

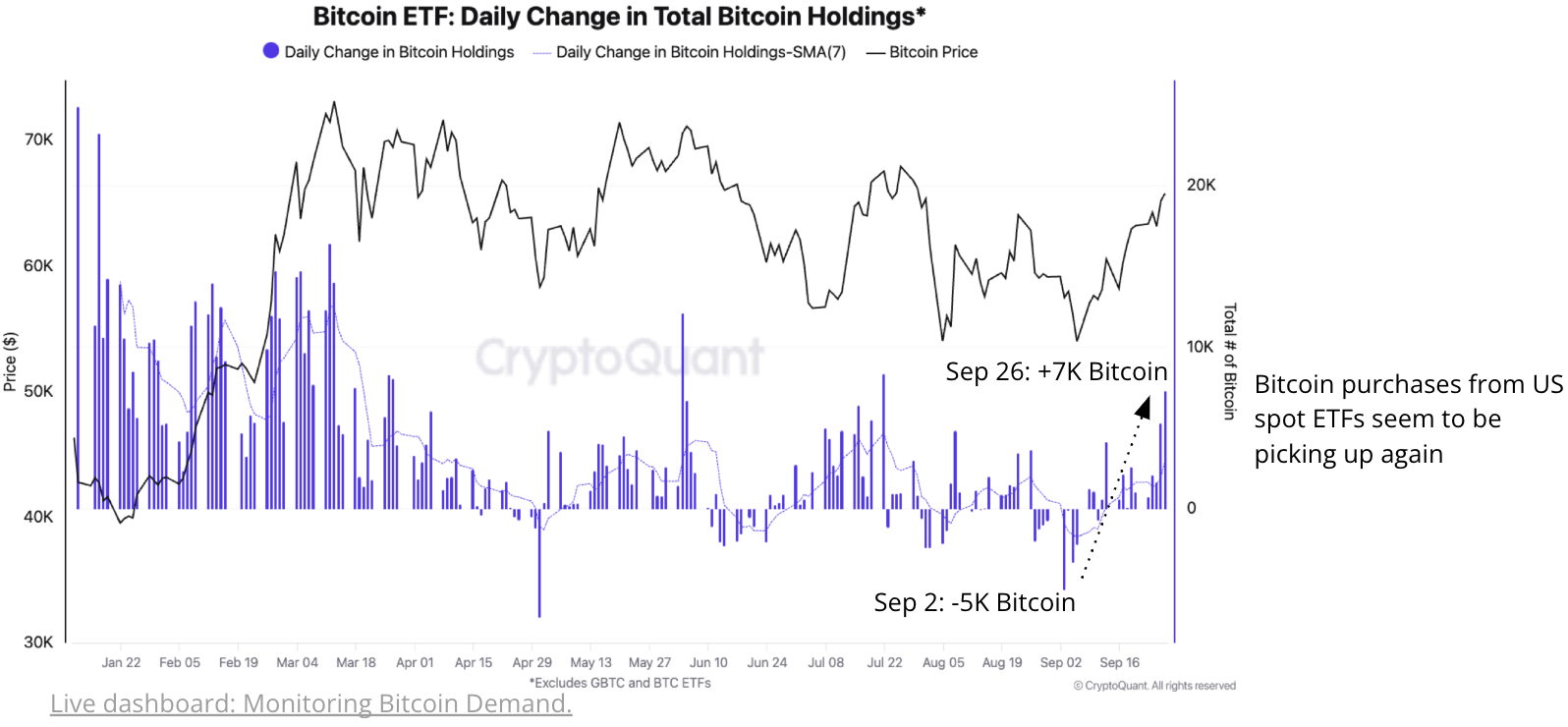

“Bitcoin’s apparent demand growth has remained muted basically since July, oscillating between -23K and +69K bitcoin on a monthly basis,” the report published on cryptoquant.com states.

The analysis adds:

For comparison, bitcoin’s apparent demand grew by as much as 496K bitcoin in April, when the price was hovering at $70K. It seems that demand has a lot of room to grow in Q4.

Despite the recent slowdown, spot exchange-traded funds (ETFs) in the U.S. resumed absorbing BTC in late September, with net purchases of 7K bitcoin by the month’s end.

According to Cryptoquant (CQ), this trend could indicate a recovery in demand, a key factor in driving prices higher during the seasonally strong fourth quarter. The report states:

If ETF demand continues to accelerate it can have the effect of propel prices up in the last quarter of 2024.

If demand continues to improve, CQ’s report suggests that bitcoin could target prices between $85,000 and $100,000 by the end of 2024. These levels align with the upper range of the onchain trader realized price bands, where traders historically take profits. The CQ analysis concludes that with recovering demand and favorable seasonality, bitcoin may experience another significant rally before the year closes.

Although bitcoin requires stronger demand, the digital asset succumbed to the global market downturn on Monday as tensions in the Middle East escalated. Following the release of CQ’s report, BTC dipped to a low of $60,164 on Bitstamp. The slump hit U.S. equities, risk assets, and the broader crypto market, while gold and silver shrugged off the chaos, posting gains. Macroeconomic events often impact markets across the board, and news like this can strike unexpectedly, leaving few assets untouched.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。