CZ, Sun Yuchen, Dorof… Every founder in the cryptocurrency ecosystem is swept up in the market's waves, either calling the shots, ending up in jail, going into hiding, or leaving their hometown. The story of capital continues…

By: Daorji, ChainDeDe

The capital market is like a game, only those who have the right strategy can become the ultimate winners.

Following the arrest of Pavel Durov, the founder and CEO of the social media platform Telegram, near an airport in Paris, the subsequent impact of this event continues to ferment.

The Paris prosecutor's office stated in a declaration that France has brought multiple charges against Durov, and various government departments are investigating illegal activities on the Telegram platform, including fraud, drug trafficking, organized crime, child pornography, promoting terrorism, and disseminating hacking tools. Durov is accused of not taking appropriate measures to prevent these crimes.

The TON chain ecosystem based on Telegram has seen a surge in trends since 2024, and Telegram's Web3 soil has provided fertile ground for the TON chain ecosystem in terms of community and ecological fission. However, after Durov's arrest, the TON network experienced two major interruptions in load, and Toncoin suffered a drop of over 20%, falling from a market value of 131 billion US dollars to the tenth place in the Crypto token market value.

Similarly, in the cryptocurrency circle where money never sleeps, stories like Durov's are played out every day.

Many influential figures who once called the shots have ended up in jail, such as SBF, the founder of the US cryptocurrency exchange platform FTX, who was sentenced to 25 years in prison for embezzling $8 billion from clients; the founder of Terra, Kwon DO, who single-handedly caused a black swan event, leading to the bankruptcy of Three Arrows Capital, BlockFi, FTX, and Slivergate, is currently detained in Montenegro awaiting further trial; Zhu Su, co-founder of Three Arrows Capital, was arrested while attempting to leave Singapore due to the Terra case; and Zhao Changpeng (CZ), the co-founder of Binance, the largest exchange with the title of the richest Chinese, was sentenced to 4 months in prison for money laundering violations and violating US sanctions, and is currently serving his sentence in the United States.

In addition to these figures, the FBI has been dedicated to uncovering the true identity of BTC network founder Satoshi Nakamoto, and XRP recently experienced a phase of "victory" in its century-long lawsuit with the SEC, but the SEC's silent attitude seems to indicate that this storm is not yet completely over. Standing under the spotlight, Sun Yuchen, known as the richest post-90s figure in the cryptocurrency circle, and his Tron, are like a clever puppeteer, weaving their own story under the scrutiny and investigation of regulators in China and the United States.

Recently, OpenSea received a Wells Notice from the SEC - an informal notice issued by the US SEC to companies listed in the US before civil litigation, becoming another encrypted project targeted by the SEC after CoinBase, Li-do, Bittex, Uniswap, and Robinhood.

It seems that every star in the cryptocurrency world will be embroiled in the gray area of regulation and law, subject to the hammer of strong regulation. On the one hand, the entire cryptocurrency industry is thriving, with public chain ecosystems flourishing like mushrooms after the rain, and the GameFI ecosystem becoming a lifesaving straw for the people in Southeast Asia. The power of encryption is beginning to influence the US presidential election, and BTC is expected to become a strategic reserve for the United States after Trump takes office in the White House. On the other hand, cryptocurrency companies and exchanges dancing on a tightrope are waiting for the judgment of fate under the Damocles' sword of compliance, money laundering, and anti-terrorism. Similarly, most cryptocurrency developers, whether for security reasons or to practice their belief in decentralization, choose to go into hiding.

Since the birth of the Bitcoin white paper in 2008, in the 16-year time dimension, the cryptocurrency industry has seen a surge of people, with the alternation of technology and the rise and fall of business stories washing against the reefs of the times. When we look back, we see vivid figures deeply mired in the quagmire of fate.

The founding father of the Ton ecosystem: Will the arrest of the "Internet Robin Hood" Durov affect the strong rise of the TON ecosystem?

Different from many Web3 giants mired in the quagmire, Pavel Durov, known as the "Internet Robin Hood" and "Russian Zuckerberg," and his Telegram rose to fame in the traditional business world. This genius developer, who operates outside the regulatory system, is seen as a rebel by governments around the world. However, in Durov's eyes, he is just a liberal, and in his view, wealth and compliance have never been as important as freedom.

"I am not fighting for freedom, I am just using my existence to prove that freedom has not disappeared," Durov once said.

As early as 2006, inspired by Mark Zuckerberg's FaceBook, Durov and his brother created the VK social platform in Russia, which was a great success in the Russian-speaking world. Although VK brought him financial freedom, it also led to many frictions with the Russian government on regulatory issues. The Russian Federal Security Service once demanded that VK hand over personal information leading the incitement of the Kiev issue on the network, but Durov sternly refused. Confronting state power as a business entity, the outcome can be imagined.

In the VK incident, Durov denounced the Russian government and the large capital preparing to acquire VK—although his personal wealth was enough to rank him at the top of the wealth circle, Durov, like a poor programmer shouting for technology and freedom, fought against the entire authoritarian world. The final chapter of the story came to a halt after a night raid by the armed forces on Durov's home, where he lost control of VK and was eventually acquired by a Kremlin-affiliated company, Mail.ru.

This spirit of not fearing authority and advocating liberalism later evolved into the cultural core of Telegram, which was admired by the Crypto circle.

In 2013, Durov and his brother Nikolai founded the instant messaging software Telegram, which currently has over 1 billion global users. This time, Durov had only one goal: to create a free software and prioritize defending personal freedom and privacy.

To achieve this goal, after selling his VK shares, Durov also divested his real estate in Russia, and then moved from Russia to Dubai—since then, Dubai has become the headquarters of Telegram, and Durov has embarked on his nomadic life. Learning from the lessons of the VK incident, in addition to Russian citizenship, Durov also obtained citizenship in the United Arab Emirates, France, and Saint Kitts and Nevis. Like the icon of a paper airplane, it can fly in all directions.

Telegram, a global social software with over 1 billion users, is known as the world's most secure and anonymous chat platform with end-to-end encryption—its encryption mode is based on 256-bit symmetric AES encryption, RSA 2048 encryption, and the secure key exchange protocol of Diffie-Hellman, using direct point-to-point transmission and encrypted keys, with no third-party servers retained and unable to be deciphered. The software also provides a self-destruct feature.

Durov's attitude of not wanting to subject Telegram to the regulatory system of content review in various countries has quickly attracted countless users to Telegram. However, it is a double-edged sword, as it has become the preferred social software in the encrypted world, but has also provided a convenient breeding ground for terrorism, making mainstream countries uneasy.

The development of the TON blockchain ecosystem is a crucial part of Telegram's business model monetization. On one hand, Pavel Durov, a tech geek himself, is a supporter of Crypto. Meanwhile, Telegram's privacy protection almost jeopardized the path to commercial advertising monetization, but its massive user base and thriving community culture have become the nourishing ground for Crypto public chains. The strategic significance of TON is to provide Telegram users with fast, secure decentralized payments and digital identities. Based on these attributes, TON must be a high-performance public chain, scalable and shardable, which is the path for TON's development. This is also the reason why the TON ecosystem ultimately chose an asynchronous architecture—although it may be limited in some areas, solving the problem of large-scale user applications is what TON needs to address.

Interestingly, the monetization of advertising traffic on Telegram's public channels is ultimately achieved through TON.

Currently, the TON ecosystem relies on the exposure and viral marketing based on Telegram's massive user base, as well as TON's technical support. The ecosystem's payment and wallet infrastructure, along with projects like GameFi, NFT, and MeMe, have all gained a larger user base than typical Crypto projects and experienced rapid growth. For example, projects like DOGS and Notcoin have accumulated millions of users in a short period of time. It can be said that the beginning of the bull market in 2024 was the Bitcoin ETF, with MeMe and DePIN as the narrative hotspots, and the most dominant public chain is undoubtedly the TON, which is currently in the limelight.

However, with Durov's arrest, the development of the TON ecosystem is now facing uncertainty.

In fact, legal risks have always surrounded Durov and Telegram. After the 2015 Paris attacks, Telegram was accused by the French authorities of not fulfilling its obligations in counter-terrorism. This time, Durov's arrest is due to the French government's accusation that Telegram refused to respond to requests to investigate illegal activities on the platform and that Durov knowingly allowed criminal activities to take place on the platform.

In the context of various countries countering terrorism, political disputes, and local wars, Telegram has become a thorn in the side of governments around the world, especially in the recent Russia-Ukraine conflict, where it has become a communication tool for both sides of the conflict. Western forces have repeatedly tried to access Russian communication content. Durov's arrest is also analyzed by multiple experts as being driven by geopolitical demands.

Currently, Durov has provided a 5 million euro bail and is prohibited from leaving French territory. He faces a maximum sentence of 20 years, and under such high pressure, it may be difficult for him to uphold his pursuit of freedom.

As for the direct impact on the TON ecosystem, Durov's arrest, along with two major interruptions in the blockchain network, resulting in block production stagnation, has caused localized panic and a seismic drop of over 20%. After a brief liquidity retreat, the next serious issue is that due to being targeted by Western countries, the previously favorable user community for the TON ecosystem is now cautious about risk management. Several heavyweight projects were expected to be listed on Binance, but these expectations may now be dashed.

Fortunately, the TON ecosystem is decentralized enough, and the bridge between Web 2 and Web 3 built by Telegram and TON seems to be less affected by the long-term implications of the Durov incident. The real test for TON is whether its ecosystem can continue to thrive if Telegram's ecosystem is truly brought under regulation and backdoors are left open.

Founder of the Binance ecosystem: Former "richest Chinese" CZ serving time in the US

In the cryptocurrency industry, where wealth accumulates and money never sleeps, on the edge of money and power, in the center of the real and virtual worlds, the story of CZ, the former "richest Chinese" who once topped the Forbes list, is nothing short of legendary.

Even the most steadfast Bitcoin believers rarely have the courage and determination of CZ. When Bitcoin rose to over $200 after a surge, CZ, who had just come into contact with the Bitcoin white paper, had the courage to go all in—he sold his house in Shanghai and went all in on Bitcoin, thus kicking off his legendary life.

CZ's first half of life was always involved in securities trading. When he entered the Crypto industry, CZ, with his sensitivity to trading, quickly realized that this industry was not only full of primitive opportunities but also rife with lawlessness and fraud. Even at that time, the main trading scene for Bitcoin was the dark web. It was this rampant illegal trading that also rapidly drove up the price of Bitcoin.

Just one year after entering the industry, the world's largest Bitcoin exchange, Mt. Gox, collapsed, with suspicions of self-theft leading to the loss of 750,000 Bitcoins. Seeing an opportunity, CZ launched his own exchange in 2017—Binance, a seemingly secure exchange, which was everyone's most sincere hope in the market at the time.

The turning point came after the issuance of Document 94. After clearing out ICOs, Binance quickly accumulated a large number of registered users due to the full refund based on the post-surge price. With the increasingly strict regulatory system in China, CZ and Binance began to move overseas, opening the curtain on his digital nomadic life.

Unlike the highly internalized domestic market that has undergone market baptism, Binance found itself in its element in the overseas market. Just five months after its launch, Binance attracted 6 million users, covering over 180 countries, with a daily trading volume exceeding $3 billion, making it the world's largest Crypto exchange.

However, Binance's friction with the traditional world began to escalate as its size expanded. The earliest conflict was with the investment giant Sequoia Capital. Sequoia Capital, known as the top equity investment giant in the classical investment world, had a process that was too long, from valuation to later-stage background checks to investment. CZ bluntly stated: "The valuation you gave is too low now." He then turned to negotiate with IDG.

Although CZ claimed that the negotiation with IDG was for a Series B financing, due to the high pressure from Sequoia Capital and court intervention, IDG's investment ultimately fell through. After Binance rose to prominence, CZ launched a counterattack, and all projects related to Sequoia Capital were not allowed on Binance.

However, Binance's globalization strategy quickly encountered its first problem: due to the lax KYC process and the rampant growth worldwide, many funds of unknown origin began to trade through Binance. This was especially true for countries and regions on the US Treasury Department's high-risk area list, where the US government suspected involvement in drugs, terrorism, and child abuse.

In May 2021, Bloomberg reported that Binance was facing investigations for money laundering and tax evasion from the US. In August 2021, Binance began to require customers to provide KYC information.

The real trouble for Binance came from its struggle with FTX and the high-pressure control of the global Crypto market by the US government behind the scenes. In this business war, the FTX business empire collapsed overnight in less than 10 days, and CZ was the one who personally drove the final nail into the coffin. After the liquidity issue at Alameda Research was exposed, SBF began to urgently salvage the situation, while CZ expressed concerns about a Luna-style collapse and began selling FTT, showing a strong stance. After SBF was unable to turn the tide and Binance reached a purchase agreement, Binance tore up the agreement, stating that it would abandon the acquisition of FTX.

This final straw that broke the camel's back ultimately led to the downfall of FTX. But Binance's attitude may have truly angered Wall Street and the White House. It was not just the failure of Binance to assist FTX that led to a systemic financial crisis in the US market, but more importantly, the US cannot tolerate the world's top Crypto exchange being beyond its control.

Regulatory issues from various countries have caught up with Zhao Changpeng, leaving Binance no choice but to frequently face inquiries from traditional regulatory authorities. The Singapore Police Force launched a financial crime investigation into Binance, and the Dubai Virtual Asset Regulatory Authority requested more information about its audit procedures. In March 2023, the US Commodity Futures Trading Commission (CFTC) and the US Treasury Department sued CZ and Binance for multiple violations of the Commodity Exchange Act and related regulations. At the same time, the US Department of Justice also brought multiple criminal charges against CZ, and Binance faced three charges, including violating anti-money laundering regulations, conspiring to conduct unlicensed money transfer business, and violating US sanctions. The core of the charges against Binance focused on violating anti-money laundering regulations.

US Attorney General Merrick B. Garland stated that the Binance platform was filled with criminals from around the world who used Binance to transfer various illegal funds and other criminal proceeds through cryptocurrency. The US Treasury Department stated that Binance's violations included failing to prevent and report suspicious transactions involving terrorists, including Hamas, the Palestinian Islamic Jihad, Al-Qaeda, and the Islamic State of Iraq and Syria. Court documents showed that Binance allowed at least 1.1 million related transactions, involving over $898 million, with Iranian customers.

After repeated deliberation and negotiations, Binance and its CEO CZ admitted to multiple criminal charges from the US Department of Justice. In addition, Binance will pay a criminal fine of $1.8 billion and forfeit $2.5 billion. The total fine amount is $4.3 billion, with $3.4 billion to be paid to the US Treasury Department's Financial Crimes Enforcement Network and an additional $968 million to the Treasury Department's Office of Foreign Assets Control. This is the largest fine imposed by the US Treasury Department to date.

Binance will also completely withdraw from the US market, while Binance.US, the Binance subsidiary in the US, will continue to operate. CZ has agreed to step down as CEO of Binance and is prohibited from holding any leadership positions at Binance.

On April 30, US District Judge Richard Jones sentenced CZ to four months in prison at a facility in Seattle, with his current release date set for September 29. Undoubtedly, if CZ ultimately retires after this, he will be the winner of this industry. Even though he is currently in prison, and even though such a verdict may affect Binance's long-term position, after all, Binance was able to rise because of market opportunities, and now they are leaving those opportunities to others.

It remains unknown how long Binance's leading position can be maintained, as its market share in spot and derivative trading has been declining. According to data from The Block, Binance's share in the spot market has dropped from over 62% earlier this year to 37%. In the futures market, Binance's leading position in open interest contracts has also been surpassed by the Chicago Mercantile Exchange.

On the other hand, BNB's performance and BSC have also shown weakness. In the face of the impact of new public chains and declining market share, it is not only a question of how long Binance can maintain its current leading position.

At the very least, CZ's ten years in Crypto have been full of legendary colors.

Tron Ecosystem Pioneer: Controversial Sun Yuchen and his TRON

If there is another Chinese entrepreneur who has become famous in the Crypto world besides CZ, it would be Sun Yuchen.

When it comes to Sun Yuchen, this figure who founded TRON is filled with controversial labels—genius youth from Peking University, plagiarist, entrepreneur, newcomer to the Crypto world, overnight millionaire, master of hype, billionaire, Crypto version of Jia Yueting, Warren Buffett's lunch terminator, ambassador of Grenada, and more.

Sun Yuchen founded TRON at the height of the ICO craze in 2017. In TRON's white paper, Sun Yuchen envisioned "a globally decentralized free content entertainment system." However, at the time, TRON's white paper was criticized by many industry insiders for lacking technical innovation and being full of plagiarism from Ethereum. This later led to a public spat between Vitalik Buterin and Sun Yuchen on social media.

But in the bubble-filled year of 2017, with the promotion by marketing expert Sun Yuchen, names like Wu Jihan, Li Feng, Shuai Chu, Dai Wei, and others appeared on TRON's private placement list. Despite doubts about being a "token without substance," TRON issued 100 billion TRX and raised about 400 million yuan through ICO. Riding this wave, TRON took off smoothly, and Sun Yuchen achieved his wealth goals.

By 2018, TRON's market value successfully broke into the top ten global cryptocurrencies.

In addition to TRON's success, Sun Yuchen seems to have the ability to consistently achieve high returns and cash out without hesitation. There has been a joking saying on social media: "When Sun Yuchen smiles, life and death are unpredictable."

During the craziest rise of TRON, Sun Yuchen sent 200 million TRX to exchanges for conversion into Ethereum for 19 consecutive days, which invisibly led to selling pressure and cashing out. The investment dispute story between Sun Yuchen and Xu Zijing, a Martian, has been circulating in the industry, and Xu Zijing has remained silent.

In 2019, Sun Yuchen spent $4.56 million to win the lunch with Warren Buffett. At that time, Sun Yuchen was deeply embroiled in controversy over the Super TRON community scam and exit. Throughout the entire publicity process, the Super TRON community emphasized its close connection with TRON, but neither TRON nor Sun Yuchen provided a strong rebuttal. It wasn't until after the Super TRON community exit that Sun Yuchen clarified that the project had nothing to do with TRON. Obviously, this explanation did not convince everyone. Even when Sun Yuchen posted a clarification on Weibo, he did not mention the name of the Super TRON community throughout.

Shortly after the Super TRON community incident, Caixin Media suddenly revealed: after an investigation, it was confirmed that since June 2018, regulatory authorities had issued border control orders to some sensitive individuals in the Crypto industry, including Sun Yuchen. The National Internet Finance Risk Special Rectification Office has recommended that public security organs investigate Sun Yuchen for suspected illegal fundraising, money laundering, involvement in pornography, gambling, and other issues.

In response, Sun Yuchen immediately refuted the report as untrue. "Caixin's report is completely untrue. I am safe, and I will meet with the outside world after my condition improves, to ease everyone's worries."

At the same time, Sun Yuchen posted two tweets on his Twitter account, both showing the background of his home in San Francisco and the iconic Golden Gate Bridge in the background.

However, in a rare move, the next day, Sun Yuchen posted an apology statement on Weibo. In the full text, Sun Yuchen expressed deep guilt for his excessive marketing and hype, and stated that Caixin is a well-respected journal that he subscribed to and studied repeatedly during his university days, and Ms. Hu Shuli is a senior teacher whom he deeply respects and admires. He also expressed his apologies to Wang Xiaochuan and stated that he will actively cooperate with regulatory agencies in their research and guidance.

It is worth noting that the term "regulatory agency" appears 9 times in the apology letter, and so far, Sun Yuchen has not appeared in public in mainland China.

After a period of silence, when the GameFi track became popular, TRON launched its first GameFi project, Win NFT Horse. In Sun Yuchen's view, GameFi will become the next explosive point in the blockchain world, just like DeFi. Win NFT Horse is a GameFi+NFT project jointly launched by TRON, APENFT Foundation, and Winklink.

Thanks to Sun Yuchen's influence and hype, the horse racing not only added fuel to the GameFi track but also pushed Win NFT Horse to the top of the entire blockchain game market. Players can earn NFT token rewards through the game, and it is clear that TRON's goal is to target Axie Infinity. The WIN token also became the second TRON token listed on Binance after BTT.

However, amidst the fanfare, in less than two months, players of Win NFT Horse began to report issues with withdrawals. The official silence quickly turned into a chorus of criticism on Twitter.

Before long, Sun Yuchen finally responded: the online rumors that withdrawals from the horse racing game were not possible are not true. The actual situation is that due to the game's popularity, there has been a significant increase in withdrawal demands, and the original system could not handle such a large volume of withdrawal requests. An automatic withdrawal and risk control system has been developed, and efforts are being made to resolve all backlogged issues within 48 hours.

The fact proved that the withdrawal difficulties of the horse racing game were indeed eventually resolved. However, the decline in the popularity of the horse racing game after this incident caused many players to lose patience, leading to a significant decline. As the hottest GameFi project at the time, the cooling off of the horse racing game even caused the entire GameFi market to trend cold, and even the entire market experienced a period of winter after the GameFi cooling.

Up to this point, despite the rapid development of the TRON ecosystem, the project tokens in the TRON ecosystem, JST, BTT, and WIN, all failed to escape the fate of a sharp decline after the hype.

Sun Yuchen, who has always been in the whirlpool, quickly found a new identity for himself as the Permanent Ambassador to the World Trade Organization (WTO) and the Special Envoy. In return, several tokens created by Sun Yuchen, including TRON in Grenada, became the legal digital currency of Grenada. TRON will also provide blockchain infrastructure for Dominica and has been authorized to issue the national token, Dominica Coin (DMC).

Although Grenada is one of the poorest countries in the Caribbean region, the position of a Permanent Ambassador to the WTO is evidently a powerful shelter when trouble comes knocking.

With his official status, Sun Yuchen quickly set his sights on exchanges, and the once three major exchange, Huobi, was acquired by Sun Yuchen. Shortly thereafter, the exchange, renamed as Huobi, collaborated with the government of Dominica to launch the Dominica Digital Citizen gameplay. Interestingly, mainland citizens can obtain a digital identity from Dominica and engage in virtual currency trading activities on platforms like Huobi, thereby bypassing the exchange's KYC regulations.

Indeed, Sun Yuchen seemed to have a foresight, as trouble soon came knocking. First, a report from the US tech blog The Verge listed multiple "charges" against Sun Yuchen, including allegations of fraud and evasion of ICO bans during his time at the XN currency exchange Poloniex, money laundering, and evading the law, and claimed that he was under investigation by the FBI, with the US Internal Revenue Service also planning to file a lawsuit.

At the time, Sun Yuchen responded with five strong tweets, stating that as the Permanent Ambassador to the World Trade Organization in Grenada, he has extensive diplomatic immunity during his tenure, including protection in civil and criminal matters, which means that any investigations or lawsuits by the FBI or the US Internal Revenue Service are not legally recognized. This status not only grants him special litigation status but also becomes a key basis for his defense.

In June 2022, after the change of government in Grenada, Sun Yuchen was stripped of his ambassadorial status, as the New National Party, which appointed Sun Yuchen, was removed by the National Democratic Congress. Sun Yuchen also publicly confirmed that he stepped down as the Permanent Ambassador to the WTO in Grenada on March 31, 2023.

According to a report by Coindesk, the SEC announced a lawsuit against Sun Yuchen and his three wholly-owned companies, Tron Foundation Limited (TRON), BitTorrent Foundation Ltd., and Rainberry Inc. (formerly BitTorrent), submitting a complaint to the Manhattan District Court in New York, accusing Sun Yuchen of offering and selling unregistered cryptographic asset securities Tronix (TRX) and BitTorrent (BTT), as well as engaging in wash trading to fraudulently manipulate the secondary market of TRX, involving simultaneous or nearly simultaneous buying and selling of securities to make it appear that trading is active, but actual ownership does not change.

In response, TRON stated that the SEC's civil lawsuit lacked a basis. Sun Yuchen also applied for dismissal in court, emphasizing that the SEC has no jurisdiction over his TRON Foundation in Singapore, and that BTT on TRX was sold overseas, taking measures to avoid the US market. The SEC countered that Sun Yuchen had spent over 380 days in the US from 2017 to 2019. The case has been dismissed by the court, with the judge siding with TRON.

In the SEC's allegations, Sun Yuchen's Bittrex was accused of money laundering transactions and selling unregistered securities. The SEC's accusations undoubtedly indicate that Sun Yuchen has crossed the regulatory line, and it remains to be seen whether the SEC will easily give up. It is worth noting that the SEC has almost zero tolerance for issues related to the sale of unregistered securities in the Crypto industry, and the allegations of money laundering transactions are even more serious.

On the other hand, when facing investigation pressure from both China and the US, nationality and law enforcement boundaries are not a shield. Only those who are truly without problems can remain unscathed amidst all the turmoil.

In the current MeMe wave, Sun Yuchen and TRON once again set their sights on the MeMe track. SunPump, as the MeMe fair launcher in the TRON ecosystem, announced a series of stimulating subsidies, a 10 million ecological incentive plan, and benefits such as free gas fees. When facing the media, Sun Yuchen openly stated that the current MeMe Launchpad is a stock game, and the platform needs to have low launch costs, deep liquidity, and flexibility. He hopes to inject fresh vitality into the dormant market through SunPump.

In promoting the MeMe platform and tokens, Sun Yuchen once again demonstrated his top-notch methods. Sun Yuchen even changed the avatar of his X account to the image of the Black Myth Wukong and stated that he would send a wave of benefits related to the Black Myth Wukong to everyone. The related MeMe token, Sun WuKong, skyrocketed overnight, with the highest increase reaching 391 times.

Shortly after its launch, SunPump's market value exceeded $1.1 billion, with over 20,000 daily active users.

Recently, there have been many rumors about Sun Yuchen's controversies on the X platform, as well as discussions about the appearance of black U in stablecoins on the TRON platform. Clearly, Sun Yuchen has never ceased to be a hot topic of discussion and controversy.

The Ancestor of the BTC Ecosystem: The Global Consensus of Bitcoin and the Disappearance of Satoshi Nakamoto

Who exactly is Satoshi Nakamoto? This has been a puzzle that has plagued the FBI for many years. It is also the answer that the Crypto community most wants to know. Undoubtedly, whether his true identity is an individual or a team, the person known as the father of Bitcoin, Satoshi Nakamoto, is a top-notch cryptography geek.

In 2008, Satoshi Nakamoto published a paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System," outlining an electronic currency and algorithm called "Bitcoin." In 2009, this network was officially launched, marking the beginning of the grand journey of the Crypto era.

After the first Bitcoin client program was released, computers used large CPU power to solve computational problems according to the set algorithm, and those who provided computing power within the same block had a chance to receive Bitcoin. Satoshi Nakamoto was the first person to run the Bitcoin network and received the world's first batch of 50 Bitcoins.

Satoshi Nakamoto's idea was to create a decentralized payment system, eliminating transaction friction and control by centralized institutions, and enabling more direct end-to-end transactions. This emerging concept quickly gained popularity among programmers. What truly broke Bitcoin into the mainstream was the famous Bitcoin Pizza Day—a programmer used 10,000 Bitcoins to buy two pizzas, marking the recognition of Bitcoin's transaction value. Additionally, WikiLeaks' use of Bitcoin in transactions helped spread the concept of Bitcoin, gradually making it more widely known.

Starting from the end of 2010, Satoshi Nakamoto disappeared from the internet. Apart from his initial claim on the internet that he was a 37-year-old man living in Japan, there has been no further information about him—most of the information he publicized is generally considered to be false, as he has never spoken Japanese online, and his English proficiency is more like a native speaker's.

After the price of Bitcoin reached a historic high of $73,000, it created a miracle in the history of finance and cryptography. It was also a digital currency revolution, providing society with a completely new way of transmitting and storing value. Bitcoin's market value surpassed that of silver, becoming the eighth largest asset in the world by market capitalization.

Considering asset security and national information security, the identity of Satoshi Nakamoto, who holds millions of bitcoins in his account, is a target that the FBI has been tirelessly seeking. After the approval of the Bitcoin ETF, hedge funds, pension funds, and banks began to invest heavily in Bitcoin spot ETFs, and traditional investors also began to accept this asset class. As of August 15th, 701 new funds have reported to the SEC holding Bitcoin spot ETFs, with a total of nearly 1950 funds.

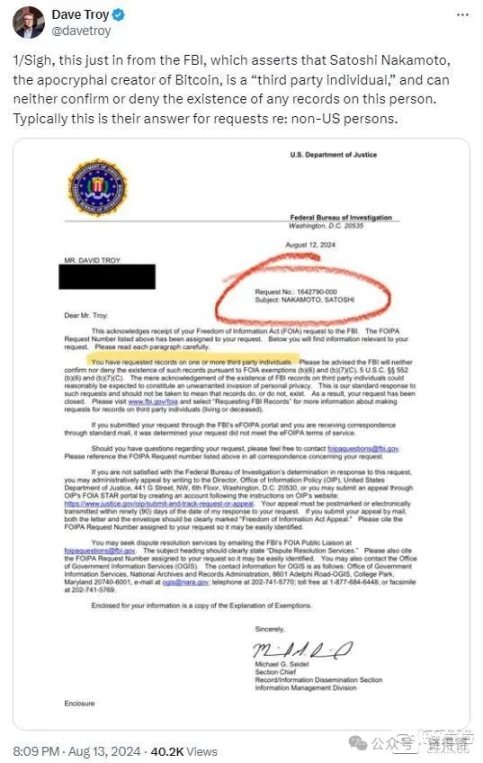

Although many people have come forward over the years claiming to be Satoshi Nakamoto, none have been able to prove it. The FBI has stated that Satoshi Nakamoto may be "one or more third-party individuals" and neither admits nor denies having information related to Satoshi Nakamoto.

Australian computer scientist Craig Wright, also known as "Faketoshi," has long claimed to be Satoshi Nakamoto. However, a British judge has ruled that Craig Wright is not Satoshi Nakamoto and is not the author of the Bitcoin whitepaper, after facing multiple police raids, investigations, and asset freezes. Wright has officially declared on his personal website that he is not Satoshi Nakamoto.

Elon Musk once tweeted that the name Nakamoto Satoshi comes from the combination of Nakamichi, Motorola, Samsung, and Toshiba.

The general consensus in the crypto community is that Satoshi Nakamoto is a crypto punk with decentralized ideals and anarchism. Unless caught red-handed by the FBI, it is unlikely that he will ever surface. After all, without a strong belief, it is difficult to create such a rare cryptographic miracle in human history, or if there is a hint of selfishness, it is hard to resist the temptation of such wealth for so many years.

As of 6:00 PM on September 9th Beijing time, the price of Bitcoin was reported at $55,130, making the story of the Tulip scam that people love to talk about more dreamlike, but it is a real commercial story that has actually happened.

The Ecological Ancestor of Dogecoin: Founder Leaves Without Holdings, Musk Becomes the New King of Pumping

In every financial market, there is always a craziest focus, and this year, the focus of the crypto world is undoubtedly on MeMe coins. Looking at the crypto industry, the most successful MeMe coin is undoubtedly Dogecoin, which Elon Musk pumped. However, looking back at the history of Dogecoin, it is full of absurdity and irony.

As Bitcoin began to gain prominence and its price continued to rise, the significant transaction friction of Bitcoin at the time made it unsuitable for small payments.

Dogecoin is a digital currency created by programmer Billy Markus in 2013. He and a research friend, Jackson Palmer, were considering creating a small digital currency for tipping. The reason it's called Dogecoin is because it uses the popular internet meme "Doge" featuring a Shiba Inu. Jackson Palmer, who was working at Adobe at the time, tweeted that he was "investing in Dogecoin and believes it will be the next big thing."

Interestingly, the origin of Dogecoin is indeed an imitation and mockery of Bitcoin. Whenever there was news of Bitcoin's rapid growth, the popular internet meme would appear, representing the disdain and mockery of the poster towards Bitcoin. Markus also admitted that he wanted to express his disdain for the speculative atmosphere in the crypto world in this way.

However, due to its interesting design and unconventional distribution method—100 billion were issued in the first year, with an additional 5 billion issued each year, with no limit to the total supply—it quickly gained the community's love. This project, which is not highly technical but has strong viral potential, quickly became a dark horse in the market. Billy Markus also rose to prominence in the crypto community and was hailed as the "father of Dogecoin."

Dogecoin's technology is based on Litecoin and has been improved using Bitcoin's code, with a different hashing algorithm (Scrypt) and faster block generation time to increase transaction speed. Dogecoin's block generation time is set at 1 minute, significantly faster than Bitcoin's 10 minutes.

Of course, Billy Markus certainly did not expect that this project, based on internet meme culture and community dissemination, with little technical foundation, would open up a mainstream market path for the future. This community-rooted dissemination path has become the core logic for the development of future blockchain projects.

After Dogecoin was launched, it ignited the Reddit and Twitter communities. In less than two weeks, people spontaneously created blogs and forums for Dogecoin, and the number of followers quickly exceeded 1 million. In everyone's eyes, Dogecoin was something fun and cool.

But after the initial hype, Dogecoin was not very successful, at least at the time, there was no vision for the future. The two founders also clearly did not have much patience or expectations for Dogecoin. In 2015, both of them sold their Dogecoin holdings and left the Dogecoin community. They also had little to no further involvement in the crypto world. After selling all his holdings, Markus bought a used Honda Civic. This was his biggest profit from the Dogecoin project.

After their departure, Elon Musk's entry pushed the Dogecoin frenzy to its peak, making Dogecoin overnight one of the top ten tokens by market value and the largest MeMe coin. The rest of the story is well-known, as the Dogecoin effect propelled the popularity of many MeMe cultures such as SHIB and PEPE, and also became the mainstream cultural symbol in American society. However, since then, the two founders of Dogecoin have not contributed to the development of Dogecoin.

Other Ecological Ancestors: How Are They Doing Now?

The recent progress of the Ethereum Foundation is not very good. On one hand, with the birth of high-performance public chains, the usability of the Ethereum ecosystem has been diverted. On the other hand, the Ethereum Foundation's expansion of layer 2 development has become too large, severely hampering the economic form. With the foundation selling a large number of tokens, the value of Ethereum and Bitcoin has become unanchored, leading to a downturn in the ETH market. Ethereum co-founder Vitalik Buterin has also been accused by the community of selling tokens and enjoying life.

Vitalik Buterin recently responded to speculation about selling millions of dollars worth of ETH assets for profit, stating that the sale of his ETH holdings was to support various crypto asset projects and charitable projects.

Blockchain analysis company Lookonchain revealed that Buterin transferred 800 ETH to a multi-signature wallet. Subsequently, the recipient exchanged 190 ETH for 477,000 USDC. Lookonchain also reported that the Ethereum founder transferred 3,000 ETH to the same multi-signature address on August 9th.

These transfers have sparked speculation about Vitalik Buterin selling tokens and enjoying life, but this kind of community banter and suspicion can be considered a happy annoyance, as Ethereum is still vibrant. However, what currently gives Vitalik Buterin a headache is the battle between L1 and L2, how to solve the difficult problem of expanding L1, and the current unfavorable situation of ETH prices.

In comparison, Ripple's recent situation is relatively prosperous. The century-long lawsuit against XRP has finally achieved victory in recent times.

The SEC sued Ripple, accusing it of illegally issuing securities through the sale of XRP on exchanges. This century-long lawsuit was once considered a regulatory benchmark, sparking controversy over whether cryptocurrencies are securities. Its outcome will directly determine the boundaries of the future development of the crypto world. In fact, before suing XRP, the US SEC also researched the three giants of blockchain cryptocurrencies at the time, BTC and ETH, which were also referred to as blockchain cryptocurrencies, but ultimately determined that BTC and ETH are not securities.

On July 13, 2023, Judge Analisa Torres of the Southern District of New York ruled that Ripple's programmatic blind sale of XRP on exchanges did not meet the definition of an investment contract in securities law and is not considered a security. Although there is still some regulatory uncertainty, this ruling sets a strong precedent and provides a clearer legal path and framework for the future development of companies like XRP.

Another company in the top 10 market cap, Solana, represents a typical story of Wall Street's strong rise. At its peak, the market value of its token SOL exceeded 540 billion, second only to Bitcoin and Ethereum. However, during the FTX black swan event, SOL shrank by 97% and liquidity dried up. But with the dissipation of the black swan event, Solana's core team has a background in high-tech companies such as Qualcomm and Google, and the capital behind it represents the will of Wall Street. With high-quality underlying code, substantial financial support, and being a native public chain in the United States, it successfully rose from the ashes.

Where there are people, there is a world, especially in the capital Shura field of the crypto world, where countless geniuses rise and shine like shooting stars. The only thing that is eternal is that human desires are always insatiable, and exciting stories will continue to unfold here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。