Article: Will Awang @will_7th, a financing lawyer, focuses on Web3 & Digital Asset; an independent researcher, focusing on tokenization, RWA, payments, and DeFi.

If I were to imagine how future finance should operate, I would undoubtedly introduce the numerous advantages brought by digital currency and blockchain technology: 24/7 availability, instant settlement, fair access without permission, global liquidity, asset composability, and transparency.

The future financial world in this imagination, proposed by Satoshi Nakamoto in the Bitcoin whitepaper in 2008, is gradually being built through tokenization and is expected to achieve mass adoption through PayFi in the future.

Since the emergence of Bitcoin in 2009, the rise of digital currency has swept the globe. However, over the past decade, attention to price speculation and volatility has diverted people's attention, causing us to overlook the groundbreaking innovations that digital currency and blockchain technology can bring.

As Chris Dixon, a partner at a16z, stated in his book "Read Write Own": "Cryptocurrency is just one of the many applications that blockchain technology can bring. Digital currency (Token) built on the blockchain network is the most effective use of Web3 value internet."

Digital currency allows value to no longer be stagnant, but to be transferred almost instantly and at low cost through the Web3 value internet in a permissionless manner, accessible to anyone with internet connection. The essence of payment is the transfer of value.

With the annual development of underlying blockchain infrastructure and the arrival of the tokenization wave, it indicates that the greatest opportunity for digital currency may not be to view it as digital currency, but as a new set of payment methods combined with blockchain.

This revolutionary paradigm shift indicates that people will break free from the constraints of the traditional financial system, bypassing the complex and outdated settlement systems of today to embrace the possibilities brought by digital currency and blockchain technology. This is similar to how Starlink directly meets the fundamental communication needs of people deep in the Serengeti, rather than waiting for communication companies to lay the network.

Therefore, this article will combine my limited understanding of Web3 payments, RWA tokenization, and the financial currency system, and through 13 latest Web3 payment cases, outline the development from the grand vision of Bitcoin to the current wave of tokenization, and further look forward to how PayFi will land, opening the next chapter for Web3 payments.

If there were doubts last year when writing the 10,000-word report on Web3 payments: Industry giants' all-out attack, which could change the existing encryption market landscape, I am now convinced that the killer application of Web3 has arrived, and it is payments!

I. Overview of Web3 Payments

1.1 Payments and Payment Systems

Let's first look at the definition of traditional payments: Payment is the act of transferring currency or claims from the payer to the payee, completing the exchange of value through the matching of information flow and fund flow. The essence of payment is the exchange of value.

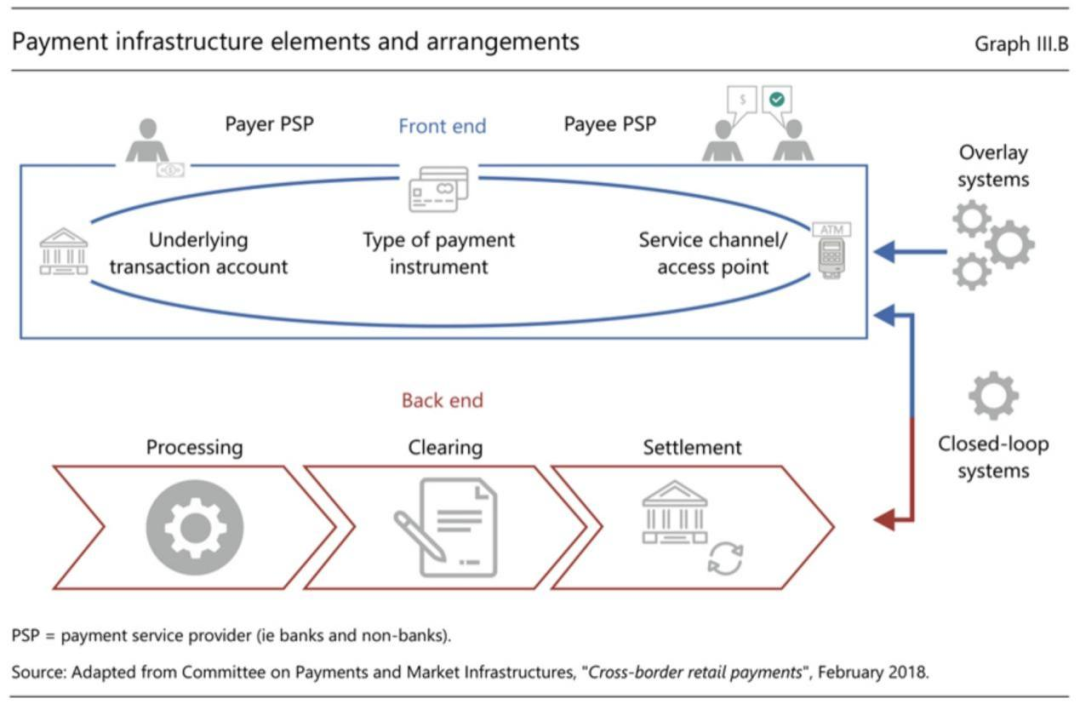

According to the 2020 annual report of the Bank for International Settlements (BIS), a payment system refers to a set of tools, processes, and rules developed for the clearing and settlement of transactions between multiple transaction participants (including payment service providers). This financial infrastructure for payments is usually divided into "front-end" and "back-end": "front-end" involves interactions with end consumers, merchants, and payment service providers, handling the information flow of payment transactions, involving:

1) Funding sources; 2) Service channels for initiating payments; 3) Payment instruments;

The "back-end" involves the fund flow of payment transactions, payment settlement networks, and other financial infrastructure, involving:

1) Clearing, which refers to the transmission of payment instructions and reconciliation process, sometimes including transaction confirmation before settlement; 2) Settlement, which refers to the transfer of funds to discharge payment obligations between two or more parties.

(Central banks and payments in the digital era)

(Central banks and payments in the digital era)

From the above image, we can see the complexity of traditional payments, not to mention cross-border payments in a global context, which involves domestic clearing systems (such as the Fedwire operated by the U.S. Federal Reserve, and China's CNAPS), cross-border payment settlement systems (such as CHIPS in the U.S. and CIPS for cross-border RMB settlement in China), and international payment and settlement systems (such as SWIFT), not to mention the involvement of various banks in this system.

With the rise of cryptocurrencies, represented by Bitcoin, the so-called "sovereign digital currency" (although currently priced in USD), stablecoins issued by the private sector, and central bank digital currencies (CBDC) issued by various central banks, the exploration of tokenized money is continuously creating new forms of currency and new ways of currency circulation.

Web3 payments built on blockchain are the carrier of this new form of currency and the operational mechanism of the new currency circulation method. Blockchain directly embeds digital currency into the Web3 value internet as a fundamental architecture for currency settlement, allowing it to transfer value like data in the early days of the internet.

More importantly, digital currency and blockchain technology can represent real-world assets in a unique (or non-fungible) digital form on the Web3 value internet through tokenization. Digital currency and tokens representing real-world assets, based on the atomic exchange properties of blockchain, can quickly open up a free market for asset purchase, sale, financing, and trading that anyone, anywhere can participate in at any time.

The endowment of blockchain is the financial infrastructure itself, initially constructed to solve the final consistency problem of payment settlement. Digital currency built on blockchain can leverage the enormous advantages brought by digital currency and blockchain technology, reflected in the near-instant settlement, 24/7 availability, low transaction costs, as well as the programmability, interoperability, and composability with DeFi brought by digital currency itself, which are the infinite possibilities that traditional financial payment systems desire but find difficult to achieve.

1.2 Outdated Infrastructure, Complex Payment Systems

To further understand the fundamental driving force of Web3 payments, let's first understand some historical background of payments.

Our current payment channels and information transmission protocols (such as ACH, SEPA, and SWIFT) constitute the global payment network - the international payment and settlement system. They enable us to conduct large-scale transactions across regions and time zones and ensure relatively smooth payments.

However, these global payment infrastructures built over 50 years ago are now considered outdated and fragmented. It is an expensive and inefficient system that operates within limited banking hours and relies on many intermediaries.

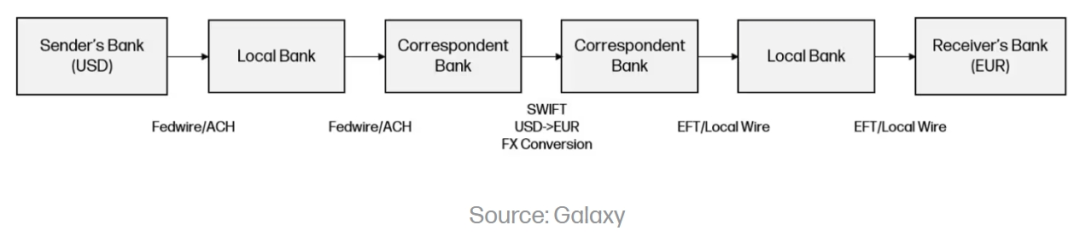

A significant problem with the current financial infrastructure is the lack of global standards, and the fragmented financial payment systems of various countries hinder seamless international transactions and add complexity to establishing a consistent payment system. This complexity is best illustrated by the structure of cross-border payment transactions (as shown in the example of remitting USD from the U.S. to receive EUR in Europe), which includes many actual pain points:

(Galaxy Ventures: The Future of Payments)

(Galaxy Ventures: The Future of Payments)

- Multiple Intermediaries: Cross-border payments typically involve multiple intermediaries, such as local banks and correspondent banks, clearing institutions, forex brokers, and payment networks. Each intermediary adds complexity to the transaction process, leading to delays and increased costs.

- Lack of Standardized Processes and Formats: Different countries and financial institutions may have different regulatory requirements, payment systems, and information transmission standards, making streamlining payment processes inefficient and challenging.

- Manual Closed Processing: Traditional systems lack automation, real-time processing capabilities, and interoperability with other systems, leading to delays and manual intervention.

- Lack of Transparency: The lack of transparency in cross-border payment processes can lead to inefficiencies. Limited visibility of transaction status, processing times, and related fees may make it difficult for businesses to track and reconcile payments, leading to delays and management expenses.

- High Costs: Cross-border payments often incur high transaction fees, exchange rate markups, and intermediary fees. Cross-border payments typically take up to 5 business days to settle, with an average cost of 6.25%.

Despite these challenges, B2B cross-border payments are a pressing need in a global context, with a huge market size that continues to grow. According to FXCIntelligence, the total market size of B2B cross-border payments is estimated to be $39 trillion in 2023, projected to grow by 43% to reach $53 trillion by 2030.

1.3 Urgent Needs Addressed by Web3 Payments

Just as PayPal stated upon launching its PYUSD stablecoin: "People want to be able to pay as they please, and the current payment networks are unable to meet the demand. Payment networks built on digital currency and blockchain technology can meet the demand and be practical. As a company dedicated to promoting payment innovation, we are launching a stablecoin payment solution to meet people's current payment needs."

Today, digital currency and blockchain technology provide us with a new Web3 payment channel that can simplify payment settlement processes, making payments fast, inexpensive, and easily accessible to meet the increasingly globalized needs of people.

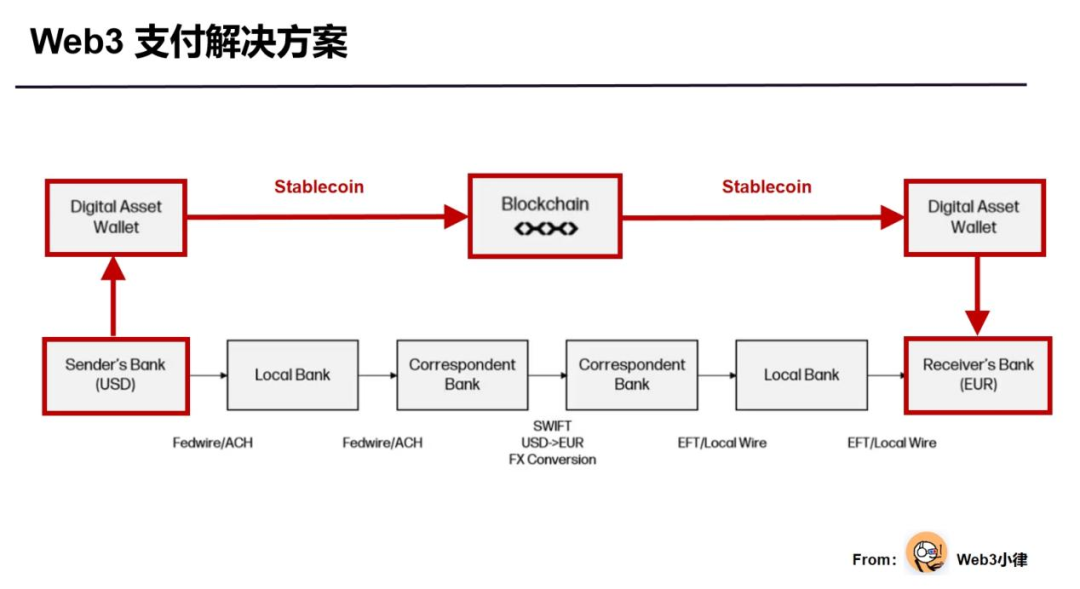

Stablecoins built on blockchain, as a primary form of tokenized money, have now become an ideal solution to the existing challenges in areas such as cross-border payments. Let's review the elegant solution of Web3 payments to the previously complex cross-border payment examples (as indicated by the red box):

- Instant Settlement: Payments on the blockchain can settle transactions globally in real-time, unlike most traditional payment methods that take days to settle.

- Cost Reduction: Blockchain payments can offer lower costs compared to existing products, as they eliminate various intermediaries and have superior technological infrastructure.

- Transparency: Blockchain provides higher visibility in tracking fund flows and reduces management costs for reconciliation.

- Global Accessibility: Blockchain provides a "high-speed railway," allowing anyone with internet access to easily access it.

By using the payment track built on blockchain, the payment process can be greatly simplified, reducing the number of intermediaries. Compared to traditional payment methods, fund flows are instantly visible, settlement times are faster, and costs are lower.

We urgently need Web3 payment solutions to help people transfer value instantly and inexpensively around the world, addressing the legacy issues of traditional payments: 1) slow settlement times; 2) high transaction costs; and 3) incompatibility with under-banked and unbanked regions globally.

(Galaxy Ventures: The Future of Payments)

(Galaxy Ventures: The Future of Payments)

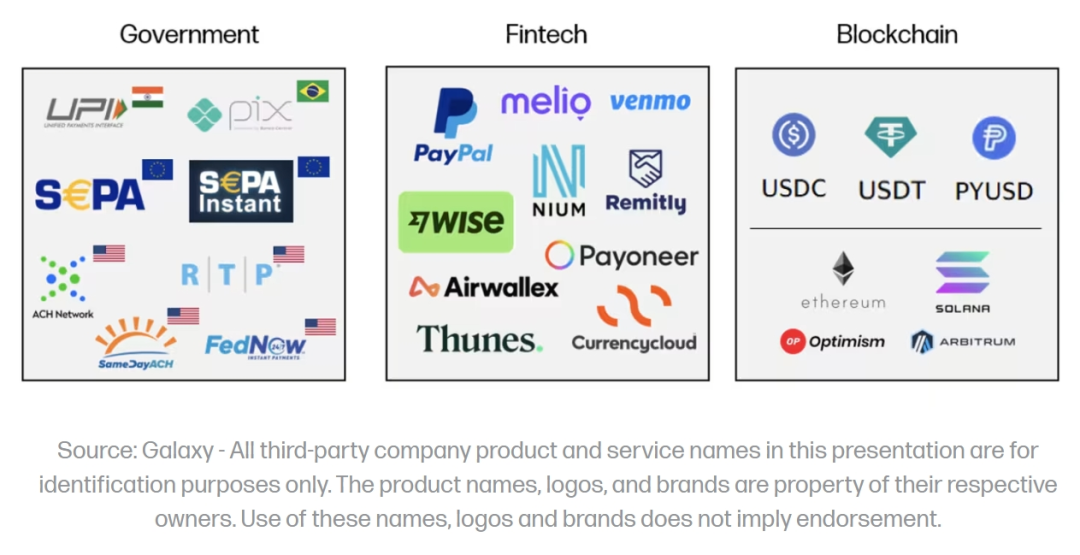

1.4 Web3 Payment Stack

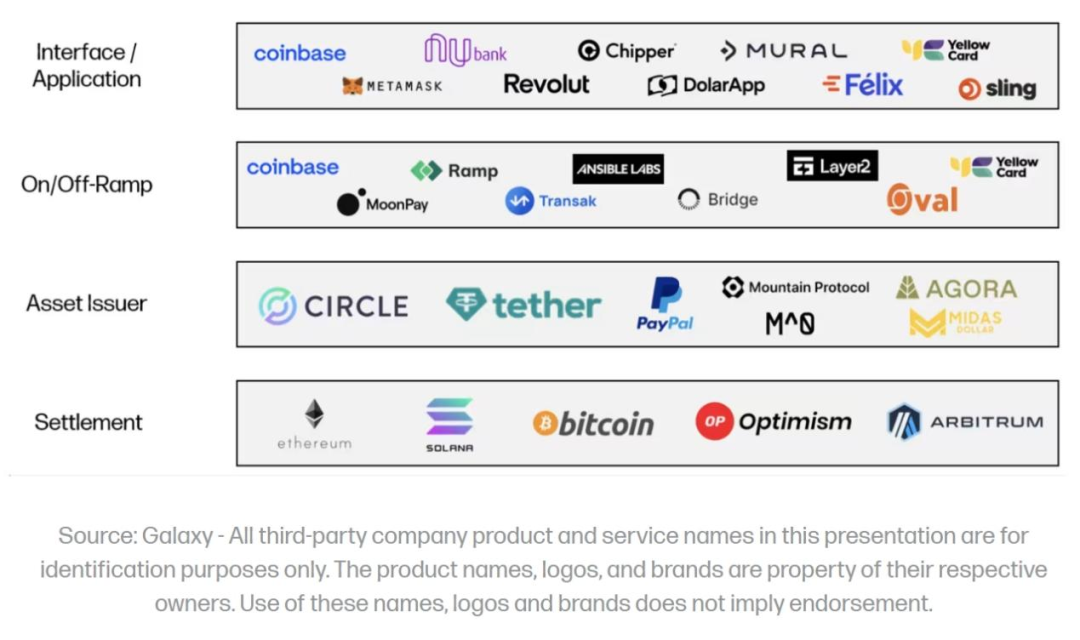

(Galaxy Ventures: The Future of Payments)

(Galaxy Ventures: The Future of Payments)

When we take a close look at Web3 payments, we find that there are primarily four layers in the technology stack:

1.4.1 Blockchain Settlement Layer

The endowment of blockchain is the financial infrastructure itself, initially constructed to solve the final consistency problem of payment settlement. Blockchain will serve as the underlying infrastructure for payment transactions. Layer1 blockchains such as Bitcoin, Ethereum, and Solana, as well as general Layer2 environments like Optimism and Arbitrum, are competing in the market in terms of speed, cost, scalability, security, and distribution channels. Over time, payment use cases will become significant consumers of block space.

1.4.2 Asset Issuers

Asset issuers are responsible for creating, maintaining, and redeeming financial transactions and payment media. For example, stablecoins are designed to maintain a stable value relative to the underlying reference asset or a basket of assets (most typically the US dollar). Stablecoin issuers such as Tether-USDT, Circle-USDC, and PayPal-PYUSD typically operate on a balance sheet-driven business model similar to banks, absorbing customer deposits and investing them in higher-yielding assets such as US treasuries, then issuing stablecoins as liabilities, profiting from the interest spread or net interest margin.

1.4.3 Currency On/Off Ramps

Currency on/off ramps play a crucial role in increasing the availability and adoption of primary tools such as stablecoins as financial transactions and payment media, promoting the widespread application of Web3 payments. Fundamentally, they act as a technical layer connecting digital currencies on the blockchain with fiat currencies in traditional bank accounts. Their business models are often traffic-driven, earning a small commission from the amount of USD flowing through their platforms.

For example, GatePay, leveraging exchange liquidity, provides users with a smooth Web3 payment solution while facilitating the integration of on-chain and off-chain payment paths. Similarly, Switzerland's Web3 bank Fiat24 directly integrates the bank's business logic on the blockchain, offering users seamless connectivity from digital currency wallets to bank accounts in fiat currency.

1.4.4 Front-end Applications

Front-end applications are ultimately customer-facing software in the Web3 payment stack, providing a user interface for Web3 payments and utilizing other parts of the stack to facilitate such transactions. Their business models vary, but they often involve a combination of platform fees and traffic-driven fees generated through front-end transactions.

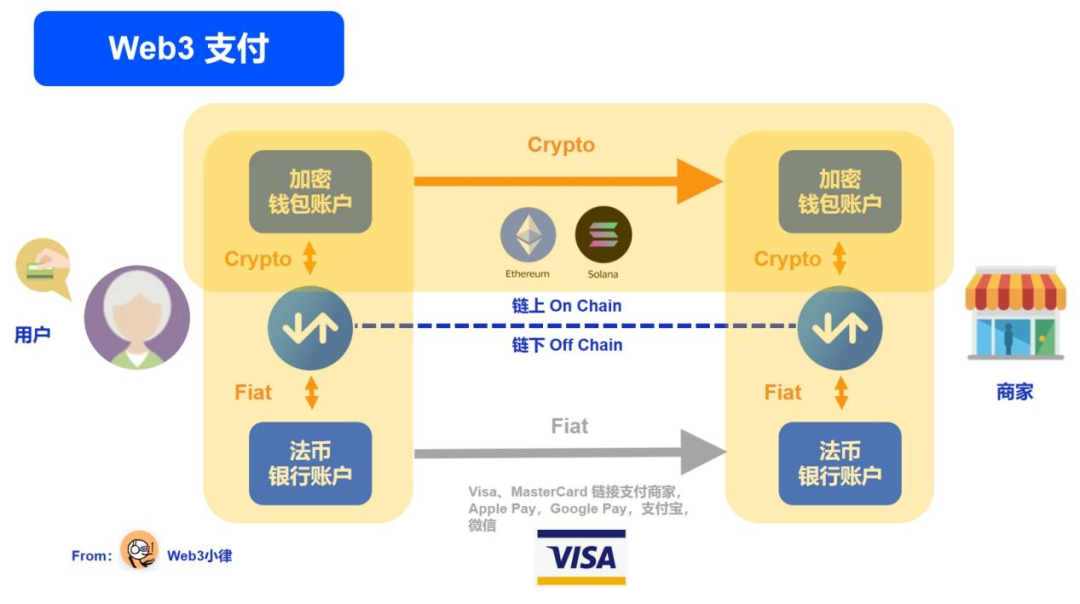

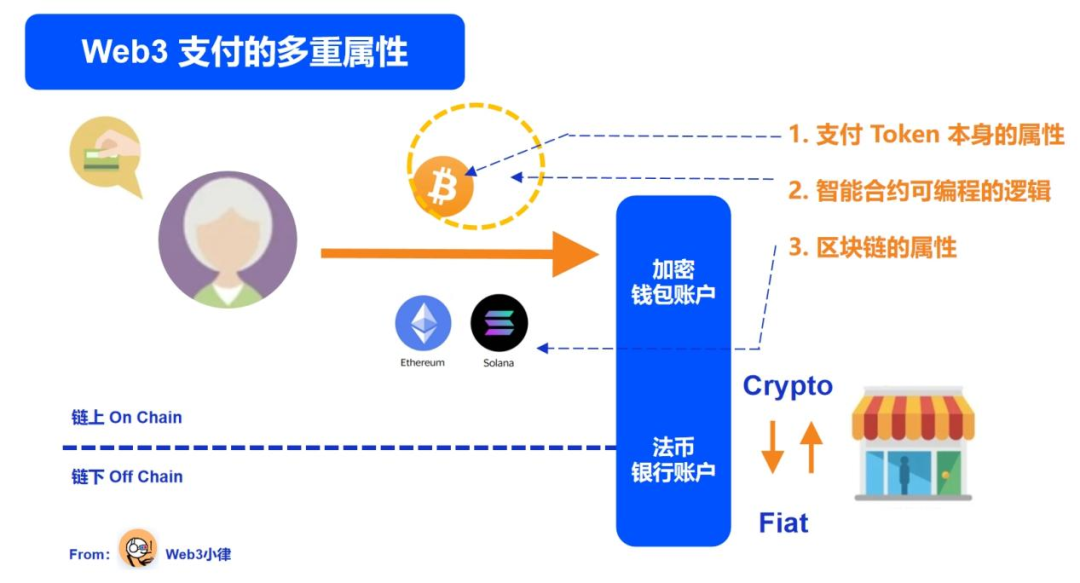

1.5 Multiple Attributes of Web3 Payments

So, for Web3 payments, in simple terms, it refers to a payment method based on digital currency and blockchain technology. However, due to the token attributes of digital currency itself and the characteristics of the underlying blockchain infrastructure, Web3 payments cannot be simply understood as a single attribute of a new payment method.

Here is the complete translation of the provided markdown:

For example, Bitcoin, built on the Bitcoin blockchain network, has multiple attributes. It is not only a form of payment and a medium of exchange but also a store of value and a financial infrastructure. In transactions, it can also serve as a unit of account to denote value.

Therefore, Web3 payments should not only focus on the properties of the payment token itself (cryptocurrency, tokenized currency, etc.) but also need to consider the attributes of the blockchain network that carries the payment transactions (as a financial infrastructure). It is important to understand how they fully utilize blockchain technology to reduce costs, increase efficiency, and build new business models.

Just as understanding dollar payments cannot solely focus on the dollar but must also consider the overall extensive dollar payment clearing and settlement network. Understanding this point is crucial. Let's look at the case of PayPal launching PYUSD.

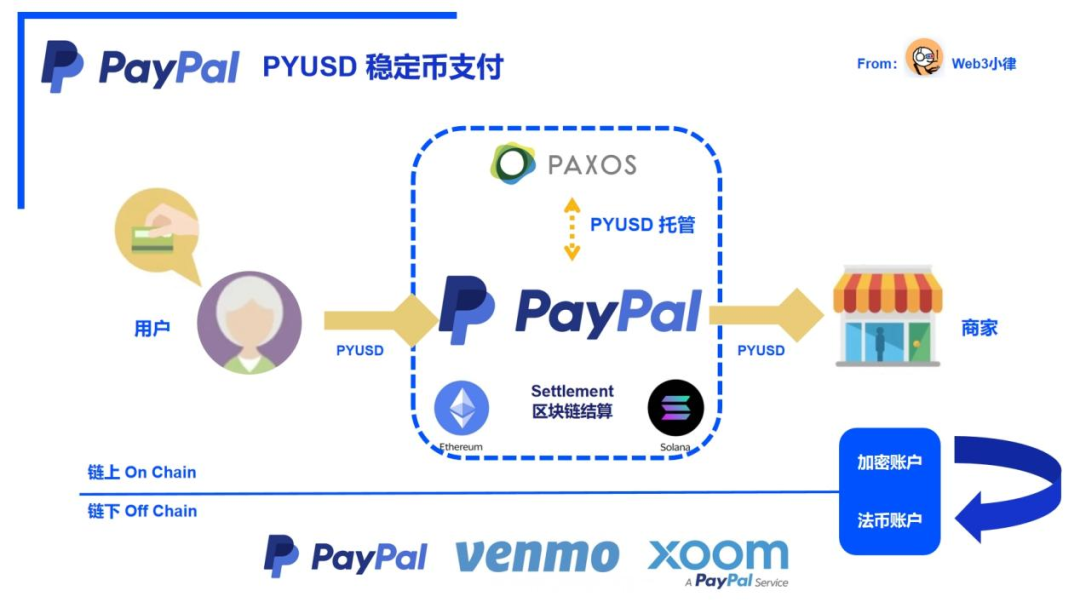

Case Study A: The Logic of PayPal's Web3 Payments

On August 7, 2023, the U.S. payment giant PayPal announced the launch of its stablecoin PayPal USD (PYUSD) on the Ethereum blockchain. PYUSD stablecoin is fully collateralized by dollar deposits, short-term U.S. treasuries, and similar cash equivalents, and eligible U.S. users can exchange 1:1 with the dollar through PayPal. As a result, PayPal became the first tech giant to issue a stablecoin.

PayPal turned its attention to Web3 payments for a simple reason: it meets the demand and is practical.

Traditional online payment settlement times are still long (averaging 2-3 days in the U.S.), markets, banks, and service providers operate on business days, further extending settlement times. Employers find it difficult to pay an increasingly distributed workforce, and the increasingly global population struggles to make cross-border remittances in a cost-effective manner. In short, people today cannot pay as they please.

Now, Web3 payments based on digital currency and blockchain technology can bring people closer to realizing their payment desires: fast, inexpensive, and global payments. This new generation of financial/payment infrastructure can help PayPal better serve its 40 million users, allowing everyone to pay as they wish.

Therefore, more than a decade after the emergence of digital currency and blockchain technology, PayPal has once again arrived at a crucial moment in payment history, a moment filled with potential and opportunities, much like the early 2000s of the internet. Just as PayPal brought payments online before, PayPal is now bringing payments onto the chain.

Since its launch on Ethereum, PYUSD has been running steadily, more like an experimental product, operating more within PayPal's SuperApp. At this stage, PYUSD has reached early adopters, namely cryptocurrency holders, accounting for about 15% of the global population, ensuring early adopters' awareness and awakening.

(PayPal launches USD stablecoin on Solana: A new chapter in blockchain payments)

(PayPal launches USD stablecoin on Solana: A new chapter in blockchain payments)

On May 31, 2024, PayPal announced the launch of PYUSD on the high-performance Solana blockchain, covering the most active and enthusiastic groups in the crypto ecosystem, letting the world know that "PYUSD has truly arrived." At this stage, PayPal aims to truly realize payment utility, transforming the initial cognitive awakening into practical payment utility in real life.

Solana has brought PYUSD far faster settlement speeds, lower transaction costs, stronger scalability, interoperability, programmability, and global network support compared to other blockchains. With the combination of Solana's advantages, users can truly realize payment utility when using PYUSD, in various scenarios such as cross-border peer-to-peer remittances (C2C), inter-enterprise transfers (B2B), and global payments (B2C).

In this case of PayPal's Web3 payments, we can see that PayPal and Paxos, as stablecoin asset issuers, have issued the PYUSD stablecoin, the only stablecoin supported in the PayPal ecosystem. PYUSD combines the efficient, low-cost, and programmable features of the Solana blockchain (as the settlement layer) and will be used to connect PayPal's ecosystem to all front-end applications, serving 431 million users, providing a seamless connection between fiat currency and digital currency for Web2 consumers, merchants, and developers.

Traditional payments and Web3 payments are not separate but are showing a two-way trend, with fiat and digital currencies constantly interacting and gradually integrating into various real-world use cases such as stablecoins, tokenized deposits, central bank digital currencies, and more. Web3 payments are redefining our payment methods and financial systems.

II. From the Beginning of Bitcoin Electronic Cash

Before delving into the specific content of Web3 payments, we must first review the "bible" of digital currency and blockchain technology—the Bitcoin whitepaper—to explore the birth of Web3 payments, the significance of blockchain networks, and to understand that PayPal's form of Web3 payments is not the ideal payment form as described in the Bitcoin whitepaper (issues of centralized trust, infinite inflation of payment currency, etc.).

To understand the Bitcoin and its blockchain network constructed by Satoshi Nakamoto represents a new solution to the currency problem born in the digital age, aiming not only to solve the eternal problem of human society: how to allow economic value to flow across time and space but also to address the issue of trust in third parties in payment transactions.

2.1 The Origin of Bitcoin

The traditional financial system in the real world heavily relies on intermediaries as trusted third parties. This intermediary transaction model, endorsed by trusted third-party trust, while providing some convenience, often has many flaws, such as unnecessary transaction costs, reversible transactions, and centralized malfeasance. The most real and brutal lesson is the global financial crisis of 2008.

Is there a new way that allows any two trading parties to transact directly without the need for a trusted third party, just like cash transactions?

This is exactly what Satoshi Nakamoto wanted to achieve. In 2008, Satoshi Nakamoto released the Bitcoin whitepaper "Bitcoin: A Peer-to-Peer Electronic Cash System," proposing a vision of a peer-to-peer electronic cash payment system, where electronic cash can be based on blockchain technology, using distributed ledgers, asymmetric encryption, and consensus mechanisms to achieve decentralized peer-to-peer transactions without the intervention of any neutral, trusted third party.

The Bitcoin whitepaper, through the combination of various innovative technologies and the design of changes in social production relations, aims to change the centralized financial system core of traditional banks, solve the issue of centralized trust in the current financial system, and provide users with a more secure, convenient, and low-cost payment method (a peer-to-peer version of electronic cash (system) would allow online payments to be sent directly from one party to another without going through a financial institution).

(Bitcoin: A Peer-to-Peer Electronic Cash System)

(Bitcoin: A Peer-to-Peer Electronic Cash System)

2.2 Collapse of the Intermediary Trust System

Cash payment is the oldest form of transaction for people, with no delay and no effective intervention or hindrance from any third party. However, with the development of communication technology, cash transactions have become inadequate to meet people's payment needs in different places, time zones, and scenarios, leading to the emergence of intermediary payments.

Intermediary payments require a trusted third party, such as banks, PayPal, and other payment service providers, to offer innovative payment methods like credit cards, debit cards, bank transfers, and cross-border remittances. However, the biggest problem lies in the fact that people need to fully trust the intermediary as a third-party in transactions. This trust often has many flaws, such as unnecessary transaction costs, reversible transactions, and centralized malfeasance.

The timing of Bitcoin's proposal was in 2008, during the bursting of the U.S. real estate market bubble, where numerous financial institutions suffered massive losses from their heavy investments in mortgage-backed securities. This led to the bankruptcy of once prestigious financial institutions and banks, causing people to lose confidence in the traditional trust system and triggering a global financial crisis.

The fundamental reason for such a financial tsunami and the evaporation of massive wealth is the forced and unconditional trust in the current financial system, allowing centralized banks and other financial institutions to control, manage, and dispose of our assets.

If banks only provided a means for customers to save cash, using bank services would only involve the bank's own counterparty risk, which is relatively manageable. However, this is not the case. Money never sleeps, and banks are greedy. They lend out people's hard-earned savings to purchase government bonds or other investments to generate returns. Sometimes, banks may lend out too much, leading to an inability to maintain sufficient liquidity for redemption, resulting in bankruptcy.

This is the reason for the collapse of the 16th largest bank in the U.S., Silicon Valley Bank, in 2023. The subsequent forced closure of Signature Bank and Silvergate Bank is the most vivid and bloody example.

Furthermore, the traditional financial system is subject to the strictest regulations. Despite the ability of information technology to disrupt geographical and temporal limitations, payments are still under the strict control of government and state-owned banking monopolies. National and local regulations restrict how individuals can use their hard-earned wealth through the traditional financial system, which is particularly severe in countries with strict capital controls. These restrictions on intermediary payments greatly diminish the performance of currency. Currency is not powerful when accumulated; it only realizes its maximum value in a free-flowing environment.

Due to the development of the modern communication industry, physical cash transactions are no longer feasible. The transition to digital payments is weakening people's control over monetary sovereignty, making them subject to third-party intermediaries, with no other choice but to trust them.

Banks and other financial intermediaries have collapsed in the past, and undoubtedly, they will collapse again in the future.

2.3 Blockchain Reconstruction of Trust

To avoid the uncertainty of trust in the black box/custody of funds and the risk of collapse of a single point of intermediary third parties, Satoshi Nakamoto provided guidance through the Bitcoin whitepaper to reconstruct a payment network without the need for any neutral, trusted third party using digital currency and blockchain technology.

Satoshi Nakamoto thoroughly built Bitcoin on the basis of proof and verification, using distributed ledgers, asymmetric encryption technology, and consensus mechanisms to achieve decentralized peer-to-peer transactions, eliminating the need for a trusted third party. This allows every member on the network to verify the authenticity of each transaction without needing to trust each other.

Only through thorough verification can reliance on trust be completely eliminated. Don't Trust, Verify it.

The Economist published an article in 2015 about Bitcoin titled "The Trust Machine," indicating that the technology behind Bitcoin will change the way the economy operates. Blockchain allows people without a basis of trust to cooperate without the need for endorsement from a neutral central trust.

In short, it is a machine that creates trust. In Trustless We Trust.

Blockchain is a powerful technology. Essentially, it is a shared, trusted, public ledger that anyone can inspect, but no single user can control it. Participants in the blockchain system collectively maintain the ledger's updates, which can only be modified according to strict rules. The Bitcoin blockchain network prevents double spending of transactions and continuously tracks the ledger. This is the key to creating a currency without central bank control.

Indeed, early Bitcoin was notorious for its illegal uses, but we cannot ignore the extraordinary potential of the blockchain technology behind Bitcoin. The significance of this technological innovation far exceeds that of cryptocurrency itself.

(The Economist: Bitcoin - The trust machine)

(The Economist: Bitcoin - The trust machine)

2.4 Bitcoin and Payments

Let's imagine a world where people no longer need to rely on traditional financial intermediaries to hold, dispose, and manage our assets. People can truly control their financial sovereignty through the use of digital wallets and blockchain technology, achieving financial sovereignty.

This is the essence of the Bitcoin whitepaper.

Although the 9-page Bitcoin whitepaper from 2008 did not provide a complete solution for a peer-to-peer electronic cash payment system, it was undoubtedly a beacon of hope in the midst of the dark storm, guiding those who lost faith in the financial tsunami and lighting the way forward.

Today, 16 years later, in this era characterized by innovation and disruption, the financial landscape is undergoing significant change. Over the past decade, billions of dollars have been invested in developing underlying blockchain infrastructure. It is only in the past few years that we have had blockchain networks capable of supporting "payment-level scale," making blockchain-based payments increasingly feasible and popular.

With the widespread adoption of digital currencies, represented by Bitcoin (according to a recent report by Tripple-A, approximately 5.62 billion people globally owned cryptocurrencies in 2024, accounting for 6.8% of the global population), and the gradual acceptance of digital currencies and blockchain technology by traditional Wall Street finance, such as the approval of BTC/ETH ETFs and BlackRock's launch of tokenized fund BUIDL, everything has changed.

The concept of Bitcoin electronic cash is turning into reality through the efforts of early idealists, like a seed sown in the past and now thriving.

We can see that the grand vision in the original Bitcoin whitepaper can now be fulfilled in today's underlying blockchain technology infrastructure. Blockchain-based Web3 payments can achieve instant settlement and global access, while the large-scale practical use cases of stablecoins can demonstrate that the greatest opportunity for digital currencies may not be as digital currencies, but as a new set of payment methods combined with blockchain.

III. The Wave of Tokenization Has Arrived

Although Bitcoin was initially positioned as electronic cash, at one point, people hoped it would become a new global currency, taking on the three functions of money—medium of exchange (e.g., using Bitcoin to purchase goods and services), store of value (investing in Bitcoin for long-term returns), and unit of account (pricing the value of goods and services).

In the development over the past decade, due to its scarcity design, Bitcoin's function as a store of value has become prominent in the fight against global inflationary currencies. The purpose of cryptocurrencies, represented by Bitcoin, is to reward those who confirm blockchain transactions. However, due to its significant price fluctuations and unstable value, it is not suitable as a unit of account for payment of goods and services.

Therefore, a new form of digital currency representation has emerged, especially represented by stablecoins—Tokenized Money. They are usually pegged 1:1 to fiat currency (especially the US dollar) and serve as a new medium of exchange on blockchain networks. Tokenized money aims to solve the payment and accounting issues of goods and services by maintaining stable value and has been widely used in the Web3 payment market.

We have already seen the explosive rise of the stablecoin market in this wave of tokenization. However, before delving deeper into the current Web3 payment market dominated by stablecoins, it is necessary to understand what tokenization is and the significant advantages it can bring to us after the tokenization of currency.

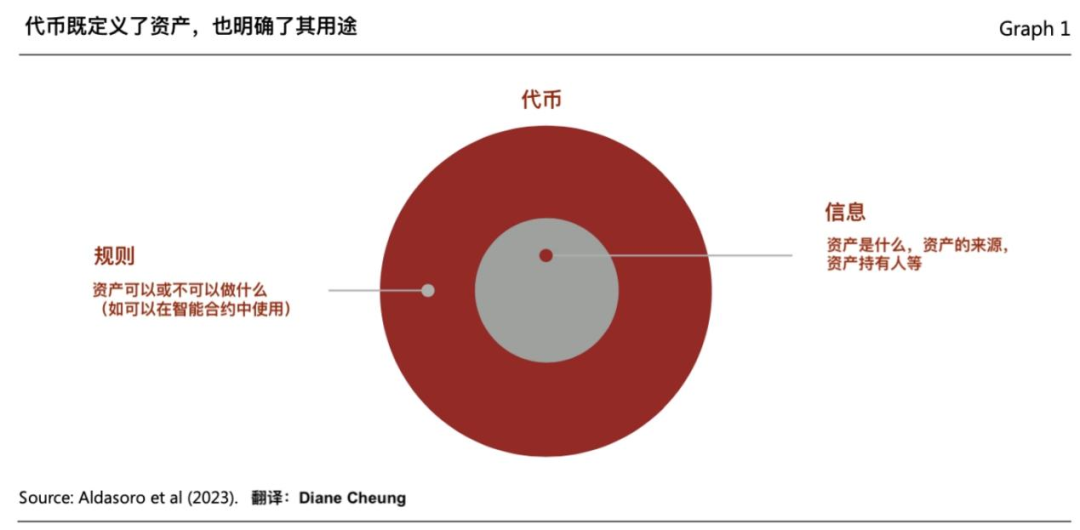

3.1 What is Tokenization?

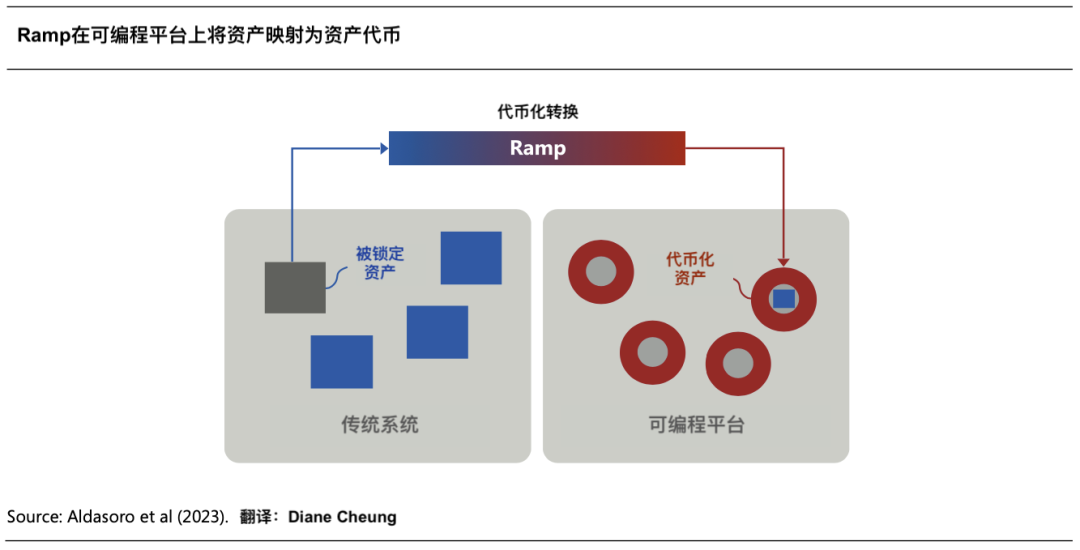

"Tokenization" refers to the process of recording ownership of financial or real assets existing in traditional ledgers onto a blockchain programmable platform, creating a digital representation of the assets. These assets can be traditional tangible assets (such as real estate, agricultural or mineral commodities, and digital art), financial assets (stocks, bonds), or intangible assets (such as digital art and other intellectual property).

The resulting "tokens" are the ownership certificates recorded on the blockchain programmable platform available for trading, helping to ensure authenticity and traceability. Tokens are not just single digital certificates; they also typically encapsulate the rules and logic governing the transfer of underlying assets in traditional ledgers. Therefore, tokens are programmable and customizable to meet personalized scenarios and regulatory compliance requirements.

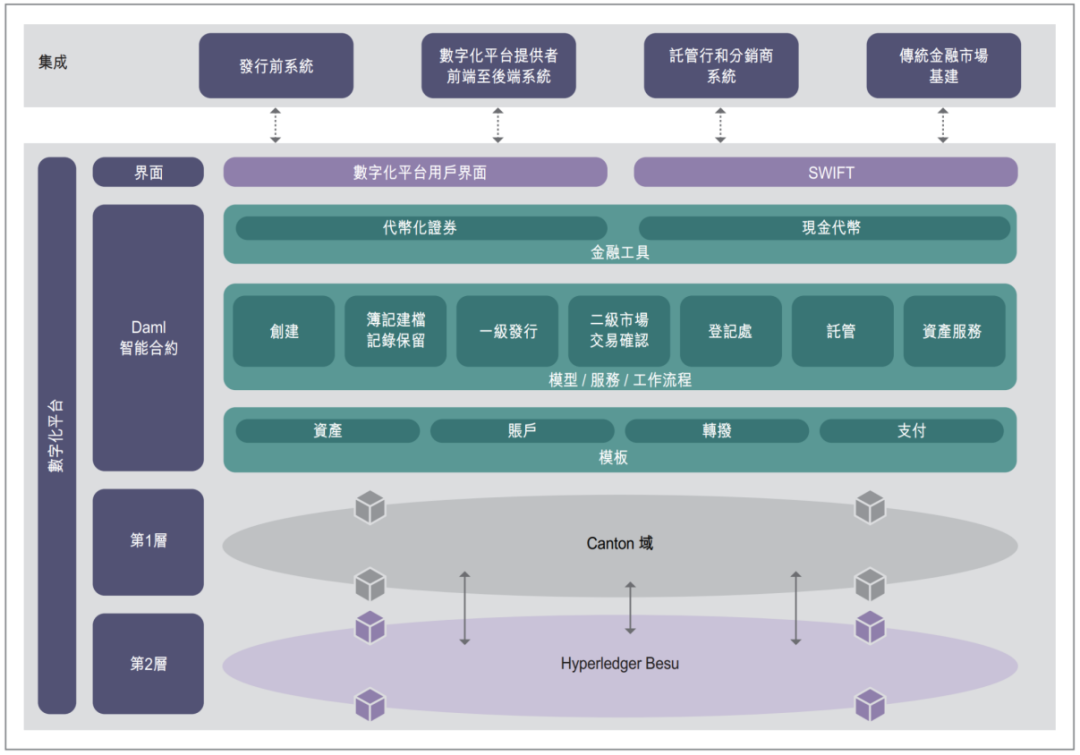

(Tokenization and Unified Ledger—Blueprint for the Future Monetary System)

(Tokenization and Unified Ledger—Blueprint for the Future Monetary System)

Currently, the world's second-largest stablecoin, USDC, is issued by the U.S. private institution Circle, with the U.S. dollar as collateral and anchor currency, creating the tokenized currency product—USD Coin (USDC).

Due to the global ubiquity of the US dollar, USDC not only serves as a medium of exchange and unit of account for goods and services but also highlights the significant advantages of tokenization on the blockchain. These advantages are often difficult to achieve in the traditional financial system.

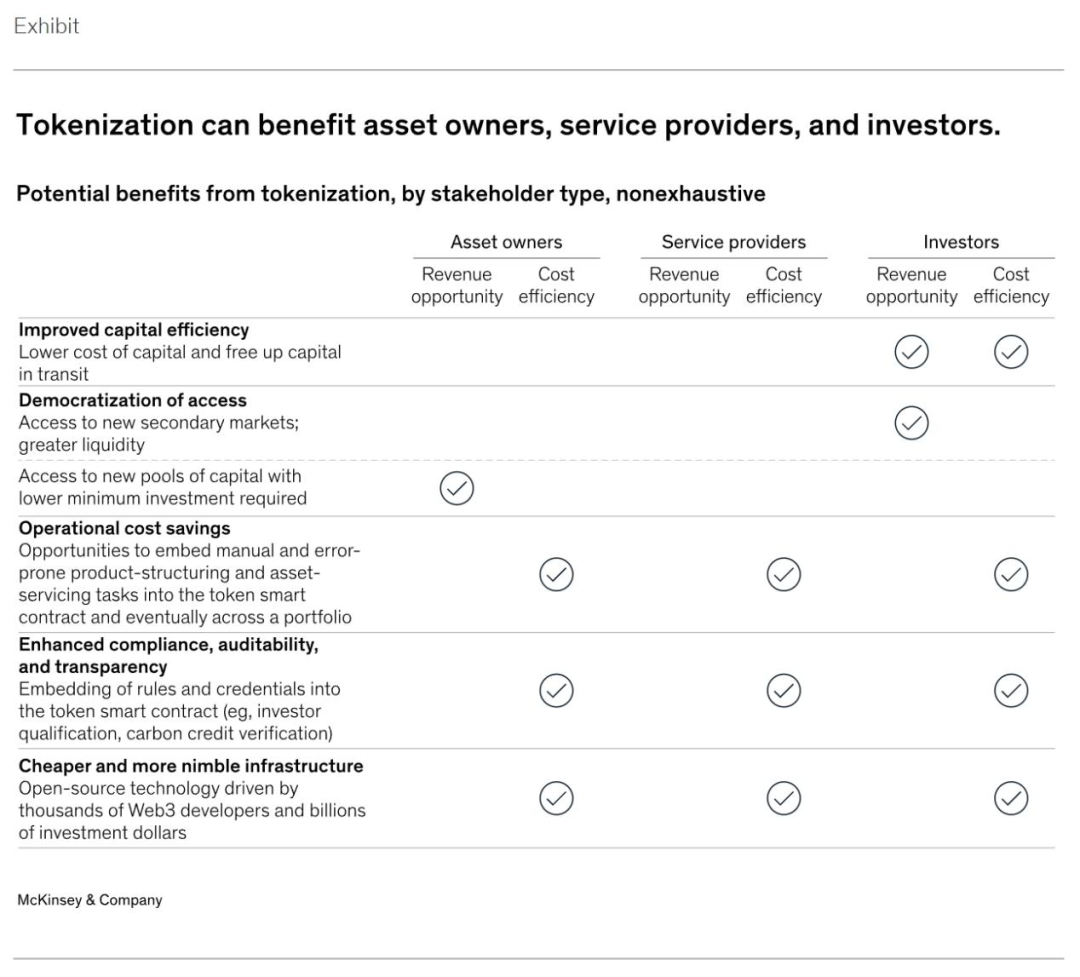

3.2 Advantages of Tokenization

Tokenization allows assets to harness the enormous potential brought by digital currency and blockchain technology. Broadly speaking, these advantages include: 1) Advantages of blockchain: 24/7 availability, data availability, and so-called instant atomic settlement; 2) Advantages of tokens themselves: programmability—the ability to embed code in tokens, and the ability for tokens to interact with smart contracts (composability), enabling a higher degree of automation and access to decentralized finance (DeFi).

Especially as the tokenization of assets advances on a large scale, in addition to concept validation, the following advantages will become increasingly prominent:

3.2.1 Improved Capital Efficiency

Tokenization can significantly improve the capital efficiency of assets in the market. For example, tokenized repurchase agreements (Repos) or redemptions of money market funds can be completed instantly within a few minutes (T+0) after tokenization, compared to the current traditional settlement time of T+2. In the current high-interest rate market environment, the shorter settlement time can save a significant amount of funds. For investors, these savings in funding costs may be the reason why tokenized U.S. Treasury projects have had a huge impact in the near term.

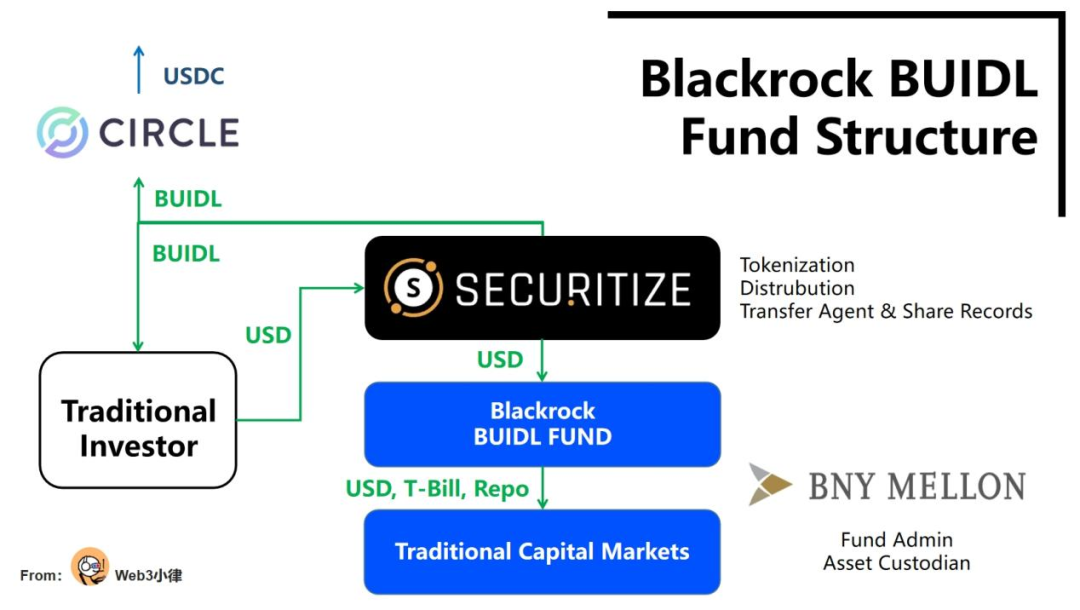

Case Study B: Blackrock's Tokenized Fund BUIDL

On March 21, 2024, Blackrock and Securitize launched the first tokenized fund BUIDL on the public blockchain—Ethereum. After tokenization, the fund can achieve instant settlement of a unified ledger on-chain, significantly reducing transaction costs and improving capital efficiency. It can achieve (1) 24/7 fiat USD fund subscription/redemption, a feature that many traditional financial institutions are eager to achieve, and also, in collaboration with Circle, achieve (2) 24/7 instant exchange of stablecoin USDC and fund token BUIDL at a 1:1 ratio.

This tokenized fund that can connect traditional finance with digital finance is a milestone innovation for the financial industry.

(Analyzing Blackrock's Tokenized Fund BUIDL, Opening a Beautiful New World for RWA Assets in DeFi)

(Analyzing Blackrock's Tokenized Fund BUIDL, Opening a Beautiful New World for RWA Assets in DeFi)

3.2.3 Cost Savings in Operations

The programmability of assets can be another source of cost savings, especially for asset categories that often involve highly manual, error-prone, and multi-intermediary processes, such as corporate bonds and other fixed-income products. These products often involve custom structures, imprecise interest calculations, and coupon payment expenses. Embedding interest calculations and coupon payments into the smart contracts of tokens will automate these functions, significantly reducing costs. System automation achieved through smart contracts can also reduce the costs of securities lending and repurchase transactions.

Case Study C: Tokenized Bond Project Evergreen

In 2022, the Bank for International Settlements (BIS) and the Hong Kong Monetary Authority conducted the Evergreen project, issuing green bonds using tokenization and a unified ledger. The project fully utilized the distributed unified ledger to integrate the participants involved in bond issuance on the same data platform, supporting multi-party workflows and providing specific participant authorization, real-time verification, and signing functions, improving transaction processing efficiency. Bond settlement achieved Delivery versus Payment (DvP), reducing settlement delays and settlement risks, and the real-time data updates on the platform also improved transaction transparency for participants.

(Tokenization in the Hong Kong Bond Market)

(Tokenization in the Hong Kong Bond Market)

Over time, the programmability of tokenized assets can also create benefits at the portfolio level, allowing asset managers to achieve real-time automatic rebalancing of portfolios.

3.2.2 Permissionless Democratic Access

One of the most touted benefits of tokenization or blockchain is democratized access, which, after the fragmentation of tokens (dividing ownership into smaller shares, reducing investment thresholds), may increase asset liquidity, provided that the tokenization market becomes widespread.

In certain asset categories, simplifying intensive manual processes through smart contracts can significantly improve unit economics, enabling services for smaller investors. However, access to these investments may be subject to regulatory restrictions, meaning that many tokenized assets may only be available to qualified investors.

Case Study D: Tokenized Private Equity Funds

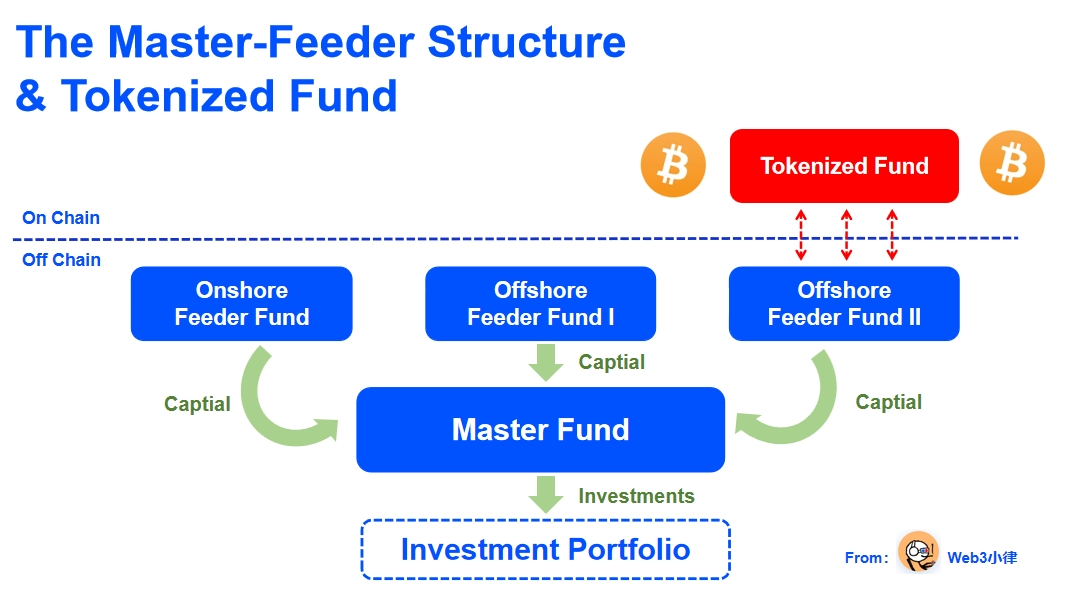

We can see that renowned private equity giants Hamilton Lane and KKR, in collaboration with Securitize, have tokenized their managed private equity funds' feeder funds, providing a "fair-priced" way for a wide range of investors to participate in top-tier private equity funds, significantly reducing the minimum investment threshold from an average of $5 million to just $20,000. However, individual investors still need to undergo qualified investor verification through the Securitize platform, which still presents a certain threshold.

(RWA 20,000-word research report: The value, exploration, and practice of fund tokenization)

(RWA 20,000-word research report: The value, exploration, and practice of fund tokenization)

3.2.4 Enhanced Compliance, Auditability, and Transparency

Current compliance systems often rely on manual checks and retrospective analysis. Asset issuers can automate these compliance checks by embedding specific compliance-related operations (such as KYC/AML/CTF, and transfer restrictions) into tokenized assets. Additionally, the 24/7 data availability of blockchain systems creates opportunities for simplified consolidated reporting, immutable record-keeping, and real-time auditability.

3.2.5 Cheaper, More Flexible Infrastructure

Blockchain is inherently open-source and continues to evolve with the contributions of thousands of Web3 developers and billions of dollars in venture capital. Entities involved in Web3 payments can choose to operate directly on public permissionless blockchains or public/private hybrid blockchains. The innovations in blockchain technology (such as smart contracts and token standards) can be easily and quickly adopted, further reducing operational costs.

(Tokenization: A digital-asset déjà vu)

(Tokenization: A digital-asset déjà vu)

3.3 The Tipping Point of Mass Adoption

The digitization of assets in the previous stage has unfolded alongside technological maturity and measurable economic benefits. However, the widespread adoption of tokenized assets will not happen overnight. One of the most challenging aspects is the transformation of the infrastructure of traditional finance in the heavily regulated financial services industry, requiring the participation of all players in the entire value chain.

Nevertheless, we have already seen the first wave of tokenization, mainly driven by the current high-interest rate environment and existing scalable use cases (such as stablecoins and tokenized U.S. Treasury bonds).

Blackrock CEO Larry Fink emphasized the importance of tokenization for the future of finance at the beginning of 2024: "We believe the next step in financial services will be the tokenization of financial assets, meaning that every stock, every bond, every financial asset will operate on the same unified ledger."

Similarly, the Bank for International Settlements (BIS) has shown great interest in tokenization in a previous research report, stating: "The global monetary system is at the cusp of a historic leap. Tokenization is the key to the leap after digitization. By changing the way intermediary services users are served, breaking down barriers in information transmission, reconciliation, and settlement, tokenization greatly enhances the capacity of the monetary and financial system. Tokenization will create new economic activities that are difficult to achieve in the current conventional monetary system."

The current flow of tokenized assets is just the beginning of this new field of tokenization. The history of the internet has been marked not only by the complete reshaping of existing industries but also by the creation of entirely new business models that were previously impossible or unimaginable before technological and connectivity advancements.

One of the greatest breakthroughs of blockchain is that it allows "real-world assets" (such as houses, cars, office buildings, factories, concert tickets, customer loyalty points, stock certificates, etc.) to be presented online in the form of digital tokens with unique identifiers. These tokens allow you to easily track, transfer, and store ownership proofs of the corresponding assets in a digital wallet.

Embedding ownership of these assets in the form of digital currency into the Web3 value internet (directly with accompanying fund flows) could open up a potential future where almost anything can be marked, financed, and traded by anyone at any time and place without the need for traditional financial intermediaries.

And what drives this value flow is Web3 payments.

Four, Tokenized Money—A New Form of Currency Circulation

Understanding tokenization allows us to understand that stablecoins, tokenized deposits, central bank digital currencies (CBDCs), and other digital currencies on which Web3 payments rely are all forms of currency after being tokenized. This form of digital currency represents a new way of currency circulation based on blockchain technology, rather than a new way of currency creation.

As human society continues to develop, the concept and forms of currency have been constantly changing. From the simple barter system of stone coins and shells on Yap Island to the invention of coins and paper money, which completely transformed trade. The advent of globalization and the increasing complexity of economic activities have driven the demand for more efficient and secure payment methods, leading to the rise of digital payments on the internet and the emergence of digital currencies, laying the foundation for the efficiency improvement, access threshold reduction, and global integration of financial services.

(Tokenization and Unified Ledger—Blueprint for the Future Monetary System)

(Tokenization and Unified Ledger—Blueprint for the Future Monetary System)

Although the current form of currency is still dominated by fiat trust currency guaranteed by national credit, innovative forms of currency such as stablecoins, tokenized deposits, and central bank digital currencies (CBDCs) represent new ways of currency circulation in the era of digital currency and blockchain technology.

4.1 Central Bank Digital Currency (CBDC)

The International Monetary Fund (IMF) defines CBDC as "a digital representation of sovereign currency issued by the monetary authority of a jurisdiction, appearing on the liability side of the central bank's balance sheet." CBDCs vary in design, especially between wholesale CBDCs designed for large-scale interbank transactions and retail CBDCs for public use, the latter aiming to replace traditional cash payments with modernized digital cash payments.

In pilot projects with the Bank for International Settlements and regulatory authorities in various countries, 15 out of 26 are focused on exploring CBDCs and digital currencies. This reflects global recognition of this development trend. These pilots demonstrate the potential of tokenized digital currencies for stability, programmability, liquidity, and efficient asset transfers.

Each country has its own motivation and interest in exploring CBDC pilots. The Monetary Authority of Singapore (MAS) has proposed an open, interoperable digital asset network framework and conducted pilot projects in asset management, fixed income, and foreign exchange. The European Central Bank (ECB) emphasizes the need for central banks to maintain technological advancement to make cash or central bank currency attractive in transactions and to maintain stability in financial innovation. The European Commission has proposed creating a legal framework for a digital euro, indicating progress in the potential for CBDCs in the EU. Hong Kong has shown similar motivations, focusing on acquiring practical use cases and exploring the potential functions of CBDCs, such as programmability to unlock new types of transactions and the development of tokenized markets. Meanwhile, other markets such as Brazil, India, and Kazakhstan are committed to using CBDCs to promote financial inclusion. For example, a pilot project in collaboration with Visa and Agrotoken in Brazil uses CBDCs to provide digital financial access to farmers by tokenizing crops as collateral and automating payments through smart contracts to reduce costs and risks.

4.2 Tokenized Deposits

Tokenized deposits are digital certificates of commercial bank deposits issued on the blockchain, combining the familiarity and reliability of bank deposits with the advantages of blockchain technology, such as programmability, instant settlement, and enhanced transparency.

Tokenized deposits can be designed to operate in the same way as conventional bank deposits, serving as liabilities of the issuer. Tokenized deposits cannot be transferred directly, and central bank-provided liquidity will continue to ensure the normal functioning of payment functions.

Tokenized deposits are likely to become an innovative cornerstone in the application layer of the traditional banking financial system, providing innovative momentum for the business of the traditional banking industry.

Case Study E: JPMorgan Onyx Network

J.P. Morgan has been early in experimenting with blockchain, and the essence of its tokenization business relies on tokenized deposits. Its institution-level blockchain payment network, Onyx, is currently capable of processing $2 billion in transactions per day. The transaction volume of Onyx can be attributed to J.P. Morgan's "Coin System," which focuses on addressing clients' cross-border payment and liquidity financing needs, using JPM Coin as the digital currency for cross-border transaction settlements.

Additionally, J.P. Morgan has launched a digital asset tokenization platform in collaboration with Goldman Sachs, introduced an intraday repo solution, launched a tokenized collateral network in partnership with BlackRock and Barclays, and issued bonds in cooperation with local municipalities. Furthermore, J.P. Morgan's application of tokenization innovation includes participation in BIS's Project Guardian last year, and Onyx plans to launch tokenized funds. Onyx is deploying its JPM Coin tokenized deposit solution for on-chain settlements on the Broadridge platform (DLR).

(Onyx by J.P.Morgan)

(Onyx by J.P.Morgan)

Case Study F: Visa's Tokenized Deposit Case

In addition, in a tokenized deposit research report led by the Hong Kong Monetary Authority, Visa collaborated with HSBC and Hang Seng Bank in a pilot project, providing some use cases that achieved end-to-end atomic settlement of the payment process, demonstrating the potential to improve the efficiency of existing settlement processes and support application innovation.

Firstly, tokenized deposits can fully leverage the advantages of blockchain's unified ledger to reduce settlement risks, achieve instant settlement, and improve fund transfer efficiency. For example, in a bank-to-bank use case (acquiring bank - merchant settlement), the acquiring bank aims to simplify the settlement process for merchants by using tokenized deposits, making it more transparent and seamless for merchants.

In the existing interbank workflow, the acquiring bank processes credit card and debit card transactions on behalf of merchants. When a customer completes a transaction, the acquiring bank initiates the settlement process, ultimately transferring funds to the merchant's account. This process may take several hours to a day to settle, and merchants lack real-time visibility into the settlement status, making it difficult to manage cash flow and reconciliation.

Through the tokenized e-HKD and Visa solution, settlements between the acquiring bank and merchants are almost instantaneous. Merchants receive real-time settlement notifications, enabling better transaction reconciliation and reducing dispute risks. The immutability of blockchain also provides tamper-proof audit records, enhancing overall transparency and trust in the settlement process.

Secondly, tokenized deposits built on blockchain can serve as a medium of exchange, enabling atomic settlement with other categories of tokenized assets (such as real estate, securities, commodities, etc.), facilitating real-time transactions and instant settlement. This logic also applies to other business operations in the banking and financial system, such as mortgages and pledges.

Finally, in addition to the advantages brought by blockchain, tokenized deposits can enhance payment functionality through programmability using smart contracts. These features allow for the automation of complex business logic. Settlement between transaction parties can be more efficient, potentially reducing the number of intermediaries, as ownership transfer and payments can be handled simultaneously through smart contracts.

For example, in real estate transactions, the buyer can use tokenized deposits to secure the property and initiate the payment process. Smart contracts can automatically execute the remaining transaction steps once predefined conditions are met (such as completing due diligence or transferring property ownership), triggering immediate action. Using tokenized deposits and smart contracts can minimize the need for custodial services, reduce human intervention, and consequently reduce transaction costs and settlement time.

4.3 Stablecoin

The explosive rise of stablecoins in the past decade has been particularly noteworthy. Stablecoins are tokenized currencies (digital currencies) anchored to fiat currencies (usually the US dollar), designed to maintain price stability and avoid the volatility of cryptocurrencies like Bitcoin. This characteristic makes stablecoins an important financial tool and medium of exchange, playing an increasingly important role in cryptocurrency asset settlement, cross-border payments, international trade, and more. Fiat-backed stablecoins account for over 90% of the stablecoin market, and the following discussion will focus on fiat-backed stablecoins.

4.3.1 Explosive Growth of Stablecoin Data

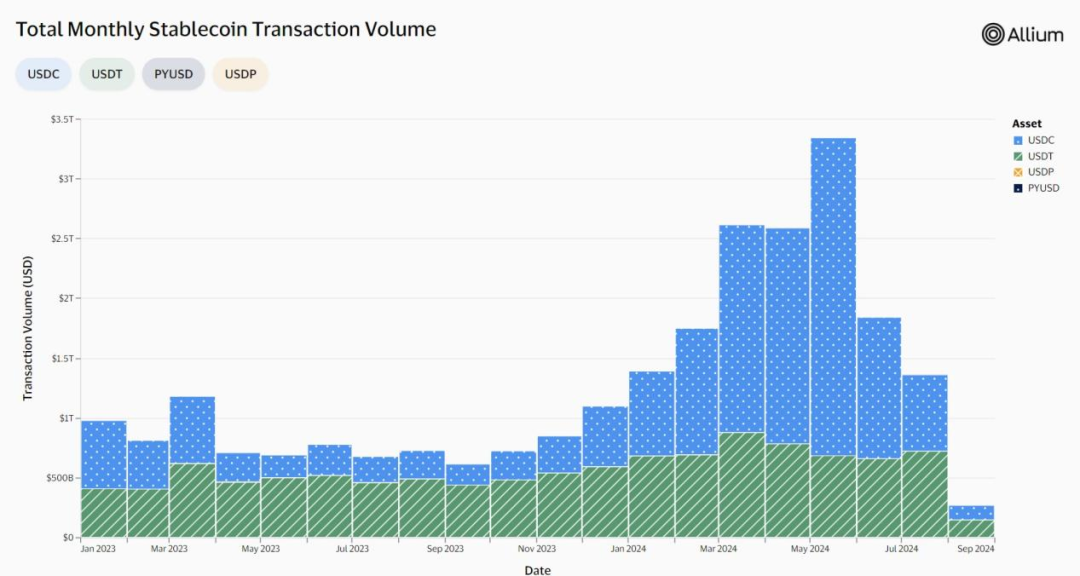

According to SoSoValue data, as of July 2024, approximately $165 billion in tokenized currencies is circulating in the form of stablecoins. According to Coinmetrics data, the total transaction volume of stablecoins reached nearly $7 trillion in 2023, with USDT accounting for about two-thirds of it.

Stablecoins are experiencing explosive growth globally, which is clearly a long-term trend. Visa recently launched a public-facing on-chain stablecoin data platform (Visa Onchain Analytics), allowing us to glimpse the growth trend of stablecoins and demonstrating how stablecoins and underlying blockchain infrastructure are used to facilitate global payments.

The total market volume of stablecoin transactions has grown approximately 3.5 times year over year. When the analysis focuses on transactions initiated directly by consumers and businesses (excluding automated high-frequency trading, large institutional fund flows, smart contract operations, etc.), the transaction volume of stablecoins reached $25 trillion in the 12 months ending May 2024. From this perspective, it is 1.5 times the annual transaction volume of PayPal in 2023 (PayPal's annual transaction volume was $15.3 trillion in 2024, and Mastercard's annual transaction volume was $90 trillion), which is equivalent to the GDP of India or the UK.

(Visa Onchain Analytics)

(Visa Onchain Analytics)

4.3.2 Advantages of Stablecoins

Fiat-backed stablecoins offer the best of both worlds: they can maintain low daily volatility while providing the advantages of blockchain—efficient, cost-effective, and globally accessible. This characteristic makes them the primary medium of exchange for Web3 payments and the unit of account for goods and services. These blockchain-based advantages have been mentioned several times before. In addition, the qualities of being anchored to the US dollar also demonstrate the unique value of stablecoins.

1) Alleviating Currency Depreciation Pressure—Store of Value

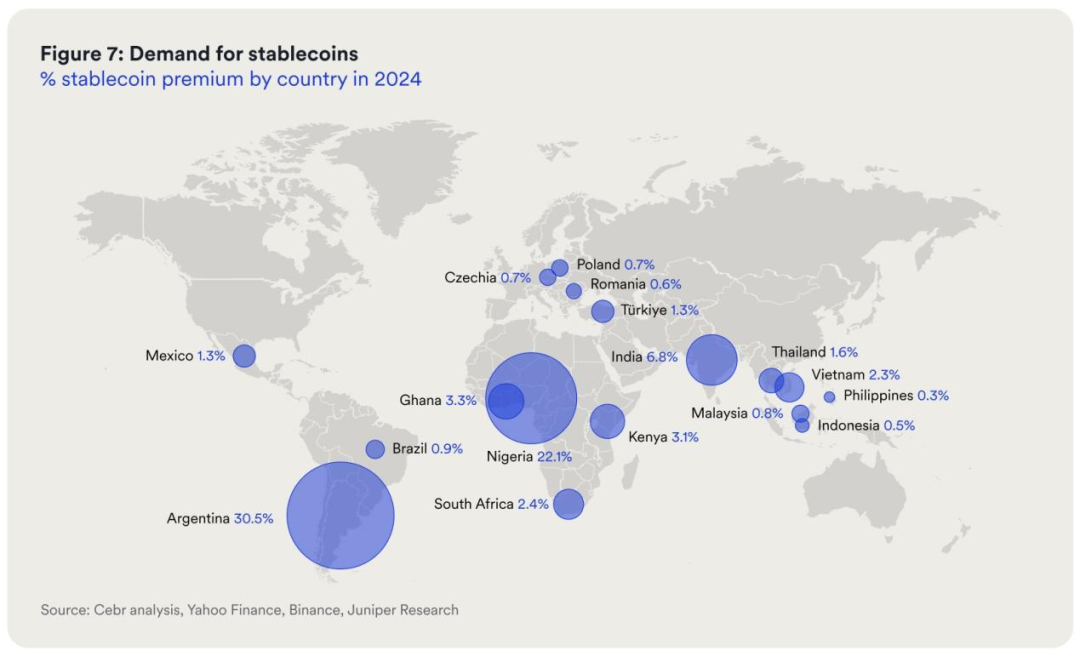

Currency fluctuations have had profound negative effects on the economies of emerging market countries, resulting in a total GDP loss of $1.2 trillion across 17 emerging market countries from 1992 to 2022, averaging 9.4% of the GDP of these countries. US dollar stablecoins help these countries cope with the uncertainty and economic losses caused by currency fluctuations by providing stable value pegged to the US dollar.

2) Enhancing Accessibility of the US Dollar—Settlement Currency

The US dollar is stable, widely accepted, and dominates global trade. In 2022, the US dollar accounted for 88% of all foreign exchange transactions and over 40% of cross-border payments. Directly using the US dollar as a medium of exchange may be restricted in some countries and regions. As a digital substitute for the US dollar, US dollar stablecoins can be sent around the world via the blockchain internet, operating 24/7 with just an internet connection, and enabling convenient transactions.

According to the BVNK & Cebr report "The decade of digital dollars," there is a significant demand for USD stablecoins in emerging economies, manifested as a "stablecoin premium." Enterprises and consumers in 17 surveyed countries/regions paid a premium to obtain USD stablecoins: an average of 4.7% higher than the standard USD price, rising to 30% in countries like Argentina. It is estimated that by 2024, these 17 countries will pay a premium of $4.7 billion to obtain stablecoins, and this number will rise to $25.4 billion by 2027.

3) Global Accessibility—Financial Inclusion

According to World Bank research, approximately one-quarter of the global population still lacks access to banking services (especially in Asia, Africa, and Latin America). Increasing electronic payments, internet access, and mobile usage can enhance financial inclusion.

Stablecoins are the best solution. Stablecoins allow anyone with internet access to use them without the need for traditional bank accounts or identity verification. This mechanism enhances global financial inclusion, and the low entry barrier supports the premium demand for USD stablecoins.

Global accessibility is crucial for the adoption of stablecoins in regions like Asia, Africa, and Latin America, where stablecoins, as digital/tokenized versions of cash, can securely store value and be transferred at any time. In any place where USD is used, stablecoins can serve as digital versions and become a way to extract more value in commerce.

Case Study G: Circle USDC—The Next Form of USD

Circle's mission is to promote global economic prosperity through frictionless exchange of value, leveraging the openness and interoperability of the internet to establish a new Internet Financial System. Circle is dedicated to using breakthrough innovations in the next generation Web3 value internet to facilitate the free flow of funds, making the world fairer and more prosperous.

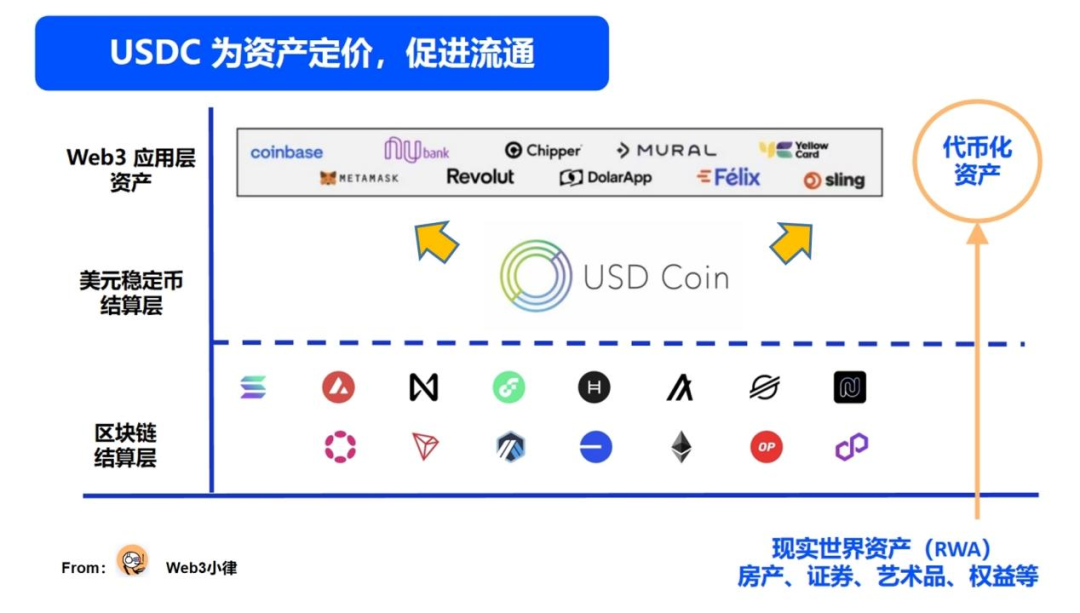

In 2018, Circle launched the USD-anchored stablecoin USDC, currently the second-largest stablecoin by market capitalization, with a circulation of over $33 billion, accounting for approximately 20% of the stablecoin market. In 2023, the scale of USDC minting/redemption for the financial system and blockchain ecosystem reached $197 billion and supported usage in over 190 countries and regions globally.

Circle CEO Jeremy Allaire envisioned the digital currency form of fiat currency, which he called fiat currency tokens (not yet known as stablecoins at the time), running on blockchain networks, allowing anyone to build interoperable value exchange applications on this open network.

So, Circle positions itself as "An Open Platform for Money on the Internet," or more understandably, "the USD API on the Web2 internet, and the USD settlement layer on the Web3 value internet." It is a well-regulated open-source building block that can be easily integrated into other fintech, traditional banking entities, and digital currency projects, enabling valuation and transactions using the most widely used currency (USD) in the world.

The internet infrastructure of Web2 has achieved frictionless, nearly free information flow, but the flow of value has not been realized. The value internet of Web3 can provide a carrier for this value, tokenizing it for digital currency circulation on the blockchain, and USDC stablecoin is used to price this value, facilitate transactions, and ultimately achieve the seamless free flow of value.

Now, people can send value through the Web3 value internet like they do with emails, video files, and JPEGs—ubiquitous, global, instant, and inexpensive—eliminating significant economic friction in today's complex and outdated payment systems. In the future, real-world assets (RWA) such as cars and real estate, once tokenized, can be widely held, financed, and traded on the chain, creating deeper liquidity and reducing the time, effort, and cost required for such transactions.

In summary, Circle USDC can be summarized as: pricing value in USD, enabling value circulation on the blockchain, and promoting openness and circulation on the internet. USDC is the next form of USD.

Of the $2.2 trillion in global cash circulation, 80% is in $100 bills, reflecting that this cash is primarily used as a store of value. Blockchain-based stablecoins can have anonymous features similar to cash, but they can provide more value than cash.

Blockchain enables stablecoins to power ordinary USD with programmability and the same cost and speed advantages as other forms of internet data. Whether it's the programmability of stablecoins or payments, the programmability of stablecoins opens up more possibilities.

As USDC is used on smart contract blockchains with open-source code, anyone can easily program it to adapt to simple "if/then" business conditions. These programmable internet-based payments represent a significant breakthrough in the way businesses transfer value.

For example, Circle has discussed with a Kenyan company that provides agricultural seed insurance, which incorporates local weather data into smart contracts to automatically pay insurance premiums using USDC. Some remittance companies have programmed USDC payments that can only be redeemed for medical supplies at pharmacies. These scenarios are numerous, and current stablecoin payments only scratch the surface.

By adding programmable logic to the payment/stablecoin layer of USDC, it helps USDC fundamentally become a new global currency operating system, opening up infinite possibilities for the future of digital currencies.

Case Study H: GatePay's Web3 Payment Solution in Practice

If Circle is building a new global currency operating system, then payment service providers like GatePay are further promoting the implementation of Web3 payments, providing a more practical and feasible Web3 payment solution for traditional payment networks.

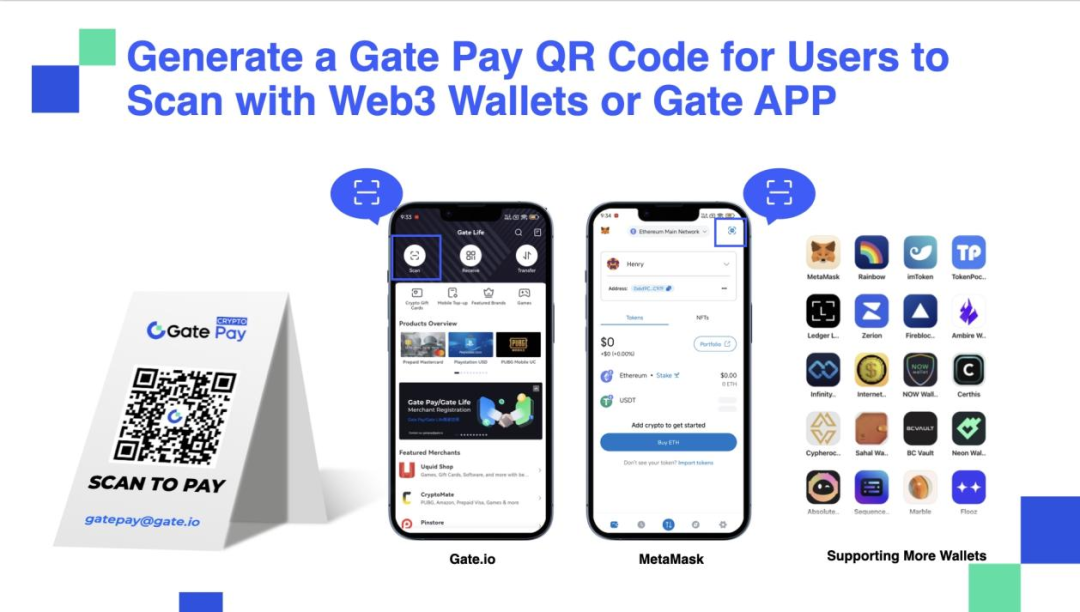

GatePay is a Web3 payment solution created by Gate.io, aimed at helping cryptocurrency holders flexibly and conveniently send and receive cryptocurrencies globally, supporting real-time transactions for over 300 major cryptocurrencies.

In the early stages of the Web3 payment market, due to the need for improvement in blockchain networks and the education cycle of emerging things, Web3 payments mainly revolved around the Crypto Native population to address their currency acceptance and daily consumption needs.

As a result, the cryptocurrency payment gateway launched by GatePay aims to meet the demand for Web3 payment scenarios for merchants and individual users. GatePay has integrated multiple payment scenarios, supporting cryptocurrency income and expenditure services for online and offline stores. Users can easily connect to over 300 mainstream merchants and choose from over 300 cryptocurrencies through wallet/account connections and QR code payments, among other methods.

In addition, to meet the demand for Web3 payments, GatePay is collaborating with traditional cross-border payment service providers to provide them with the capability to process cryptocurrency payments and meet the diverse and personalized needs of their clients.

This Crypto Native capability of GatePay is something that the vast majority of traditional cross-border payment service providers cannot possess. The ability to handle cryptocurrencies, support various types of cryptocurrencies, liquidity depth, and most importantly, compliance and regulation, are not something that traditional cross-border payment service providers can achieve overnight.

As FZ, the head of GatePay, said, "In this industry, the most important thing is not the construction of the technology stack, but the expansion of the scenario channels and meeting the diverse needs of users. Everyone is welcome to collaborate with GatePay."

V. PayFi—The Next Chapter of Web3 Payments

Although the Web3 payment industry has grown in scale in recent years, the current value proposition of Web3 payments mainly lies in the instant settlement, 24/7 availability, and low-cost transactions brought about by the characteristics of blockchain. But how can Web3 payments deliver on the promised interoperability, programmability, and composability with DeFi? The answer is PayFi.

The fusion of Web3 payments and DeFi has given rise to PayFi. Lily Liu, the chairperson of the Solana Foundation, introduced the concept of PayFi at the Hong Kong Web3 Carnival and elaborated on it, saying, "PayFi is a new financial market created around the Time Value of Money. This on-chain financial market can achieve new financial paradigms and product experiences that traditional finance cannot."

To understand PayFi, it is necessary to first understand several concepts:

1) Time Value of Money is a fundamental financial concept, referring to the change in the value of money over time. The value of money held now is higher than its value in the future due to considerations of inflation and investment returns. If people want to access funds now rather than in the future, they should pay additional costs—interest.

If current Web3 payments mainly involve using the money we have now for transactions, then PayFi allows us to use tomorrow's money for transactions. In financial transactions, time is money, my friend.

2) Real-world Asset Tokenization (RWA) is essential for achieving PayFi. It involves tokenizing the logic of real-world assets and the entire payment scenario and business processes onto the Web3 payment logic to capture the Time Value of Money in real-world payment scenarios.

PayFi not only reshapes the grand vision in the Bitcoin whitepaper—peer-to-peer electronic cash payments without the need for trusted third-party intervention but also enables efficient and fast global payments on high-performance blockchain networks, leveraging tokenized money represented by stablecoins as the medium of exchange and unit of account for goods and services.

More importantly, PayFi can integrate with DeFi, fully leveraging its interoperability, programmability, and composability to create a new paradigm for on-chain finance.

With this, the next chapter of Web3 payments is being opened.

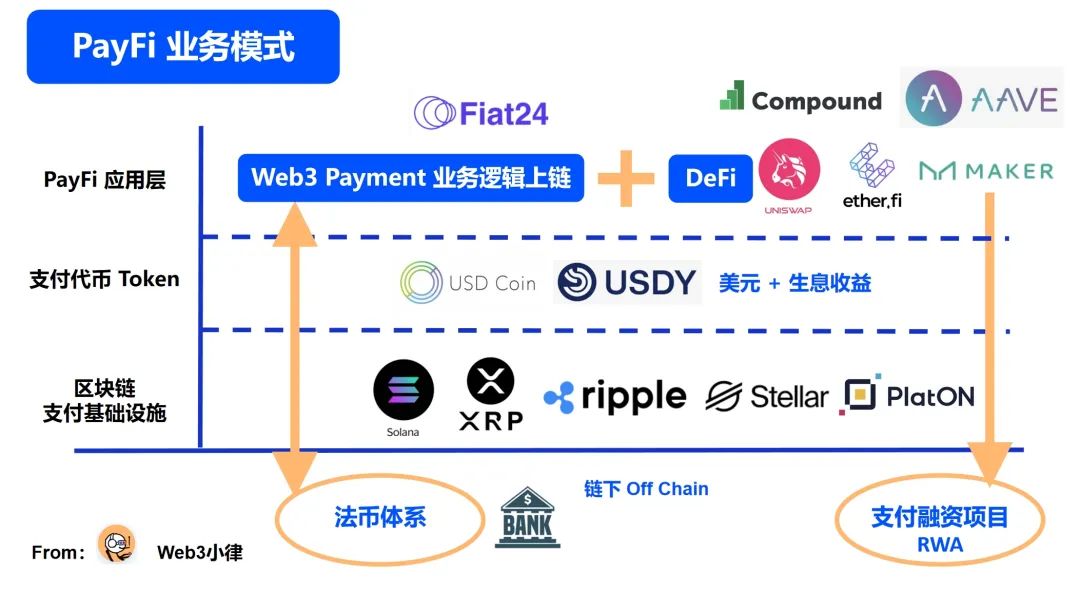

Combining the multiple attributes of Web3 payments as previously explained, PayFi's business model can be categorized into four types:

A. Payment Token itself, such as the Time Value of Tokenized US Treasury Bonds/Stablecoin projects; B. Payment Financing RWA, using DeFi lending funds to address financing needs in real payment transaction scenarios, achieving on-chain payment financing yields; C. Innovative Web3 payment businesses integrating with DeFi; D. Moving the traditional payment business logic onto the chain, achieving complete Web3 payment logic. This is also a form of RWA tokenization.

5.1 The Time Value of Payment Token Itself—Tokenized US Treasury Bonds

The current high-interest rate environment has brought widespread attention to use cases based on tokenized US Treasury Bonds. These products not only achieve risk-free, highly liquid, and scalable returns on US Treasury Bonds but also significantly improve capital efficiency for many payment/financial application scenarios due to the transaction medium properties of cash equivalents.

The underlying asset of these tokenized US Treasury Bonds is US Treasury Bonds, essentially the interest paid by the US government to us for using our current funds. Therefore, these tokenized US Treasury Bond tokens themselves possess the Time Value of Money.

According to RWA.XYZ data, the market size of tokenized US Treasury Bonds has increased from $770 million in early 2024 to $1.916 billion as of August 1, 2024, representing a growth rate of 248%.

Case Study I: Ondo Finance Tokenized US Treasury Bonds

Ondo Finance is an RWA tokenized US Treasury Bonds protocol dedicated to providing institutional-level investment opportunities for everyone. Ondo Finance brings low-risk, stable-yielding, and scalable fund products (such as US Treasury Bonds, money market funds, etc.) onto the chain, providing on-chain investors with an alternative to stablecoins—allowing stablecoin holders, rather than issuers, to earn returns.

Previously, Ondo Finance launched OUSG for US residents by tokenizing US Treasury Bond funds and, in August 2023, introduced USDY, a tokenized note project collateralized by short-term US Treasury Bonds, for non-US users. As of August 1, 2024, the TVL of $OUSG and $USDY reached $570 million.

Compared to traditional stablecoins, the innovation of USDY lies in its permissionless provision of an investment vehicle that can store USD-denominated value and generate USD returns for global investors. More importantly, the transaction medium function of this interest-bearing stablecoin and its status as a settlement currency are becoming increasingly prominent.

USDY=USDC + 5% US Treasury Bond Yield

In December 2023, Ondo Finance launched USDY on the Solana blockchain, and its ecosystem has pushed the boundaries of Web3 payment innovation. To date, multiple payment platforms on Solana have integrated USDY into their products.

For example, Helio, a leading Web3 payment platform on Solana with over 450,000 unique active wallets and 6,000 merchants, has integrated USDY as a native payment option. With its Solana Pay plugin, millions of Shopify merchants can now settle payments with cryptocurrencies and instantly convert USDY into other stablecoins such as USDC, EURC, and PYUSD. Sphere, a payment technology provider on Solana initially designed around stablecoins, has now integrated USDY, enabling secure, cost-effective, and near-instant cross-border payments for merchants in emerging markets, while also earning support from US Treasury Bonds.

In addition to serving as a payment transaction medium, USDY can also provide additional capital efficiency, utility, and composability in DeFi scenarios, such as using USDY as collateral for borrowing. On July 31, 2024, USDY was launched on the Aptos blockchain and integrated into multiple DeFi platforms within its ecosystem.

5.2 Payment Financing RWA

Since 2023, the crypto ecosystem has been continuously seeking assets with sustainable value and stable sources of income, leading to the natural emergence of tokenized real-world assets.

We have seen explosive growth in tokenized US Treasury Bonds, but unfortunately, this growth is likely temporary. If we look back 2-3 years, we were in a zero-interest rate era. As US Treasury bond yields decline in the future, crypto capital will seek other high-yield and low-risk assets for allocation. This is where the concept of PayFi payment financing RWA comes into play.

The logic of PayFi payment financing RWA is simple: using DeFi lending funds to address the needs in real payment scenarios and achieve on-chain payment financing yields.

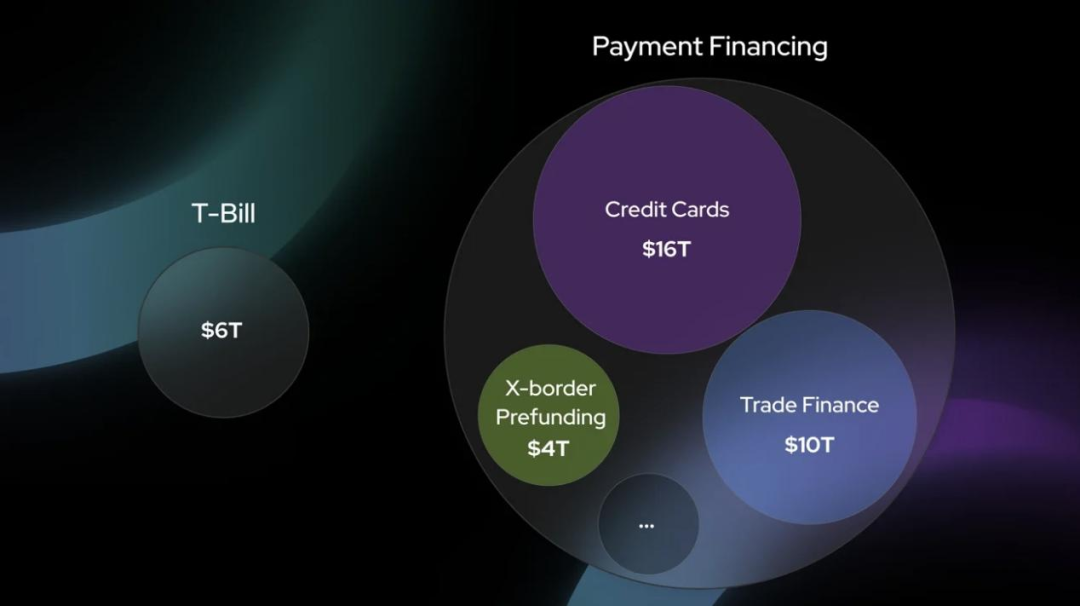

Payment financing is a crucial foundation of the global financial/trade ecosystem, including credit cards ($16 trillion), trade finance ($10 trillion), and global pre-financing for payments ($4 trillion). PayFi payment financing can serve as an important asset class for RWA assets, achieving:

Bringing trillions of payment transaction volumes onto the chain to better optimize the time value of money and drive the adoption of stablecoins; Providing yield rates with different risk preferences, from single-digit risk-free yield rates to attractive double-digit yield rates in the private credit sector; Rapidly scaling with extremely low systemic risk; More favorable for liquidity allocation due to the short-term nature of the underlying assets in payment financing transactions.

We can already see Huma Finance raising on-chain funds to support off-chain payment financing needs, such as bridge financing needs in cross-border payments and financing needs in supply chain finance.

5.3 Innovative Web3 Payment Businesses Integrating with DeFi

In her presentation, Lily Liu mentioned the concept of "Buy Now Pay Later," which can be transformed by PayFi into "Buy Now Pay Never." Let's analyze this. Imagine a scenario where a user, Kevin, spends $5 on coffee, and a PayFi payment service provider processes the transaction.

1) The PayFi payment service provider needs to integrate with DeFi lending protocols. 2) User Kevin happens to be a liquidity provider (LP) in a DeFi lending protocol, earning lending yields from the protocol. 3) The PayFi payment service provider obtains authorization from user Kevin to use the lending yields to pay for the coffee. 4) Kevin doesn't have to pay the actual cost of the coffee but uses the yields generated from his DeFi lending protocol to pay $5.5, with $0.5 as the service fee for the PayFi payment service provider. 5) The PayFi payment service provider can ultimately convert the DeFi yields into fiat currency and settle with the merchant.

This is a simple and intuitive use case of PayFi overlaying DeFi on Web3 payments, using DeFi yields to cover payment costs, and it can further integrate the utility of token economics.

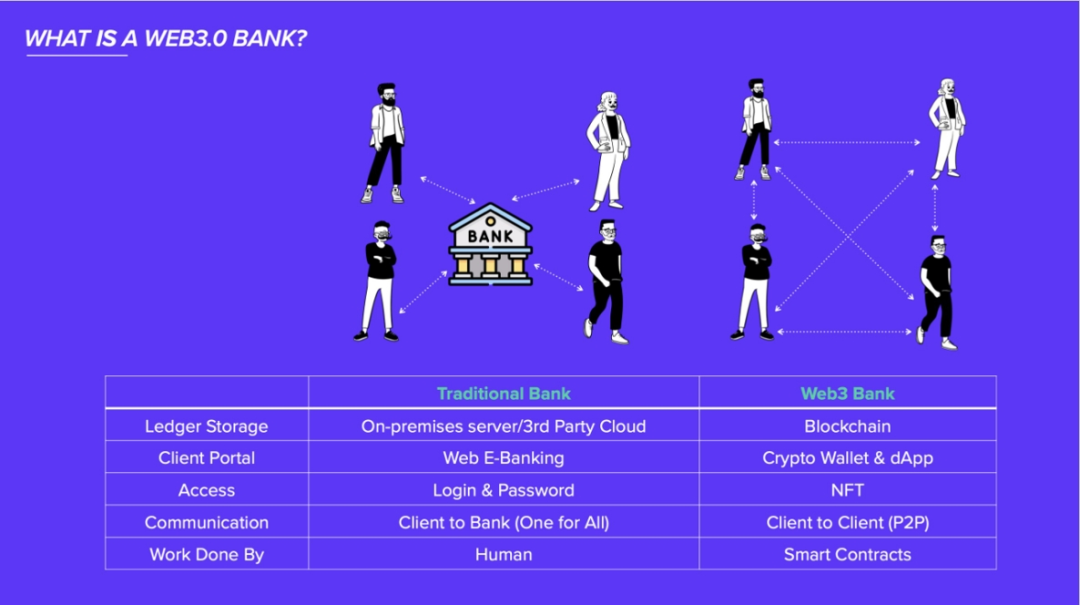

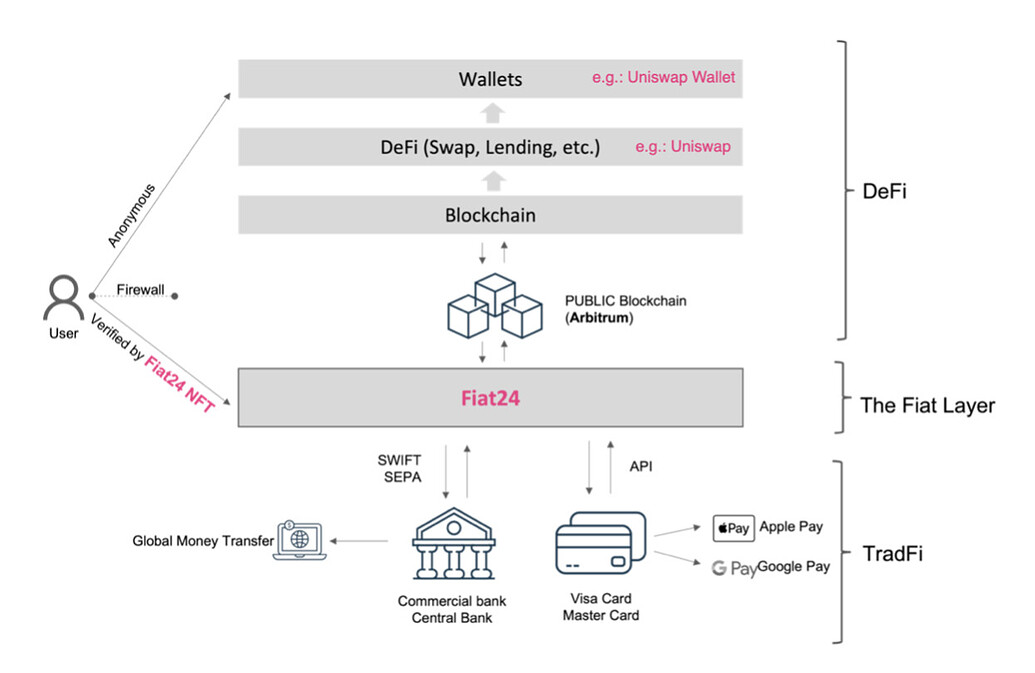

The integration of DeFi with Web3 payment scenarios is only limited by your imagination. For example, Fiat24 has structured itself as a fiat banking protocol layer, bringing the business logic of fiat banking systems to DeFi, and Ether.Fi can use staked crypto assets as collateral to obtain stablecoins and then achieve fiat currency payments through a Crypto Payment Card.

Case Study J: Building a Web3 Bank on the Blockchain—Fiat24

Fiat24 is a fintech company regulated by the Swiss banking authority and is the world's first to fully architect banking logic on a public blockchain (Arbitrum), driven by smart contracts as a decentralized application (DApp), providing users with a range of Web3 banking services including currency acceptance, Web3 payment consumption, savings, transfers, and fiat currency exchange. Fiat24 aims to bridge the gap between the crypto world and traditional finance through the Banking Protocol, bringing innovation to traditional banks, financial, and payment systems.

The innovative blockchain banking architecture of Fiat24 seamlessly integrates traditional banking services with Web3 payment innovations, enhancing convenience and security while avoiding the risk of single points of failure. Unlike any other traditional bank, Fiat24 caters to numerous non-custodial wallet users and can be envisioned as a fiat protocol layer for DApps, such as the Fiat Layer Banking Protocol built under Uniswap.

In the fiat protocol layer, Fiat24 provides Swiss bank accounts (Cash Accounts) for KYC-verified users, enabling integration of Web3 payment services and achieving currency acceptance, as well as Web3 payments. Additionally, Fiat24's Swiss bank accounts are directly connected to the Swiss National Bank, the European Central Bank, and the VISA/Mastercard payment networks, enabling traditional banking services such as savings, currency exchange, and merchant settlements.

"Just as Chainlink serves as the infrastructure for a decentralized oracle network, Fiat24's positioning is as the infrastructure for a decentralized digital banking network—DApps' fiat protocol layer," said Fiat24 Co-founder Yang. "We believe that in the future, DEX will replace CEX, but the biggest drawback of DEX lies in the fact that, unlike CEX, it cannot achieve currency acceptance through its own payment channels. As a protocol, traditional banks cannot be compatible with a protocol, nor can they open APIs or accounts for a protocol. However, Fiat24 can connect DeFi on-chain and traditional finance off-chain through a protocol, providing a perfect solution and filling the gaps in fiat services for many DApps."

Thus, Fiat24, as a Fiat Layer Banking Protocol, can bring the business logic of fiat currency to DeFi. These are the PayFi scenarios as outlined by Lily Liu.

1) Mortgage lending: Bob provides ETH as collateral to borrow stablecoins on a DeFi platform, and the DeFi protocol can directly call the Fiat24 banking protocol to form USD fiat lending.

2) Investment/Staking Yield: Alice provides ETH for staking yield, and the DeFi protocol can directly call the Fiat24 banking protocol to distribute staking yields in the form of fiat currency, truly achieving passive income in real life.

3) Investment Management: Will uses ETH to invest in the tokenized securities of the DeFi protocol Coinbase. The DeFi protocol can directly call the Fiat24 banking protocol to purchase stocks on Nasdaq with fiat currency. This is what Ondo Finance's Global Markets is currently achieving.

Case Study K: Ether.Fi's Crypto Payment Card

Ether.Fi is an innovative project within the DeFi ecosystem that focuses on Ethereum staking and liquidity re-staking. By providing non-custodial staking solutions, EtherFi allows users to earn staking rewards while maintaining asset liquidity, solving the problem of locked funds in traditional staking.

Here, I won't elaborate on staking and re-staking, but I'll talk about Ether.Fi's Cash business. The Cash business is essentially the most common Crypto Payment Card business, where users can make payments using cryptocurrency (Crypto Payin), convert it through a payment service provider into fiat currency, and settle with merchants through traditional payment channels such as V/M (Fiat Payout).

Ether.Fi's Cash business can directly integrate with its staking/re-staking business, embodying the characteristics of PayFi:

1) Ether.Fi Cash is a combination of a digital mobile wallet and a Visa credit card that can be used anywhere in the world. 2) It can facilitate prepaid card consumption using regular USDC deposits (Pre-Paid/Debt Card). 3) It can also use Ether.Fi's assets as collateral to obtain USDC for consumption and use staking and liquid yields to repay.

By integrating its products, Ether.Fi helps users with cryptocurrency savings, investments, and consumption.

The story of PayFi is just beginning, as Ether.Fi puts it: "Relying on traditional payment channels still poses significant scrutiny risks and nightmares for user experience. Tying cryptocurrency to the continuously inflating junk coins (Shitcoins) minted by the Federal Reserve seems absurd. Both of these issues need to be addressed in the next few years, and they are an important part of our next stage roadmap."

5.4 Envisioning the Future of PayFi

PayFi brings tremendous imagination to Web3 payments. What we see is just the tip of the iceberg, and there is a huge market and space waiting for us to explore and transform. This is not only about integrating DeFi into Web3 payment innovation but also about transforming the traditional payment business logic and payment systems into Web3.

5.4.1 On-Chain Credit System

Our current Web3 payments are based on cash transactions using stablecoins, where you need to have the corresponding cash stablecoin on hand. However, in real life, besides cash transactions, we also have credit cards, credit loans, installment payments, and other credit-based payment methods. Can these be implemented in Web3 payments?

A characteristic of Web3 payments is that both parties to the transaction need to undergo identity verification such as KYC/KYB, and transaction records are recorded on the blockchain. This rigid requirement is a prerequisite for forming an on-chain credit system. Once information can be effectively integrated (such as on-chain transaction records, stablecoin salary information, on-chain collateral information, KYC/KYB information, compliance information, etc.), and combined with the collection of necessary off-chain information, can we build an on-chain credit system to further promote the development of PayFi?