In the future, obtaining data itself is not the ultimate goal, but a means to achieve innovation.

Produced by | OKG Research

Planned by | Lola Wang

Author | Hedy Bi

In 1981, in an office of only 10 square meters, four people and a coffee pot were all that Bloomberg had. With the enduring principle of its founder, Bloomberg, "There is no new economy, business is about providing what users need," Bloomberg has become a global financial news and data analysis giant in less than 50 years.

Image source: Internet

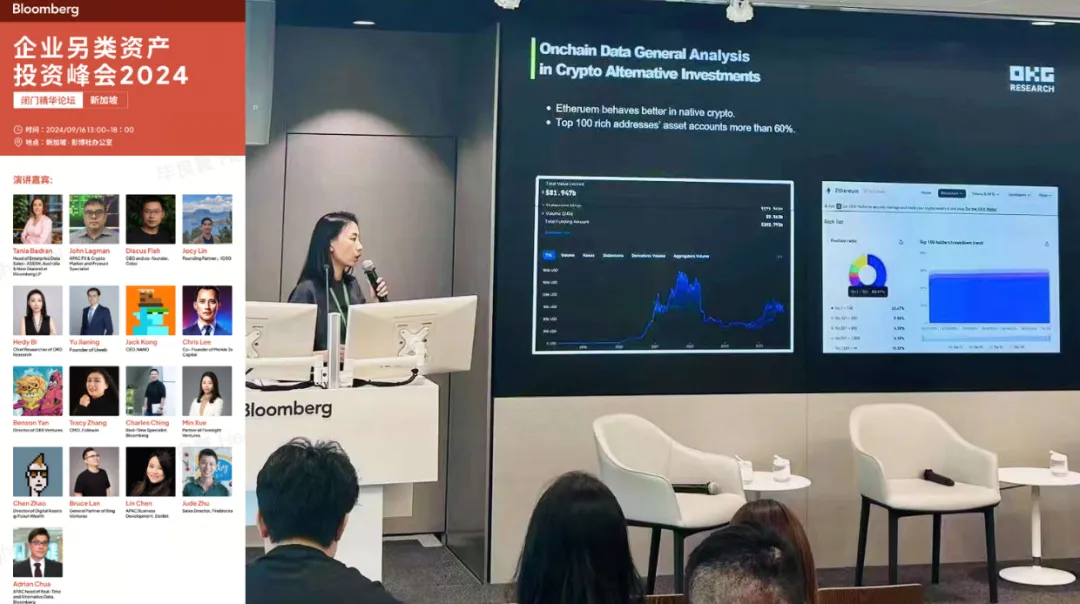

On September 16, 2024, OKCloud Chain Research Institute was invited as the keynote speaker at the 2024 Alternative Asset Investment Summit hosted by Bloomberg to give a keynote speech on on-chain data. During the event, Hedy Bi, Chief Researcher of OK Cloud Chain Research Institute, had in-depth discussions with Bloomberg product experts on the future form of data and the future development of on-chain data products. Bloomberg has also conducted surveys on the demand for on-chain data, with 85% of clients expressing the hope that data product providers, including Bloomberg, can provide on-chain data-related products for encrypted analysis. In addition, we also found that technological development drives the diverse development of data forms, but different eras have similarities in data product services.

Image source: Bloomberg🇸🇬 Closed-door meeting scene OKG Research as the keynote speaker demonstrating the application of on-chain data

The demand originated in chaotic times

In the early 1980s on Wall Street, the financial markets were in chaos. Despite the proliferation of securities firms, information was blocked, and traditional manual information acquisition methods were inefficient. At the same time, quantitative trading began to show its potential, with only a few pioneers attempting to use computers for trading. However, the limitations of technology made data processing and transmission relatively primitive. Bloomberg keenly observed the pain points of the industry and was the first to launch a service terminal for data integration and analysis. This not only made it easier and faster for traders to obtain data, but also quickly gained prominence in the financial information field with a news team of over 2,700 journalists producing over 5,000 news articles daily. This combination of business strategies quickly allowed Bloomberg to surpass Reuters, the leader in financial media.

Image source: "The Wolf of Wall Street" screenshot

This combination of business strategies allowed Bloomberg to reduce its reliance on a single market, with its terminals serving securities firms and traders, and its news business catering to the general public. On one hand, it attracted more readers with its "news 15 minutes faster than other media" service, and on the other hand, it provided faster data sources for terminals. This flexible and diverse business strategy not only enhanced Bloomberg's competitiveness in the financial information field, but also improved its perception and brand influence among the general public, laying the foundation for its continued growth. This allowed Bloomberg to grow from a startup value of $10 million to a business giant valued at as high as $60 billion.

The crypto industry originated from a similar starting point: public chains based on decentralized technology provided the underlying foundation for native innovative applications in the crypto space. As the public chain ecosystem continues to develop, the problem of information silos between public chain ecosystems has gradually become apparent. In addition, the entire crypto market exhibits high volatility and complexity due to the deep integration of supply and demand with financial trading mechanisms, making the market full of uncertainty and chaos. Therefore, improving the circulation of on-chain data between different public chain ecosystems and enhancing the integration capability of on-chain data has become an important issue that the crypto industry urgently needs to address.

Although times have changed, OKLink is on the path of exploring the value of data, much like Bloomberg: based on strong technical capabilities, on one hand, it provides information aggregation services for users across multiple chains, integrating complex and dispersed blockchain data into clear and understandable real-time information, making it easy for users to obtain cross-chain information, greatly improving the accessibility of information; on the other hand, by providing unified and rich API interfaces, OKLink provides strong support for developers to build innovative applications based on public chains, reducing development barriers, improving efficiency, accelerating product iteration, and enabling developers to respond to market changes more quickly and launch competitive products and services. Different times, different markets, but OKLink and Bloomberg, based on strong data and technical capabilities, reduce their reliance on a single market through the establishment of this "combination punch" business model, and by meeting the needs of different user groups, they can forge ahead in a chaotic market.

Image source: OKLink, Bloomberg

Advancing on-chain, from data aggregation to value creation

Data itself does not create value; the value of data comes from its efficient and precise use to unleash its application value. Just as Bloomberg expressed, "For us, the essence of the information conveyed is paramount, including the channel." This is the key to Bloomberg's ability to surpass Reuters at the time—by providing financial data to users through terminals and analyzing the data to help investors make investment decisions, Bloomberg also completed the transformation of data from aggregation to value discovery.

Therefore, the core value of on-chain data platforms currently lies not only in providing one-stop aggregation of information for users, but also in conducting value discovery based on the integration and analysis of data from different public chains behind it. In the crypto field, the public chain ecosystem has formed a thriving scene of "a hundred schools of thought." According to incomplete statistics from OK Cloud Chain Research Institute, there are currently over 1,000 public chains in the market, leading to market fragmentation. Especially, the different technical architectures of public chains, such as Solana and TON, have led to low interoperability between chains, and the lack of unified data standards for different public chains has made users face many confusions and challenges when choosing the right public chain for trading or development, further limiting industry integration and innovation.

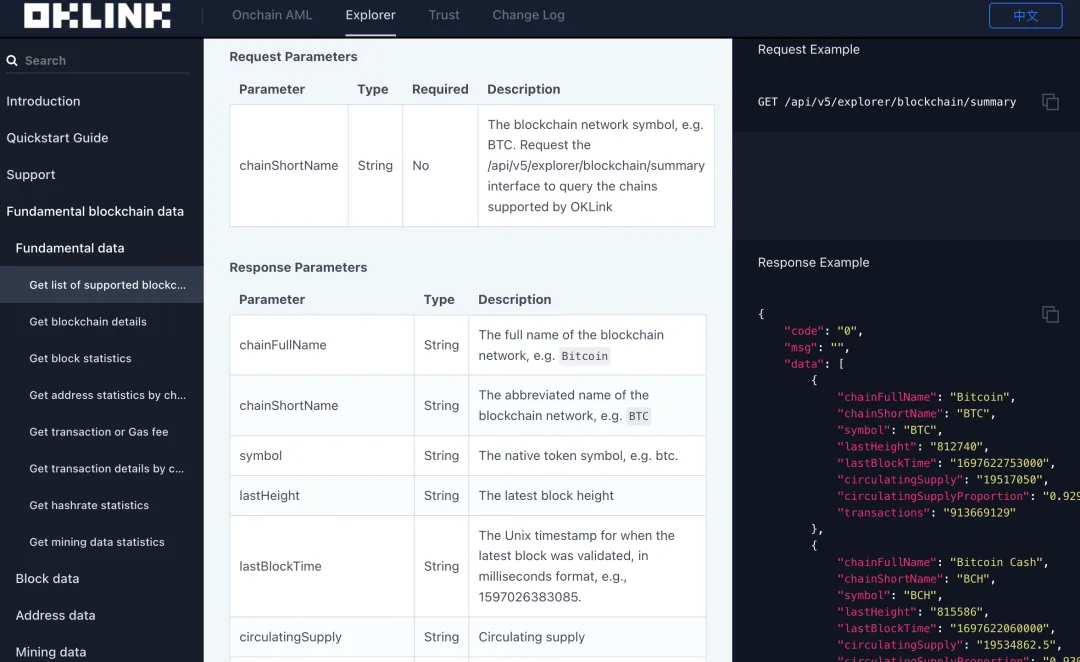

This is similar to Bloomberg's standardization of financial data: the openness of on-chain data makes data acquisition simple, but the protocols, data formats, and interfaces of each public chain are different, and the complex cross-chain integration increases the usage barriers of on-chain data. Packaging data according to a unified standard into APIs can greatly improve the efficiency of using on-chain data. Two years ago, OKLink launched the OPEN API, which allows developers to simultaneously and frequently access data from dozens of mainstream public chains through API integration. This allows users to easily obtain various on-chain data without needing to delve into the details of each public chain and learn the language of each public chain.

Image source: OKLink

Developers no longer need to "reinvent the wheel," greatly promoting the release of innovative on-chain value. And data can be used multiple times without exhausting its value, thus generating greater benefits. Moreover, by standardizing data products to connect different public chain ecosystems, forming a network effect of on-chain data, and complemented by on-chain development tools, just as Bloomberg provides a variety of analysis tools for investors, ultimately achieving value creation based on on-chain data.

Looking back at Bloomberg's development, from that time to today, it has shown an extraordinary transformation of data from aggregation to value discovery. And now, with the advancement of blockchain technology, we believe that the era of on-chain UGC has arrived. In the future, obtaining data itself is not the ultimate goal, but a means to achieve innovation. Users, especially developers, will further stimulate new imagination and innovation possibilities based on diverse on-chain data products, creating value on the blockchain! Let's BUIDL!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。