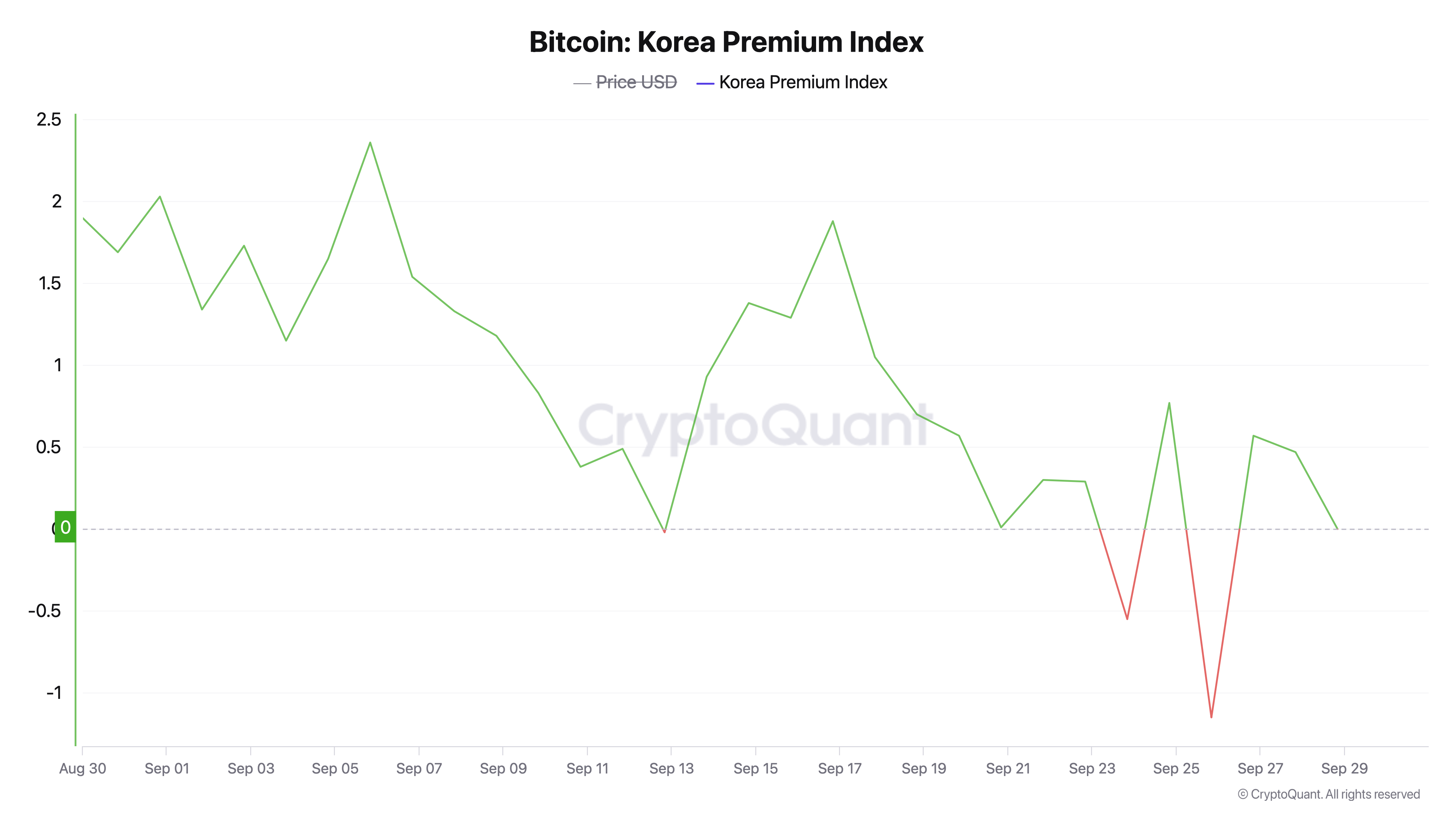

On Sept. 23, bitcoin (BTC) in South Korea was trading at a discount, its largest since October 2023, according to figures from cryptoquant.com (CQ). Specifically, the price was 0.55% below the global average. By Sept. 25, CQ reported that the discount had widened to 1.15%. But by the next day, the premium was back, with BTC trading 0.57% higher than the worldwide average.

Just two days ago, on Sept. 28, South Korea’s bitcoin exchange rate had aligned with the global average. South Korea often experiences a premium on bitcoin due to high demand, strict capital controls, and a more limited cryptocurrency supply. For instance, Upbit, the country’s top exchange by trade volume, offers far fewer coins than many global competitors.

While Binance boasts 425 coins and Bybit offers 662, Upbit lists just 215, and Bithumb carries 299. As of 2:30 p.m. EDT on Sept. 30, the South Korean premium stood at 0.60% on Upbit. Earlier this year, the premium hit significantly higher marks—on March 15, 2024, the day after BTC soared to $73,737, CQ recorded a premium of 10.88%.

Bitcoin is kicking off the week on a rough note, slipping 4% against the U.S. dollar over the past 24 hours. This Monday dip drags its weekly return down to a slight loss of 0.5%. On the evening of Sept. 29, BTC was hovering around $66,000, but by Monday’s trading sessions, the top crypto had been fighting to stay above the $63,000 mark as of 2:45 p.m. EDT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。