During his interview with Jeremy Szafron, Anchor at Kitco News, Cortez outlined the importance of sound money principles, focusing on the role of gold and silver as a hedge against fiat currencies. He explained that precious metals offer protection against inflation, which has become a central issue as more states recognize the value of sound money.

“Gold and silver are money,” Cortez asserted, stating that sound money holds its value over time, unlike fiat currencies, which can be devalued by inflation and political decisions. The movement to remove taxes on precious metals has already led to 45 states eliminating sales tax on these assets.

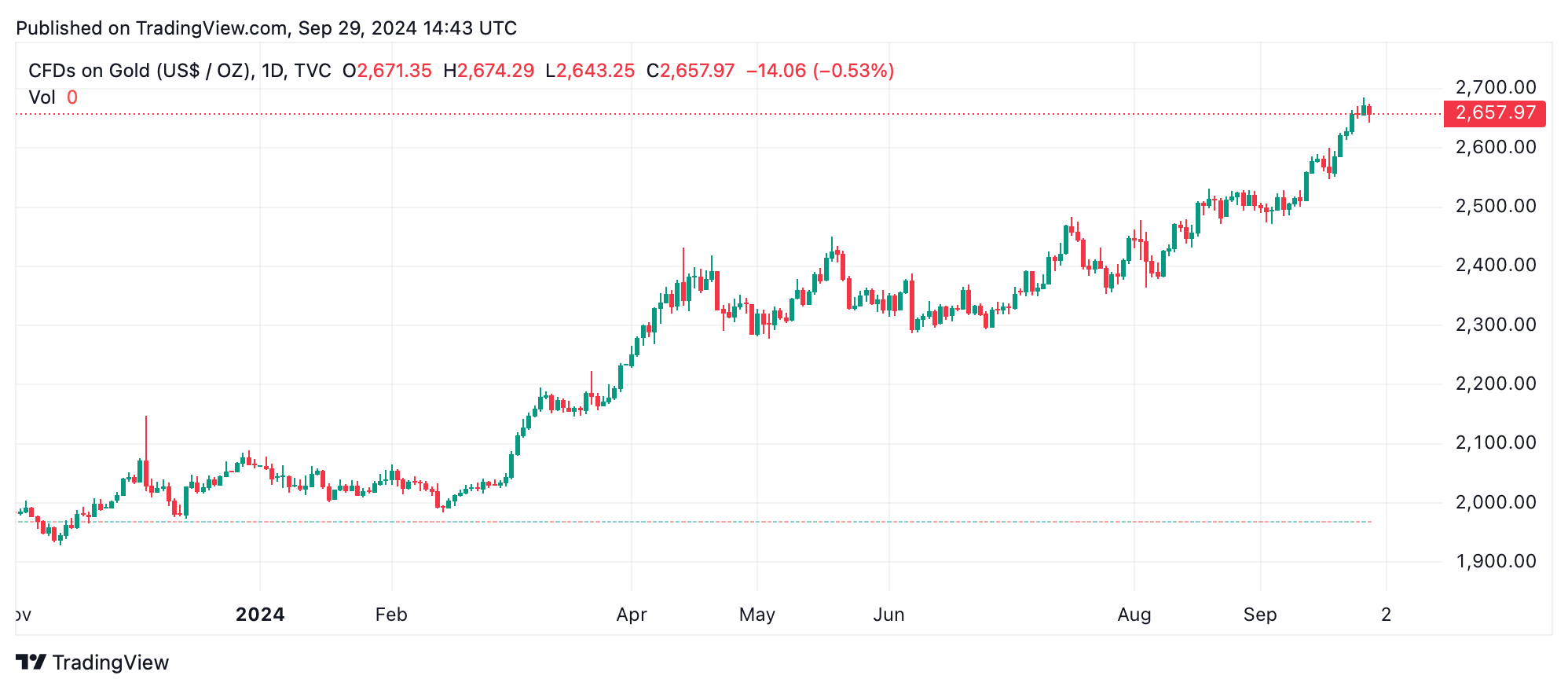

The price of one ounce of .999 fine gold has risen 28.87% since the start of January 2024.

At press time, an ounce of .999 fine gold is trading for $2,658 per unit and just recently on Sept. 27, 2024, gold reached a peak of $2,674. Year-to-date alone gold has spiked 28.87% higher against the U.S. dollar. Meanwhile, Cortez explained that New Jersey became the 45th state to eliminate sales taxes on gold and silver purchases.

Although Cortez expressed concern over a provision in the New Jersey law that still taxes transactions under $1,000, calling it “regressive” and harmful to smaller investors. “In many cases, these are people who are dollar cost averaging who are going to their local precious metals dealer and buying a couple of Eagles or a couple of silver rounds every paycheck,” Cortez said.

The Sound Money Defense League executive director added:

This tax harms them … it actively picks them out and says that no you cannot buy precious metals without being subject to penalty by the state.

The growing sound money movement reflects a broader de-dollarization trend, according to Cortez. With global economic instability and rising national debt, more states are beginning to recognize the need to safeguard their financial systems by investing in gold and silver. Cortez pointed to Utah’s decision to hold physical gold in state coffers as a major step forward in this effort. As more states move towards sound money policies, Cortez believes this trend will continue to reshape the U.S. financial landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。