From the situation in the first half of the year, the volatility of this cycle has decreased compared to previous cycles.

Author: InnoMin Capital

Abstract

- In the first half of 2024, the cryptocurrency market experienced intense volatility from the peak of the bull market to a volatile pullback. Bitcoin reached a historic high in March, but the halving effect did not sustain market strength, instead entering a pullback period after May. The market was influenced by multiple factors such as global macroeconomic uncertainty, geopolitical conflicts, miner and government sell-offs, exacerbating the volatility. Despite this, Bitcoin recorded a 39% increase for the year, far exceeding the S&P 500 index.

- Major market indicators have declined from their highs in the first half of the year, but since July, exchange trading volume and stablecoin supply have begun to recover, indicating a resurgence in market funds and activity. Although the low trading volume of spot ETFs and the sluggish growth of primary market financing activities reflect institutional caution towards the market, the continuous emergence of market hotspots such as Meme, political-related, and DeFi has supported the overall lock-up volume to a certain extent.

- The cryptocurrency industry is playing an increasingly important role on the global political stage, mainly reflected in: on the one hand, during the U.S. election, cryptocurrencies have become a focus of attention for both parties, with their influence on policies and markets continuously increasing. Market volatility risk increased significantly before the election. If Trump is elected, it will significantly benefit the crypto market, while Harris's election will have a relatively weaker positive impact. On the other hand, under the influence of geopolitical conflicts and Western sanctions, Bitcoin is becoming an important tool for cross-border value transfer. The interdependence between cryptocurrency and war situations is becoming increasingly apparent, and its price trend and correlation with gold, BTC, and ETH are gradually strengthening.

- The global economy slowly recovered in the first half of 2024, gradually emerging from the trough of the pandemic. Economic recovery faces differentiation, with the U.S. strong and Europe weak, and emerging markets facing high interest rates and geopolitical challenges. Global inflation is slowly receding, but service prices have strong stickiness. Strong U.S. economic growth and a strong dollar have made the expected rate cut by the Federal Reserve a focus of the market, and the magnitude of the rate cut will affect the performance of risk assets such as BTC. Despite the challenges, the recovery of global trade and consumer confidence has provided support for economic growth.

- The biggest drivers of the first half of the year were the approval of Bitcoin and Ethereum spot ETFs and the Bitcoin halving event. The former increased the recognition of cryptocurrencies in traditional financial markets, attracting institutional funds into the market; the latter, although with a longer response cycle, is expected to significantly increase the value of BTC in the medium to long term. The main drivers of the pullback after March were the Mt. Gox compensation and the German government's sell-off events, both of which to some extent caused market selling pressure and spread panic sentiment.

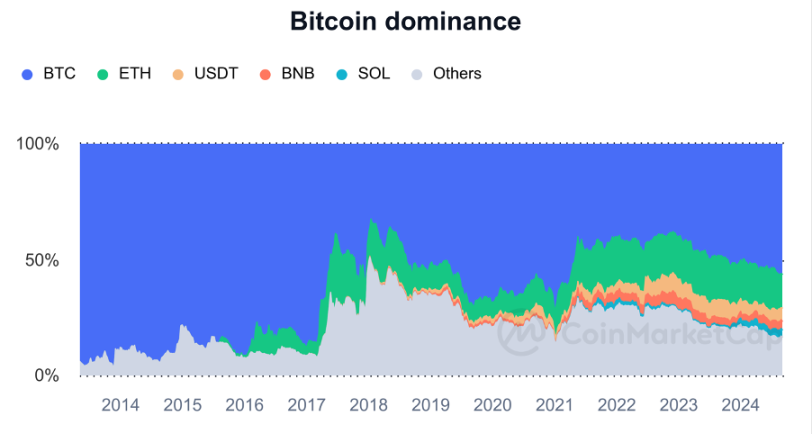

- This cycle differs from previous cycles in the following ways: the deepening participation of institutional investors may change the previous market pattern to a certain extent; BTC continues to consolidate its dominant position as a core asset, while ETH's market share is gradually declining in the face of challenges from emerging public chains and its insufficient value capture capability; Meme sector outperforms BTC in terms of rise; the concept of Altcoin Season is fading and weakening in intensity.

- Looking ahead to the second half of the year, U.S. dollar liquidity and the election will continue to be important driving factors for the subsequent market development direction. In the short term, the uncertainty of interest rate policy trends and the election will lead the market to be more inclined to trade based on news. The probability of continued volatile market conditions in September and October is high. In the medium to long term, after November, with the gradual implementation of loose policies and the dust settling on the election results, the inflow of institutional funds and the incremental retail demand brought about by the new narrative will drive the start of the second phase of the uptrend in this cycle, with the peak expected to be around $100,000 to $120,000.

I. Summary

Review of 2024 to Date

At the beginning of this year, riding on the bull market that began at the end of last year, Bitcoin quickly rose to over 30,000 points in March, reaching a historic peak of 73,881.40. Although Bitcoin underwent a new round of halving in April, the market did not open a new long-term bull market as in previous years. Instead, it experienced a strong rise in May, breaking through 72,000 points, but encountered a sharp drop in mid-June, followed by a long period of adjustment for the overall market. As the halving time for this round had been predicted by the market, the short duration of the bullish market and the market trend after the halving may not have met expectations. There have been several other bullish news in the past six months, such as Trump's support for cryptocurrency policies and signals of a U.S. rate cut. Although these news to some extent boosted market confidence, the coin price experienced a corresponding pullback after the market digested the news. At the same time, global turmoil, such as geopolitical conflicts, large-scale sell-offs, and fears of a U.S. economic recession, brought negative impacts, leading to significant market volatility caused by investors' hedging and panic selling. After June, the overall trend fluctuated between 52,000 and 72,000 points, with resistance at the high level. About 90% of the market liquidity of virtual currencies has also decreased in the past six months, indicating a decrease in market trading activity for cryptocurrencies, as investors have taken a wait-and-see attitude towards the overall market due to the volatility in the past six months. Nevertheless, the price of Bitcoin has still risen by 39% since the beginning of 2024, far exceeding the 19% return of the traditional investment benchmark S&P 500 index. In the next six months, the Bitcoin market will also face multiple tests such as the specific implementation of the U.S. rate cut and the results of the U.S. election.

Figure 1: BTC Daily K-line

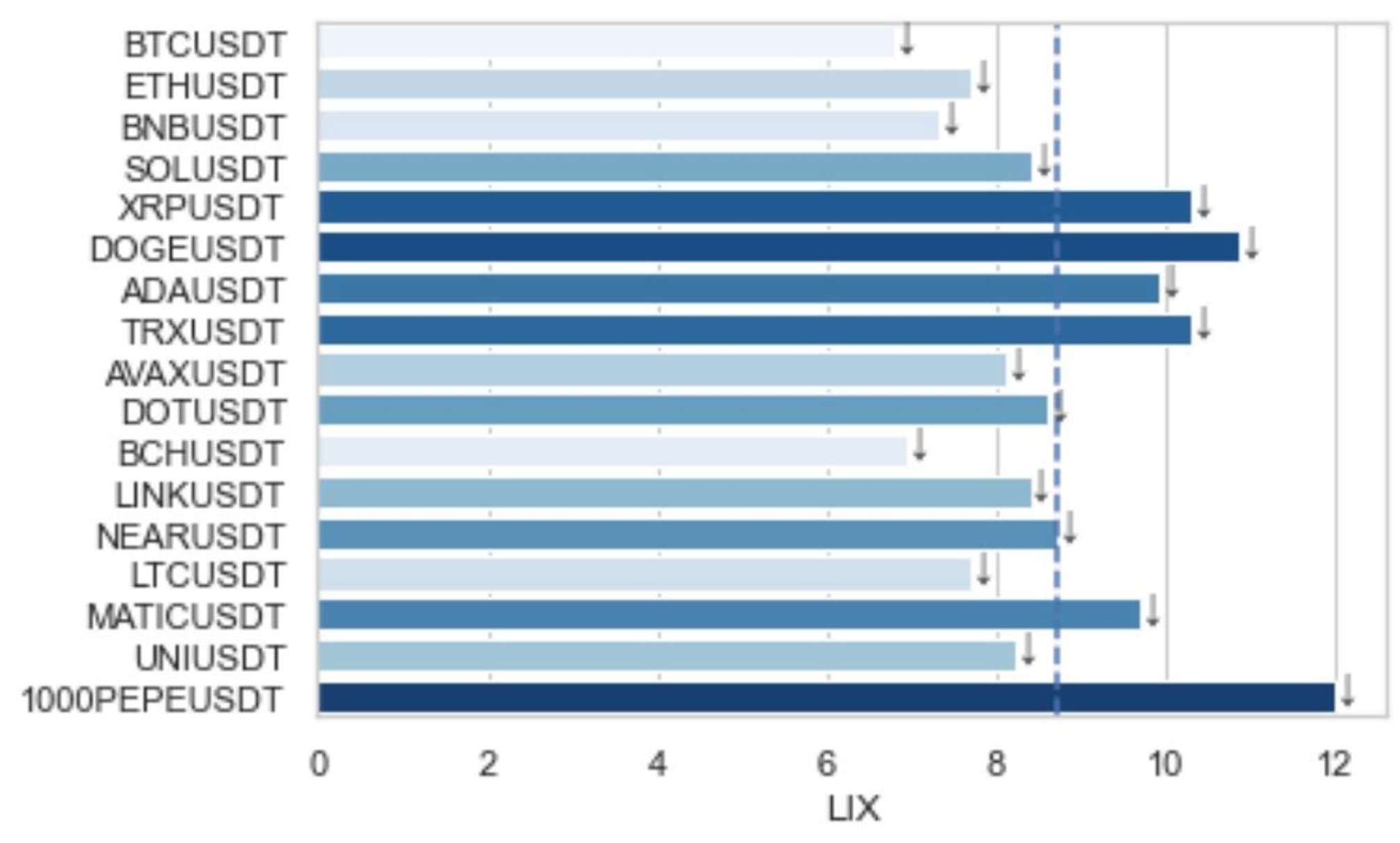

Figure 2: Mainstream currency LIX index

(Note: The LIX index represents the amount of assets needed to create a fluctuation of 1 USDT in the market; the dashed line represents the average LIX in the market; the arrows represent the changes in LIX in the past six months compared to the first half of the year, with a downward arrow indicating a decrease in liquidity)

The reasons for the pullback from the high point in the first half of the year may be as follows:

First, in terms of mining, after the new round of halving, the hash rate and mining difficulty of Bitcoin increased by about 50% compared to last year, leading to a continuous decrease in Bitcoin mining profitability. August 2024 became the month with the lowest Bitcoin mining profitability since September 2023, and part of the selling pressure in the market may come from the mining community.

Second, as the participation of governments and large institutions deepens, the attitudes of government and institutional "whales" towards virtual currencies are crucial to the market. As of August, governments of various countries, including the United States and Germany, collectively held 2.2% of the world's Bitcoin, and the potential selling pressure brought to the market by the German government's sell-off and Mt. Gox compensation is also one of the reasons.

However, in January of this year, the world's largest cryptocurrency by market value, BTC, had its historic moment: after SEC approval, several financial companies issued Bitcoin spot ETFs for the first time, bringing virtual currencies onto the stage of traditional finance and beginning to attract funds from more directions. To date, the total market value of various Bitcoin spot ETFs has reached $55.4 billion, accounting for 10% of the market value of the most popular S&P 500 index ETFs in the world. The second most popular virtual currency, Ethereum, also began trading its ETF in July, and the value and potential of virtual currencies are gradually being recognized and acknowledged by the investment community.

Cryptocurrencies are receiving increased attention but are also facing challenges in the global regulatory environment. This year, governments around the world have implemented stricter policies to strengthen the regulation of virtual currencies. In April of last year, Europe introduced the "Cryptocurrency Market Regulation" and planned to implement it this year. The law imposes strict regulatory requirements on cryptocurrency service providers and enhances the transparency of cryptocurrencies and consumer protection. The U.S. House of Representatives passed the "Financial Innovation and Technology Act of the 21st Century" (FIT21), which establishes a comprehensive digital asset regulatory framework, strictly defining whether digital assets are commodities or securities based on multiple indicators such as decentralization, market activity, and Howey Test. It standardizes the jurisdiction of various U.S. government agencies over digital assets, and through this innovative framework and departmental regulation, establishes orderliness in the cryptocurrency market and protects consumers. In May of this year, Zhao Changpeng, CEO of Binance, the world's largest cryptocurrency exchange, was sentenced to prison in the United States for allegations of money laundering and aiding criminals in transferring funds, demonstrating the U.S.'s determination to regulate cryptocurrencies. The various positive measures taken by European and American countries in recent years to regulate cryptocurrencies will steadily promote market standardization and health, and legally protect cryptocurrency investors.

Current Market Stage and Indicator Data

Shakeout period after the first major uptrend, overall in the mid-term of the bull market

In terms of the total market value of cryptocurrencies, the first phase of this bull market opened in October 2023 and reached a peak of $2.89 trillion in March of this year, then entered a shakeout period, with a maximum pullback of 29.6%, lower than the first pullback of the previous cycle (2020-2022) at 42.6%. Currently, it has pulled back by 27.3% from the March peak.

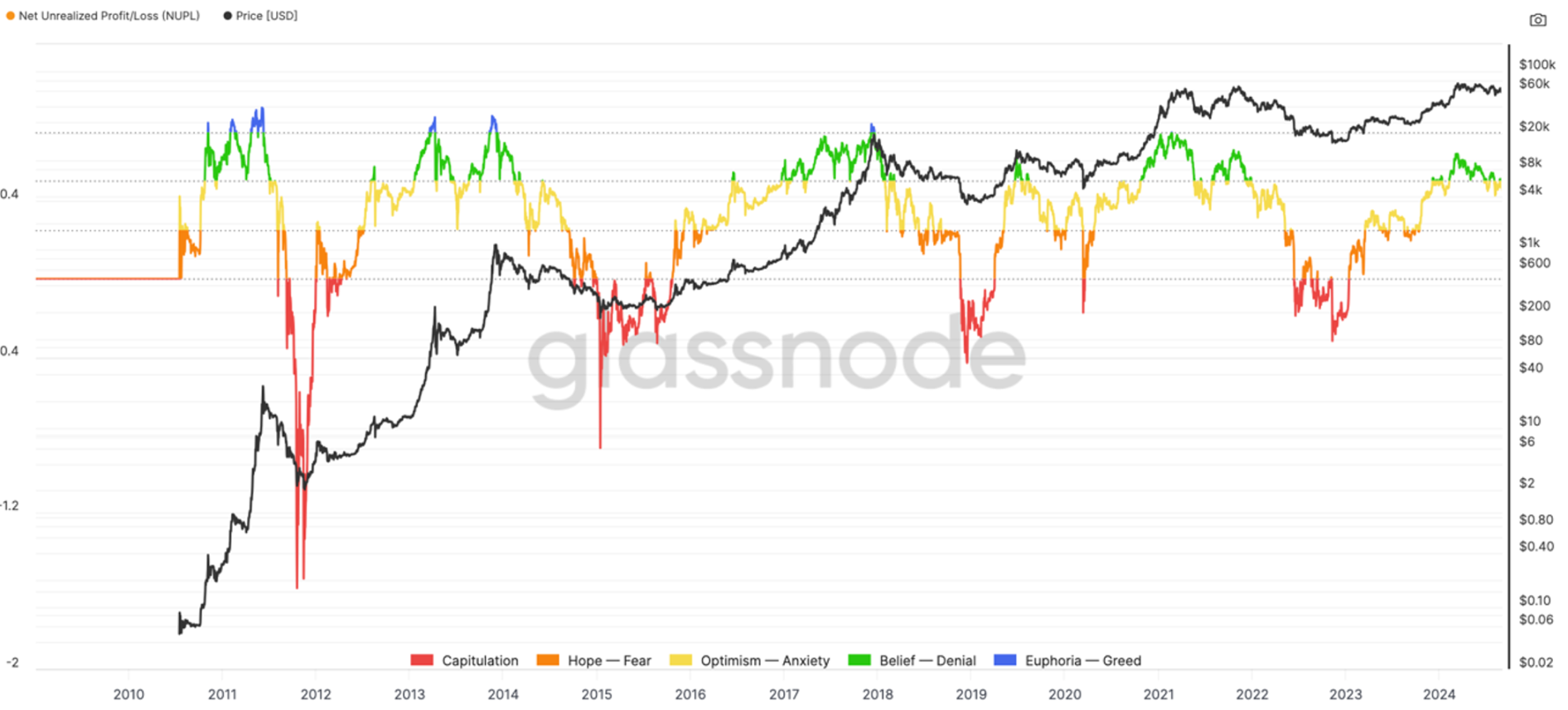

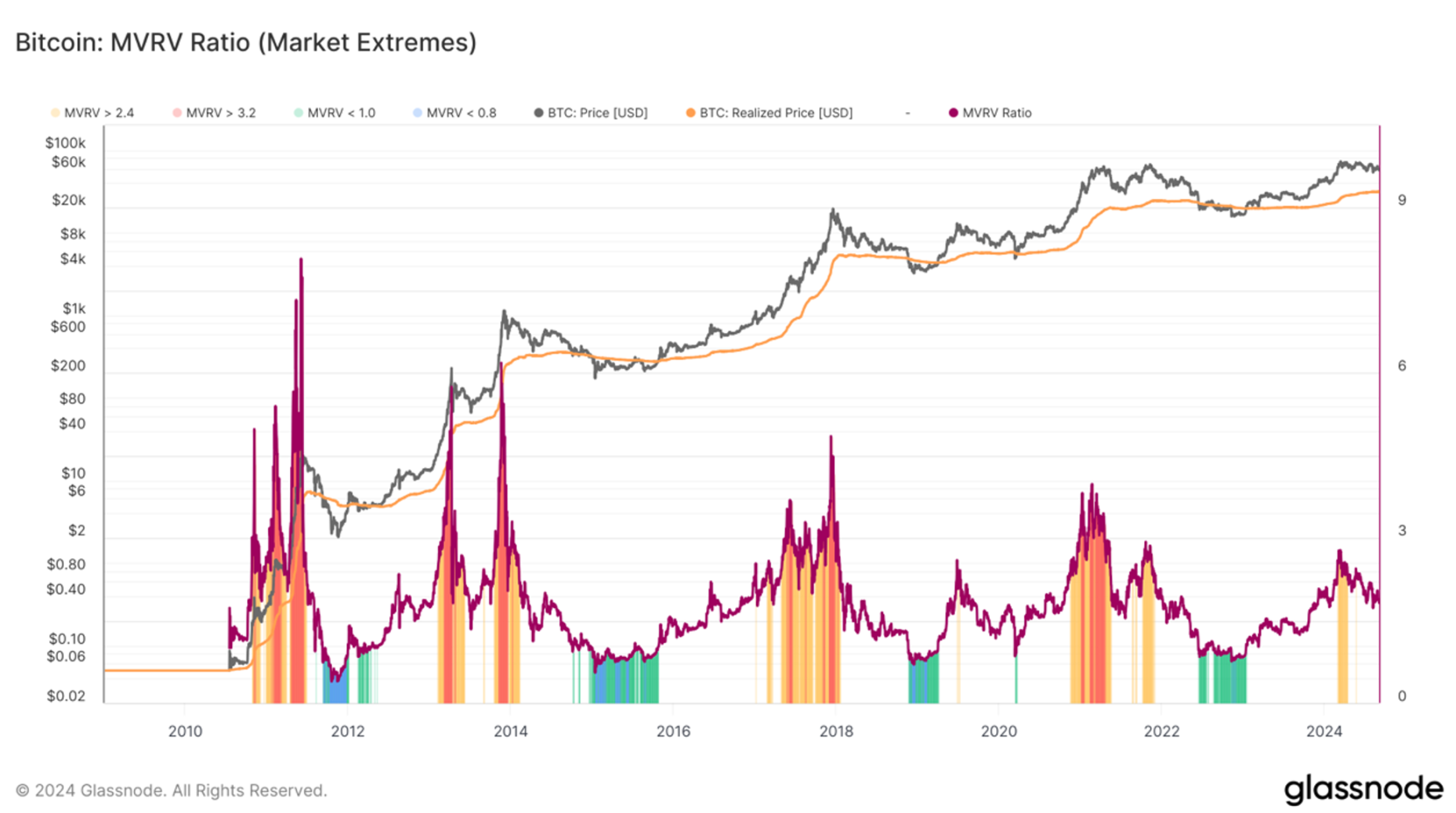

In terms of on-chain indicators for BTC, the unrealized profit/loss of BTC is currently at a neutral level of around 0.5 (in the optimistic-anxious stage), consistent with the mid-to-late stage of the bull market. The peak in March was 0.63, also lower than the peak of 0.75 in the previous cycle. The MVRV indicator also reflects the same situation, with a peak of 2.75 in March (in the 'gradually high' range), lower than the peaks of previous cycles and of shorter duration. Additionally, the first major uptrend in the first half of the year did not reach the 'extremely high' range as in previous cycles, indicating that the first round of upward momentum in the first half of the year did not match the strength of previous rounds, despite the stimulus of the BTC halving and ETF approval.

Figure 3: Cryptocurrency total market value has pulled back from the March peak of $2.89 trillion to the current $2.1 trillion, with a pullback of 27.3%

Figure 4: BTC unrealized profit/loss is currently at a neutral level of around 0.5, in the optimistic-anxious stage

(Note: BTC unrealized profit/loss is the difference between unrealized profit and unrealized loss, with thresholds set at 0.0, 0.25, 0.5, and 0.75, showing different sentiments throughout the macro BTC cycle.)

Figure 5: BTC MVRV peaked at 2.75 in this cycle in March, lower than the peaks of previous cycles and of shorter duration

(Note: This method calculates the proportion of days in history when the MVRV trading price is lower or higher than certain levels. The standards are as follows: 🔵Extreme low point: MVRV has been below 0.8 on about 5% of trading days; 🟢Gradually low: MVRV has been below 1.0 on about 15% of trading days; 🟠Gradually high: MVRV has exceeded 2.4 on about 20% of trading days; 🔴Extremely high: MVRV has exceeded 3.2 on about 6% of trading days.)

Key Market Data

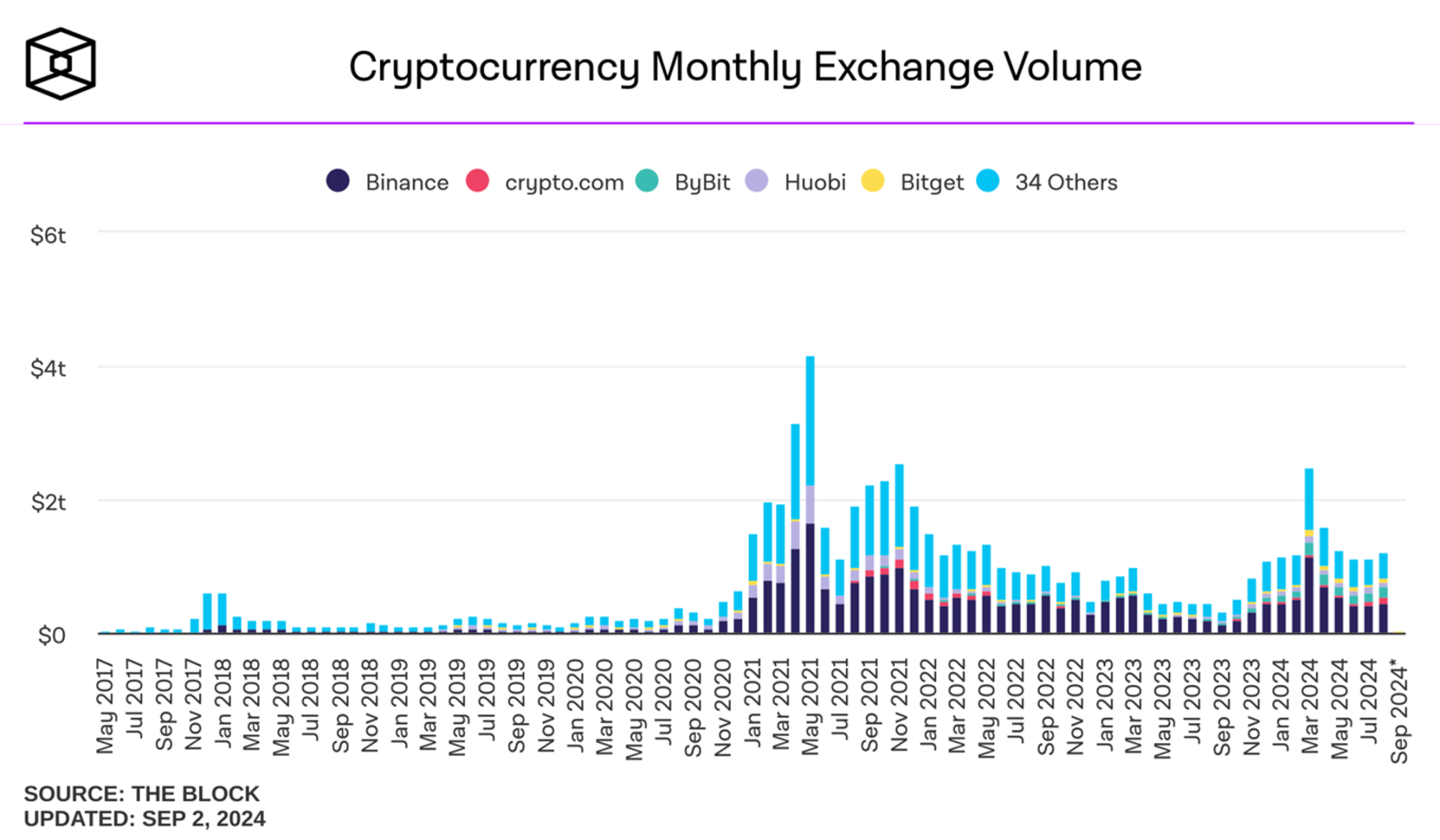

(1) Cryptocurrency Exchange Trading Volume

The peak in March of the first half of the year reached $2.48 trillion, a level close to that of November 2021, and then the trading volume shrank for three consecutive months until a slight recovery began in July.

Figure 6: Monthly cryptocurrency exchange trading volume (in USD)

(2) Total Supply of Stablecoins

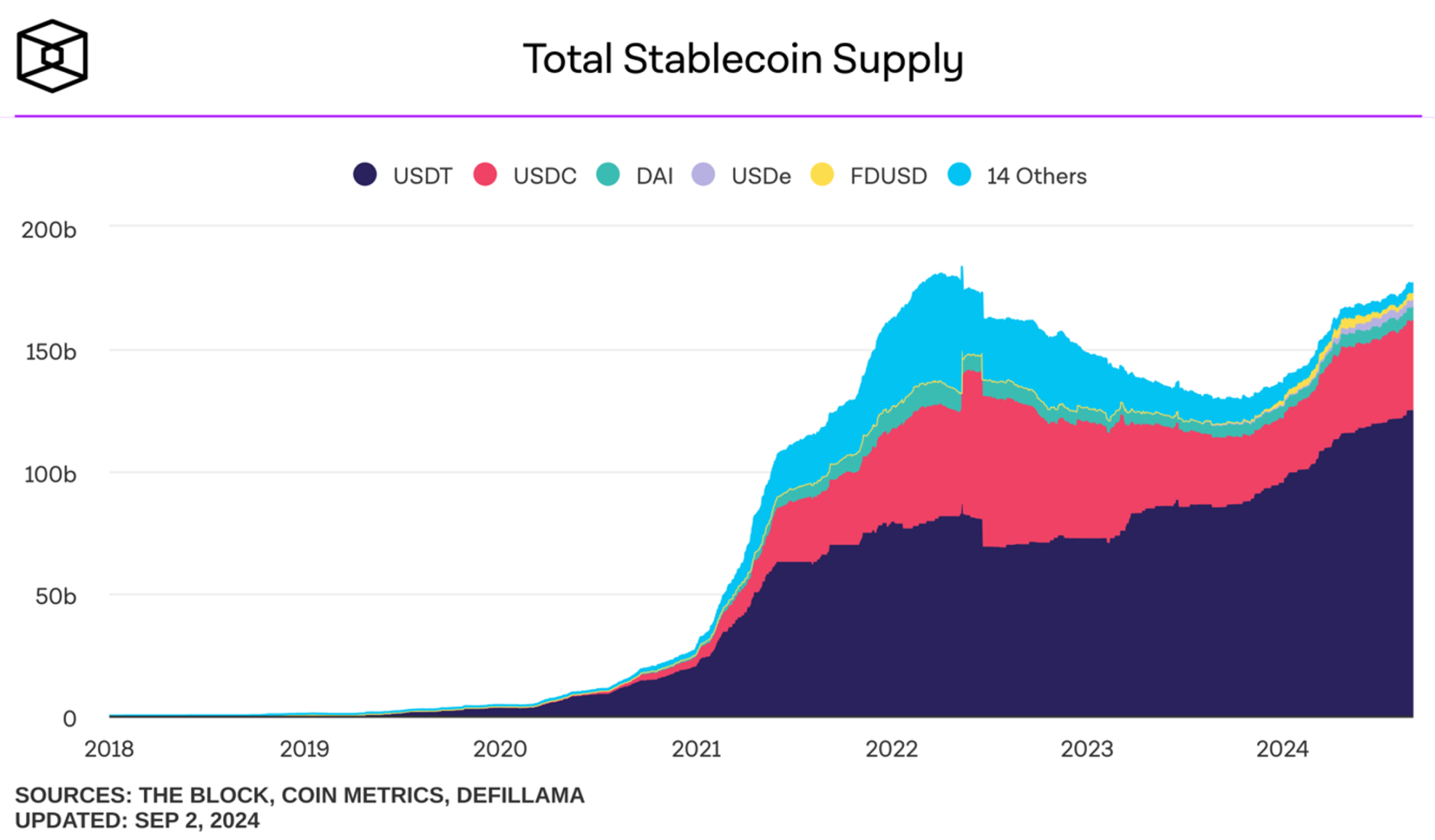

The current total supply of stablecoins is 17.67 trillion, with an overall growth of 15.8% from the beginning of the year to March, growing rapidly. However, the growth slowed after April of this year, and the growth rate began to slowly recover in August, with incremental funds slowly entering the market.

Figure 7: Total supply of stablecoins, with USDT accounting for 70.7% and its share still rising

(3) Spot ETF Trading Volume

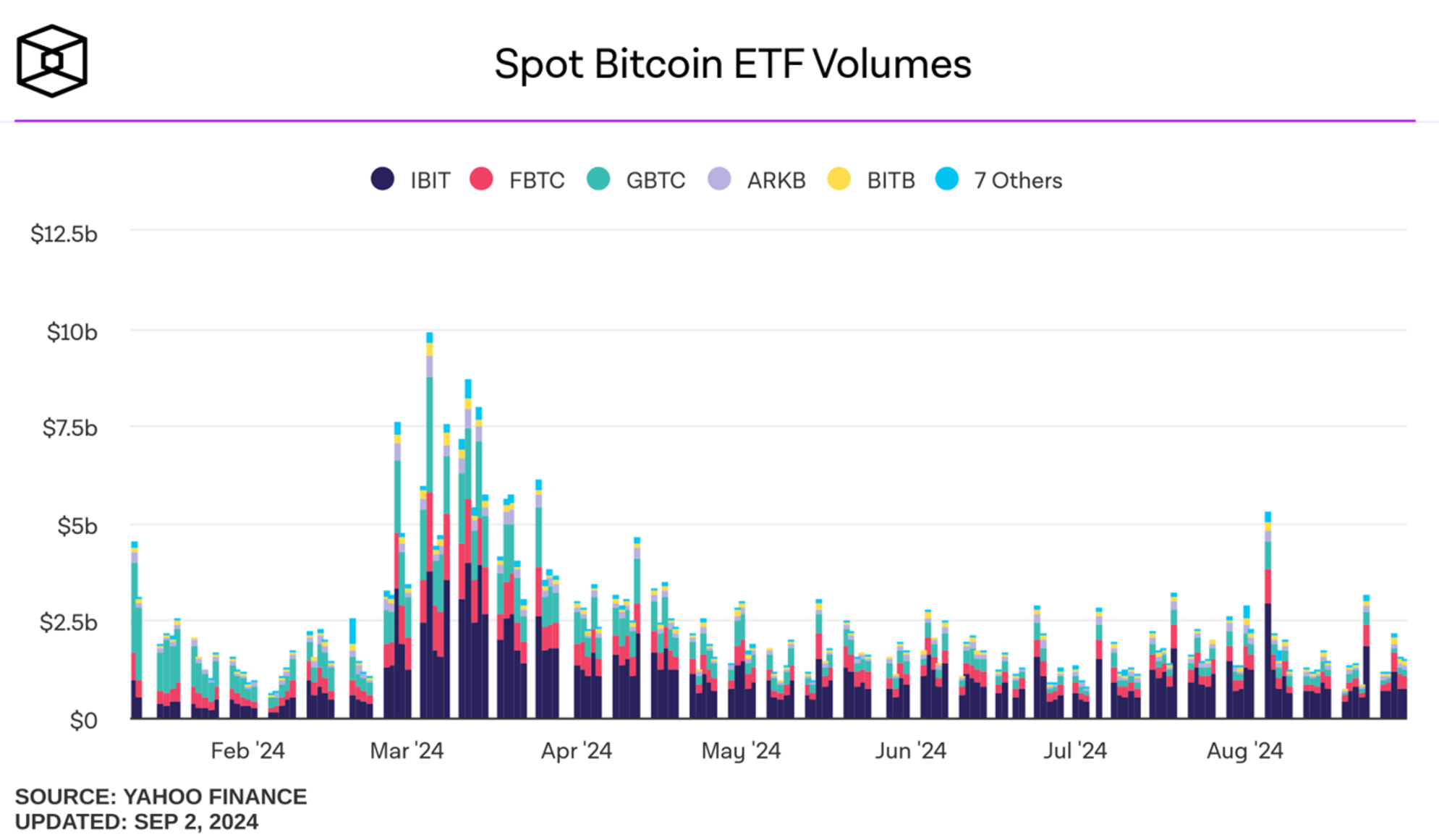

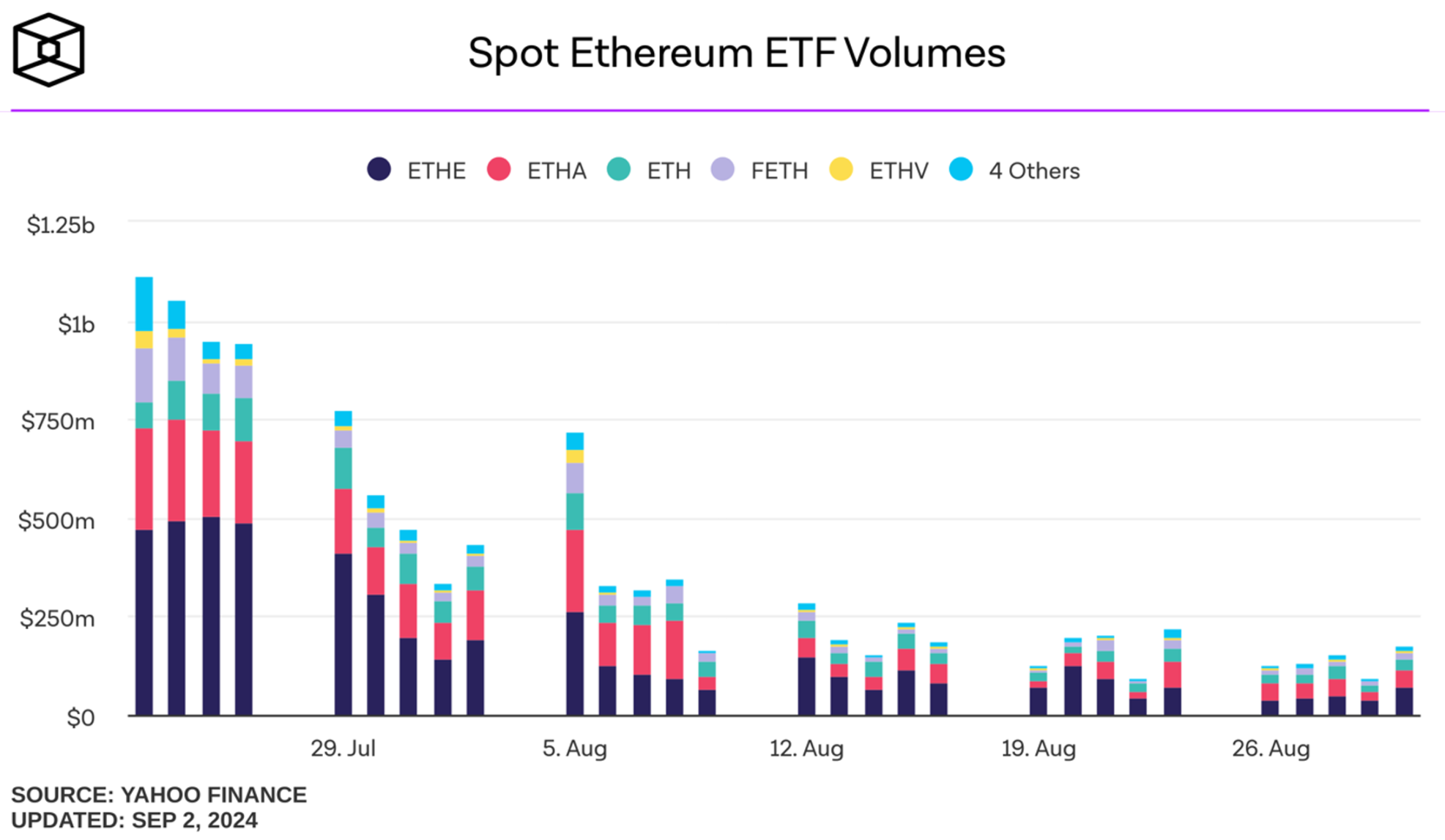

BTC ETF set a single-day net inflow record of $1.05 billion on March 12, and the second-largest net inflow occurred on June 4, at $887 million. Recently, BTC ETF trading volume has remained low, indicating a weakening institutional interest compared to the first half of the year. The situation for ETH ETF is different, as its trading volume has continued to shrink since its launch in July.

Figure 8: Spot BTC ETF trading volume (in USD)

Figure 9: Spot ETH ETF trading volume (in USD)

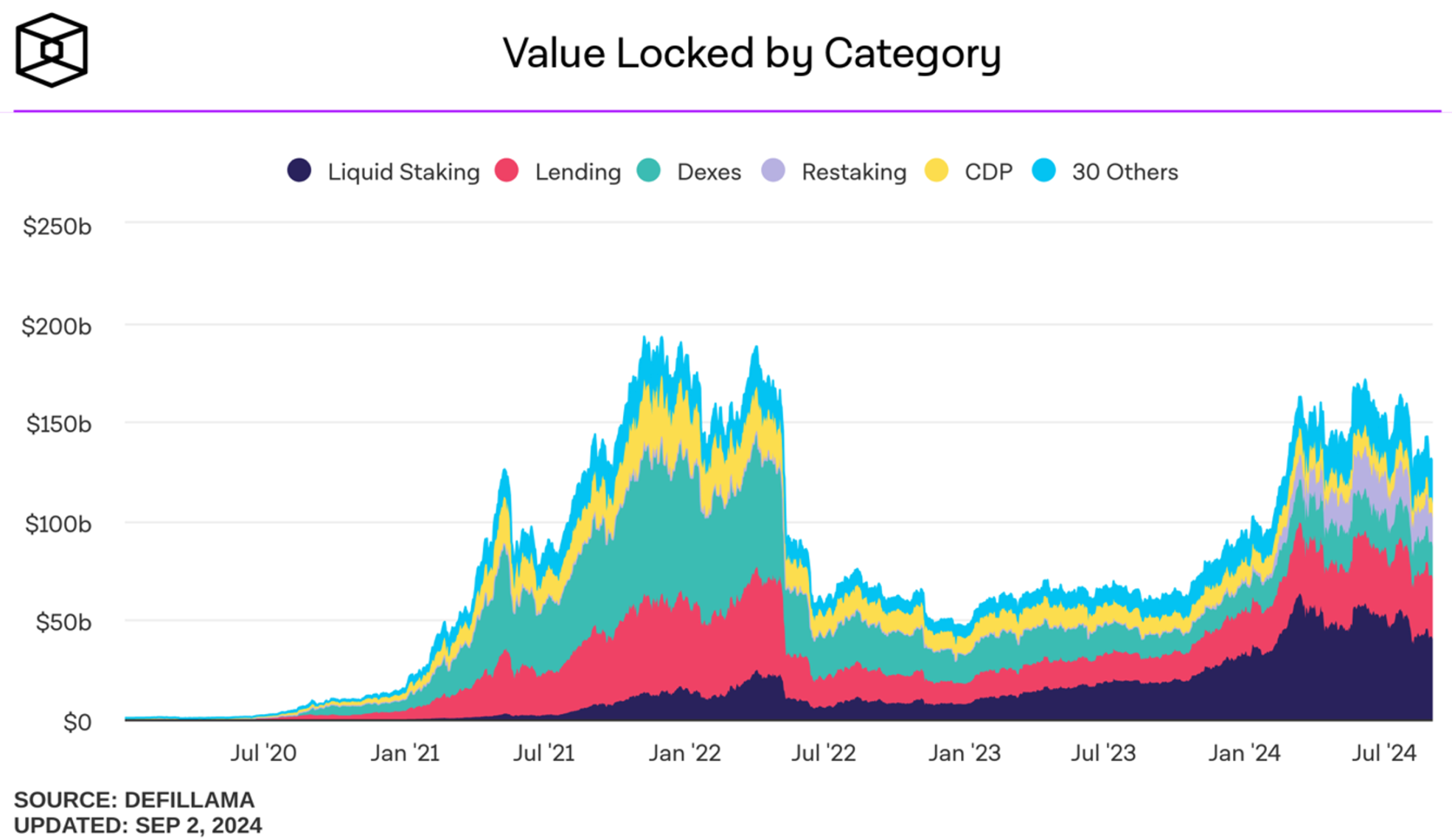

(4) Total Locked Value in DeFi

After the end of the first major uptrend, the total locked value in DeFi has decreased by 30% from the peak, but due to the existence of periodic hotspots in the market, such as the rise of liquidity re-collateralization tracks led by Eigenlayer, the activities of new Layer 2 tokens such as Blast, and the rapid development of the TG public chain The Open Network (TON) ecosystem, there has been an increase in locked value.

Figure 10: Total locked value in DeFi (in USD)

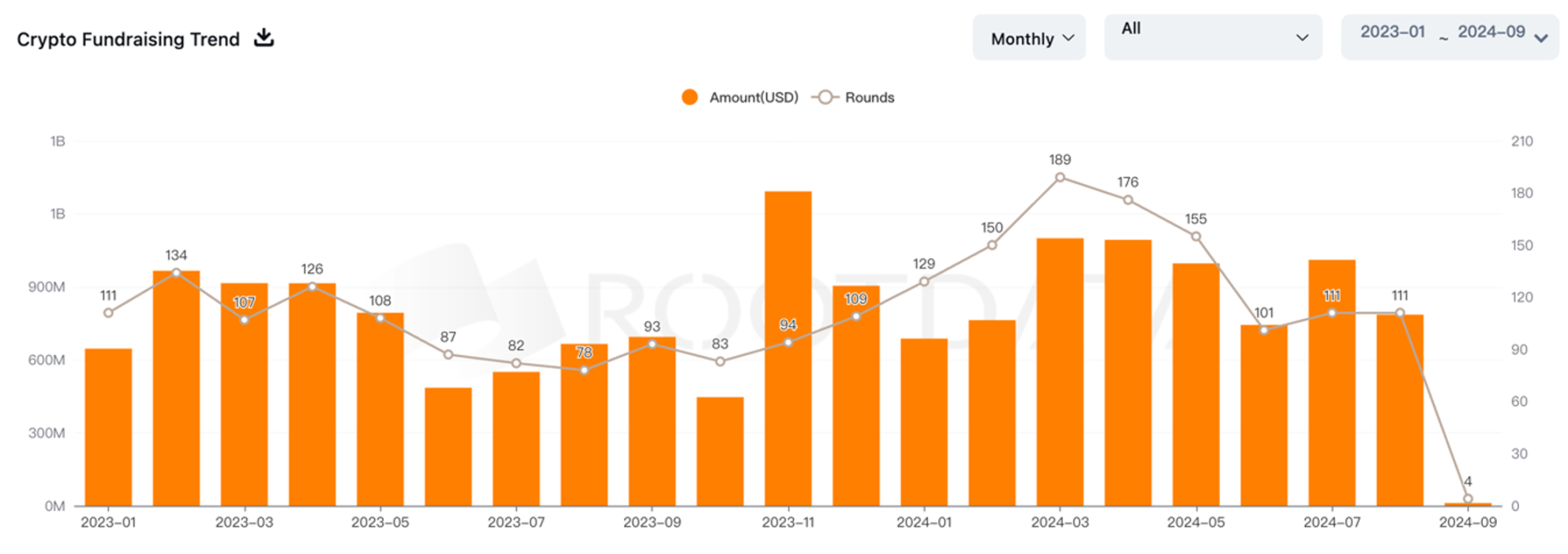

(5) Cryptocurrency Primary Market Financing Quantity

In the first three months of this year, the number of primary market financings showed an increasing trend, reaching a peak of 189 financings in March. Since then, financing activity has declined, and has been relatively stable since June.

Figure 11: Trend of cryptocurrency primary market financing

Summary: Major market indicators have experienced a certain degree of decline since the peak in the first half of the year, but since July, there have been signs of a moderate recovery in exchange trading volume and the total supply of stablecoins, indicating a recovery in market funds and activity. Spot ETF trading volume continues to fluctuate at low levels, and primary market financing activities have not shown a significant increase, indicating a cautious attitude among institutions in the current uncertain macroeconomic and political situation. The DeFi sector has maintained a certain level of total locked value, without a significant decline overall.

II. Politics and War Endow New Characteristics to Cryptocurrencies

U.S. Election

The U.S. election and the cryptocurrency market have a significant mutual influence.

The U.S. election undoubtedly has a broad impact on the economy and financial markets, including a significant impact on the cryptocurrency market. The election results have a decisive impact on the future direction of fiscal and monetary policies, which will also affect the development direction of the cryptocurrency market and determine the position of the United States in the global cryptocurrency market. If the new government adopts loose monetary policies or large-scale fiscal stimulus measures, it may trigger inflation concerns, leading investors to turn to cryptocurrencies as a hedge. Conversely, if policies tend to tighten or regulatory efforts intensify, especially in the regulation of the cryptocurrency market, it will exert downward pressure on cryptocurrency prices.

At the same time, the cryptocurrency industry is trying to play a greater role in politics, especially in the U.S. election. Currently, several major cryptocurrency companies, including Ripple, Coinbase, and Andreessen Horowitz, have invested approximately $150 million to establish a Super Political Action Committee (PAC) alliance to support cryptocurrency-friendly candidates. This action indicates that the cryptocurrency industry is actively shaping the policy environment to promote its development and may have an impact on the election results.

Currently, the cryptocurrency community is waiting for clear positions from the two main candidates on the cryptocurrency market. As of now, Trump himself has publicly expressed his preference for the cryptocurrency industry and envisioned favorable policies, while the Harris team has also privately courted the cryptocurrency community but has not made a public and clear statement of preference. As Sean Farrell, Vice President of Digital Asset Strategy at Fundstrat, stated in Morning Brief when analyzing the political future of Bitcoin: cryptocurrency has become a partisan issue, and certain qualities unique to Bitcoin are likely to align with the interests of the right side of the political spectrum. However, it is certain that this technology does involve many themes related to access to banking services and holding elites accountable, which also involve many themes that the left may identify with.

It can be expected that cryptocurrencies will likely be a bipartisan issue in the future, and with political endorsements, the cryptocurrency market will go further.

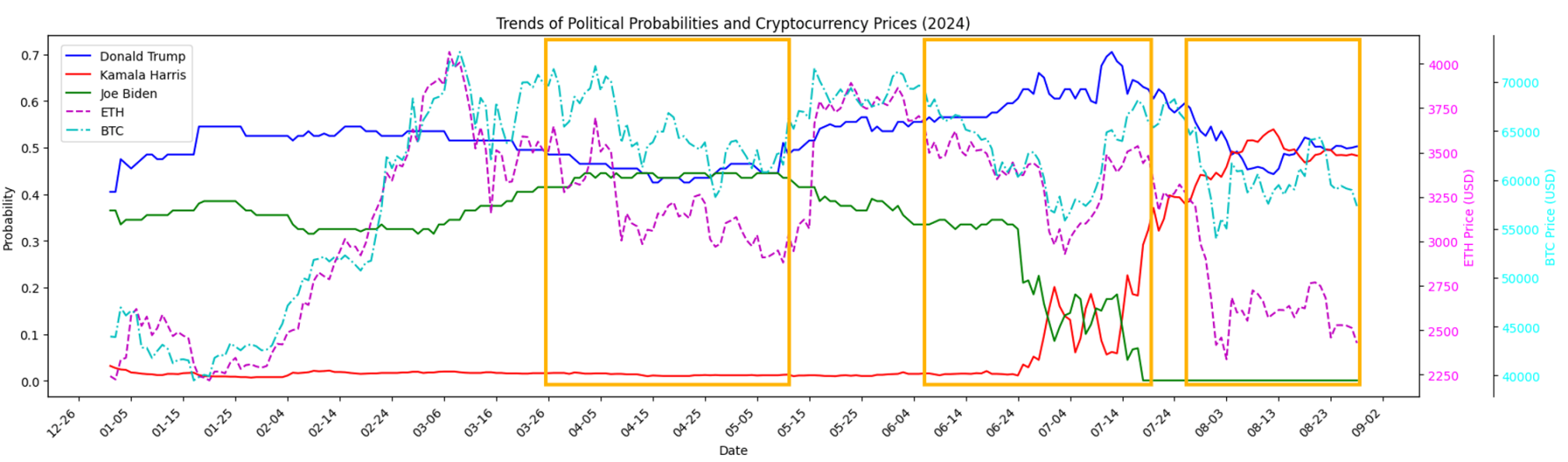

Impact Analysis: According to Polymarket's predictions for the U.S. election and the trend chart of cryptocurrency prices, during the period of overlapping winning probabilities (a period in which the winning probabilities of at least two candidates are similar and cannot be distinguished), BTC and ETH prices are likely to decline.

Table 1: Overlapping winning probabilities of the U.S. election and cryptocurrency price performance

Figure 12: Polymarket's predictions for the U.S. election and cryptocurrency price trends

Conclusion: Before the election results are announced, it is expected that there will be multiple periods of overlapping winning probabilities, during which the probability of a setback in cryptocurrency prices is high. Considering the positions of the two main candidates on the cryptocurrency market, if Trump is elected as the next president, it will significantly benefit the cryptocurrency market; if Harris is elected, the positive impact on the cryptocurrency market will be less significant.

Geopolitics

Geopolitics and the cryptocurrency market have a mutual influence, but compared to the U.S. election, the impact is relatively weak.

On the one hand, the impact of war on the cryptocurrency market is complex and far-reaching, usually affecting market sentiment, demand, and price trends through various channels. The geopolitical tensions, uncertainties, and fluctuations in traditional financial markets brought about by war will affect investor behavior, thereby driving changes in the cryptocurrency market.

On the other hand, due to its anonymity, decentralization, and characteristics as a safe-haven asset, cryptocurrencies have gradually become important tools for all parties in conflicts. These characteristics enable cryptocurrencies to play a special role in wartime, including fundraising, safeguarding property security, and bypassing financial sanctions, thereby affecting both the warring parties and the people in the affected areas.

In the first half of the year, in the conflicts between Israel and Palestine and the Russia-Ukraine war, cryptocurrencies are demonstrating the aforementioned complex characteristics. The new round of Israel-Palestine conflict has resulted in tens of thousands of casualties, and outside the battlefield, the cryptocurrency war between Israel and Palestine continues. Several leading blockchain companies in Israel have initiated the Crypto Aid Israel action, while some Arab charities have also initiated cryptocurrency donations. On the other hand, radical organizations such as Hamas have long strengthened their power through cryptocurrency donations, and Israel and the United States have intercepted with technological advantages. According to public reports, Hamas has confiscated millions of dollars in cryptocurrency, while receiving cryptocurrency donations totaling tens of millions of dollars. In the cryptocurrency confrontation, the Israel-Palestine conflict has become somewhat mysterious. In the Russia-Ukraine war, people in both countries rely on anonymous and decentralized cryptocurrencies to store and move funds. Since the invasion began, the daily trading volume of Bitcoin priced in Russian rubles has increased by 259%; at the same time, in Ukraine, the daily trading volume of the cryptocurrency exchange Kuna has more than doubled. In response to the sanctions imposed by the United States and a group of countries on wartime Russia, the Russian Ministry of Industry and Trade has developed tools to help cryptocurrency miners evade sanctions, becoming a potential safe haven to help Russian oligarchs avoid sanctions.

As a result, there is a trend in which Bitcoin is being used to transfer value in the context of war and Western sanctions.

War and peace have always been eternal topics for humanity, and the Israel-Palestine conflict has been ongoing since 1948, while the Russia-Ukraine war has continued and gradually become normalized. We will see the irreplaceable role of the cryptocurrency market in closer cooperation with the increasingly tense war situation.

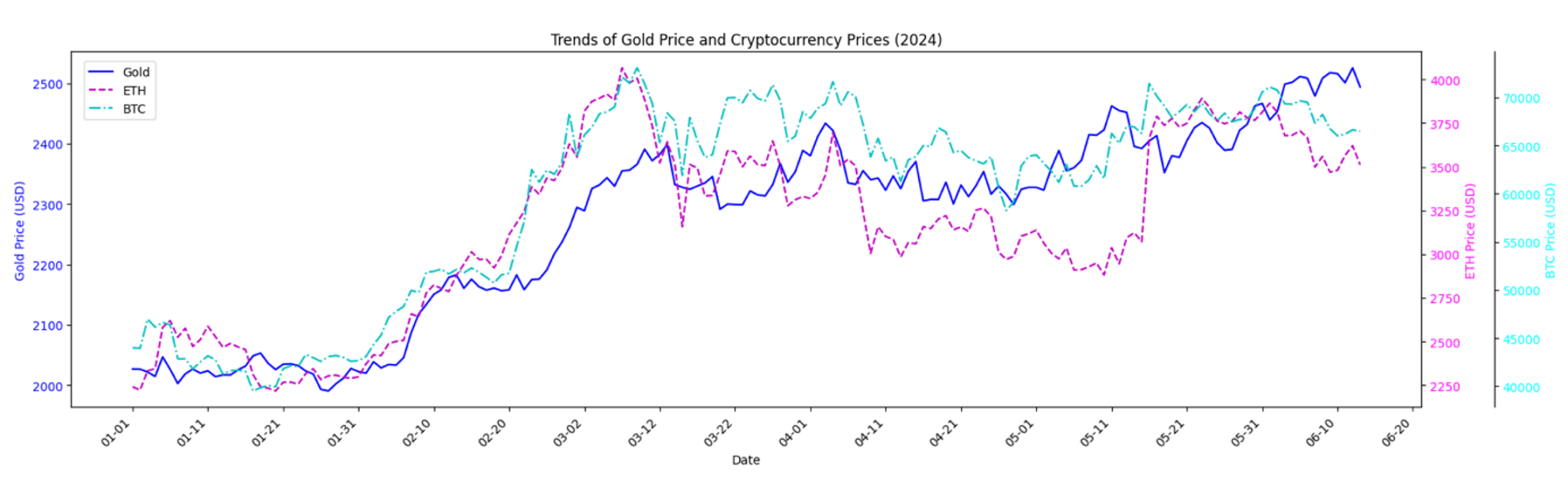

Impact Analysis: Given the highly positive correlation between the price of gold and the war situation, we consider it as an indicator that indirectly reflects the war situation. According to the trend chart of gold prices and cryptocurrency prices, it is not difficult to find that the price trends of gold, BTC, and ETH show a certain degree of correlation.

Conclusion: Under the mutual influence of geopolitics and the cryptocurrency market, the enhanced role of cryptocurrencies in war has led to a general trend of consistency between the war situation and the price trends of cryptocurrencies.

Figure 13: Trend of gold prices and cryptocurrency prices

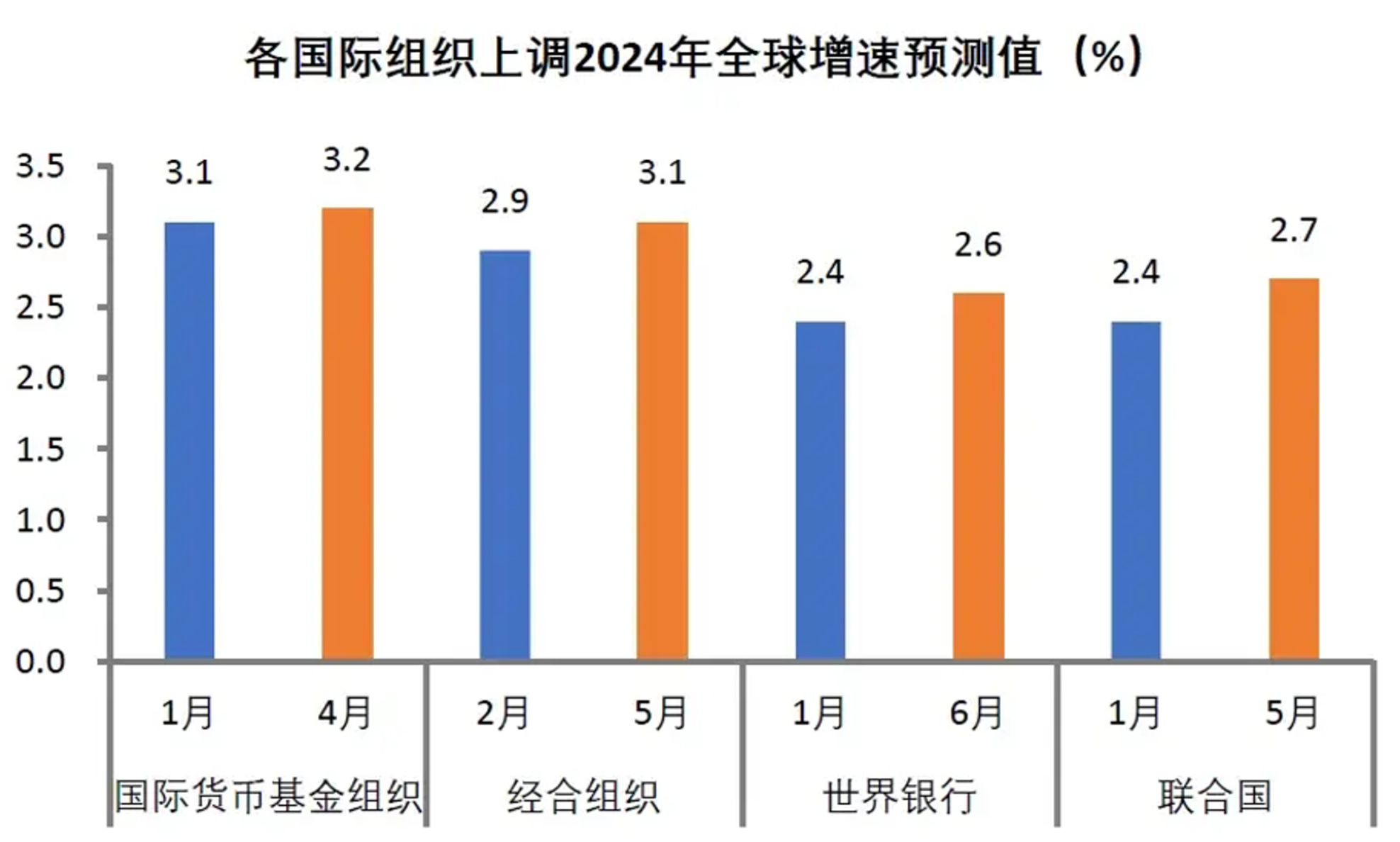

III. Global Economy Slowly Growing, Inflation Stickiness Still Present

In 2024, after multiple rounds of policy adjustments and market fluctuations, the global economy is showing a slow growth trend. Several international institutions such as Goldman Sachs, the World Bank, and the International Monetary Fund (IMF) have released their respective economic outlook reports. Goldman Sachs predicts a global GDP growth rate of 2.6% in 2024, slightly higher than the consensus forecast of 2.1% compiled by Bloomberg. The World Bank expects the global economy to achieve its first stable growth in three years, with a growth rate of 2.6% in 2024, increasing to 2.7% from 2025 to 2026. Although this growth rate is lower than pre-COVID-19 levels, it signifies a gradual recovery of the global economy. The global economy has shown unexpected resilience after the pandemic, leading international organizations such as the IMF and the World Bank to raise their annual growth forecasts, indicating that the global economy still maintains growth momentum. However, the global economy also exhibits a pattern of differentiation, with the U.S. strong and Europe weak, developed economies outperforming emerging markets and developing economies, and facing challenges such as high interest rates, high debt, and geopolitical tensions. Global inflation continues to decline due to improvements in supply and a slowdown in demand, but the stickiness of service prices and supply-side shocks to commodity prices may prolong the decline in inflation.

The U.S. economy continues to show strong growth in 2024, despite facing challenges such as high interest rates and geopolitical risks. Goldman Sachs predicts a 2.3% growth for the U.S. economy, higher than market expectations. The U.S. economy remains robust in a high-interest-rate environment, mainly due to increased consumer spending and a resurgence in business investment. However, inflation levels in the first half of the year remained higher than the Federal Reserve's target, posing a challenge to monetary policy. The U.S. economy in the first half of the year exhibited the following three characteristics:

- Resilient demand despite a slowdown: Consumer demand slowed due to lower income growth and an increase in the savings rate, but a tight labor market and wealth effects supported consumption.

- Resilient private investment: Investment in intellectual property products maintained high growth, and equipment investment is expected to "decline before rising," providing momentum for economic growth.

- Sticky decline in inflation: The Personal Consumption Expenditures (PCE) price index and core PCE slowed at a reduced pace, with the stickiness of service prices becoming the main obstacle to inflation decline.

If the U.S. economy unexpectedly slows down, it will exert downward pressure on risk assets, including BTC.

In 2024, the European economy faces multiple challenges, including the Russia-Ukraine conflict, energy crisis, and geopolitical tensions. Goldman Sachs predicts a 1.0% growth for the eurozone economy in 2024, increasing to 1.6% in 2025. The European economy is experiencing a slow recovery under the impact of the energy crisis and geopolitical risks. However, with the gradual easing of the natural gas shock and fiscal policy support, the European economy is expected to gradually recover. Asian economies play a crucial role in the global economic recovery. China's economy leads major global economies, with an expected growth rate of 4.8%. Countries and regions such as India and ASEAN also maintain stable growth trends. The strong performance of Asian economies is attributed to their relatively ample policy space and stable macroeconomic environment. Emerging markets and developing countries face a more complex economic environment in 2024. Challenges such as high interest rates, debt issues, geopolitical tensions, and climate risks pose serious threats to economic growth. However, some export-oriented economies such as Thailand and Vietnam have performed well in international trade, providing momentum for economic growth.

Global inflation continues to decline but faces challenges. Global inflation is a major focus in the economic field in 2024. Inflation in most countries has decreased since its peak in 2023, but core inflation remains close to the range where policymakers would relax contractionary monetary policies. Major central banks such as the Federal Reserve continue to maintain relatively high policy rates in 2024 to control inflation and maintain financial stability. However, with slowing economic growth and easing inflation pressures, it is widely expected that monetary policies will gradually relax in the future. Global inflation will continue to decline due to the combined effects of supply-side improvements and demand-side slowdown, but the rate of decline may be lower than expected. Energy and food prices will no longer be the decisive factors for the decline in inflation after the relief of supply chain tensions, and service prices, especially housing rents and labor costs, will continue to influence the inflation trend, making the decline process highly sticky.

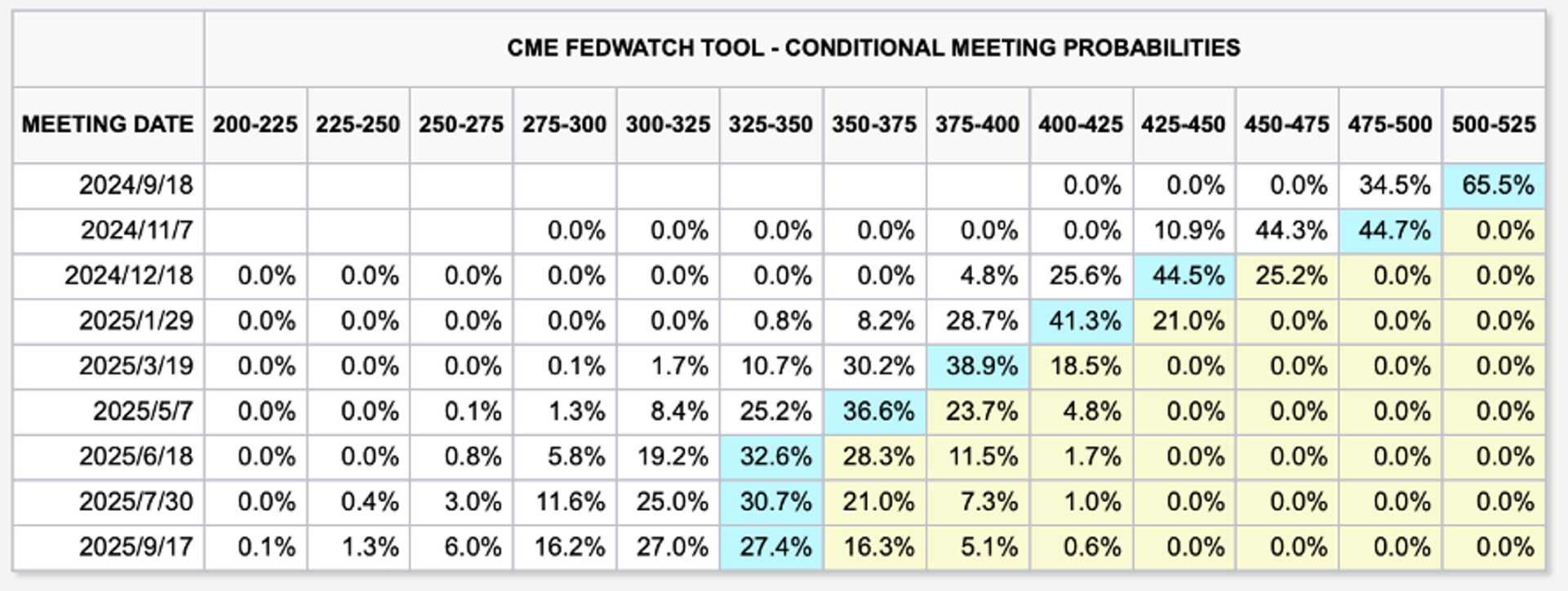

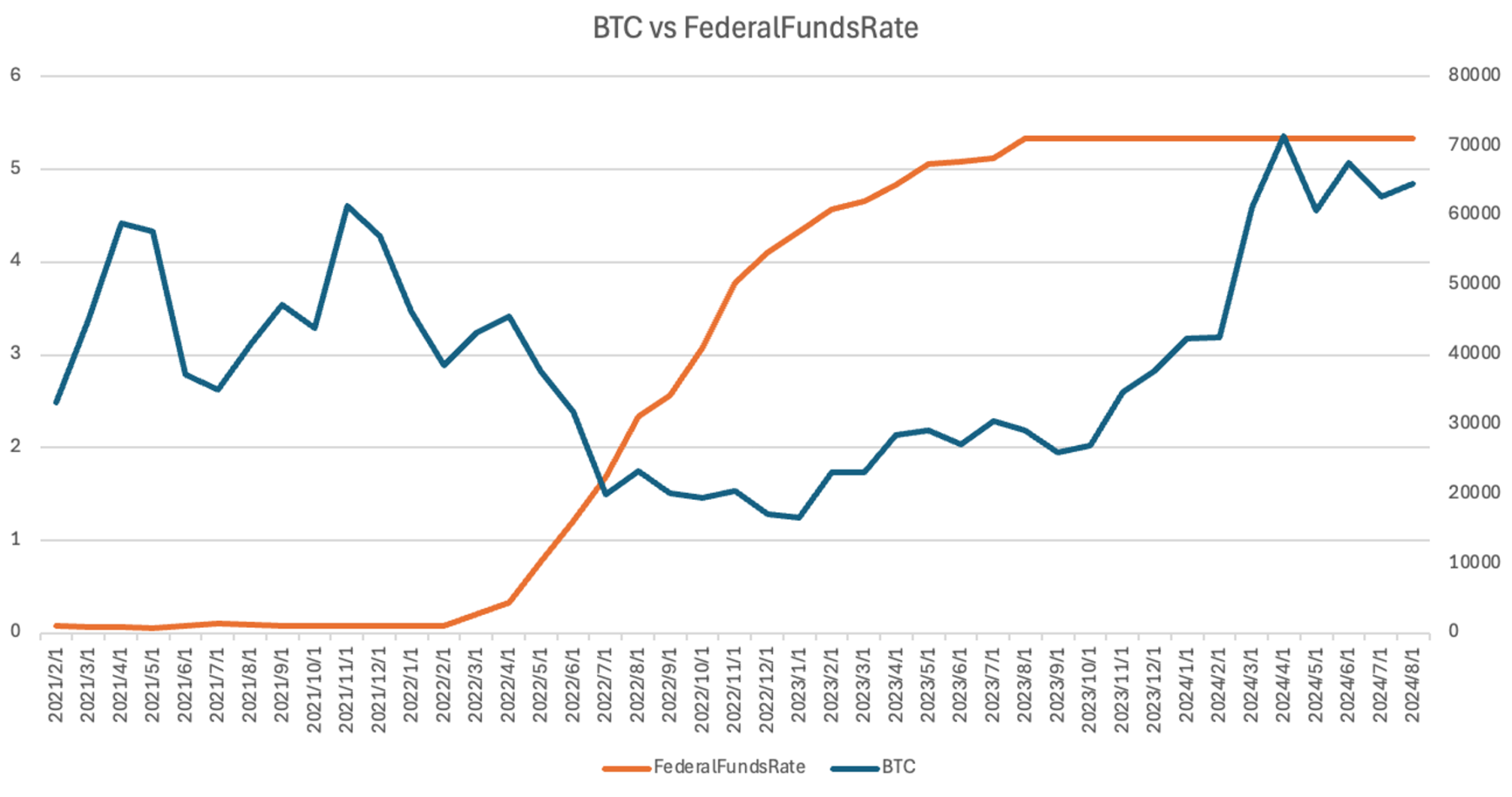

The U.S. dollar index is fluctuating upwards. The main reasons for the strengthening of the U.S. dollar are the unexpectedly strong growth of the U.S. economy and the weak growth of the eurozone, which collectively support the strengthening of the U.S. dollar. Additionally, the delayed timing and reduced frequency of interest rate cuts by the Federal Reserve, as well as the expected interest rate cuts by the European Central Bank, have widened the interest rate differential between the U.S. and Europe, driving the upward movement of the U.S. dollar index. When the interest rate hike began in 2022, the price of BTC plummeted significantly. Historical data shows a clear negative correlation between the price of BTC and the trend of the federal funds rate, and a loose monetary policy environment will help drive up the prices of risk assets such as BTC. The Federal Reserve announced a 50 basis point rate cut at its rate decision meeting this week, officially starting a rate-cutting cycle. The dot plot shows another 50 basis point rate cut this year, with two expected 25 basis point rate cuts later in the year, which will help drive inflows of risk capital and boost the cryptocurrency market.

However, the global economy still faces challenges and uncertainties. Continued high real interest rates increase the cost of debt repayment, add fiscal pressure, and limit fiscal policy space. Geopolitical tensions may impact energy and food supplies, affecting the global economic recovery process. Global trade is driving economic growth. After experiencing low growth in 2023, global commodity trade is expected to achieve positive growth in 2024, supporting the global economic recovery. Despite geopolitical tensions and various trade restriction measures, the prospects for global trade growth remain positive. Labor market shortages in major economies in Europe and the United States have eased, with unemployment rates still at historic lows, providing support for economic growth. Consumer confidence continues to recover, and household consumption expenditure exceeds expectations, becoming an important driver of economic growth.

In summary, the global economy in 2024 exhibits three main characteristics: slow growth, high sensitivity, and deep-seated transformation in a complex and changing environment. Despite facing many challenges and uncertainties, the global economy still demonstrates resilience and growth potential. Assuming a hard landing for the global economy, especially the U.S. economy in the future, will exert certain pressure on risk assets, including cryptocurrencies. However, if the Federal Reserve's future interest rate cuts exceed expectations, it will have a boosting effect on cryptocurrencies.

Approval of BTC/ETH Spot ETFs

Event Overview:

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved a Bitcoin spot ETF. At the end of July 2024, the SEC approved an Ethereum spot ETF. These two decisions mark the formal acceptance of Bitcoin/Ethereum by mainstream financial markets, making investment in these two cryptocurrencies more convenient and standardized. The issuance of Bitcoin/Ethereum spot ETFs injects new institutional demand sources into the cryptocurrency market, significantly increasing the diversity and depth of investments compared to previous cycles. Now, various U.S. institutional investors, from hedge funds to pension funds, can easily enter the cryptocurrency market in a simple and intuitive manner. ETF packaging tools are well-known to institutional investors and are an excellent way to attract conservative investor groups to the cryptocurrency market. Currently, the total market value of Bitcoin ETFs has reached $55.4 billion, and the total market value of Ethereum ETFs has reached $6.8 billion.

Other countries/regions have also shown interest, including Hong Kong's approval of Bitcoin and Ethereum spot ETFs in April. Although the trading volume is relatively limited compared to the United States, this is a step in the right direction. European ETPs and U.S. spot ETFs are essentially the same type of product and have shown significant growth since their launch in 2015.

Documents from the U.S. Securities and Exchange Commission (SEC) show that the largest holders of the U.S. BTC spot ETF are primarily hedge funds, asset management companies, and banks. While it is encouraging that companies like Morgan Stanley are among the top ten holders, it is worth noting that many hedge funds are also among the top ten, and these funds typically focus on short-term strategies rather than long-term holdings.

Impact Analysis:

- Market Reaction: The approval of Bitcoin/Ethereum spot ETFs has attracted broader investor participation in the market, leading to a positive market response. Investor confidence has been strengthened, leading to a rapid increase in Bitcoin/Ethereum prices after the news was released.

- Long-term Impact: The approval of the U.S. Bitcoin/Ethereum spot ETFs has had the greatest impact on increasing the recognition of the cryptocurrency industry in traditional financial markets. For other participants, the recognition and support of BlackRock, the world's largest asset management company, may encourage them to start getting involved in Bitcoin. Many professionals combining traditional finance and emerging technology have opened up a new development path with the support of large-scale participants in the market. The launch of Bitcoin/Ethereum spot ETFs further promotes market maturity and liquidity. With the introduction of more financial products, investors can invest in cryptocurrencies through traditional financial channels, which may bring greater market stability and transparency. Additionally, this development may prompt more financial institutions and investors to focus on and participate in the cryptocurrency market, driving industry development.

Bitcoin Halving

Event Overview:

Bitcoin halving refers to the halving of Bitcoin mining rewards every 210,000 blocks added to the Bitcoin blockchain. This mechanism is a core part of Bitcoin's design, aiming to reduce the supply of new bitcoins every four years to maintain the scarcity and stability of Bitcoin's value. On April 20, 2024, at block height 840,000, Bitcoin successfully completed its fourth halving, reducing the mining reward from 6.25 BTC to 3.125 BTC. The price of BTC on that day was $64,897. Over the past five months, BTC has fluctuated between $49,000 and $72,000, showing significant volatility.

Impact Analysis:

- Market Reaction: Bitcoin halving typically triggers a strong market response. Looking back at previous halvings, each halving event has led to a significant increase in the price of BTC in the medium to long term. However, in the short term, BTC has experienced significant volatility around the time of the halving event. The significant fluctuations in BTC price over the past five months are consistent with historical trends, reflecting the market's sensitivity to short-term price movements.

- Long-term Impact: The halving event increases the scarcity of Bitcoin, helping to maintain or increase its market value. Additionally, the launch of Bitcoin/Ethereum spot ETFs this year and the clear signal of interest rate cuts in the second half of the year in the United States further enhance the recognition of the macroeconomic value of cryptocurrencies. BTC has a strong expectation of significant appreciation. On a non-price level, BTC halving will prompt miners to seek more efficient mining methods to reduce costs, directly impacting miners' economic pressure and technological progress in the mining industry. While the sentiment surrounding the 2024 halving is optimistic, it cannot be guaranteed that its dynamics and impact will be completely consistent with previous halving events. Each halving represents a unique milestone in Bitcoin's development, influenced by changes in market conditions, technological advancements, and regulatory developments. Therefore, while there is optimism about the transformative potential of the 2024 halving, it is important to cautiously acknowledge the inherent unpredictability of market dynamics in navigating the evolving landscape of digital assets.

Mt. Gox

Event Overview:

Due to the theft of 744,000 bitcoins belonging to Mt. Gox exchange customers, Mt. Gox exchange announced bankruptcy in February 2014. This year, after a long wait of 10 years, the trustee of Mt. Gox announced the commencement of the repayment of Bitcoin (BTC) and Bitcoin Cash (BCH) in early July 2024. Currently, the total amount of recovered currency has exceeded 141,686 BTC, with nearly 109,315 BTC already redistributed to creditors, reaching a repayment progress of 77%. Another 32,371 BTC will also be allocated soon.

Impact Analysis:

- Market Reaction: During the repayment process of Mt. Gox, the price of Bitcoin has been fluctuating between $68,000 and $66,000. The selling pressure brought to the market by Mt. Gox's compensation has actually been less than expected. Looking at the distribution of Bitcoin UTXO age, nearly 70% of the BTC has been held for over a year, indicating that most investors have confidence in the long-term value and potential of Bitcoin. This means that even in the face of market fluctuations or downturns, panic selling is unlikely, providing a certain degree of price support for the Bitcoin market. However, not all Mt. Gox creditors will immediately sell Bitcoin upon receiving compensation, so the selling pressure may not be as significant as expected, but it has indeed brought some negative impact on market sentiment. Especially in the late July repayment, accompanied by a significant drop in BTC price, the event has caused a certain degree of panic in the market.

- Long-term Impact: The commencement of the repayment work for Mt. Gox creditors is a major victory for them. Given the significant price increase over the past decade, it is foreseeable that recipients may trigger some selling pressure. The Mt. Gox event itself has caused a crisis of trust in certain cryptocurrency projects, leading to significant price fluctuations in related crypto assets. Investors have become more cautious about cryptocurrency projects, and there is increased attention to the transparency and compliance of projects. This event may prompt regulatory authorities to conduct stricter reviews and regulations of cryptocurrency projects, driving the industry's self-cleansing and compliance development. Additionally, the event has prompted the industry to enhance investor protection and improve the transparency and legitimacy of projects. This event may have a profound impact on the trust and stability of the cryptocurrency market, driving the establishment and improvement of industry standards.

German Government Sell-off

Event Overview:

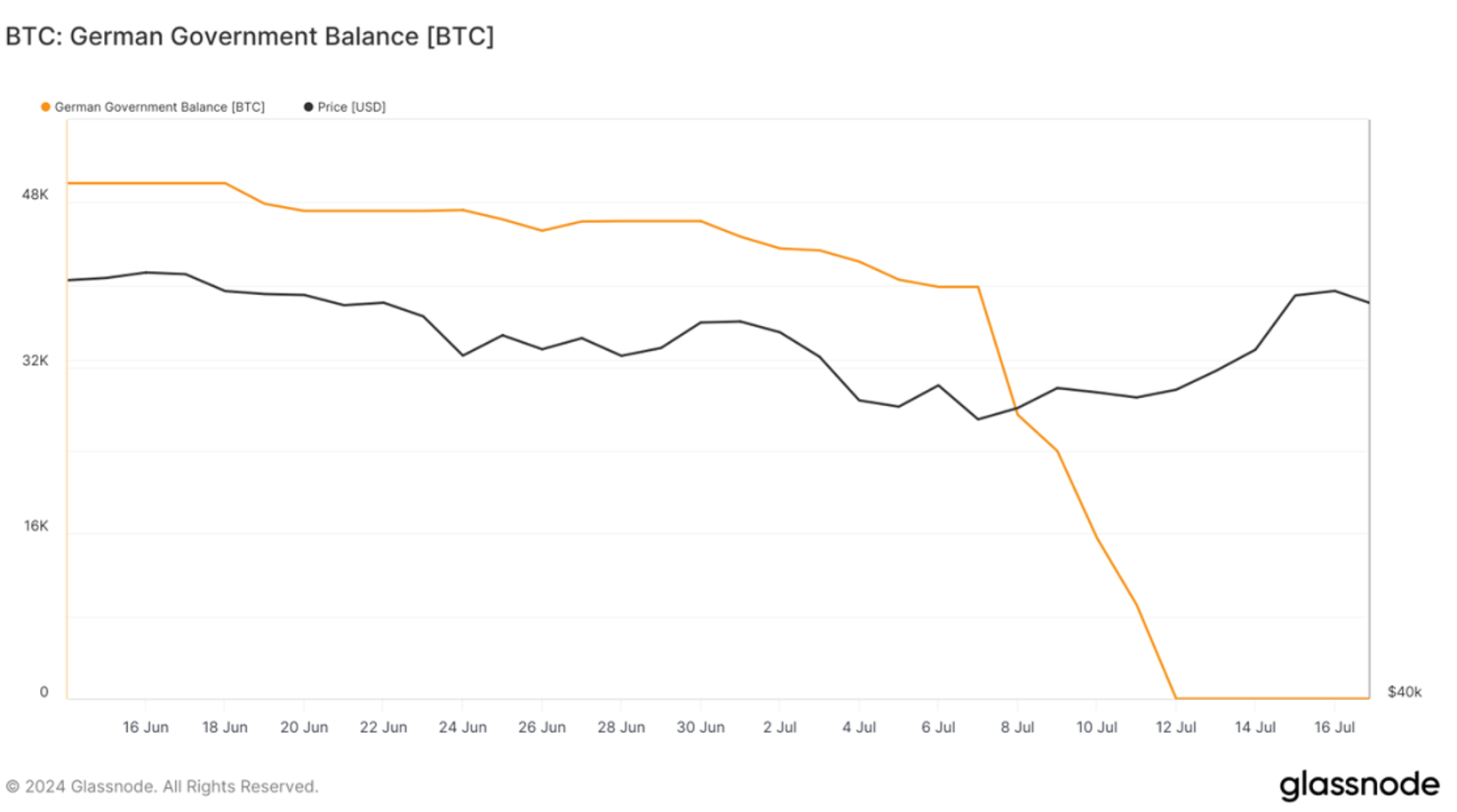

The German government continued to sell Bitcoin in late June, with a significant increase in sales starting from July 8th. The sell-off continued until July 14th. The assets sold by the German government were nearly 50,000 bitcoins confiscated by the Saxony state police in mid-January this year, valued at approximately $2.2 billion at the time. This massive Bitcoin reserve managed by the German Federal Criminal Police Office has attracted widespread attention due to its scale and legal implications.

Impact Analysis:

- Market Reaction: The timing of the German government's sell-off news shows a temporal correlation with the decline in BTC, causing a certain level of spreading panic in the market and leading to a vicious cycle.

Table 2: Timeline of German Government Sell-off

Figure 19: German Government BTC Holdings and Bitcoin Price

- Long-term Impact: The significant sell-off of Bitcoin by the German government is considered a key factor in the substantial price decline during this period. This event has sparked widespread attention and panic in the market, leading to investors selling off their Bitcoin and other cryptocurrencies. It is evident that the cryptocurrency market is highly sensitive to major unexpected events, and any large-scale operations by governments or institutions can quickly impact market sentiment and price trends. This event not only reflects the market's vulnerability but also underscores the need for investors to maintain a cautious attitude when facing major news.

Different from Previous Cycles

Institutional Funds Entering the Market

With the approval of ETFs in the first half of the year, institutional funds entering the market, the microstructure of the market is different from previous cycles. Although the majority of participants in the cryptocurrency market are still retail investors, the proportion of BTC ETFs to total market value is 4.88%, and the proportion of ETH ETFs is 2.4%. As the ETF scale increases, institutional participation in the market is gradually deepening, which may change the previous market pattern to a certain extent.

BTC Dominance and ETH's Decline

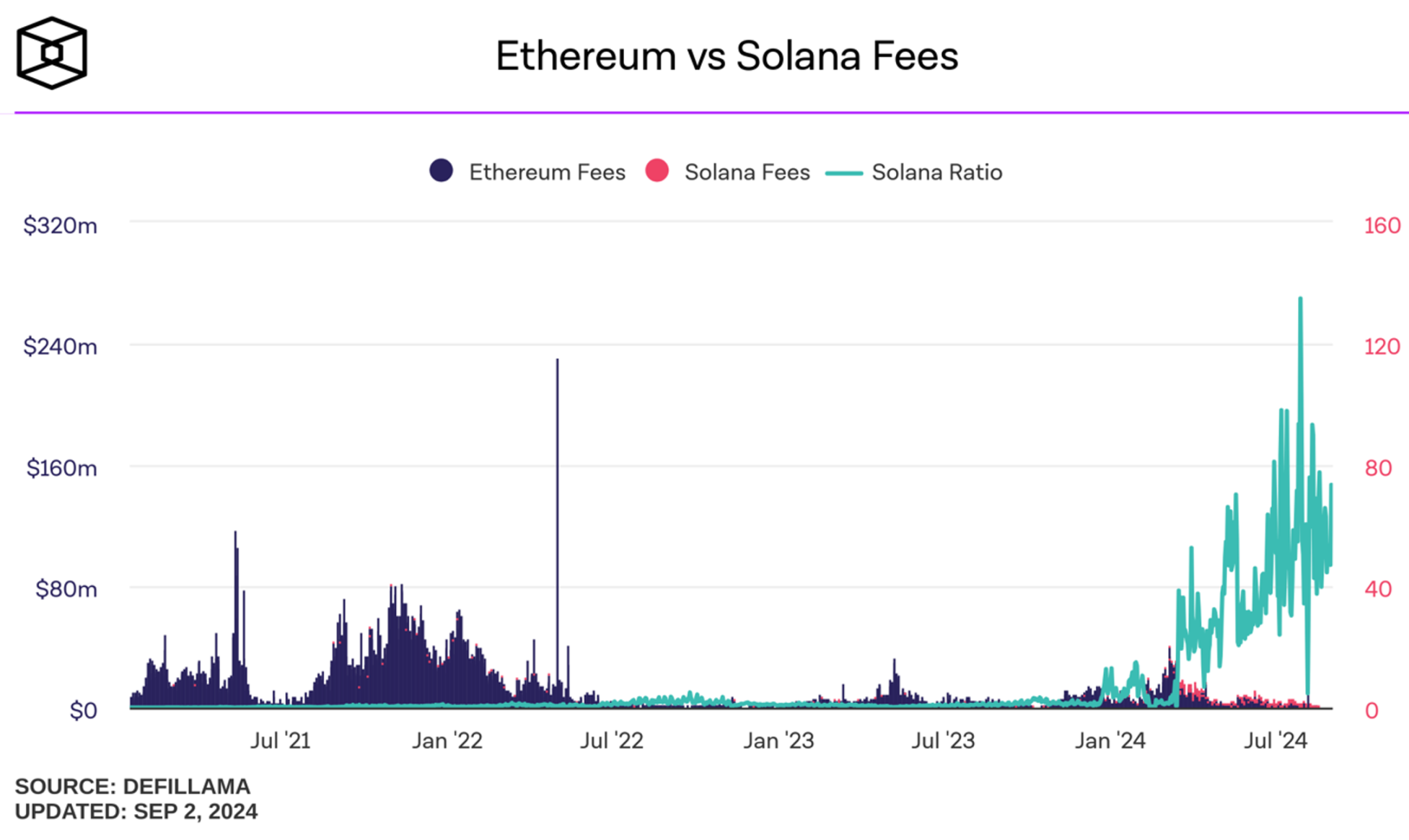

This year, BTC's market dominance has continued to rise, from 52% at the beginning of the year to the current 56%, maintaining its strong position as a core asset. However, ETH's market dominance has decreased from 16% at the beginning of the year to the current 14%, and has also declined compared to the previous cycle's market share of 17%-19%. ETH is facing multiple challenges: on one hand, it has been facing continuous selling pressure since the launch of ETH ETFs, and the emergence of new narratives such as L2s and liquidity re-collateralization has not been able to boost ETH prices, indicating that ETH's ability to capture value within its ecosystem is relatively limited; on the other hand, it needs to address the challenges from new emerging public chains such as Solana and TON. Since March, the ratio of Solana's daily network fees to Ethereum has been fluctuating and rising, currently increasing from around 5 at the beginning of the year to around 25, with a peak of 135, indicating that the level of activity on the Solana network is gradually surpassing that of Ethereum.

Figure 20: BTC Market Dominance

Figure 21: Ethereum and Solana On-chain Network Transaction Fees (USD)

(Note: Solana Ratio is the ratio of Solana's daily network fees to Ethereum)

Meme Taking the Lead

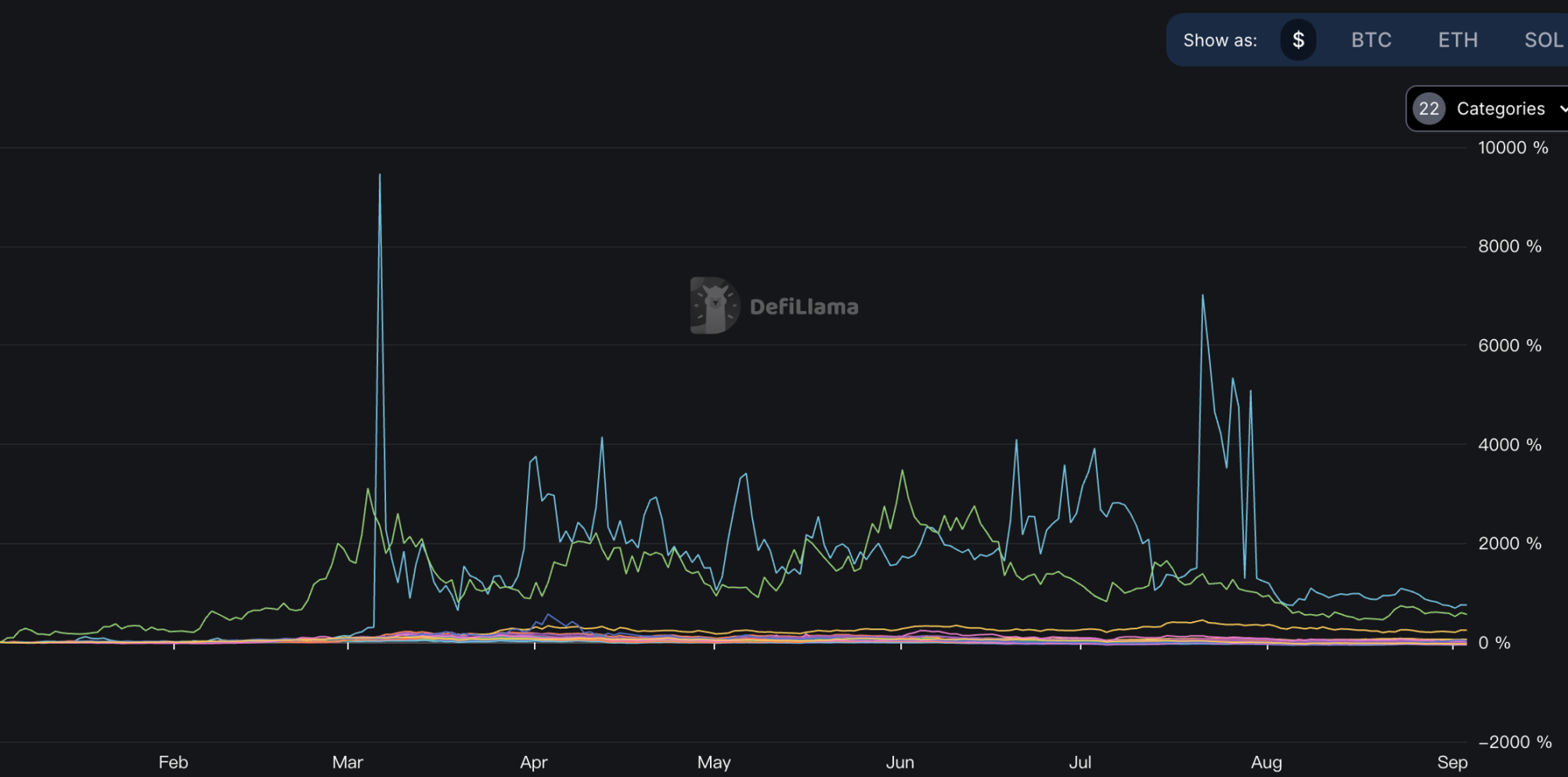

Meme is one of the most prominent sectors in this cycle, rising approximately 1 week ahead of BTC during the uptrend in March. The returns of the Meme sector this year have reached 757%, with a peak of 956%, ranking first. The second-highest return is related to the election, with a return of 568% this year.

Figure 22: Returns of Popular Narrative Sectors This Year, Meme sector with a return of 7.57 times ranks first

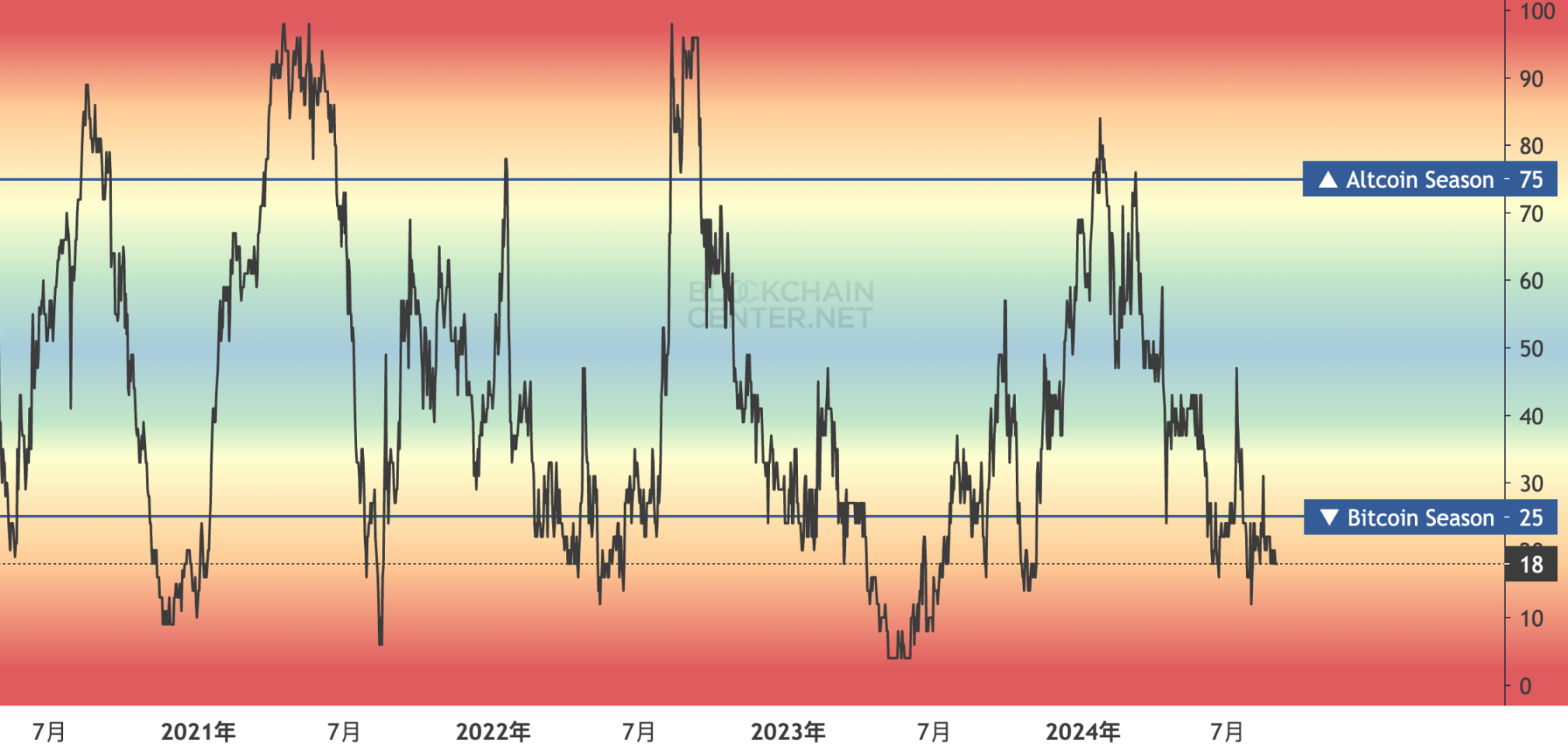

Weakened Altcoin Season

During the uptrend in the first half of the year, the peak of the Altcoin Season index was far below the levels of previous cycles. Given the following reasons, whether there will be another Altcoin Season in the latter part of this cycle is still uncertain, and if it does occur, the intensity is expected to be reduced: 1. BTC's strong dominance in this cycle; 2. As institutional entities gradually become more prominent, their risk appetite is generally lower than that of retail investors, which may lead to profits from Bitcoin Season not necessarily flowing into Altcoins but being converted into stablecoins or exiting directly.

Figure 23: Altcoin Season Index

Outlook for the Next Six Months

Looking ahead to the next six months, the cryptocurrency market will present a complex and dynamic development trend under the combined influence of macro liquidity factors, the U.S. election, new narratives, and other factors.

Macro Factors

The liquidity of the U.S. dollar will continue to be the primary driving factor for the direction of the market in the subsequent trend, as BTC's historical price trends have shown a high sensitivity to this factor. Under the influence of factors such as inflation pressure, uncertainty in interest rate policies, and global liquidity tightening, the volatility of traditional financial markets may transmit to the cryptocurrency market. In the short term, the rate-cutting cycle has already begun, but the Federal Reserve remains cautious and flexible in the magnitude and speed of rate cuts. In addition, the short-term effects of positive news from a messaging perspective have diminishing marginal effects, increasing the probability of continued volatile market conditions in September and October. In the medium to long term, given the negative correlation between BTC prices and interest rate levels, as loose policies gradually take effect and market sentiment improves, the actual inflow of funds from more institutional and retail investors into the market will drive the second wave of price increases in this cycle.

Election

According to current polling results, there is still significant uncertainty about the election results before November. The impact of cryptocurrencies on this election seems to be more important than in the past. Although it is difficult to estimate the specific scale of campaign funds supported by cryptocurrencies, in terms of crypto-friendliness, Republican candidate Trump is evidently closer to the crypto community. In the short term, before the dust settles on the November election, the market will continue to trade based on messaging: positive news related to the election, especially those related to Trump, will significantly stimulate market uptrends, while during the period of close election, prices may face downward risks. In the medium to long term, only the actual implementation of policies related to BTC (such as using BTC as a reserve asset) will truly impact the real buyer demand in the market and form the driving force for medium to long-term price increases.

New Narratives

BTC Scalability and BTCFi

The first half of the year has witnessed the prosperity of memes and the rapid development of the BTC network ecosystem. With the gradual implementation of some BTC scalability solutions in the second half of the year, BTC scalability and BTCFi (Bitcoin decentralized finance) may become new narratives. This could introduce more use cases for Bitcoin, attract more users, and help Bitcoin transition from being "digital gold" to "digital financial infrastructure."

Connecting to the Physical World - DePIN

DePIN (Decentralized Physical Infrastructure Networks) aims to connect physical infrastructure through blockchain technology and is one of the most promising directions for the large-scale application of blockchain. As the infrastructure matures and the crypto community expands, DePIN will once again come into the public eye.

Conclusion

Looking back at the historical BTC halving cycles, historically, new highs tend to occur 12-18 months after the halving. Looking ahead to the next six months, the cryptocurrency market will exhibit a variable trend under the combined influence of macroeconomics, the U.S. election, and emerging narratives: due to the uncertainty of interest rate policies and election results, there is a high probability of continued volatile market conditions in September and October. However, after November, with the gradual implementation of loose policies and the settling of the election results, the inflow of institutional funds and the incremental retail demand brought by new narratives will drive the second phase of the uptrend in this cycle. It is expected that the peak of this cycle will be between $100,000 and $120,000, with a higher probability in the first half of 2025 on the timeline. Compared to previous cycles, the volatility of this cycle has decreased based on the first half of the situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。