The 1-hour chart reveals a strong sell-off following bitcoin’s recent peak of $66,071, dropping as low as $63,259. Volume surged during this decline, underscoring strong bearish momentum. However, bitcoin has found temporary support near $63,259, a level where price action paused, signaling a potential rebound.

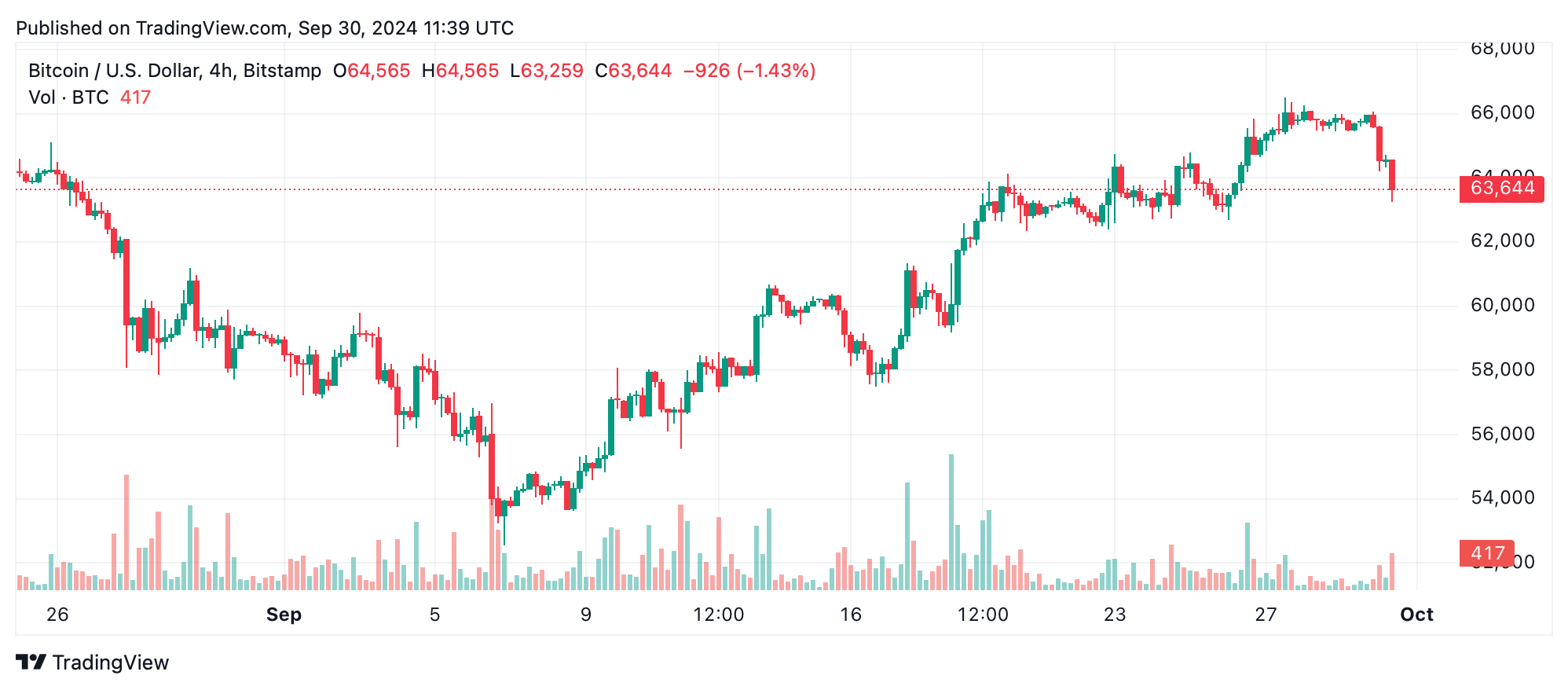

On the 4-hour chart, the rejection from $66,508 has led to consistent drops, suggesting ongoing downward pressure. With selling volume still elevated, bitcoin appears to be consolidating near the $63,000-$64,000 zone. This region, which has previously acted as both support and resistance, will be critical for any potential reversal. A sustained hold above $63,000 could spark a bounce, but a failure to maintain this level could push the price lower.

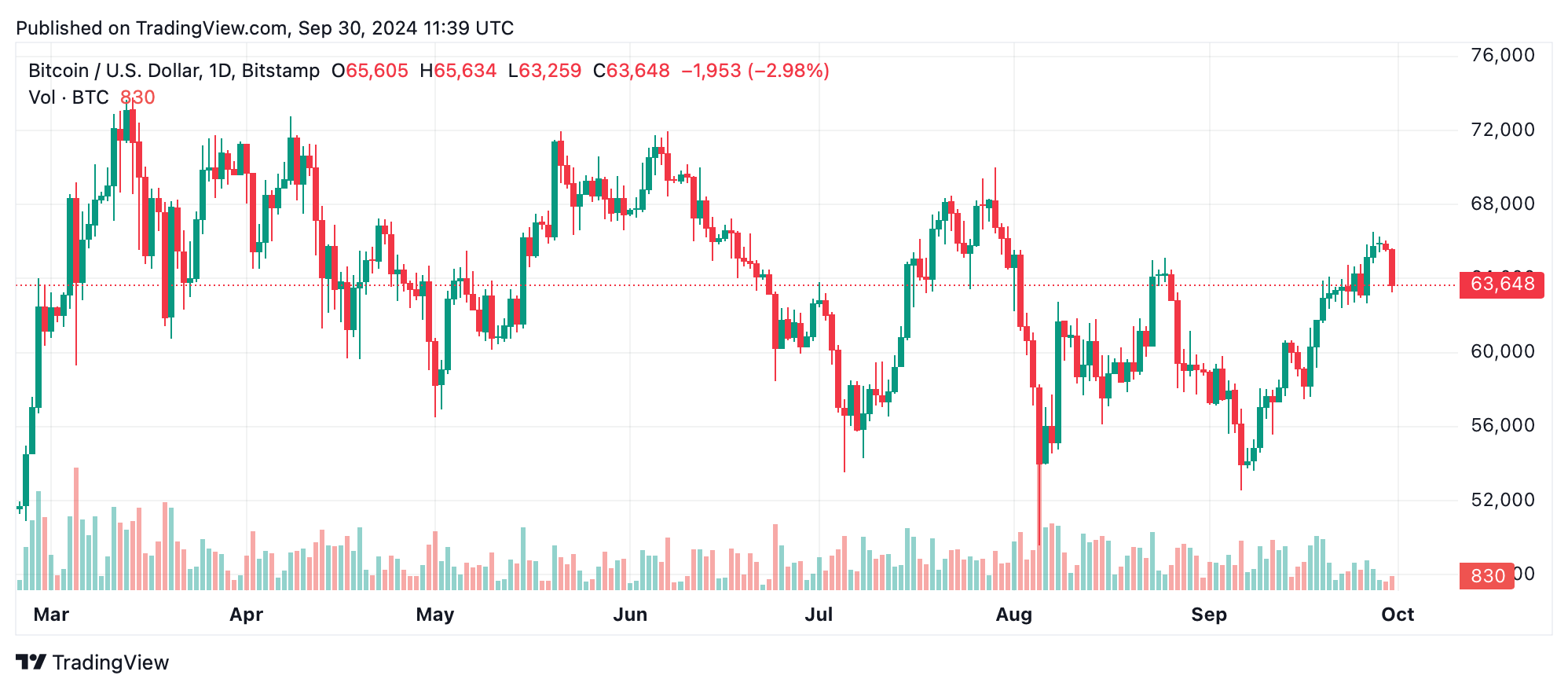

The daily chart shows a broader picture of bitcoin’s retracement from a strong rally that began at $52,546. The correction phase now sees the price hovering near a historically significant support zone of $63,000. A break below this level could signal further downside, with potential targets at $60,000 and $58,000. Long-term buyers may find value in this zone, but only if the price shows stabilization.

In terms of oscillators, the relative strength index (RSI) stands neutral at 56, while the Stochastic is showing a sell signal at 84, indicating possible further downside. Momentum indicators, including the commodity channel index (CCI) and awesome oscillator, are also neutral, highlighting market indecision. The moving average convergence divergence (MACD), however, points to a buying opportunity, suggesting potential recovery.

The mixed signals from the moving averages reflect the uncertainty. Short-term averages like the 10-period exponential moving averages and simple moving averages indicate a sell, but longer-term averages, such as the 50-period and 100-period, are flashing buy signals. Investors should remain vigilant, as the interplay between short-term selling pressure and long-term support levels could define bitcoin’s next move.

Bull Verdict:

If bitcoin holds the critical support at $63,000, we could see a short-term recovery toward the $64,500-$66,000 range. Positive signals from longer-term moving averages and the MACD’s bullish divergence suggest that bitcoin might regain upward momentum, making this level a strategic entry point for buyers looking for a potential rebound.

Bear Verdict:

Failure to maintain the $63,000 support could trigger further selling pressure, driving bitcoin down to key levels around $60,000 or even $58,000. With bearish signals from the Stochastic oscillator and the recent sell-off volume, the risk of a deeper correction remains high, urging caution for traders expecting immediate upside.

Register your email here to get weekly price analysis updates sent to your inbox:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。