Has CZ truly practiced the answers from back then?

Written by: Alvis

On September 28, Binance founder Changpeng Zhao (CZ) sent out a brief "GM" tweet. Following that, on September 29, he published a lengthy article expressing gratitude to his followers and supporters, revealing that Binance continues to thrive without his direct oversight. In the future, he will continue to invest in blockchain, decentralized technology, artificial intelligence, and biotechnology, while also writing a book. This sparked heated discussions throughout the crypto world, as if announcing his strong return.

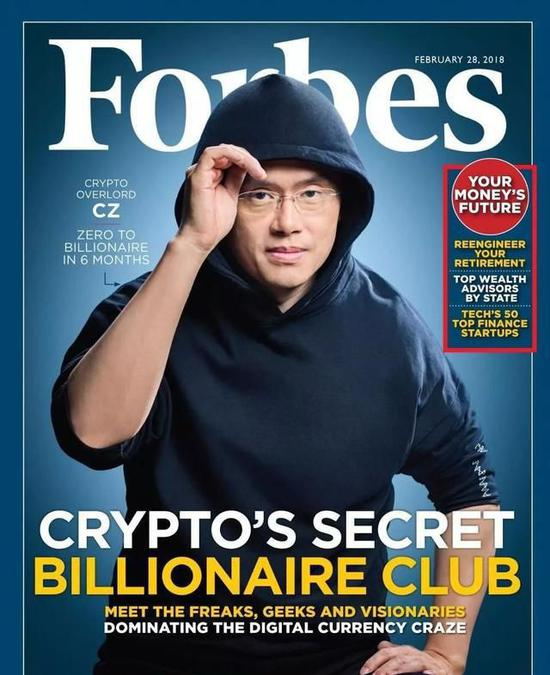

Looking back to June 29, 2018, MarsBit conducted an exclusive interview with Binance founder Changpeng Zhao (CZ) as part of the "Wang Feng's Ten Questions." At that time, CZ had just founded Binance a year prior and was already listed as a billionaire on Forbes' cryptocurrency rich list, with Binance's valuation reaching $10 billion and its spot trading volume firmly at the top of the industry.

However, the strong rise of new-generation exchanges represented by trading mining has intensified competition among cryptocurrency exchanges. MarsBit invited CZ, the CEO of this crypto trading giant, who, in a light-hearted manner, revealed the industry's dilemmas, market competition, and future strategies.

Six years have passed in the blink of an eye, the crypto world has experienced ups and downs, and numerous projects have risen and fallen, with new things emerging endlessly.

When we witness events like the Luna crash and the FTX bankruptcy, we realize that many of CZ's viewpoints are not only forward-looking but also demonstrate his ability to insightfully address and solve problems from a high industry perspective. The ten questions posed to CZ back then now carry deeper significance. So, has CZ truly practiced the answers from back then? Next, let us delve into the insights behind these questions.

First Question: Binance's Global Expansion, from Uganda to Global Layout

MarsBit asked at the time: Why choose Uganda as the first stop for Binance's fiat trading? Can fiat trading bring more traffic to digital assets, or will it just trigger asset bubbles?

CZ: Many people focus on developed countries where it's easy to make money, but Binance wants to deeply cultivate the industry and promote blockchain and digital currencies worldwide at its own pace. I believe we should open up the channels for trading between fiat and cryptocurrencies as much as possible, making the bridge wider so that more people can freely enter or exit. We have indeed had very in-depth communication with the financial regulators in Uganda, and they are very supportive of this. In fact, with our efforts, more and more countries and regulatory bodies will support digital currencies, which will help the entire industry grow.

When CZ chose Uganda as the first stop for Binance's fiat exchange in the 2018 interview, some were quite surprised by this choice. However, this decision showcased CZ's unique vision for globalization: Binance has aimed to promote the development of digital currencies globally from the very beginning, not just limited to developed countries.

In 2018, Binance launched its fiat exchange in Uganda and closely collaborated with local regulatory and financial institutions to ensure compliant operations. Additionally, Binance launched new products in Russia and established connections with local partners to promote the use of digital assets.

In 2020, Binance further increased its investment in the African market, particularly in South Africa and Nigeria, launching localized versions of the Binance exchange to enhance user experience. At the same time, Binance partnered with a fintech company in Brazil to explore the potential of the Latin American market. The addition of fiat channels: Binance increased support for up to 15 fiat currencies, including the UAE Dirham, Australian Dollar, and Euro, through partnerships with entities like Etana Custody, allowing users to conveniently deposit fiat via SWIFT transfers.

In 2021, Binance announced partnerships with financial institutions in Argentina and Chile to promote the use and adoption of digital currencies. CZ frequently mentioned at various international conferences that Binance would continue to focus on emerging markets, promoting digital currency education and adoption globally.

In 2022, Binance's global layout further expanded, collaborating with financial regulators in the UAE to obtain legal operating licenses. Additionally, Binance actively advanced compliance processes in countries like India and the Philippines, establishing good communication channels with local regulatory bodies to promote the healthy development of digital currencies.

Six years later, Binance has business coverage in over 100 countries globally, adhering to local regulations and obtaining regulatory approvals in multiple jurisdictions. Furthermore, Binance has established offices in various regions worldwide, such as Abu Dhabi, Bahrain, Dubai, and Paris, to better communicate with local users and regulators. Binance is also recruiting compliance talent globally, including senior executives from leading financial institutions like Morgan Stanley and Kraken. Additionally, Binance launched a separate platform, Binance.US, to comply with local regulatory requirements. The new CEO of Binance, Richard Teng, emphasized the importance of a global regulatory framework and stated that as the industry develops, more standardized regulatory convergence is expected.

Overall, CZ's strategy of "pioneering first, then cultivating" has allowed Binance to rapidly occupy a leading position in the exchange market by continuously adapting to and responding to changes in regulatory environments across different countries and regions.

Second Question: Exchange Wars, Competition, and Sustainable Development

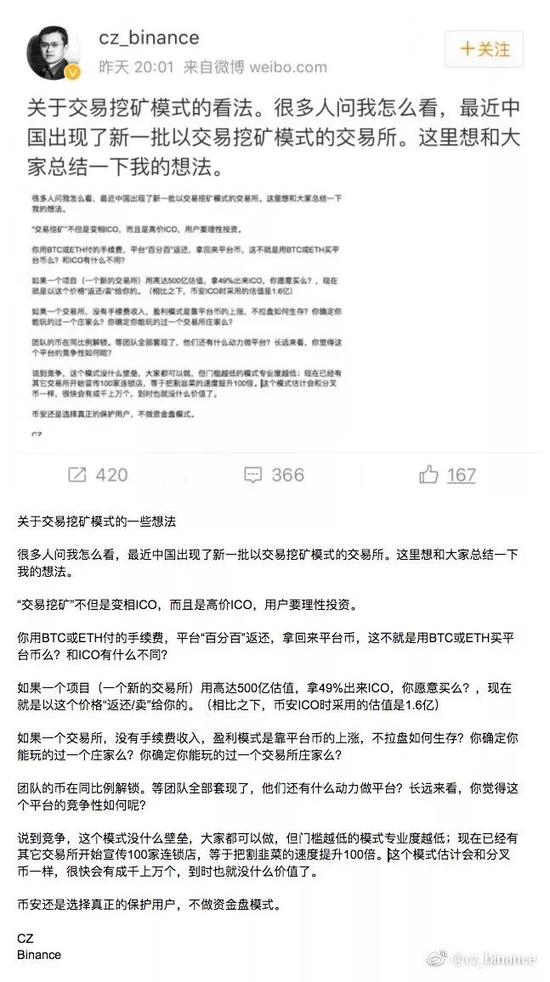

MarsBit asked at the time: FCoin, characterized by "trading is mining," claimed to have reached the top trading volume in just 15 days, and that "its trading volume is equal to the sum of the second to seventh." What was your first reaction to its market performance? How does Binance view the exchange wars brought about by "trading is mining"?

CZ: For any business model to succeed, it must be sustainable. There’s no need to worry about the threats they pose; the ultimate competition will depend on products and services. Due to supply and demand dynamics, the trading is mining model will fall into a vicious cycle, and it’s already quite difficult to sustain for this long.

Changpeng Zhao candidly and succinctly pointed out the sustainability issues faced by many exchanges, and looking back now, one can't help but marvel at how his predictions have come true.

In 2020, FCoin announced the closure of its exchange, and its founder Zhang Jian faced accusations of fraud. Similarly, BitMax adopted the trading mining model in 2019, but with the drastic changes in the market environment and a decline in user trust, the platform faced a liquidity crisis in 2021 and had to adjust its business model to maintain operations. Although it has not completely shut down, BitMax's market share and reputation have been severely damaged. Likewise, CoinTiger introduced a trading mining mechanism in 2018, initially attracting a considerable user base; however, over time, trading volume and user activity significantly declined, ultimately leading to its forced closure in 2022, unable to maintain the sustainability of its business model. This illustrates that many exchanges based on the trading mining model ultimately faced failure.

In stark contrast, Binance's success reflects the long-term value of focusing on products and services. During this period, Binance continuously launched new trading pairs, options, contract trading, as well as liquidity mining and DeFi products, providing users with a diverse range of service options. It has been proven that for any business model to succeed, it must be sustainable, and the ultimate competition among exchanges will rely on products and services. CZ's keen market judgment and prudent strategies have made Binance rock-solid amidst fierce competition among exchanges.

Third Question: Maintaining a Low Rate of Token Price Drops on Binance

MarsBit asked at the time: How does Binance maintain a low rate of token price drops and attract quality projects?

CZ: The most important thing is to have a brand effect; what we do must be right, creating a positive energy cycle. Strict review is the second step; Binance's listing team works tirelessly to research projects, and even so, we will still encounter pitfalls, but the number of pitfalls should be minimal. We treat industry veterans equally, which has offended some people, but Binance's principle of prioritizing user protection remains unchanged.

In the interview back then, CZ mentioned that Binance's listing policy is extremely strict, with the review team placing great importance on team strength, product quality, and community feedback. This rigorous review system has attracted numerous quality projects to Binance over the past six years.

In 2019, Binance launched Launchpad, allowing blockchain projects to raise funds through Initial Exchange Offerings (IEOs).

In 2020, Binance listed several highly anticipated tokens, among which Dogecoin (DOGE) was the hottest. Although Dogecoin was launched back in 2013, it regained massive attention in 2020 due to social media promotion and community support, and it received trading support on Binance.

Additionally, Binance also listed other popular tokens such as Chainlink (LINK) and Yearn.finance (YFI). Notably, Chainlink, as an important project in the DeFi space, received widespread attention during the "DeFi Summer" of 2020, with its price significantly rising.

In 2021 and 2022, projects like Polygon (MATIC), Axie Infinity (AXS), and StepN were successively listed on Binance, quickly becoming star projects in the crypto market. Those vibrant moments of competition are still fresh in memory.

Binance has established a strong brand reputation in the market, becoming the preferred listing platform for project parties and investors. If one wants to gain maximum liquidity, choosing Binance is undoubtedly a wise decision. However, this phenomenon has led Binance to encounter several controversies in 2024.

At the beginning of 2024, the market was generally preparing for a bull market, but Binance successively listed several tokens with high FDV, and then Bitcoin failed to effectively break through $73,000, leading to market fluctuations and declines in altcoin market values, with newly listed Binance tokens like AEVO, W, and STRK experiencing declines of up to 90%. The anti-VC wave spread in the crypto circle, and many long-time users criticized Binance's listing policy for affecting the liquidity of this bull market.

In September, Binance continued to list some low market cap tokens, such as the NEIRO token, which has a market cap of less than $15 million and only a few thousand community members. This move sparked dissatisfaction in the market, with some even questioning Binance's internal trading practices. In this context, He Yi stepped in to stabilize the situation, emphasizing that Binance's listing process is strict, with the core principle being to select projects with a user base, sustainable development, and solid business logic, while denying any issues of internal trading.

In the current market environment, Binance has transcended the traditional exchange model, becoming a symbol of user expectations and aggregation, setting industry benchmarks, and wielding significant influence. Therefore, every move it makes attracts attention. This also explains why other trading platforms received a lukewarm response when launching MEME or TG game tokens, while similar actions by Binance sparked widespread controversy.

Currently, Binance seems to be in a dilemma: launching infrastructure tokens may be accused of deviating from community positions and supporting VCs; while launching MEME tokens could be seen as lowering listing standards and manipulating the market. If it chooses to maintain the status quo, it may face criticism for lacking innovation and failing to lead industry development.

Despite facing numerous doubts, Binance remains a leader in the ecosystem. Discrepancies between users and managers are gradually emerging within the ecological network, and internal and external uncertainties have become a catalyst, even leading to aggressive remarks directed at He Yi herself.

Now, the new tokens listed by Binance can no longer guarantee a low rate of price drops, and I believe no exchange can achieve this. We look forward to the recently released CZ providing new answers.

Fourth Question: What Crises Has Binance Encountered?

MarsBit asked at the time: What difficulties did Binance encounter during its expansion from China to Japan and then globally?

Changpeng Zhao commented on Bermuda shorts: They look very formal, feeling both comfortable and organized.

CZ: Our team is very international. In fact, when we were in China, we also had teams in other countries. I have lived in many countries since I was young, so I have no problem moving around. I think what’s more important for me is that we need to understand the user habits and cultures of international users; this is crucial and is a significant part of our ability to go international. The Earth is my home, and when Elon Musk makes humanity intergalactic, our scope can be even larger. I think most Chinese people may only look at China, but the world is quite big. If you walk around the world, you will find that most countries want to attract blockchain companies and cryptocurrency exchanges. It’s not that these small countries have fewer resources; it’s just that they respond more quickly. Their internal coordination and actions are faster. During this round of transformation, they should have a very strong advantage.

In May 2019, Binance faced a major security incident where hackers successfully obtained user account information and transferred over 7,000 bitcoins, amounting to $40 million. In response to the crisis, Binance quickly took measures, suspending withdrawals, launching an investigation, and promising to cover user losses with its security fund to restore trust.

In June 2021, Binance was banned by the UK Financial Conduct Authority (FCA) from providing regulated services in the UK, which severely impacted its market operations and drew the attention of other global regulatory bodies.

In 2022, Binance announced it would relocate its headquarters to the UAE in response to regulatory changes in the global crypto market, enhancing its expansion in the Middle East and North Africa.

In November of the same year, Binance witnessed the collapse of the FTX exchange. FTX was reported to be facing a liquidity gap of up to $8 billion, and Binance was shocked by the significant holes in its financial status during its due diligence on FTX. Although Binance initially hoped to support FTX's customers and provide liquidity, it ultimately decided not to pursue a potential acquisition of FTX, as its problems were beyond Binance's control and capability. This incident was akin to the "Lehman moment" for the crypto industry, reigniting deep skepticism towards centralized trading platforms. To rebuild industry confidence, Binance promised to publicly disclose auditable Merkle tree reserve proofs within a month. Calls for increased regulation within the industry surged again, and this incident was seen as a landmark historical moment for the normative development of the crypto industry.

In 2024, Binance announced plans to hire 1,000 people, many of whom will be designated for compliance positions to meet increasingly stringent regulatory requirements. CEO Richard Teng pointed out that Binance's annual spending to meet U.S. regulations exceeds $200 million. Binance plans to have over 700 compliance staff by the end of 2024, currently around 500.

Over the past six years, Binance has faced drastic regulatory and policy changes globally, especially compliance challenges in developed countries like Japan, the U.S., and the UK, forcing CZ to adopt a rapid response strategy. CZ's statement, "The Earth is my home," reflects his flexible and adaptable global strategy. He maintains close contact with governments and regulatory bodies in multiple countries, allowing Binance to sustain a diversified global strategic layout without relying on a single market.

In 2024, CZ resolutely chose to endure imprisonment, and the persistence and resilience he demonstrated make one believe that Binance will no longer fear the next crisis.

Fifth Question: He Yi in CZ's Eyes

MarsBit asked at the time: How did you persuade your old partner He Yi to join Binance? What is your view of the "sister of the crypto circle"?

CZ: In my eyes, He Yi is someone who "could easily rely on her looks to make a living but chooses to fight for her ideals," and it’s not just personal ideals; she genuinely wants to do something meaningful. From the very beginning, I knew there would be no issues with our collaboration. She can do things I cannot, and she has abilities I lack. Always find people who are better than yourself, give them space, responsibility, and authority. Our philosophies align, so it’s very easy.

In July 2017, Binance launched its own platform token BNB, with an issuance price of 1 yuan. However, shortly after its launch, the price of BNB fell below the issuance price to 0.5 yuan, leading to intense criticism of Binance. He Yi recalled that this period was the most stressful for CZ, as he lost 10 kilograms in weight over three weeks. After He Yi joined Binance, the price of BNB quickly rebounded, trading volume surged, and it even entered the top ten globally. Within half a month of her joining, the price of BNB skyrocketed from $0.15 at ICO to $2.57, an increase of over 20 times.

In March 2018, Binance suffered a hacking attack, and He Yi actively participated in crisis management, communicating promptly through social media to ensure users received transparent information.

In 2019, to promote the newly launched contract products, He Yi engaged in debates with competitors like Huobi and OK in WeChat groups, creating a rare lively scene in the crypto circle that year.

In 2020, He Yi made several eye-catching statements during media interviews. In response to external doubts about the donation of all listing fees, she stated, "The destination of listing fees is Binance's freedom." Regarding accusations that Binance's ICO was illegal, she remarked, "CZ did not specifically consider the Chinese market, which reflects our lack of Eastern wisdom."

In 2022, when Binance faced an investigation by the U.S. Securities and Exchange Commission, He Yi actively participated in communications with the SEC, striving to demonstrate Binance's compliance and ensure its legal operations in the U.S. market.

In 2023, He Yi was involved in Binance's expansion plans in Latin America, particularly in Brazil and Argentina, collaborating with local partners to launch localized products while promoting user education initiatives.

On April 30, 2024, just before the verdict, CZ submitted a letter to Judge Jones, who was responsible for the case, sincerely expressing his apologies for his actions and acknowledging that he should take full responsibility. In this letter, He Yi's handwritten note was particularly noteworthy, spanning three pages and conveying her deep feelings for CZ and Binance. He Yi reminisced about the ten years of ups and downs shared with CZ, especially the six years spent building Binance together. Some lesser-known details mentioned in the letter vividly illustrated the shared journey of CZ and Binance. Many industry veterans expressed their sentiments on social media, stating, "Although many things have changed, the sister of the crypto circle remains your sister."

Today, Binance describes He Yi on its official website as follows: "The growth of Binance into the world's largest cryptocurrency exchange is inseparable from the business strategy crafted by the team led by He Yi. She transformed Binance from a cryptocurrency trading platform into a global blockchain ecosystem, enabling it to break through in fierce competition and capture over 60% of the market share. Her strategic vision and talent management approach are crucial for any enterprise."

Sixth Question: Closed-Door Practice, Binance's Trading System

MarsBit asked at the time: Why do you have such a great interest in trading platforms? Where does your understanding of trading come from?

CZ: I actually consider myself quite lucky; I was exposed to the corresponding trading systems during university, so I have always been in the industry where finance and technology converge. I believe trading is the lifeblood and heart of an economic system, and exchanges should be more like the heart, allowing you to directly see its impact on the entire economy.

Trading platforms must have bottom lines, not participate in trading or manipulate the market, and provide users with a fair trading environment. This is what we have always been doing, but our values are to protect users; users are our community members. What I will do is operate the exchange; I know how to create a very fair exchange, and we need to make this industry right.

In 2019, Binance focused on global expansion while obtaining necessary regulatory approvals in new markets. This move demonstrated its commitment to compliance and transparency, aligning with local laws to ensure a fair trading environment without market manipulation.

In 2020, Binance introduced additional security features to protect user accounts and transactions, which are crucial for maintaining a fair trading platform. It established the Secure Asset Fund for Users (SAFU) to protect user funds in extreme situations, further ensuring a fair and secure trading environment.

In 2021, Binance released a series of transparency reports detailing its operational methods and how it handles listing processes and market events. These reports are part of educating users about the internal workings of the exchange and promoting a transparent relationship with the community.

During the Luna crash in 2022, Binance took multiple measures to ensure the fairness of trading on its platform, refraining from participating in trading or market manipulation while striving to provide users with a fair trading environment. After this incident, Binance strengthened its market monitoring to better detect and respond to potential similar situations in the future. This includes improving its market monitoring systems to detect and prevent potential manipulative behaviors.

In 2023, Binance enhanced its interaction with the community, directly collecting user feedback through social media platforms and other channels to promptly address issues users encountered during trading.

These measures not only reflect Binance's commitment to user and market responsibility but also highlight its relentless efforts in maintaining trading fairness and market order. Through these ongoing efforts, Binance aims to shape a more just and transparent trading environment, further solidifying its position as a leading global cryptocurrency exchange.

Overall, Binance's initiatives and strategies demonstrate its determination to promote positive industry development on a global scale, emphasizing the key role and responsibility of an exchange in the market. As Binance continues to advance these core values and principles, it sets new standards for the healthy and long-term development of the cryptocurrency industry.

Seventh Question: Public Chain Performance is the Future; DEX Replacing CEX Takes Time

MarsBit asked at the time: Why develop Binance Chain? What are the ideas and progress regarding decentralized exchanges?

CZ: Public chains will definitely be a trend in 5, 10, or 20 years, so we will not give up on truly good models; we embrace change and innovation. Currently, the performance of public chains is not fast enough, and in the short term, large trading volumes will still be on centralized trading platforms; decentralized trading platforms may take a few more years to become mainstream.

In 2018, CZ expressed great expectations for decentralized exchanges (DEX), firmly believing that this model would lead future financial trends. However, at that time, the performance of public chains and liquidity issues significantly limited the rise of DEX. With continuous technological advancements, especially after the launch of Binance Smart Chain, decentralized exchanges welcomed new opportunities.

In September 2020, Binance launched Binance Smart Chain, aimed at supporting smart contracts and decentralized applications (dApps). The launch of BSC quickly attracted numerous projects, becoming an important participant in the DeFi ecosystem.

In 2021, with the rise of DeFi, Binance Chain rapidly developed, becoming one of the most popular blockchains in the market. Numerous DeFi projects and NFT platforms flocked to it, driving the widespread use of BNB.

In 2022, Binance Chain was renamed BNB Chain, and the integration promoted further expansion of the ecosystem, emphasizing the concepts of decentralization and multi-chain. BNB Chain began to support a wider range of applications, including GameFi, SocialFi, and metaverse projects, aiming to create a comprehensive virtual ecosystem. Among them, PancakeSwap quickly became the largest decentralized exchange on BNB Chain, winning widespread user favor.

PancakeSwap is known for its efficient and convenient token swapping experience, allowing users to trade easily without intermediaries. The platform's core features include liquidity pools, where users can deposit assets to earn trading fees, while also supporting yield farming, enabling users to earn additional income by staking tokens.

Over the past six years, DEXs on other chains have also made significant progress, further proving CZ's foresight. For example, Uniswap, through concentrated liquidity and cross-chain expansion, saw its trading volume exceed $1.5 billion daily in 2024, solidifying its leadership position in the DeFi ecosystem. Meanwhile, Curve Finance focused on stablecoin trading, becoming the user’s choice with low slippage and high efficiency, achieving a daily trading volume of $139 million. Additionally, SushiSwap and dYdX have continuously attracted users since their launch, shining brightly in 2021 as important components of decentralized finance. Raydium, as the largest DEX in the Solana ecosystem, saw its trading volume hit new highs in 2024 amid the meme coin craze, greatly enhancing market liquidity and trading efficiency.

All of this not only showcases CZ's profound insights into the future of decentralized finance but also indicates his foresight driven by technological advancements. It is this unique vision that keeps CZ and Binance at the forefront of the rapidly evolving DeFi space, laying a solid foundation for the rise of decentralized finance.

Eighth Question: Data Fabrication in Exchanges is Meaningless

MarsBit asked at the time: Some articles point out that virtual currency exchanges in China engage in volume fabrication?

Exchanges moving forward amid skepticism

CZ: But I believe users are smart; they know whose trading volume is real and whose is fake, including the issue of wash trading. Users are not foolish. I think there is too much wash trading and a lot of fake trading volume, which is bad for our industry, making it seem very deceptive. True strong players do not boast about being the best; in a non-trading context, a more accurate expression is that we do not care about being number one; we care more about how much foundational work we have done for this industry, rather than engaging in harvesting behavior. It’s not about being number one for the sake of being number one; it’s about doing things well; the ranking is not important. Moreover, all current rankings have some flaws, and making rankings is very difficult, so it really doesn’t matter.

CZ expressed profound views on the issue of trading volume fabrication in exchanges in 2018, emphasizing users' wisdom and the negative impact of such behavior on the entire industry. He pointed out that true strong players do not flaunt their status but focus on the foundational work of the industry rather than short-term "harvesting" behavior.

In the past six years, several exchanges have faced severe consequences due to trading volume fabrication, leading to the collapse of some exchanges.

In 2019, Bitfinex was accused of manipulating the market through its relationship with its parent company Tether to inflate trading volume and prices. Although Bitfinex denied these allegations, the incident drew widespread attention, leading many users to question its transparency and compliance.

At the end of 2021, FTX was exposed for financial opacity and false trading volume issues, despite being a leader in the industry prior to this. In 2022, the exchange collapsed due to a liquidity crisis, triggering massive turmoil in the crypto market. This incident not only resulted in billions in user asset losses but also prompted deeper reflections on the compliance and transparency of exchanges both within and outside the industry.

In 2022, Coinbase faced "wash trading" allegations, with some analysts suggesting that its trading volume data might have been artificially inflated. Although Coinbase publicly denied these allegations, the incident reignited widespread discussions about the authenticity of data from crypto exchanges.

These events not only highlight the prevalence of trading volume fabrication in exchanges but also reveal the harm this behavior poses to users and the entire industry. As regulation continues to strengthen, the industry's demands for transparency and compliance are becoming increasingly stringent.

CZ's views remain relevant today, emphasizing the importance of building trust and transparency to promote the healthy development of the entire industry.

Ninth Question: CZ's Personal Style, From Behind the Scenes to Frontline Leader

MarsBit asked at the time: Why does CZ always seem mysterious and low-key?

CZ: I am indeed focused on technology, so I still have a lot of practical work to do, and there are many things, so I have less time. The interviews that explode are actually not related to me personally; it’s mainly because our brand awareness is quite strong. Another reason is that domestic news often involves mutual rebuttals and many contentious issues, and I generally do not like to participate in these discussions; I prefer to engage in technical discussions that are helpful to the industry.

The once low-key CZ has gradually become the spokesperson for Binance over the past few years. He frequently appears at various international summits and on social media, sharing his views on market trends and regulatory policies. He is not afraid to speak out publicly, candidly addressing market movements and competitors. As Binance has become a leader among global exchanges, CZ has transformed from a "tech geek" into a global industry leader.

In 2019, CZ spoke for the first time at the Singapore Fintech Festival, discussing the potential of decentralized finance and encouraging the industry to adopt new technologies. This appearance marked the beginning of his transition from behind the scenes to the forefront, showcasing his influence in the industry.

Entering 2020, CZ actively participated in discussions at blockchain summits, sharing his vision for Binance's future development and emphasizing the importance of globalization and compliance. He pointed out, "We must adapt to the ever-changing regulatory environment, which will be key to our success." His remarks further solidified Binance's leadership position in the market.

By 2021, CZ spoke at the Consensus conference, calling for increased transparency and trust in the cryptocurrency industry. He introduced the concept of "community trust," believing it to be the core driving force behind the development of the entire industry. That year, CZ frequently appeared in various media interviews, actively responding to market fluctuations and demonstrating strong market control.

In 2022, CZ's influence reached unprecedented heights. After experiencing a series of events such as the Luna crash and the FTX bankruptcy, CZ remained active on Twitter Spaces, addressing community concerns. He emphasized Binance's efforts in compliance and user protection, effectively restoring the confidence of many crypto holders. His phrase "If you can’t hold, you won’t be rich" quickly became his signature, conveying an unwavering investment belief that inspired every crypto holder during the bear market.

This series of public speeches and appearances not only reflects CZ's growth and transformation but also marks his leadership position in the crypto industry. As Binance's dominant position among global exchanges continues to strengthen, CZ's unique vision and strategic thinking lay a solid foundation for the rise of decentralized finance.

Tenth Question: Binance Has No IPO Plans

MarsBit asked at the time: Will Binance choose a traditional IPO or align with traditional finance?

CZ: We have no plans for an IPO; traditional finance's IPO has become a tool for financing or for early investors to exit, so I don’t want to do that. It should be said that it is a tool for VCs to exit; we do not have VC investors, and blockchain has already brought us to the next era.

In the past six years, CZ has repeatedly mentioned topics related to IPOs, consistently maintaining his critical view of traditional financial models. In 2019, he emphasized in an interview that Binance would continue to focus on technology and user experience rather than chasing short-term financing.

As time went on, CZ mentioned in several public occasions in 2021 and 2022 that Binance did not intend to go public, especially in the face of the ever-changing market environment and compliance challenges in the cryptocurrency industry. At this point, he reiterated his indifferent attitude towards IPOs, believing that it was no longer a key indicator of a company's success. The emergence and development of blockchain technology have enabled businesses to operate in a more flexible and decentralized manner, rendering the IPO, a traditional financial tool, outdated.

CZ believes that blockchain technology is driving us into a new era, granting users and businesses greater freedom and innovative capabilities. This series of statements and positions reflects his firm belief in the potential of blockchain technology and showcases his foresight as a leader in industry transformation.

Gone are the days, the remarkable figures of the past, let us look to the present

Learning from history can reveal the rise and fall of fortunes. After six years of twists and challenges, CZ's release not only marks his personal rebirth but also injects new vitality into the entire cryptocurrency industry. Looking back at that enlightening interview in 2018, the ten questions now seem even more profound in the new context. These questions not only reflect CZ's foresight but also mirror the valuable experiences and wisdom he has accumulated through storms.

From Binance's choice of Uganda as the starting point for globalization to its decisive responses to industry challenges, these topics have gained new meaning over time. The principles and strategies that CZ adheres to continue to shine with the light of wisdom, having withstood the test of time.

Today, Binance has not only become one of the largest cryptocurrency trading platforms in the world but is also driving the entire industry towards compliance and transparency. CZ's persistence and resilience make us believe that no matter how the future changes, he will continue to lead Binance forward, exploring broader possibilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。