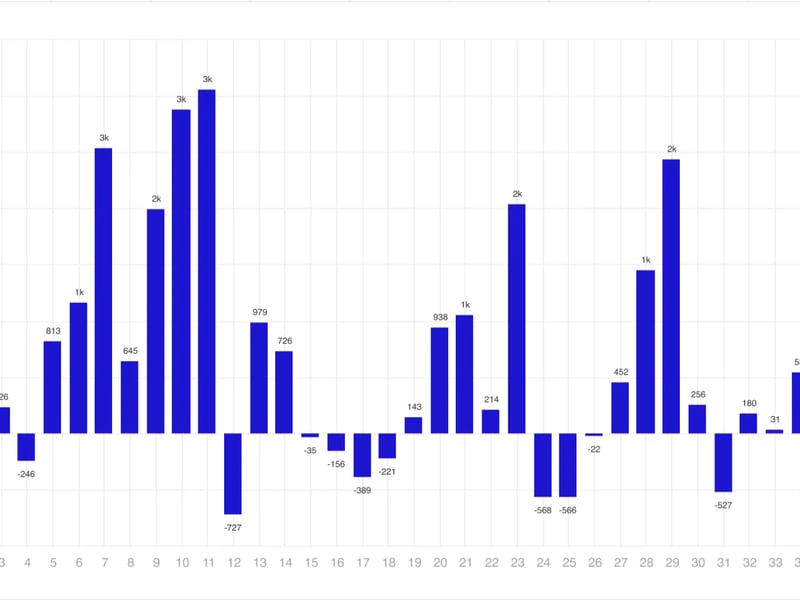

Digital asset investment products experienced a second straight week of inflows, adding a net $321 million, according to crypto asset manager CoinShares.

CoinShares attributes the performance to the 50 basis-point interest-rate cut by the Federal Reserve, the first time the U.S. central bank has reduced the cost of borrowing in four years.

Bitcoin (BTC)-linked products led the inflows with $284 million, while their ether (ETH) equivalents saw outflows of $29 million. This was the fifth consecutive week that ETH products registered outflows, even as the second-largest cryptocurrency by market value led gains after the Fed move.

"This is due to persistent outflows from the incumbent Grayscale Trust and scant inflows from the newly issued ETFs," CoinShares wrote on Monday.

Ether exchange-traded funds have consistently underperformed bitcoin ETFs since they listed in the U.S. in July. Their first five weeks of trading saw $500 million of outflows, while their BTC counterparts had experienced more than $5 billion of inflows during their first five weeks.

JPMorgan attributed the disparity to bitcoin's "first mover advantage," the lack of staking provision in ETH products and lower liquidity making them less appealing to institutional investors.

Read More: Bitcoin ETFs Are Fine Despite Suffering Their Worst String of Outflows, Says Expert

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。