Source: Binance

Key Points

What is the current situation of the cryptocurrency market? Why does it seem to lack momentum? We aim to explore this in depth by studying short-term and long-term driving factors.

Most people are well aware of the market events that have led to recent sell-offs, but we believe that structural factors also act as potential forces influencing market dynamics.

We have delved deeper into these structural factors, introduced the Binance CPT framework, and analyzed the current market situation.

Overall, we remain optimistic about the market outlook. Several upcoming catalysts will have a positive impact on the market in the second half of this year.

Recent Market Performance

The past few months have undoubtedly been challenging for the cryptocurrency market. Despite rapid growth at the beginning of the year, it seems to have been trading sideways for some time now. The decline in June was particularly severe, with the total market value of cryptocurrencies falling by about 11.4% month-on-month. In recent days, with the market rebounding, the situation has eased somewhat, but it is still down by about 14.0% compared to the peak in March.

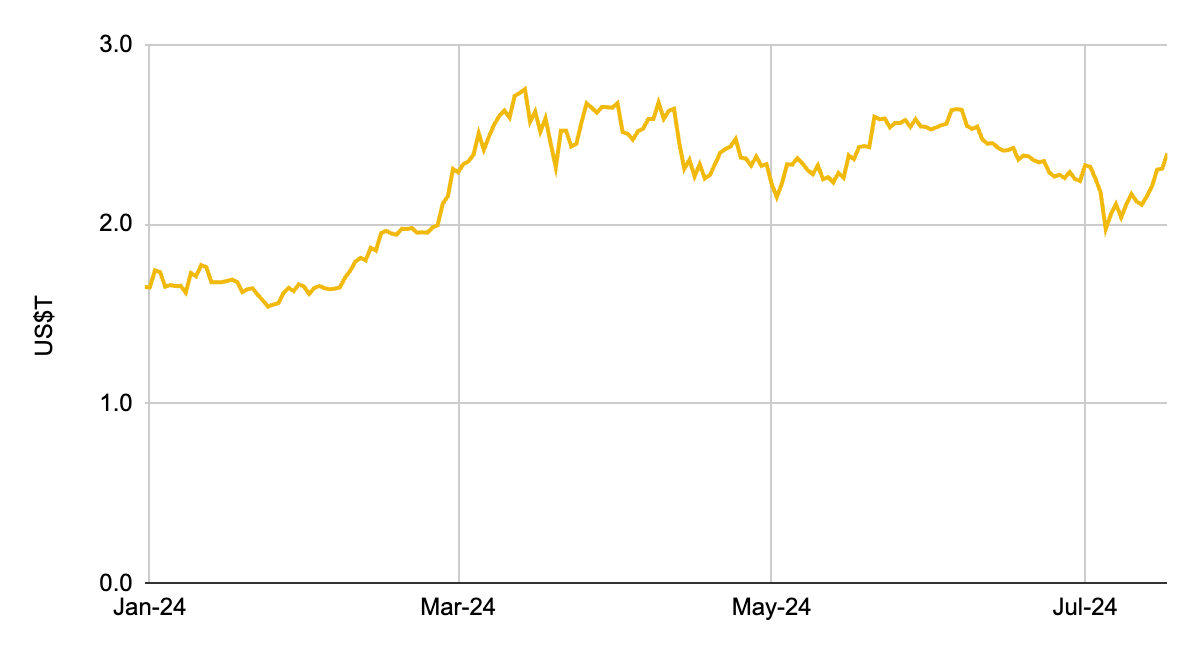

Figure 1: Signs of weakness in the cryptocurrency market following a strong performance in the first quarter

Source: Coinmarketcap. Data as of July 18, 2024.

Factors Behind the Market Weakness

The comprehensive decline in cryptocurrency prices aligns with several market events that have occurred in recent weeks. We witnessed a "perfect storm," with reports of several entities selling Bitcoin around the same time, exacerbating selling pressure and triggering negative sentiment.

Mt. Gox: Since July 5, it has been repaying creditors, distributing approximately 140,000 BTC (about $9 billion). As of now, more than one-third of the Bitcoin has been distributed to creditors.

German government: 50,000 BTC (about $3.2 billion) were transferred to centralized exchanges and market makers between June 19 and July 13.

US government: 3,940 BTC ($2.48 billion) were transferred to Coinbase Prime on June 26. At the national level, the US government remains the largest holder of cryptocurrencies, holding approximately $12.8 billion worth of cryptocurrencies.

While the large-scale sale of Bitcoin has had a negative impact on the market, there are also some mitigating factors:

Concerns about large-scale selling by Mt. Gox creditors may be overstated: It is reported that creditors can choose to receive Bitcoin or fiat currency. Those choosing to receive Bitcoin may hold at least some Bitcoin rather than selling it on the market.

The German government has sold all of its Bitcoin: The German government has already sold all of its Bitcoin holdings in the past month. Like ripping off a band-aid, the pain is only temporary and will not persist.

The upcoming US election may change the situation: Cryptocurrency has become an important issue in the election, reflecting its increasingly important position in the economic landscape. While the election results may not directly affect the government's holdings of Bitcoin, the attitude towards cryptocurrencies may lead to clearer regulations and promote widespread adoption of digital assets in the US.

Overall, the adverse effects of these events may have passed, and the sustained negative impact seems limited. We also observe that the market performance has improved in the past week.

Structural Driving Factors Should Not Be Overlooked

While most people are well aware of the market events that have led to the sell-off in the past month, we believe that structural factors also act as potential forces influencing market dynamics. This section will discuss the latter.

Introduction to the Binance CPT Framework

Market events often have a direct impact on asset prices and dominate most of the headlines. However, there are usually multiple forces at play. Some forces may not be immediately apparent but may have similar or even more lasting effects on the market. These structural factors take time to take effect but are essential for the health of the cryptocurrency market.

We classify these structural factors into three interdependent but not comprehensive areas and raise some questions to consider. Capital, People, and Technology form the foundation of the "CPT" framework.

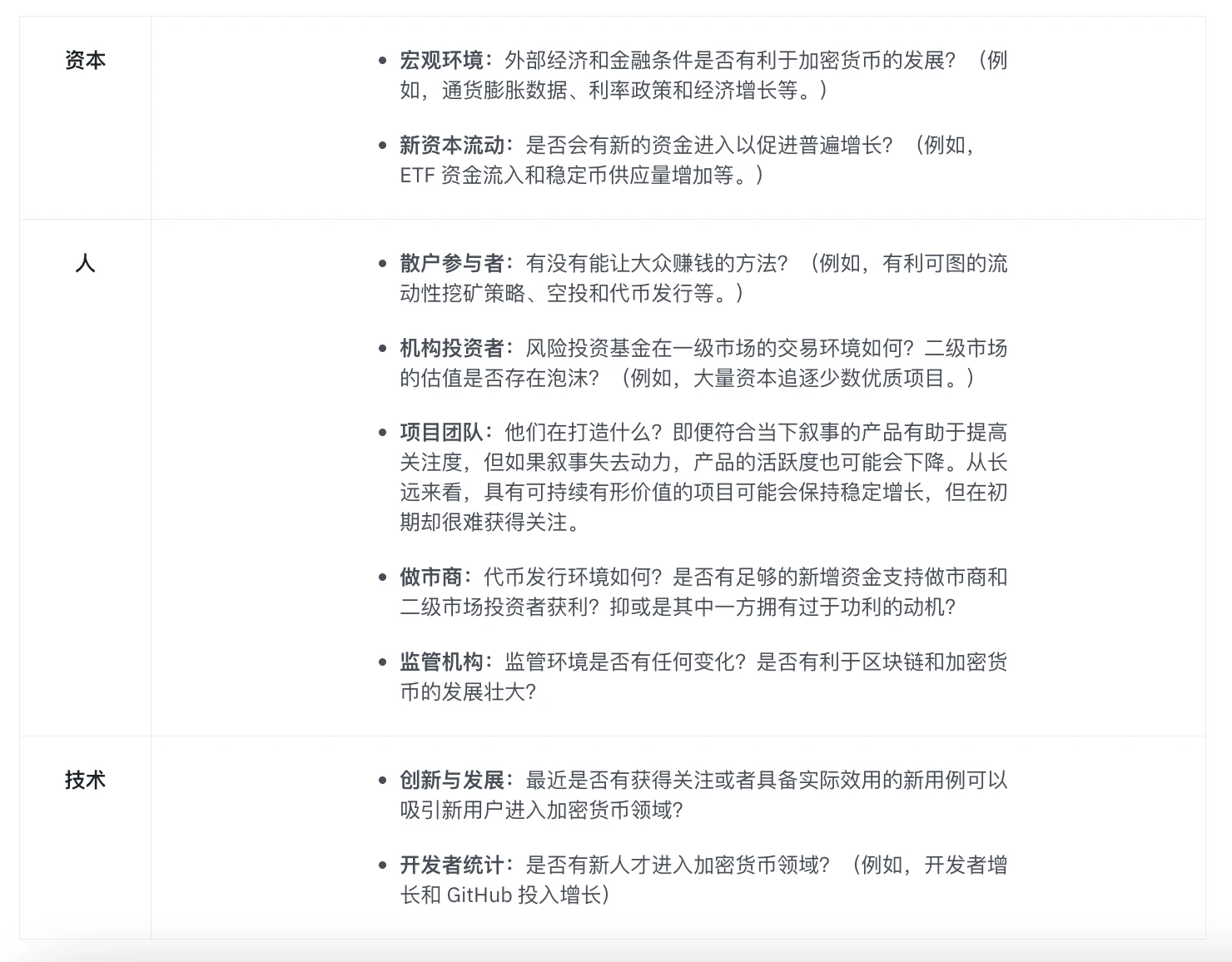

Figure 2: CPT framework

Analyzing the Cryptocurrency Market Situation with the CPT Framework

1. Capital

The speed of new capital flowing into the cryptocurrency ecosystem has slowed down. The stagnant market without new capital inflows has turned into a zero-sum game: one market participant profits, while the other inevitably suffers losses. In other words, we are in what is commonly referred to as a "player versus player" (PvP) market.

Some indicators we observe include: stagnant stablecoin supply, slowing project fundraising since the market peak in March, and outflows from spot Bitcoin ETF funds.

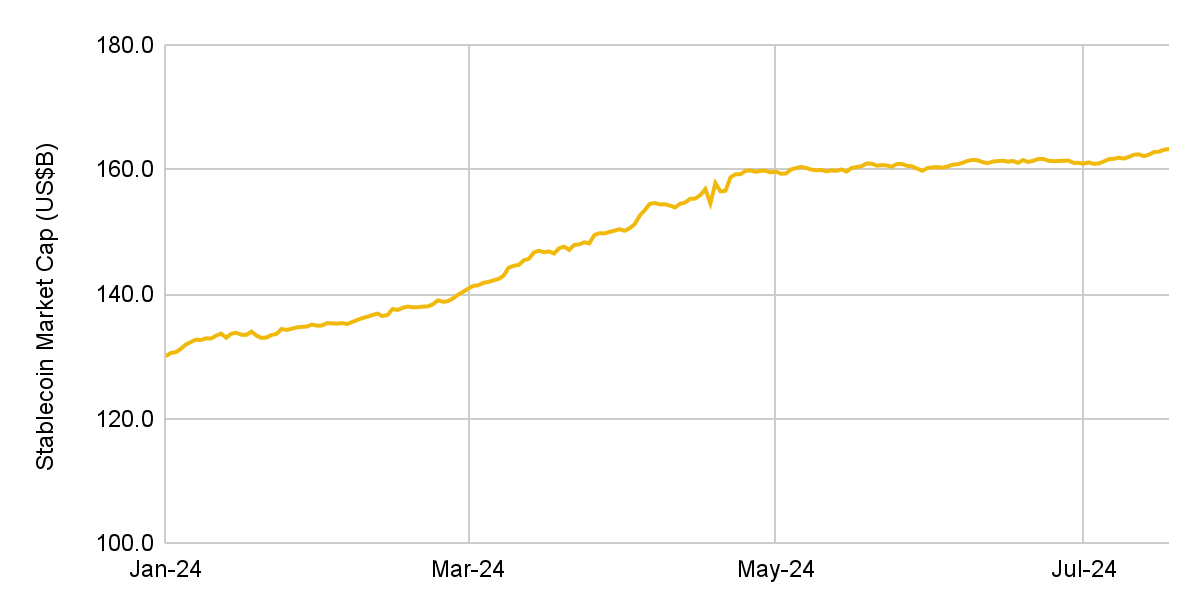

Figure 3: Stablecoin market value has almost not grown since late April

Source: DeFi Llama. Data as of July 17, 2024.

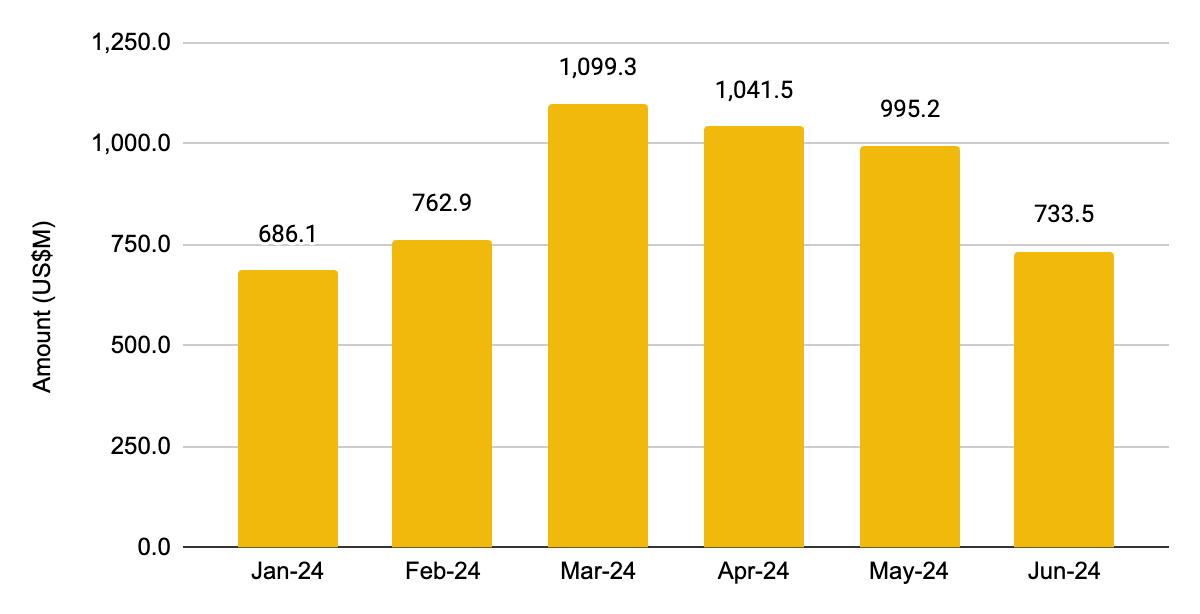

Figure 4: Project fundraising amounts have been declining over the past few months

Source: Rootdata. Data as of June 30, 2024.

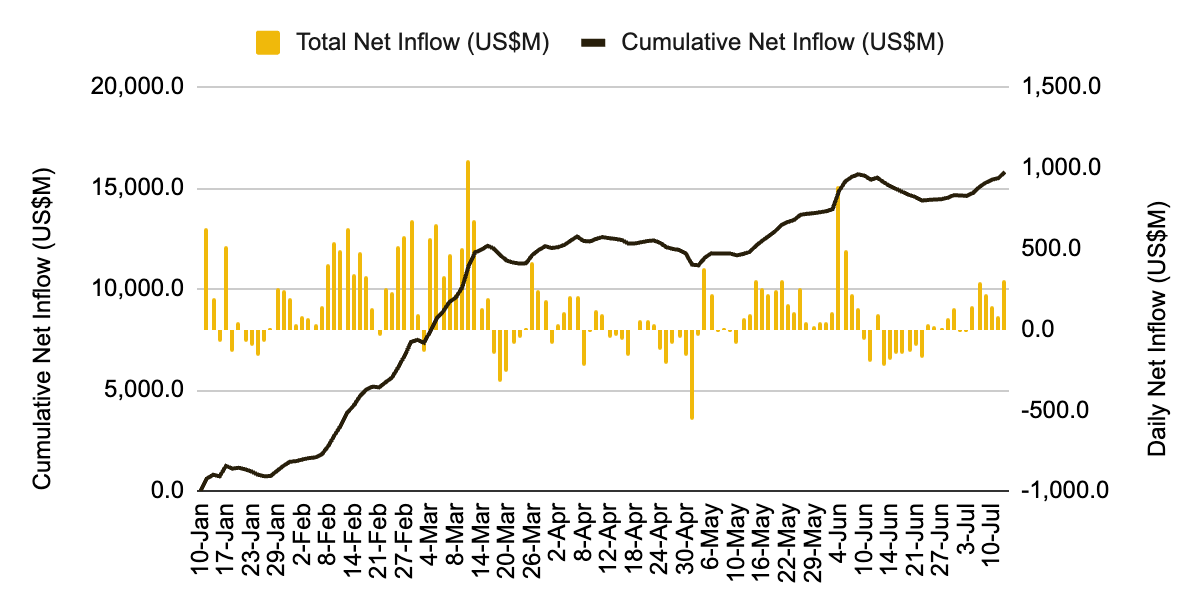

Figure 5: Net inflows of spot Bitcoin ETF have slightly slowed down

Source: SoSoValue. Data as of July 12, 2024.

Overall, the above charts show that the speed of new capital inflows into the cryptocurrency ecosystem has slowed down. Compared to the first and second quarters of this year, there has been a significant change in the speed of capital flow. In all three charts, the first quarter showed rapid growth, while the growth rate gradually slowed in the second quarter. Similarly, the cryptocurrency market saw significant growth in the first quarter of 2024, but generally declined in the second quarter, which may not be a coincidence.

Key Points:

New capital is crucial for achieving widespread sustainable growth in the cryptocurrency market. Without new capital inflows, market participants must compete with each other for profits, resulting in a zero-sum game where some benefit while others suffer.

Attracting new capital involves appealing to investors across all areas of the market: primary markets (such as venture capital funds and angel investors), secondary markets (such as institutional participants and retail traders), and traditional finance (such as ETFs).

While the macro environment plays a significant role in driving capital flows, having a compelling and easily understandable narrative, robust fundamentals (such as valuation, user attraction, product-market fit), and practical use cases will help attract and retain investor interest, ultimately fostering a healthier and stronger cryptocurrency ecosystem.

2. People

Sustainable returns and profits are important motivations for many market participants in the cryptocurrency space and other asset classes. Historical performance and a belief in the continuation of this favorable state are key reasons why many investors continue to hold traditional assets such as stocks and bonds despite market fluctuations.

However, market participants in the cryptocurrency market have faced numerous challenges in recent months. In addition to the market events mentioned earlier, we believe that the prevalence of overvalued tokens and the selling pressure from a large number of token unlocks have contributed to the difficult market environment. Earning profits in the current market environment has become increasingly challenging. We view this situation from the perspectives of several market participants:

Retail traders: Many new projects launched since the beginning of the year have mostly been on a downward trend, as the overall market and altcoins have suffered significant losses.

Institutional investors (primary markets): Most venture capital funds may still have unrealized gains, but trading activity has decreased. Lower valuations of tokens about to vest reduce their profit potential.

Project teams: As part of their compensation is usually paid in the project's native tokens, lower valuations lead to reduced overall compensation for the team. Teams that have not conducted token generation events (TGE) may remain in a longer period of private status while waiting for market conditions to improve. Overall, lower token valuations weaken financial strength and may dampen enthusiasm for engaging in cryptocurrency development.

Market Makers (MM): Market makers play a crucial role in providing liquidity for newly listed tokens. In a sideways or bear market, new tokens may not experience significant price increases due to lower trading volumes, presenting more challenges for market makers' profitability.

Regulatory authorities: Clear regulations lay the foundation for widespread adoption. Circle announced that it has become the first global issuer of stablecoins to comply with the EU's Markets in Crypto-Assets Regulation (MiCA) regulatory framework, a significant positive development. USDC, as a regulated popular stablecoin, will play a crucial role in fostering trust and adoption of cryptocurrency assets.

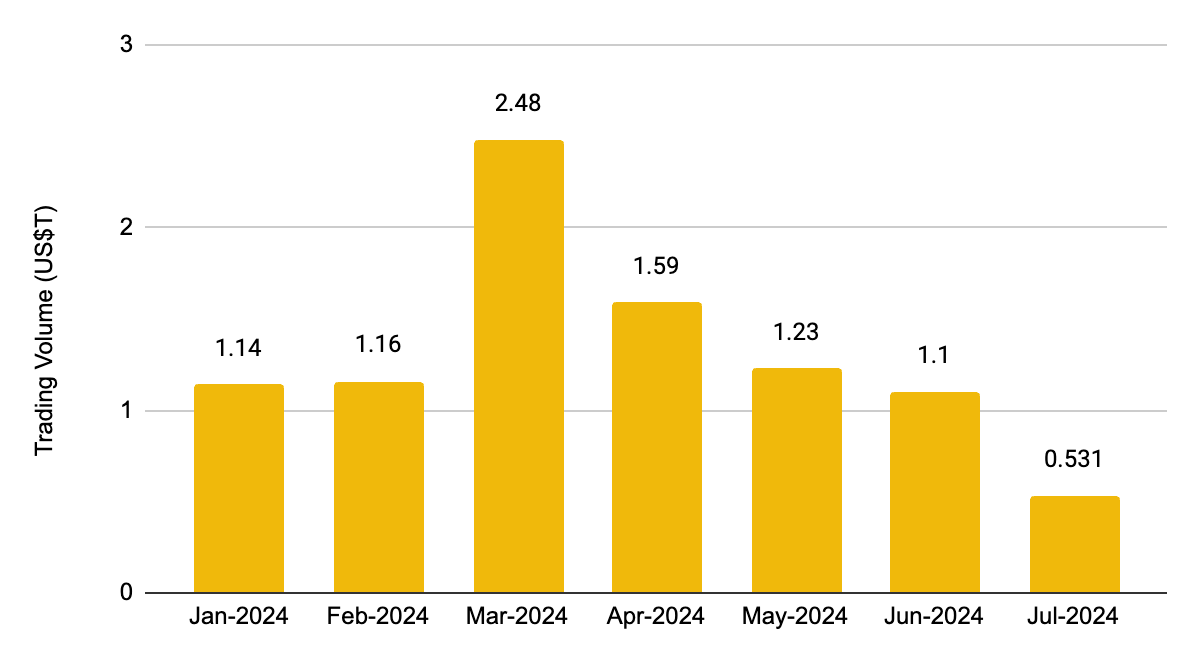

Over time, as portfolio values stagnate or decline, market participants may exit the market or reduce their trading activity. We have observed this phenomenon occurring continuously over the past few months, with trading volumes declining since the peak in March.

Figure 6: Trading volume has declined since reaching the annual price peak in March

Source: The Block. Data as of July 17, 2024.

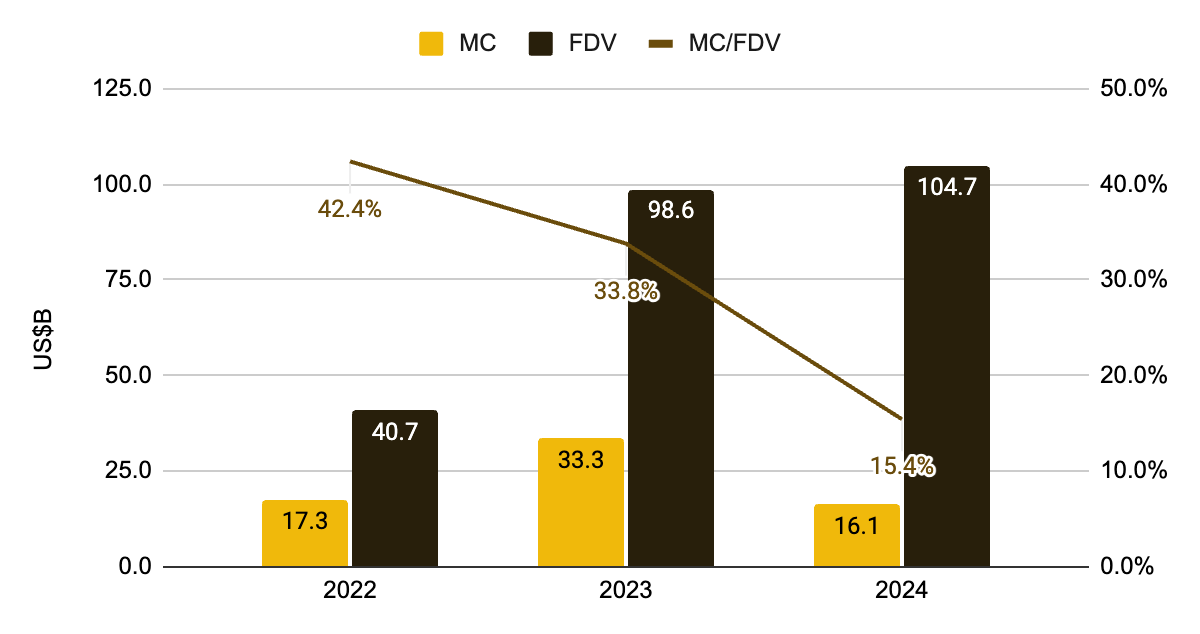

As mentioned earlier, we believe that the challenging market environment stems from structural challenges. In Binance's previous report "Low Float and High FDV: How Did We Get Here", we emphasized the issues related to low float supply and the prevalence of overvalued tokens. The prevailing view is that this market structure, post-token generation events (TGE), does not provide sustainable upside potential for the overall market. This is particularly evident when comparing these new tokens to tokens launched in previous years: the market cap (MC) to fully diluted valuation (FDV) ratio of tokens launched in 2024 is the lowest in recent years, indicating that a large number of tokens will be unlocked in the future.

Figure 7: Tokens launched in 2024 have the lowest MC/FDV ratio and a significant gap

Source: Twitter (@thedefivillain). Data as of June 3, 2024.

It is worth noting that, it is estimated that tokens worth approximately $155 billion will be unlocked from 2024 to 2030. If there is no corresponding increase in buyer demand and capital inflows, the influx of a large number of tokens into the market will create selling pressure.

Key Points:

The prevalence of overvalued tokens with low initial float supply poses a structural challenge to long-term sustainable returns.

Following the release of the previous report by Binance, we have observed increased awareness and discussions about this phenomenon, prompting more investors to conduct their own research on token economics to avoid any risks that could lead to losses.

To further foster a healthy, sustainable market environment, Binance is also committed to supporting high-quality projects in the mid-to-small market cap range.

3. Technology

Significant technological advancements have been made in the blockchain and cryptocurrency space over the past year, some of which will have positive long-term impacts (such as scaling solutions), while others address immediate needs (such as improving user experience). These initiatives are crucial for attracting more users to the cryptocurrency space with greater ease.

Features that make on-chain transactions smoother (e.g., Solana blockchain connectivity and intent-based architecture), tools that streamline processes (e.g., account abstraction and trading bots), and user-centric developments that can attract a broad user base for DApps (some decentralized social DApps have achieved some success) are examples of developments that simplify user experience and lower the barrier for non-crypto natives.

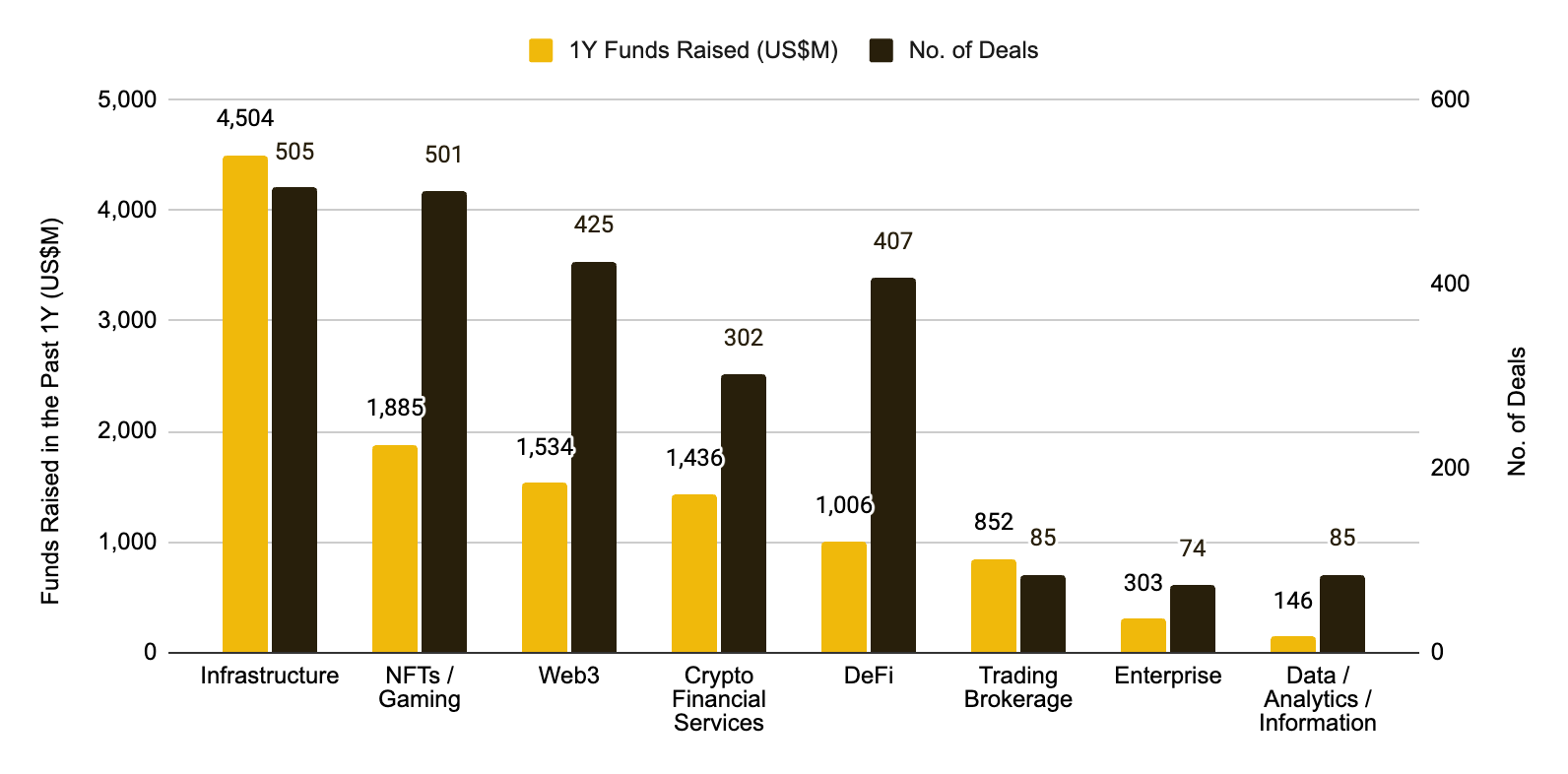

Certainly, there is still a long way to go in attracting the next billion users. Currently, significant capital continues to flow into infrastructure projects, which are crucial for the ecosystem and form the most fundamental building blocks. However, many infrastructure projects are often platforms aimed at developers (e.g., blockchains), while DApps are the front-end for consumer user interaction and attention. The proliferation of Layer 1 and Layer 2 has led to liquidity dispersion, which may not be helpful in attracting attention.

Figure 8: Infrastructure projects receiving an unusually large amount of funding from private markets

Source: The Block. Data as of July 17, 2024.

Key Points:

Technological progress and innovation play a crucial role in attracting a wider and more diverse audience to enter the cryptocurrency ecosystem. By providing practical use cases and real value, we can attract individuals who are not solely motivated by economic gains.

While infrastructure projects are important, their attention and funding have exceeded normal ranges. Allocating some resources to develop practical, diverse, and innovative DApps may help expand the coverage of the cryptocurrency ecosystem and attract more users.

Upcoming Catalysts

Despite the structural challenges, we remain optimistic about the prospects for the second half of this year. Several upcoming catalysts could drive the industry forward.

Approval of a Spot Ethereum ETF: According to multiple media reports citing sources, this could happen around July 23. New capital inflows will increase demand for ETH, and as the tide rises, this will drive a general market recovery. Please note that the impact may not be immediate (refer to what we saw after the approval of the BTC ETF in January).

Macroeconomic Environment: With signs of gradually weakening inflation (the latest CPI data has declined for the third consecutive month and is below expectations), traders are currently expecting a rate cut in September. Rate cuts reduce the cost of capital and typically stimulate multiple different markets, potentially serving as a potential positive factor for both the stock market and the cryptocurrency market.

U.S. Presidential Election and Bitcoin Conference: Polymarket currently predicts a 70% probability of Donald Trump winning the upcoming presidential election in November. The Trump campaign team accepted cryptocurrency donations in May and has become increasingly positive about the future of digital assets. Trump also announced that Senator J.D. Vance, who supports cryptocurrencies, will be his vice presidential candidate. The senator has disclosed that his BTC holdings are between $100,000 and $250,000 and has made positive remarks about blockchain technology. Trump will speak at a Bitcoin conference in Nashville on July 27, and his speech will be a focal point of attention.

Impact of Bitcoin Halving: The price of Bitcoin typically rises in the 6 to 12 months following a halving. While past performance cannot guarantee future results, this timeframe roughly aligns with the Fed's September meeting and the U.S. presidential election.

Figure 9: Historical data shows that the price of Bitcoin rises in the 6 to 12 months after a halving

Source: Coinmarketcap and Binance Research. Data as of July 17, 2024.

Conclusion

Market cycles always have their ups and downs. Pullbacks are a common occurrence and can even help restore healthy levels in the market.

At this time, broadening your perspective, focusing on the future, and re-evaluating your strategy may be beneficial. Are you considering holding cryptocurrencies in your portfolio for the long term? Perhaps you believe that cryptocurrencies have the potential to fill gaps in traditional systems, introduce entirely new modes of operation, or become significant assets in your investment portfolio. If so, you can take advantage of market pullbacks to increase your portfolio. If you lean towards risk aversion, you can evaluate your investment horizon and liquidity needs. Sometimes, holding can also be a strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。