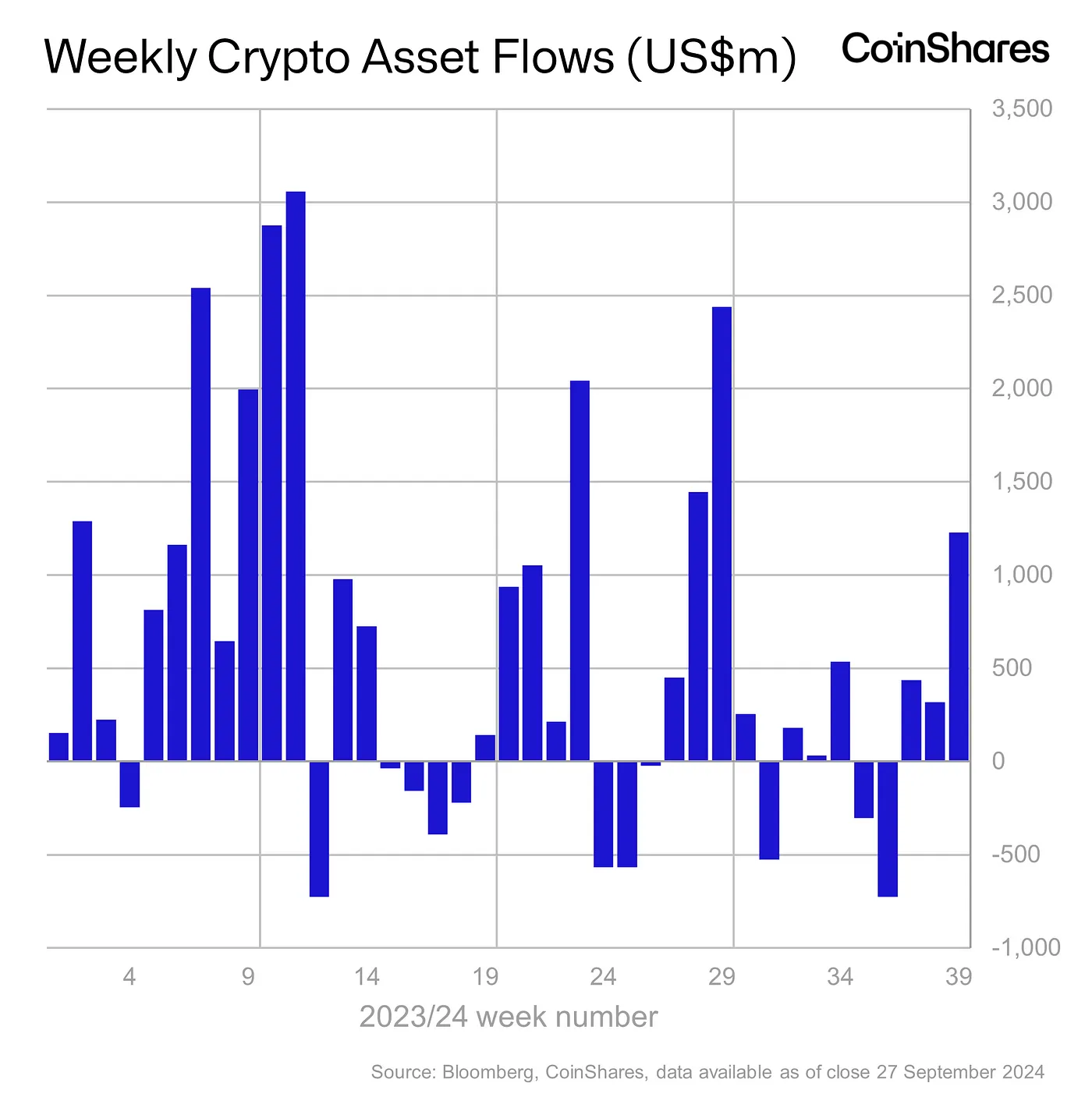

According to Coinshares’ lead research analyst James Butterfill, the rise in inflows is largely due to positive sentiment stemming from expectations of “dovish” U.S. monetary policy. The report indicates a 6.2% increase in total assets under management (AUM) over the last week, driven by investor optimism.

Despite this, trading volumes declined by 3.1%, suggesting that while inflows were substantial, actual trading activity did not mirror this increase. The approval of options for certain U.S.-based investment products likely contributed to the uptick in sentiment. Regionally, the U.S. led with $1.2 billion in inflows, while Switzerland followed with $84 million, marking its highest inflows since mid-2022.

In contrast, Germany and Brazil saw outflows of $21 million and $3 million respectively. Butterfill’s analysis noted that bitcoin (BTC) dominated the inflows, attracting $1 billion, but also spurred further investments in short-bitcoin products, which totaled $8.8 million. Ethereum (ETH) saw its first positive inflows since August, totaling $87 million, breaking a five-week negative streak.

Altcoins experienced mixed results, with some, such as litecoin (LTC) and XRP, seeing minor inflows of $2 million and $0.8 million respectively, while solana (SOL) and binance coin (BNB) experienced outflows of $4.8 million and $1.2 million. Butterfill emphasized the polarization of sentiment within the altcoin market, as it reflects the broader uncertainties in digital asset investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。