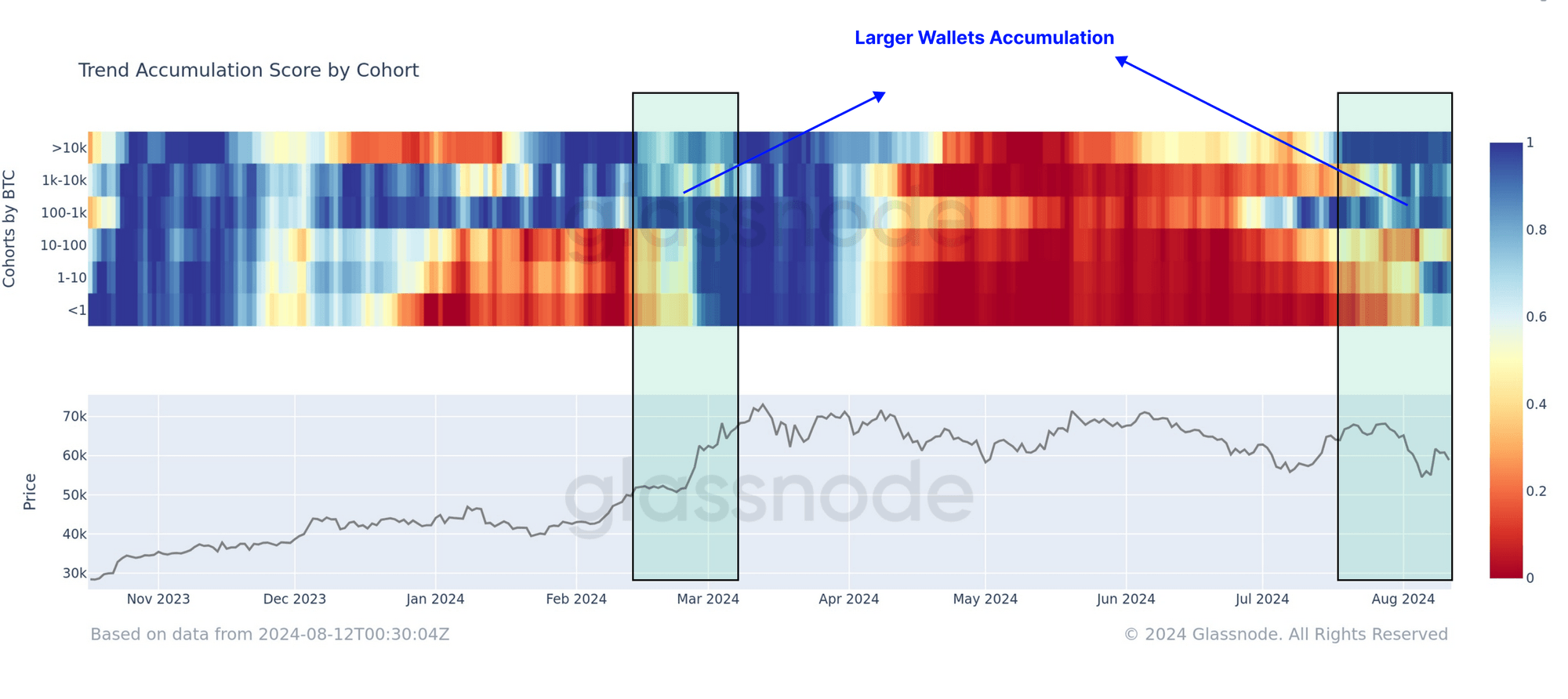

According to Glassnode‘s latest analysis, the bitcoin (BTC) market is showing early signs of a shift from sell-side pressure to a renewed focus on accumulation. The week’s onchain report notes that the Accumulation Trend Score (ATS), a key metric for assessing market behavior, has reached its maximum value of 1.0, indicating substantial accumulation activities.

“Over the last few weeks, this trend is showing early signs of reversing, particularly for the largest wallet sizes which are often associated with ETFs,” Glassnode’s research report states. “These large wallets appear to be returning to a regime of accumulation.”

Source: Glassnode’s weekly onchain report #33.

The report also emphasizes the behavior of long-term holders (LTHs), who had significantly divested their assets during the run-up to bitcoin’s all-time high (ATH) earlier this year. However, over the past three months, approximately 374,000 BTC have migrated back into long-term holding status, according to Glassnode’s findings.

The figures indicate that despite the recent price volatility, LTHs are increasingly opting to retain their assets, contributing to a more stable market foundation. Glassnode’s onchain data further shows that the Long-Term Holder Supply has returned to an upward trend, stating:

More recently, this metric has returned to positive territory, indicating that the LTH cohort are expressing a preference for holding onto their coins.

Lastly, Glassnode’s analysis of the market’s technical indicators suggests that the ongoing accumulation trend could lead to a reduction in volatility, as long-term holders continue to exhibit patience and resilience. The report points out that the Sell-Side Risk Ratio for LTHs remains low compared to previous market cycles, indicating that these investors are waiting for higher prices before resuming any significant selling.

This, combined with the market’s ability to maintain support near key levels, underscores a cautious optimism among long-term investors about BTC’s future potential. Bitcoin climbed 2.3% on Tuesday afternoon on Aug. 13, peaking at $61,600 per unit at 1 p.m. EDT. Over the past week, BTC has risen more than 7% against the U.S. dollar.

Glassnode’s latest findings align with insights from cryptoquant.com, shared by the company’s founder and CEO, Ki Young Ju, who highlighted an interesting trend: a significant amount of bitcoin has moved into long-term holder addresses in the past 30 days.

Bitcoin.com News is seeking a News Writer to produce daily content on cryptocurrency, blockchain, and the digital currency ecosystem. If you are interested in becoming a key member of our innovative global team, apply here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。