More than 80% of people believe that this is a scam…

Author: Crypto_Painter

Fun fact: MicroStrategy, led by Michael Saylor, was one of the companies hit hardest by market value shrinkage and losses during the 2000 Internet crisis, and Saylor himself suffered a huge setback in his wealth when the bubble burst.

Now, MicroStrategy's main business is an online AI and data analysis platform, but its official website interface still remains at the level of traditional Internet ToB enterprises;

Apart from holding a large amount of BTC, from my personal perspective, there are hardly any products or technologies that can support MicroStrategy's current market value of over 20 billion USD…

So, we can roughly understand MicroStrategy's stock as a "BTC price-based" enterprise "ETF";

Even so, if we calculate the market value of these BTC at the current price of 63,000 USD, it is only 15.89 billion USD, while its stock market value exceeds 20 billion USD.

At the same time, it is said that MicroStrategy still has 2,000 employees. I am curious, if the company's value comes from BTC, where does the expense for these employees come from? After all, MicroStrategy's self-operated business seems to be losing money.

This leads to a "new-style Ponzi scheme" that was once widely circulated on the internet, known as a "reverse Ponzi scheme";

Traditional Ponzi schemes rely on a large number of new users entering to pay a small amount of returns to old users, forming a pyramid-like fraudulent structure;

The "reverse Ponzi scheme" is when one is both a new user and an old user, and through attracting external investment or loans to raise the overall market value of the fund, this is a structure similar to the "pole-standing method", which is an internal circulation model of "left foot stepping on right foot, spiraling upwards";

Now, let's see if MicroStrategy's behavior fits this pattern?

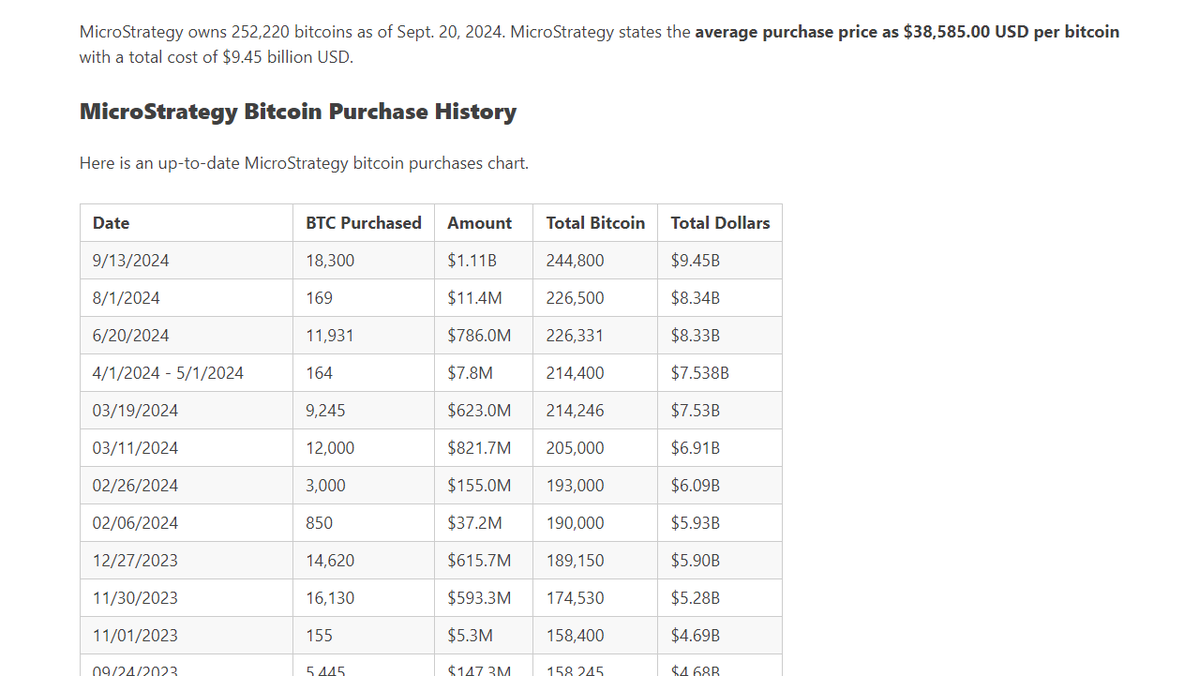

First, since 2020, MicroStrategy has been continuously purchasing BTC, with the most recent purchase occurring on the 13th of September, currently holding 252,220 BTC at an average price of about 38,585 USD.

The funds used to purchase BTC do not come from the company's deposits, but are raised from the market through a convertible bond-like method, where the borrower can obtain an equivalent amount of MicroStrategy's stock at the same price or a negotiated price;

In simple terms, MicroStrategy sells its own stock, uses the money obtained to purchase BTC, and because of the purchase of BTC, the company's stock price has increasingly maintained a high correlation with the price of BTC since 2020, especially in the past six months, the price trend has almost reached complete consistency;

From the perspective of investors or borrowers, this is equivalent to purchasing a derivative of BTC, so if there is a risk, the risk only stays on the fluctuation of the BTC price, and the entire process is completely legal.

But is this really the case?

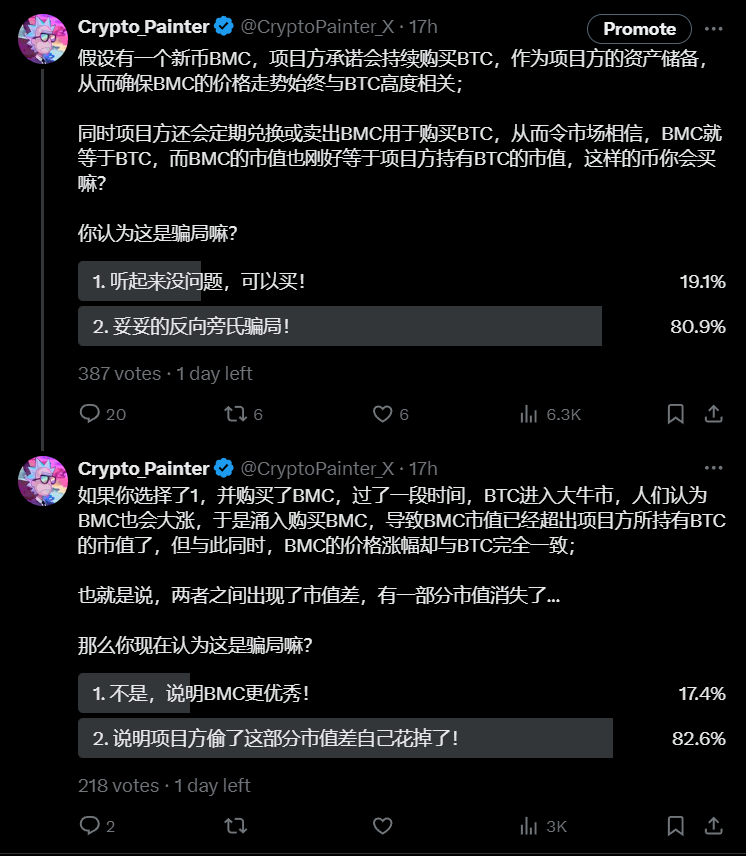

Yesterday, I initiated a poll in an analogous manner, and the results are as follows:

More than 80% of people believe that this is a scam…

Therefore, I am also considering how this behavior of incorporating a large amount of BTC into the company's balance sheet will ultimately end?

The first question is: the loophole between the inflow of funds and the valuation of assets;

Assuming that MicroStrategy raised 2 billion USD from the market to purchase BTC, and after the purchase, both the company's stock price and BTC price have risen, then in fact, the profits behind MicroStrategy have doubled, that is to say, if one only holds BTC or only holds MicroStrategy's stock, a price increase can only bring a 1:1 return, while for MicroStrategy, it can obtain a 2-fold return from the increase in the price of BTC and the stock, that is, a 1:2 return;

From the perspective of investors or borrowers, it is indeed equivalent to buying BTC spot and enjoying the returns, but for MicroStrategy, the coins are in its hands, and the stock price is rising, so the rate of increase in book wealth is twice that of the former.

Not to mention, there may be manipulation behind the act of lending or pledging stocks.

The second question: BTC cannot be increased, but stocks can…

As long as continuous purchases of BTC ensure that the market believes that MicroStrategy's stock price will always follow BTC, then even when the stock price is slightly lower than BTC, there will be a large amount of arbitrage funds entering to repair this short-term discount, the specific operation is to short BTC while going long on stocks, and when the price difference is restored, one can close the position to make a profit (although I think this operation is actually very difficult to execute);

However, this only needs to explain why MicroStrategy's stock price is highly consistent with the price of BTC;

The problem returns to MicroStrategy's stock, does it have a total limit on the issuance quantity? Can MicroStrategy split stocks or issue more in the future?

If the answer is yes, then there is an obvious arbitrage space here;

Exchanging assets that seem to be equivalent to BTC for real BTC, even if BTC falls sharply in the future or the stock price falls sharply, when investors exit at a loss, they sell stocks, but MicroStrategy does not need to sell BTC, right?

If the price of BTC falls below 38,500, is it possible for the stock price to show a large negative premium relative to BTC?

That is, do investors or borrowers bear losses far greater than the decline in BTC?

I haven't figured out this question, but logically speaking, MicroStrategy's model may not strictly be a scam, but more of a means of transferring risk to borrowers or investors;

For Michael Saylor, if BTC continues to bull run, he will sooner or later become the richest person in the world, and if BTC crashes to below 38,500, he will still be the individual or entity with the most BTC holdings in the world, apart from Satoshi Nakamoto. Either way, he wins.

Unless he is willing to sell BTC to repurchase stocks and stabilize the price difference when the stock price shows a negative premium, leading to further declines in BTC and stocks, his model can theoretically continue to play out forever.

Do you think this is possible?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。