This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 2,090.20 +1.76%

Bitcoin (BTC): $65,567.06 +1.8%

Ether (ETH): $2,649.73 +0.83%

S&P 500: 5,745.37 +0.4%

Gold: $2,666.73 -0.22%

Nikkei 225: 39,829.56 +2.32%

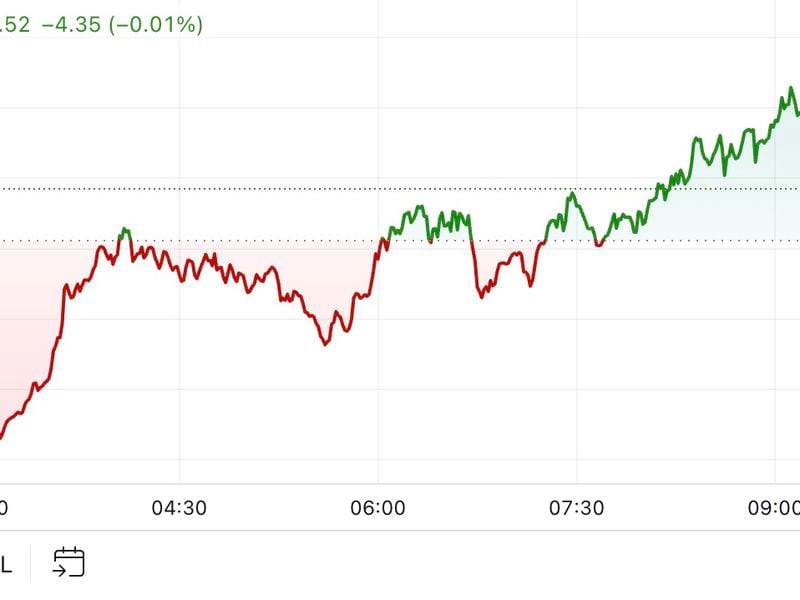

Bitcoin closed in on a return to $66,000, climbing to its highest point since the start of August. BTC rose to over $65,900 during mid-morning in Europe, an increase of over 3% in the previous 24 hours. Bitcoin then retreated to trade just above $65,500. Spot bitcoin ETFs in the U.S. enjoyed a monster day on Thursday, registering inflows of $365 million and bringing the weekly total to over $600 million. The broader digital asset market, as measured by the CoinDesk 20 Index, is also higher by around 1.8%, with dogecoin leading the gains. DOGE jumped around 9% to nearly $0.125 amid a surge in memecoin prices.

China's plans for a huge stimulus package lit a fire under memecoins, with both SHIB and FLOKI registering double-digit gains. Memecoin prices tend to respond positively to liquidity injections because the increased availability of cash nurtures a greater appetite for risk among traders. Memecoins are community-driven and jump when the market displays risk-on behavior. "Leading the gains are the SOL and BTC ecosystems, indicating a strong focus on meme coins as overall liquidity grows. While not nearly as explosive as meme coins on the aforementioned chains, meme coins on Ethereum, such as $PEPE and $SHIB, are also experiencing heightened interest from the market," HashKey OTC CEO Li Liang said.

TIA, the token of data-availability network Celestia, posted its best monthly gain this year, confounding traders who'd positioned for a drop in the price as the result of a $1.13 billion token unlock due next month. September's market-beating 40% surge takes place against a background of some market participants seeking downside hedges due to concerns the token unlock due Oct. 31, equivalent to 16% of its total supply, will flood the market and depress prices. However, the bias for shorts, likely stemming from the hedging activity, might have led to a short squeeze, contributing to the TIA rally. "Traders tried to sell ahead of the [unlock] event from Julyish. I'd argue the squeeze has already happened," Jake Ostovskis, an over-the-counter trader at Wintermute, told CoinDesk.

- Omkar Godbole

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。