Blackrock, the world’s largest asset manager with $10.65 trillion in assets under management (AUM), continues to view bitcoin as a novel investment vehicle. In its most recent research report, Blackrock analysts highlighted the increasing demand for bitcoin through its spot bitcoin exchange-traded fund (ETF), which now holds 357,550.21 BTC, valued at approximately $21.5 billion.

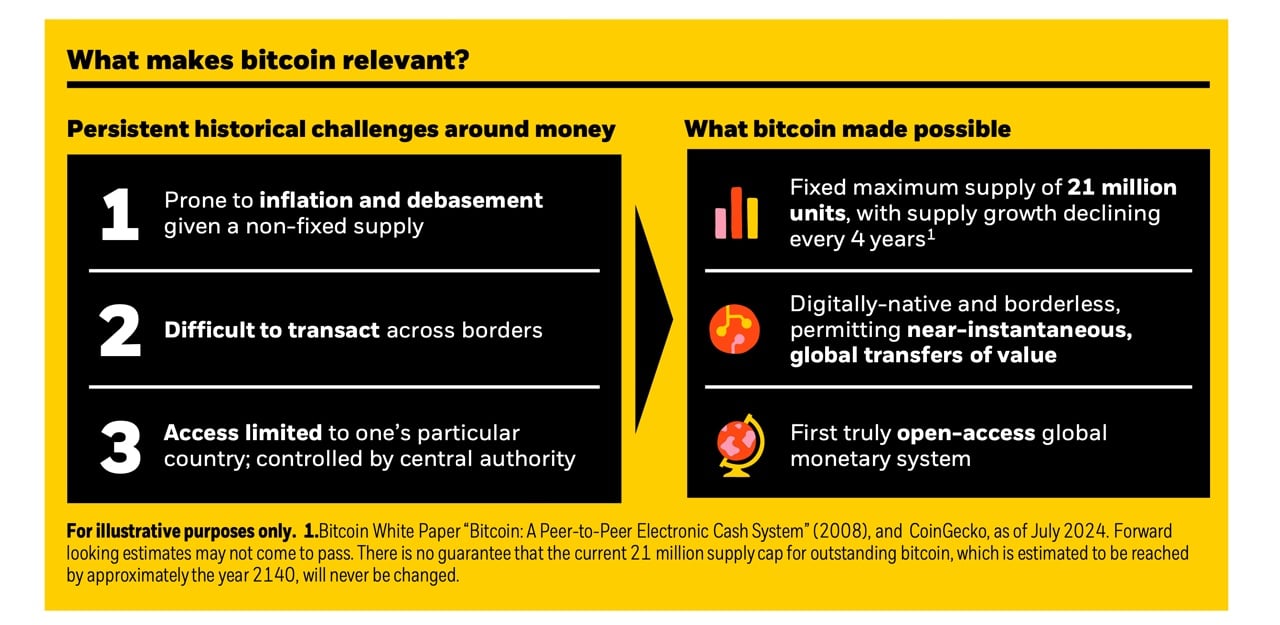

As Blackrock continues to engage with clients, the firm is keen to provide insights on bitcoin’s potential as a portfolio diversifier, especially given its unique characteristics compared to traditional financial assets. “We believe that bitcoin, via its nature as a global, decentralized, fixed-supply, non-sovereign asset, has risk and return drivers that are distinct from traditional asset classes, and that are fundamentally uncorrelated on any long-term basis,” the Blackrock study says.

Source: Blackrock report about bitcoin.

Blackrock’s research emphasizes that bitcoin’s fundamental risk and return drivers are distinct from equities and bonds. Unlike many other assets, bitcoin operates outside the control of any government or central bank, giving it a non-sovereign nature. This characteristic makes bitcoin uncorrelated to other markets in the long term, though the report acknowledges short-term price movements that can sometimes mirror broader market trends, such as those observed during the global market pullback on Aug. 5, 2024.

Blackrock’s report states:

We observed this as recently as Aug. 5, 2024, when bitcoin saw a one-day drop of 7% alongside a 3% fall in the S&P 500, as global markets experienced a sharp pullback related to the unwinding of the Japanese Yen carry trade.

Despite these occasional short-term correlations with equity markets, Blackrock analysts stress that bitcoin’s long-term price performance tends to decouple from traditional assets. The report cites multiple instances where bitcoin recovered quickly from sharp declines, underscoring its resilience and ability to act as a hedge during periods of market volatility. Blackrock views these short-term price movements as temporary reactions to liquidity crises or market sell-offs, with BTC often rebounding as market conditions stabilize.

The report also touches on the challenges and risks associated with investing in bitcoin. As an emerging asset class, bitcoin remains subject to regulatory uncertainty and ecosystem immaturity, which could impact its broader adoption. However, Blackrock’s researchers argue that when held in smaller allocations, bitcoin can provide a valuable diversification effect in traditional portfolios. The volatility of bitcoin can be managed through prudent position sizing, with the report showing that bitcoin’s addition to portfolios has historically improved risk-adjusted returns.

Overall, Blackrock’s research on bitcoin illustrates the asset’s potential as a long-term portfolio diversifier. While acknowledging the risks and regulatory hurdles, the report suggests that bitcoin’s unique attributes—scarcity, decentralization, and independence from traditional macroeconomic forces—position it as a valuable asset for investors seeking alternatives to traditional financial instruments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。