At nine o'clock Beijing time, Trump and Harris held the first presidential debate as scheduled, without mentioning cryptocurrencies. They mainly discussed traditional topics such as foreign policy and immigration. According to data from Polymarket, as the debate progressed, the balance of victory slowly shifted towards Harris, and the market's reaction highlighted traders' concern about the election results. Although cryptocurrencies were not directly mentioned, the expected decline in Trump's chances undoubtedly affected digital currency prices. The political uncertainty brought about by the draw made traders more cautious, and short-term negative risk aversion reappeared, causing BTC to drop by -1.6% within an hour and briefly test the $56,000 support.

Source: Polymarket

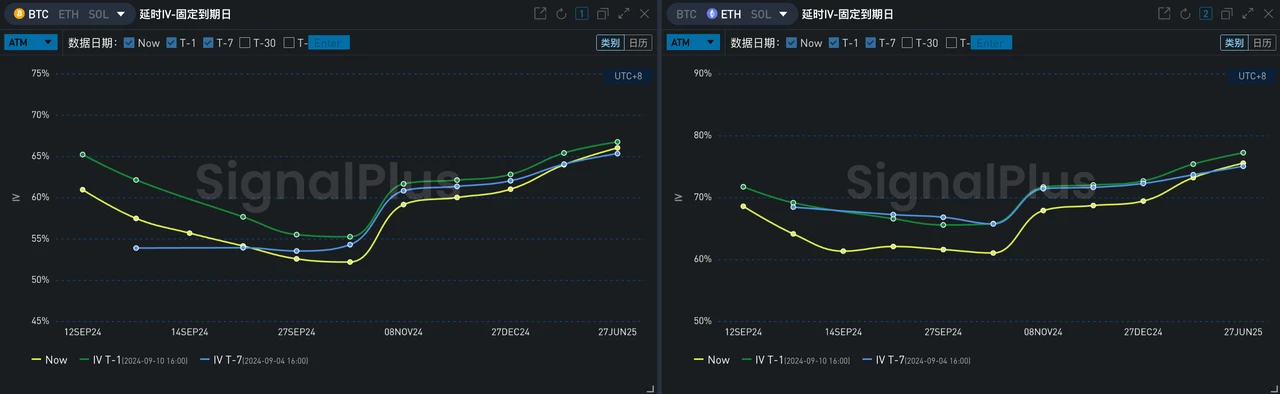

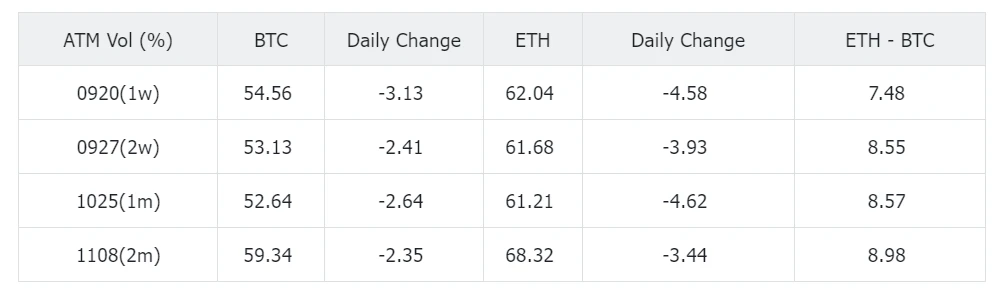

After the debate, the price completed a pullback from the high point, settling around $56,500. The actual volatility of BTC during the day was about 43%, much lower than the pricing in the options market yesterday. The implied volatility curve was also significantly revised downward, with the front end still pricing in a 60% volatility for tonight's CPI data.

Source: SignalPlus

Source: Deribit (as of 11SEP 16:00 UTC+8)

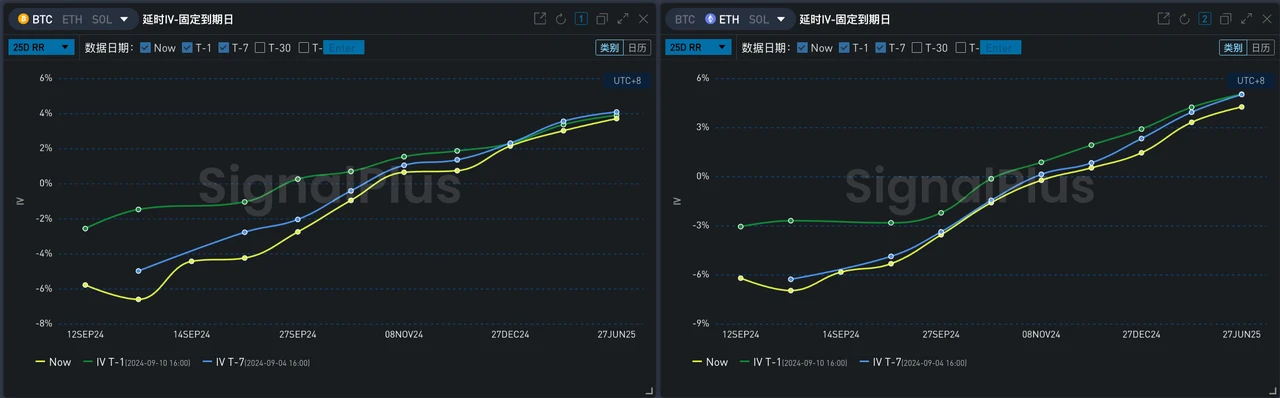

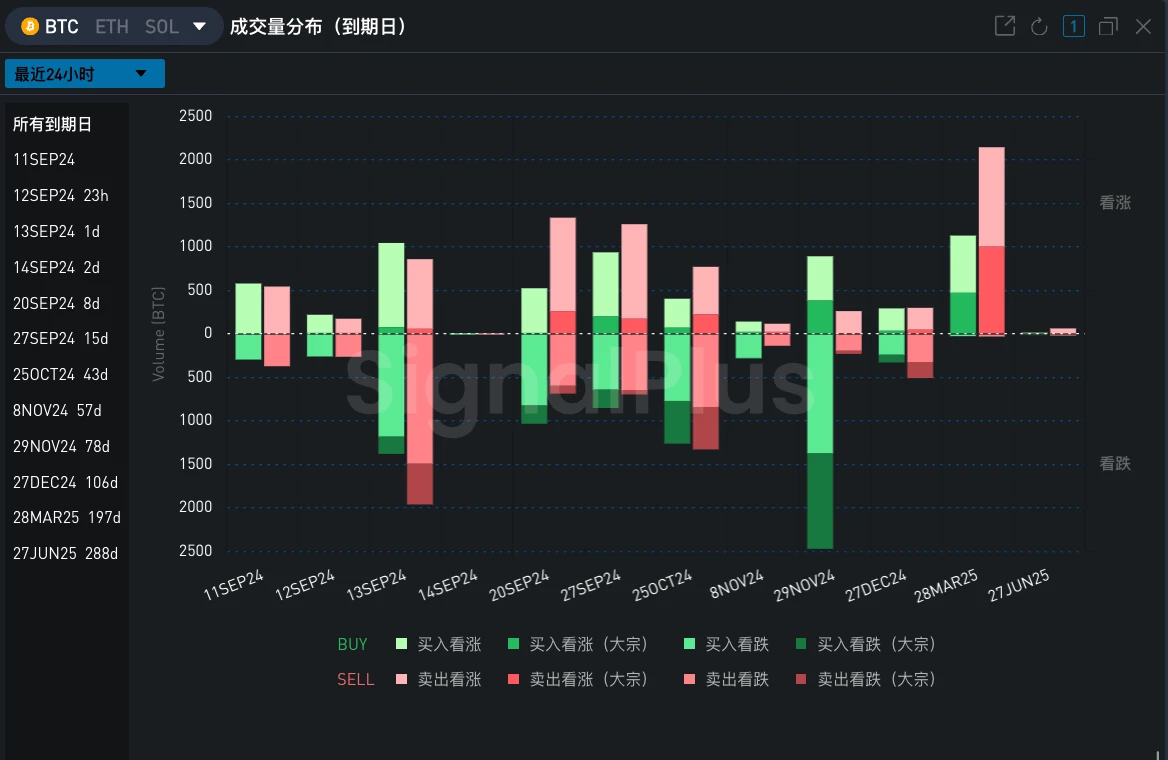

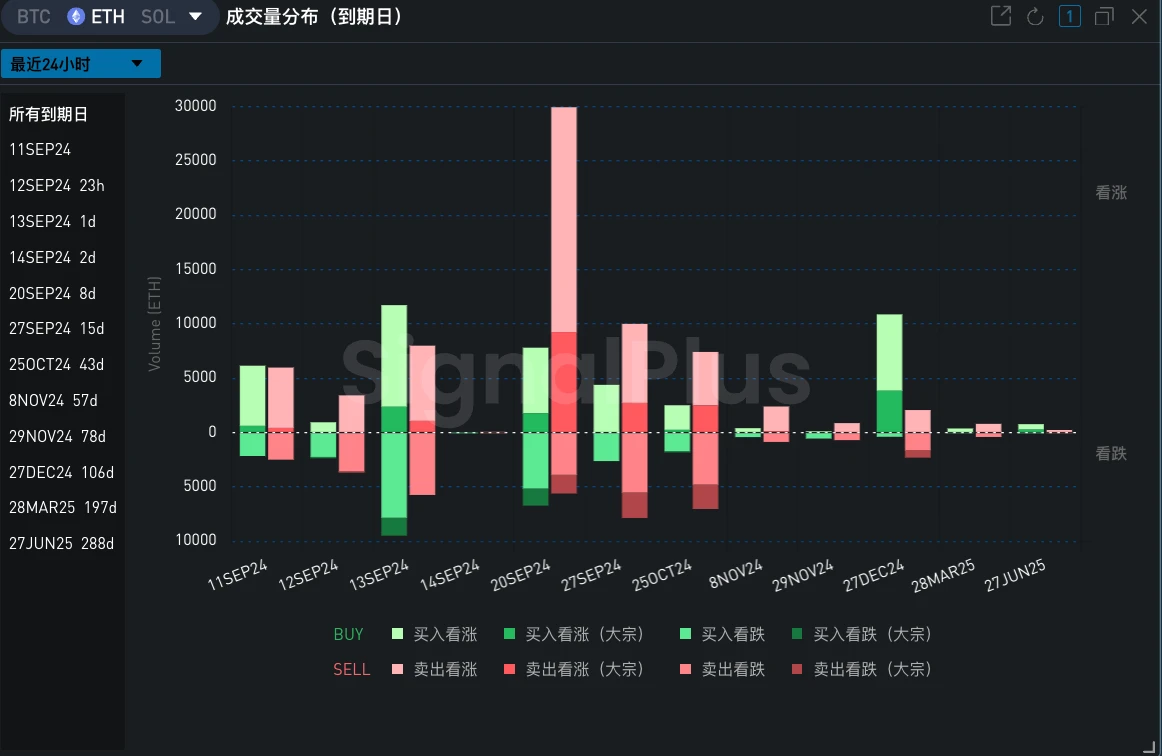

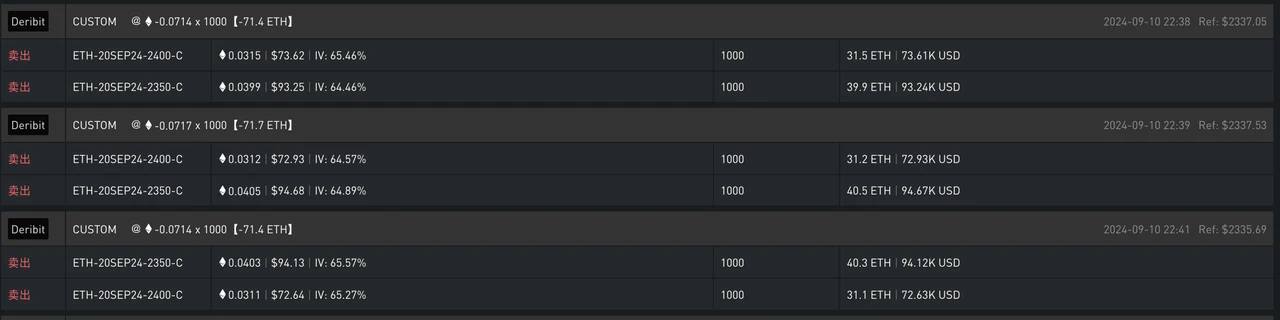

On the other hand, the change in Vol Skew reflects the recent fluctuations in market sentiment. The performance of the BTC spot ETF with negative outflows yesterday was seen by investors as a shift in market sentiment, challenging the $58,000 level and driving the Vol Skew back up. Today, despite the outflows from the Ethereum ETF and continued inflows into BTC, the negative risk aversion caused by political uncertainty poured cold water on the market's just ignited enthusiasm. Correspondingly, from a trading perspective, the rebound in price and the return of Vol Skew in BTC created opportunities to buy cheap Put options, with a significant influx of bearish options buying across various maturities, especially at the end of November. For ETH, this market situation led to a large volume of selling Call options, with a notable example being a large custom strategy from 20SEP, simultaneously selling bullish options at 2350 and 2400, generating high premium income.

Source: SignalPlus, Change in 25D RR

Source: SignalPlus, Transaction Data

Source: SignalPlus, Bulk ETH Transaction Data

You can use the SignalPlus trading barometer feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。