"Valuation of the Coin Circle and US Stocks - How to Invest in the High Bubble Background"

The two circles are different, and the valuation systems are also different. This comparison is not rigorous, but it is hoped to provide an additional dimension for consideration. It is also stated that the author is optimistic about the coin circle and firmly believes that BTC will reach 1 million per coin in its lifetime.

I. Market Value of Coin Circle Projects

- Value Coins

$BTC 1.1 trillion, valued against gold or fiat currency, with unlimited upside potential

$ETH 300 billion, valued against technology companies, currently facing bottlenecks

$BNB 800 billion, can be compared horizontally with COINBASE stock for research

$SOL 600 billion, representing the new L1

There are also leading L2, ARB, OP, STRAK, ZK, among which projects like ZK and STRK have raised a few billion and are valued at tens of billions.

For example, STRK's financing valuation is 8 billion, but the result is that after the coin was issued, it has been declining all the way. The contribution of VCs to the industry is no longer a contribution, but a sacrifice.

- MEME Coins

In addition, there is a special track called MEME, such as DOGE, which reached a market cap of 100 billion in the last round, which is quite crazy.

Current market cap:

$DOGE 15.3 billion

$SHIB 8 billion

$PEPE 3.2 billion

$WIF 1.57 billion

$BOME 430 million

The recent TG mini-games launched on Binance are also a unique landscape in the coin circle. The NOTCOIN white paper only needs one page, with a market cap of over 1 billion US dollars.

$NOT 1 billion

$DOGS 500 million

II. Comparative Valuation

For the L2 in the coin circle, the typical ones that are currently quite bad and failed are projects like STRK and ZK, which raised a few billion dollars and are valued at tens of billions. The gas fees contributed by the speculators (possibly inaccurate) have dropped to almost zero after going live, and the ecosystem has also disappeared, not to mention profitability and the future.

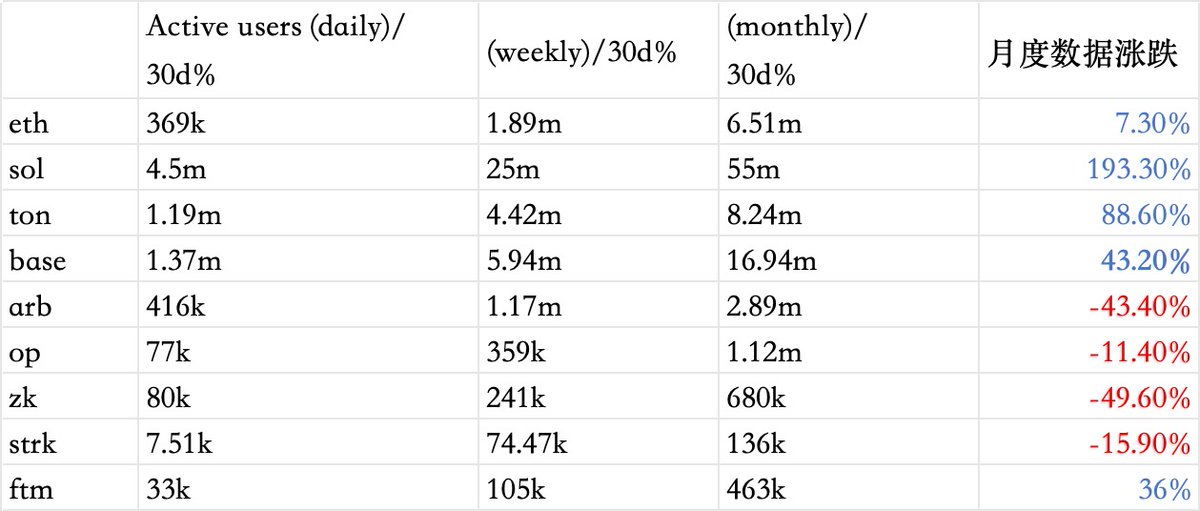

A better example is BASE. I made a table

It can be seen that among the L2, BASE stands out and performs well, but BASE does not issue coins. How should its valuation be determined?

The current activity of the BASE chain accounts for 80% of the L2 (which is counterintuitive), and its on-chain income is also very good. This chain is incubated by COINBASE.

So naturally, we can take a look at the valuation of COINBASE to compare the situation of BNB and L2.

- Valuation of COINBASE

COINBASE has a market cap of 40 billion, and its businesses include: compliant exchanges + overseas contract international exchanges, fund custody, BASE chain, wallets, etc.

Revenue situation: Coinbase's total revenue in Q2 2024 was 1.4 billion US dollars. Due to the poor market conditions, trading revenue decreased by 27%, but subscription and service revenue increased by 17% to reach 599 million US dollars, which may enhance the company's resilience in a bear market.

In addition, COINBASE's operating expenses are 229 million, with a cash reserve of 7.8 billion US dollars, actively exploring compliance and decentralization.

The aforementioned subscription and services actually come from the following aspects:

First, the fees of the $BASE chain, which currently has an absolute advantage and is several times that of ARB.

Second, custody services, whether it is an ETF or anything else, are currently being custodied by them, and they take a cut, which is quite stable.

Third, lending services, the platform generates interest income from its reserve funds, borrowing money and earning interest, which is quite cool.

Fourth, other services. For example, members who open exchanges enjoy various services.

Roughly speaking, if this were a coin circle project, I think its valuation would definitely not be 40 billion. Compared to ARB's valuation of 20 billion at the time, we thought it would be no problem for it to rise to 100 billion in a bull market. But the result is that ARB, a single chain, is far from being comparable to a branch business under COINBASE.

How does COINBASE's 40 billion compare to Binance? BNB is 80 billion.

Buying stocks makes you a shareholder, buying BNB makes you a nominal shareholder. Currently, the space for sharing corporate profits seems to be gradually shrinking - after all, the higher the market value, the less attractive it is to have some small game ecological coins after listing.

- Number of Users in TG Mini Games

Nowadays, TG mini-games easily attract hundreds of millions of users. Projects like DOGS completed the project launch, user growth, and listing on Binance, with market caps ranging from several hundred million to tens of billions.

There are still many users in the coin circle who are planning to "ambush at a low position" for various reasons, hoping for a 5x or 10x surge.

So I compared it to a company that is easy for people in the coin circle to understand, called ROLBOX. This is a company that has not yet achieved profitability (all profits are used for development) but has strong growth. It does something similar to a UGC version of Minecraft.

Children like to play it (Chinese users may be unfamiliar because they cannot play it in mainland China), but the current project has an average of 80 million daily active users, with a second-quarter revenue of 750 million in 2024, and the CEO hopes to increase the daily active users to 1 billion.

This is somewhat similar to the original metaverse narrative in the coin circle. Such projects should be very impressive in the coin circle, right? After all, there are many users, strong profitability, and high playability.

But its market cap is the same as the peak period of ARB, 20 billion, and it has hovered around 10 billion several times in the past few years.

If we assume that we have to choose one between ARB and it for 5 years, I think there will be fewer people choosing ARB.

So, in the past, we said that the coin circle needs institutional participation. Now that institutional investors have entered the BTC market, it seems that the imitation is not attractive even if the ETF is approved, given the current valuation.

- Valuation of MEME

I have talked a lot about MEME, but if you look at the US stock market too much, you may lose faith in MEME, because you may be surprised to find yourself playing with something strange:

The big players issue a coin, and I am speculating;

The big players spread a rumor, and I am buying the dip.

You can't think too much about this thing, otherwise you won't be able to play.

III. The Future of the Coin Circle

Sooner or later, we will return to the value itself:

What problem does your project solve?

How many real users are there?

What value has been created?

How much profit can this value bring?

When I buy your coin, is it possible to make money by following your project, other than hoping that other fools will follow?

Currently, there is still a long way to go, and the good news is that we are still in the early stages!

At present, in the coin circle, you need to be clear about what kind of money you are making:

Do you want to make long-term money or short-term money?

Is it value money or emotional money?

These are completely different but not conflicting.

For example, there are huge opportunities for making money in the coin circle by speculating on NFTs, MEMEs, and inscriptions. Don't avoid playing just because you think the value is low. When you enter the casino, you have to be prepared. As long as you can make money, play everything. The only thing to study is how to make more and lose less. So don't feel pessimistic because of this article - this article does not affect the improvement of gambling skills.

But if you want to return to long-term value, I think the long-term value of BTC and ETH is very high, but comparing it to US stocks will make it clearer, and there will be significant fluctuations.

For example, in the minds of us in the coin circle, what's wrong with BTC surpassing gold at 10 trillion? Nothing, it's very normal.

But in the end, this is no different from playing BOME in the short term. When it was listed on Binance, we calculated and felt that BOME's market cap of over 10 billion was not expensive, right? But is this narrative not as good as WIF and BONK? But in the end, it still depends on how many people recognize it.

It is also no different from playing ORDI. There are huge short-term fluctuations because everyone has different ideas, and the rise and fall ultimately depend on whether new people come in to buy.

Of course, in the long run, BTC and ORDI, BOME, and the like are completely incomparable!

BTC is the first decentralized currency of mankind, and the decentralization of currency, its value even benchmarks the GDP of mankind. This process requires the slow formation of consensus, waiting for the expansion of the fiat currency system, and more funds to enter.

As for the valuation of ETH, I think the valuation of ETH is actually the valuation of the development of L2 and its ecosystem. It is unlikely that there will be another narrative like the original NFT and DEFI or similar on the ETH main chain, turning ETH into a casino chip. It must be the development of the ecosystem, and currently, the most powerful one in L2 is surprisingly BASE. The results of my personal research indicate that this gap may even widen further.

In addition, ETH itself can also be simply benchmarked:

In May, Tesla was over 500 billion; ETH was also 500 billion;

In September, Tesla was over 700 billion, and ETH returned to 300 billion.

I'll stop chatting here. It's tiring to type while delivering takeout. Let me finish delivering this order of pig's feet rice first.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。