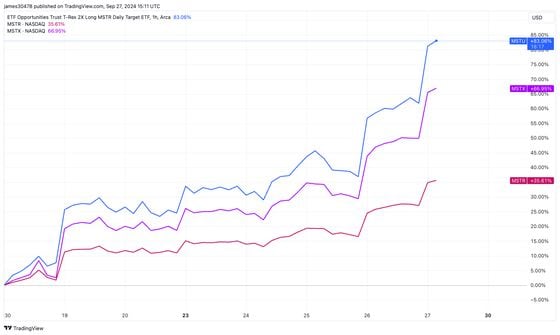

Seven days after hitting the market, the T-REX 2X Long MSTR Daily Target ETF (MSTU) has become one of the most successful new exchange-traded funds (ETFs) on the market after attracting over $72 million.

The fund, issued by REX Shares and Tuttle Capital Management, promises two times the daily performance to the stock of MicroStrategy (MSTR), the software mogul turned bitcoin strategy company, the most leverage any fund tied to MSTR gives.

A similar fund, the Defiance Daily Target 1.75X Long MicroStrategy ETF (MSTX), promises traders returns of 175% of the daily percentage change in the share price of MSTR. MSTX went live on Aug. 15 and has so far taken in roughly $857 million, according to data from Bloomberg Intelligence senior ETF analyst Eric Balchunas, putting it in the top 8% of launches this year.

“Both have robust liquidity,” Balchunas said in a post on X. “I didn't think there was room for both (esp so quickly), it just [shows] how much 'need for speed' there is out there.”

MicroStrategy has been an attractive investment for traders looking to gain exposure to bitcoin (BTC) without directly investing in the digital asset, as shares of the company are highly correlated with the token due to MicroStrategy's holding 252,220 BTC.

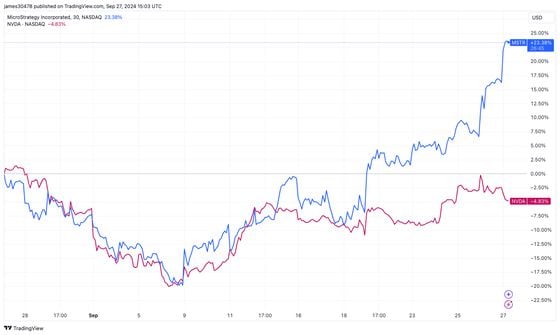

Bitcoin's price has just exceeded $66,000 for the first time since July 31. At that time, MicroStrategy was priced at $168; it is now trading at almost $178, $10 a share higher. As MicroStrategy is trading higher while bitcoin effectively has been flat since then, this shows that MicroStrategy is leading the current rally.

Another development can be seen with the divergence between MicroStrategy and NVIDIA (NVDA). Both assets were in lockstep for the past month, but since Sept. 19, MicroStrategy has gone on from strength to strength while NVIDIA has flatlined. This shows that tech is not the primary driver in this rally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。